Jelly Candies (Gummies) Market Size 2025-2029

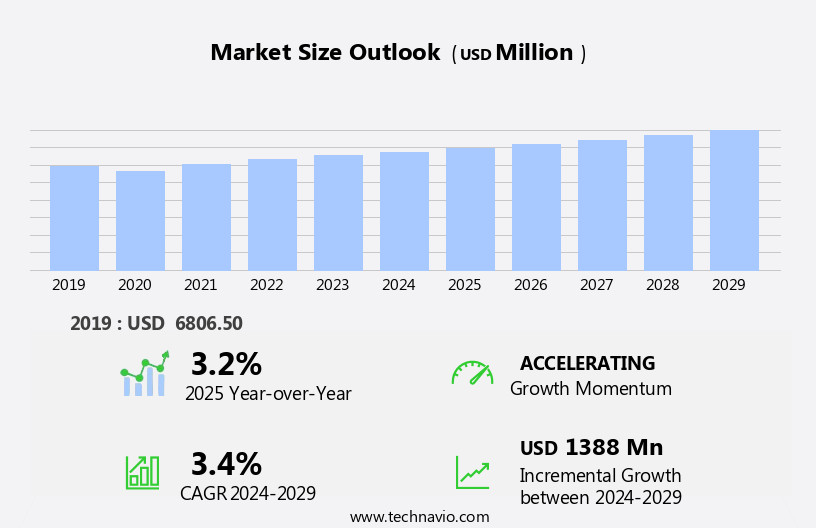

The jelly candies (gummies) market size is forecast to increase by USD 1.39 billion, at a CAGR of 3.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing preference for organic and sugar-free options. Consumers are increasingly seeking healthier alternatives to traditional sweets, leading to a surge in demand for jelly candies made with natural sweeteners and organic ingredients. This trend is further fueled by the growing influence of online retailing, which allows consumers to easily access a wide range of options and compare prices, driving competition and innovation. However, this market is not without challenges. The increasing fragmentation of the industry is leading to unhealthy price competition, putting pressure on profit margins for both established players and new entrants.

- Companies must navigate this competitive landscape by focusing on product innovation, brand differentiation, and strategic partnerships to maintain their market position and capitalize on the growing demand for organic sugar-free jelly candies. To succeed in this dynamic market, companies must stay agile, adapt to changing consumer preferences, and effectively manage costs to maintain profitability.

What will be the Size of the Jelly Candies (Gummies) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The jelly candies market continues to evolve, with dynamic market dynamics shaping its landscape. Product innovation remains a key driver, with manufacturers exploring various applications, such as citric acid-infused gummy bears and chocolate-covered hard candies. Pricing strategies also play a crucial role, as companies strive to balance affordability and quality. Production capacity expansion and stringent quality control measures are essential to meet consumer demand for a wide range of offerings, including fruit chews, jelly beans, and sour candies. The use of sugar alternatives, such as corn syrup and lactic acid, extends product appeal to health-conscious consumers.

Ethical sourcing and natural flavors are increasingly important, with many companies adhering to fair trade practices and using natural ingredients like malic and tartaric acids. The ongoing trend towards health and wellness has led to new product development, including sugar-free and low-calorie options. E-commerce sales continue to grow, with consumers preferring the convenience of online shopping. Manufacturers must adapt to this trend, optimizing their websites for seamless transactions and ensuring food safety standards are met. Wholesale distribution remains a significant channel, catering to retailers and bulk buyers. Consumer preferences for seasonal demand items, like candy corn and peanut brittle, add to the market's diversity. The manufacturing process for jelly candies is continually refined to improve efficiency and reduce production costs. The jelly candies market's continuous evolution underscores its resilience and adaptability to consumer trends and preferences.

How is this Jelly Candies (Gummies) Industry segmented?

The jelly candies (gummies) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Sugar-based

