Industrial Wireless Automation Market Size 2025-2029

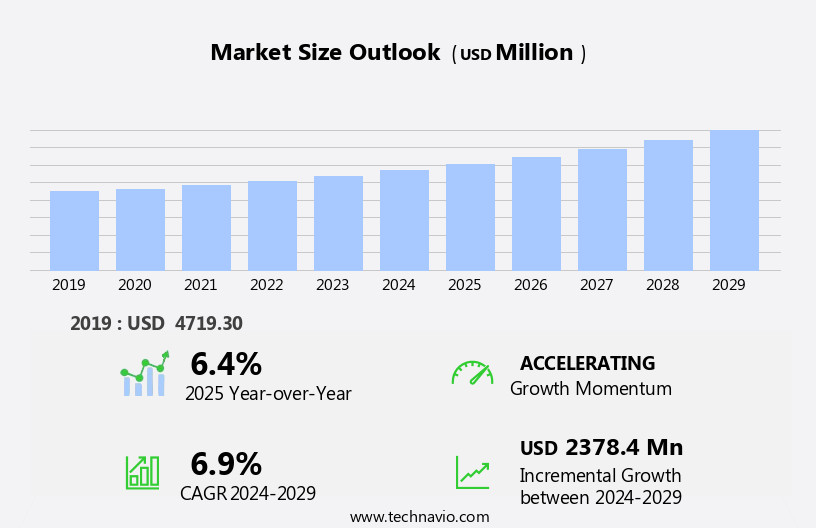

The industrial wireless automation market size is forecast to increase by USD 2.38 billion, at a CAGR of 6.9% between 2024 and 2029.

- The market is witnessing significant growth, driven by the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies with wireless automation systems. This fusion is enabling real-time data processing, predictive maintenance, and improved operational efficiency, making it a strategic priority for manufacturers. However, the high cost of implementing wireless automation remains a substantial challenge for many organizations. The complexity of integrating various wireless technologies and ensuring secure and reliable communication networks adds to the financial burden. Despite this, companies are recognizing the potential benefits of wireless automation in enhancing production flexibility, reducing downtime, and improving overall operational performance.

- To capitalize on these opportunities, businesses must carefully evaluate their implementation strategies, focusing on cost optimization, technology selection, and partnerships with experienced companies. Additionally, addressing cybersecurity concerns and ensuring interoperability between different wireless technologies will be crucial for successful adoption.

What will be the Size of the Industrial Wireless Automation Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the integration of advanced technologies such as cloud computing, wireless coverage, data management, and network reliability. These innovations enable real-time data acquisition and analysis, process optimization, and remote operations across various sectors, including power generation, water treatment, and manufacturing. Wireless communication protocols, machine-to-machine communication, and SCADA systems facilitate the seamless integration of industrial equipment, motor control, and process automation. Engineering services and software development play a crucial role in ensuring network reliability and interoperability standards. However, the market's continuous dynamism also presents challenges. Cybersecurity threats, network latency, and signal strength are critical concerns for industrial cybersecurity and data encryption.

Maintenance costs, installation costs, and regulatory requirements add complexity to the digital transformation of industries. Moreover, the integration of emerging technologies like machine learning, data visualization, and artificial intelligence enhances operational efficiency and production optimization. Wireless mesh networks, edge computing, and smart grid enable energy management and network security. The market's evolving patterns also extend to asset tracking, industrial robotics, and IoT platforms. Consulting services and firmware upgrades support the implementation and integration of these technologies, ensuring compliance with evolving industry standards. In summary, the market's continuous evolution is characterized by the integration of advanced technologies, the emergence of new applications, and the ongoing challenges of ensuring network reliability, cybersecurity, and regulatory compliance.

How is this Industrial Wireless Automation Industry segmented?

The industrial wireless automation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Solution

- Field instrument

- Communication network

- End-user

- Process industry

- Discrete industry

- Component

- Hardware

- Software

- Services

- Technology

- Wi-Fi

- Bluetooth

- Cellular (4G/5G)

- Zigbee

- LoRaWAN

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

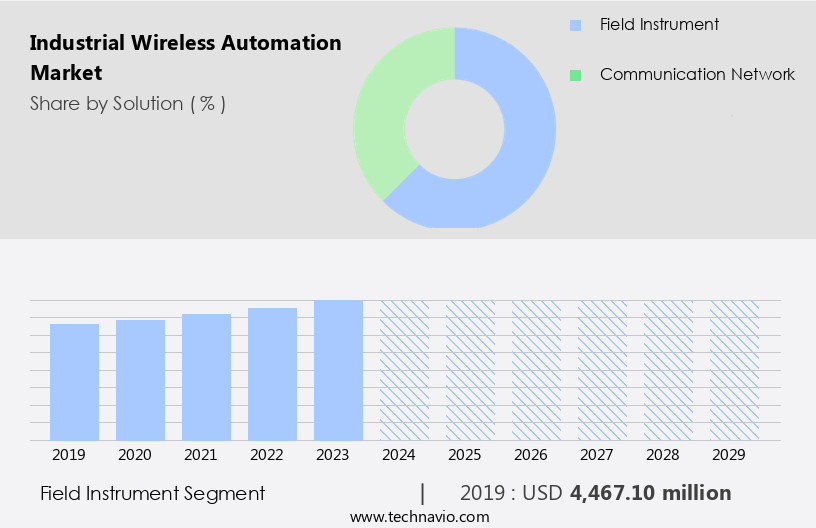

By Solution Insights

The field instrument segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing demand for enhancing operational efficiency, reducing maintenance costs, and ensuring safety and security in various industries. Industrial equipment, including motor control, power generation, and oil and gas, is being integrated with wireless communication technologies for remote operations and real-time data analytics. Machine learning algorithms and data visualization tools are being employed to optimize production processes, improve asset tracking, and enhance network reliability. Long-range communication and battery life are crucial factors for wireless sensors and transducers used in industrial applications. Machine-to-machine communication and SCADA systems enable seamless data integration and process optimization.

Industrial cybersecurity and network security are becoming increasingly important to protect against cyber threats and vulnerability assessments. Wireless communication protocols, such as Industrial Ethernet and Wireless Mesh Networks, are being adopted for system integration and edge computing. Real-time data analytics and regulatory requirements are driving the need for interoperability standards and data encryption. Maintenance schedules, firmware upgrades, and software updates are essential for ensuring network reliability and system performance. The adoption of wireless connectivity, machine vision, and artificial intelligence is transforming industrial automation systems, enabling predictive maintenance and smart factory operations. Spare parts and engineering services are critical for ensuring the longevity of industrial equipment and minimizing downtime.

The integration of wireless gateways and distributed control systems is facilitating production optimization and energy management. In the context of digital transformation, cloud computing and smart cities are emerging trends, with wireless network management and energy management playing a crucial role. Process control systems and network security are essential for ensuring compliance with industry standards and regulatory requirements. The demand for asset tracking, industrial robotics, and IoT platforms is increasing to optimize industrial processes and enhance operational efficiency. Consulting services and PLC integration are essential for ensuring seamless integration and implementation of wireless automation solutions.

The Field instrument segment was valued at USD 4.47 billion in 2019 and showed a gradual increase during the forecast period.

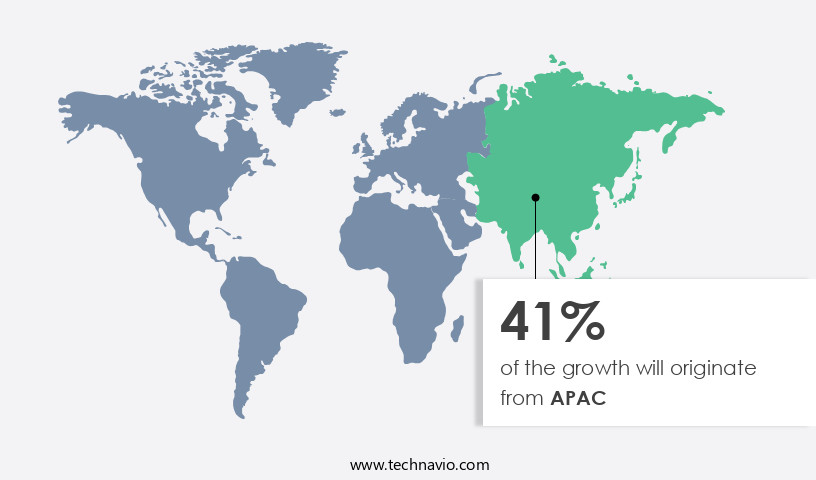

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the APAC region, there is a growing preference for wireless automation solutions to streamline intricate manufacturing processes and enhance operational efficiency. This trend is fueling the expansion of the market in APAC. As industries scale up, their supply chains become more intricate, leading established companies to collaborate with system integrators to broaden their reach by offering automation services. The economic growth of APAC countries, notably China and India, over the past few decades has resulted in significant industrialization, infrastructure development, and the expansion of manufacturing sectors. This surge in industrial activity has generated a substantial demand for industrial automation solutions.

Machine learning algorithms are increasingly being integrated into wireless automation systems to enable predictive maintenance and optimize production processes. Data visualization tools help operators gain real-time insights into their industrial processes, improving decision-making and enhancing operational efficiency. Long-range communication and data integration capabilities are essential for seamless wireless connectivity between industrial equipment, motor control systems, and other components. Network monitoring and vulnerability assessment are critical aspects of industrial cybersecurity, ensuring the protection of sensitive data and industrial control systems from cyber threats. Machine-to-machine communication and SCADA systems facilitate remote operations and process optimization, while wireless sensors and data acquisition systems provide valuable real-time data for process control and maintenance schedules.

Battery life and low-power devices are crucial considerations for wireless sensors and other wireless devices used in industrial applications, ensuring uninterrupted operations and reducing maintenance costs. Wireless mesh networks and system integration enable the seamless integration of various industrial automation systems, while real-time data analytics and regulatory requirements ensure compliance with industry standards. Digital transformation and cloud computing are driving the adoption of wireless automation solutions, allowing for edge computing, software updates, and security audits. Industrial ethernet, wireless range, and fieldbus networks provide the necessary connectivity for industrial automation systems, while process control systems and energy management systems ensure optimal performance and efficiency.

In conclusion, the market in APAC is experiencing significant growth due to the increasing demand for wireless automation solutions to simplify complex production processes and improve operational efficiency. The integration of advanced technologies such as machine learning, data visualization, and industrial cybersecurity is enhancing the capabilities of wireless automation systems, making them indispensable for modern industrial applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industrial Wireless Automation Industry?

- The integration of artificial intelligence (AI) and machine learning (ML) technologies is a primary catalyst for the growth and innovation in the wireless automation market.

- The market is witnessing significant growth due to the adoption of remote operations and the need for operational efficiency in various industries. Wireless mesh networks enable seamless communication between industrial automation systems, sensors, and transducers, allowing for real-time data analytics and system integration. Compliance with regulatory requirements and adherence to interoperability standards are essential factors driving the market's growth. Machine learning algorithms and artificial intelligence are transforming industrial automation by analyzing data from wireless sensors to predict equipment failures and optimize maintenance schedules. This proactive approach reduces downtime, extends asset lifespan, and improves process reliability. Real-time data analytics can also optimize energy usage in industrial settings, resulting in reduced energy consumption and improved efficiency.

- Power supply management is another critical aspect of industrial wireless automation, with machine learning models continuously monitoring energy usage and adjusting equipment operations accordingly. Digital transformation is a significant trend in the market, with companies investing in wireless connectivity and data encryption to secure their industrial automation systems. The integration of machine vision and advanced analytics capabilities further enhances the capabilities of industrial automation systems, enabling predictive maintenance, quality control, and process optimization. Installation costs and spare parts availability are essential considerations for businesses adopting industrial wireless automation solutions. Overall, the market is expected to continue growing due to the benefits it offers in terms of operational efficiency, safety, and process reliability.

What are the market trends shaping the Industrial Wireless Automation Industry?

- The "Advent of Quality 4.0" signifies the latest market trend towards advanced manufacturing processes. This shift prioritizes quality enhancement through technology integration and automation.

- Industrial wireless automation is a significant trend in various industries, driven by the need for real-time data management and process optimization. Cloud computing plays a crucial role in this evolution, enabling wireless coverage for low-power devices and facilitating network reliability. Wireless gateways and remote monitoring systems are essential components of industrial wireless automation, providing the necessary infrastructure for process automation and building automation. However, challenges such as network latency and cybersecurity threats persist. Ensuring strong signal strength and implementing robust software development practices are essential for addressing these issues. Industrial ethernet and fieldbus networks are popular solutions for overcoming data management challenges, providing reliable and efficient communication channels.

- Quality 4.0, a concept that emphasizes the use of connectedness, intelligence, and automation to improve product quality, is a key application area for industrial wireless automation. However, the availability and accurate real-time data acquisition remain critical challenges. IoT deployments in industrial environments can be complex and costly due to these challenges. Despite these hurdles, the potential benefits of industrial wireless automation, including process optimization and cost savings, make it a worthwhile investment for many organizations.

What challenges does the Industrial Wireless Automation Industry face during its growth?

- The high cost of implementing wireless automation is a significant challenge that can hinder industry growth. This financial hurdle may deter some organizations from adopting this technology, potentially limiting its potential impact and innovation within the industry.

- Industrial wireless automation is a significant investment for businesses seeking to modernize their maintenance schedules, firmware upgrades, edge computing, software updates, and network security. The implementation of wireless automation involves expenses for sensors, actuators, controllers, communication devices, network infrastructure, and software licenses. For smaller enterprises, the upfront cost may serve as a barrier to entry. Integration with existing infrastructure and legacy equipment can add to the overall expense, necessitating compatibility and interoperability solutions. Moreover, the size and scope of the deployment can significantly impact costs. Larger industrial facilities or global deployments with extensive coverage areas may require more equipment and infrastructure, leading to higher expenses.

- In addition, smart city applications, distributed control systems, production optimization, smart grid, wireless network management, energy management, process control systems, asset tracking, industrial robotics, and industrial IoT platforms may require consulting services and PLC integration. Ensuring network security and implementing security audits are also essential considerations, adding to the overall investment.

Exclusive Customer Landscape

The industrial wireless automation market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial wireless automation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial wireless automation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - Industrial settings benefit from advanced wireless automation solutions, such as ABB's WirelessHART technology. This system facilitates remote monitoring and control, enhancing operational efficiency and productivity. By leveraging wireless communication, industrial processes become more agile and responsive, enabling real-time data analysis and predictive maintenance. ABB's wireless automation solution is a game-changer, bridging the gap between traditional wired systems and the modern, connected industrial landscape. It empowers organizations to optimize their industrial processes, reducing downtime and increasing profitability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Ependion AB

- Belden Inc.

- Cisco Systems Inc.

- CommScope Holding Co. Inc.

- Eaton Corp. plc

- Emerson Electric Co.

- FANUC Corp.

- General Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corp.

- Motorola Solutions Inc.

- Moxa Inc.

- OleumTech Corp.

- OMRON Corp.

- Phoenix Contact GmbH and Co. KG

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Wireless Automation Market

- In February 2023, Schneider Electric, a leading energy management and automation company, introduced its EcoStruxure Automation Expert, a new industrial automation solution that combines process control, safety, and information technologies to enhance operational efficiency and productivity (Schneider Electric Press Release, 2023).

- In May 2024, Honeywell International and Microsoft Corporation announced a strategic partnership to integrate Microsoft Azure IoT and Honeywell's Forge process automation software, enabling seamless data exchange and advanced analytics for industrial customers (Microsoft News Center, 2024).

- In August 2024, Siemens AG completed the acquisition of Sensicast Systems, a US-based provider of wireless condition monitoring sensors for industrial applications, to expand its portfolio in the wireless sensors market and strengthen its digitalization offerings (Siemens Press Release, 2024).

- In November 2025, the European Union approved the Wireless Industrial Sensing and Actuating Systems (WISAS) project, a Horizon 2020 initiative aiming to develop and deploy advanced wireless sensing and actuating systems for industrial automation, with an estimated budget of â¬12 million (European Commission Press Release, 2025).

Research Analyst Overview

- The market is experiencing significant growth, driven by the increasing adoption of Internet of Things (IoT) technology and the need for wireless network optimization in industrial settings. RF engineering plays a crucial role in ensuring reliable wireless connectivity, particularly in dealing with RF interference. IOT security is a major concern, with wireless network security solutions becoming increasingly important to protect against cyber threats. Industrial ethernet switches and wireless lan controllers facilitate network bandwidth efficiency, while wireless protocols such as Zigbee and Wi-Sun enable seamless communication between devices. Predictive analytics and system integration services help optimize wireless network infrastructure, ensuring industrial wireless standards are met.

- Cellular networks and wireless gateways provide remote access capabilities, while data logging and cloud-based platforms enable real-time data acquisition and remote monitoring. Wireless control systems and wireless sensor networks offer enhanced flexibility and efficiency in industrial automation, making wireless connectivity solutions essential for modern businesses. Wireless network design and cybersecurity solutions are also critical components of the market, ensuring secure and reliable wireless communication for industrial applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Wireless Automation Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

245 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 2378.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, China, Japan, Germany, Canada, UK, Mexico, France, South Korea, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Wireless Automation Market Research and Growth Report?

- CAGR of the Industrial Wireless Automation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial wireless automation market growth of industry companies

We can help! Our analysts can customize this industrial wireless automation market research report to meet your requirements.