- Sugar-free

- Distribution Channel

- Offline

- Online

- Flavor

- Apple

- Cherry

- Berries

- Peach

- Grapefruit

- Product Type

- Traditional

- Functional

- Geography

- North America

- US

- Europe

- Germany

- Italy

- Russia

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

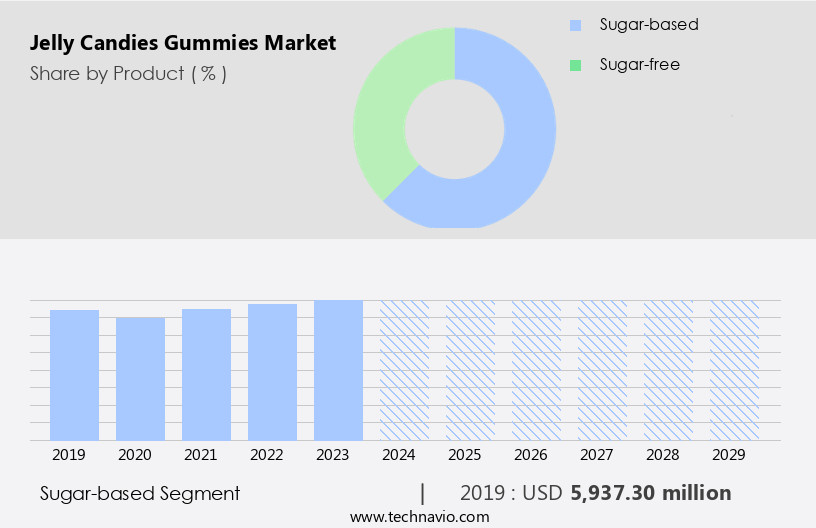

The sugar-based segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of sweet treats, including jelly beans, fruit chews, gummy bears, and peanut brittle. Product innovation is a key trend, with new product development focusing on sugar alternatives, such as corn syrup, and gelatin-free options for health-conscious consumers. Pricing strategies vary, with some manufacturers opting for premium prices for organic, fair trade, and natural flavored gummies. Production capacity expansion is essential to meet increasing demand, with a focus on food safety and quality control. Retail sales dominate, but direct-to-consumer sales and e-commerce channels are growing. Seasonal demand is strong for candy corn and sour candies, with flavor profiles ranging from artificial to natural, including lactic acid, malic acid, and tartaric acid.

Ingredient sourcing is crucial, with ethical and sustainable practices increasingly important to consumers. The manufacturing process involves cooking, cooling, cutting, and coating, with chocolate covered candies and hard candies also popular. Consumer preferences for health and wellness are driving demand for sugar-free and reduced sugar options, while wholesale distribution remains a significant sales channel.

The Sugar-based segment was valued at USD 5.94 billion in 2019 and showed a gradual increase during the forecast period.

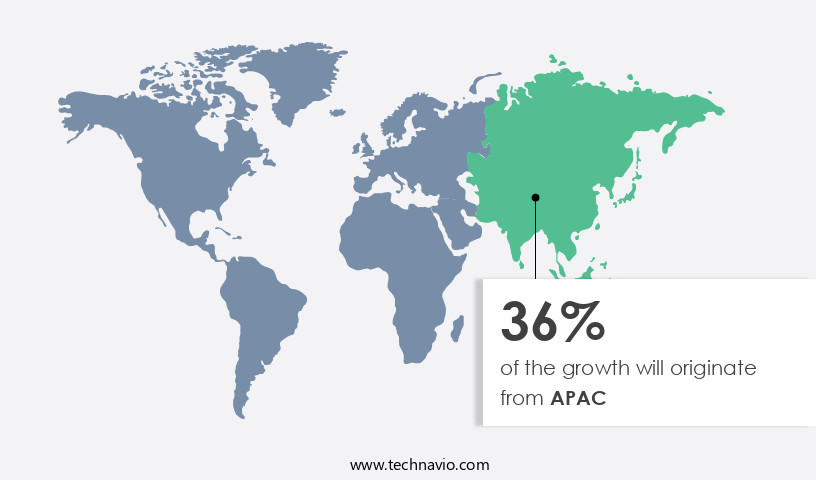

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is witnessing growth due to the increasing health consciousness among consumers and the rising trend of consuming healthy snacks. This shift is particularly driving the demand for sugar-free jelly candies (gummies). Additionally, the gifting trend for sugar and sugar-free confectionery products, including assorted candies, is bolstering market growth. Organized retail stores, such as Walmart Inc. And others, hold a significant market share in countries like Germany, contributing to high sales of jelly candies (gummies). Production capacity is being expanded to meet the increasing demand, with a focus on maintaining quality control. Corn syrup remains a common ingredient in jelly candies (gummies), but there is a growing trend towards sugar alternatives and natural sweeteners.

Fruit chews and gummy bears are popular product variants, with new product development focusing on flavor profiles and textures. Peanut brittle and chocolate-covered jelly candies are also gaining popularity. Food safety is a priority, with manufacturers using lactic, malic, and tartaric acids as preservatives. Ethical sourcing and fair trade practices are increasingly important, as are natural and artificial flavor options. Direct-to-consumer sales and e-commerce platforms are expanding the reach of jelly candies (gummies), catering to consumer preferences. Wholesale distribution remains a significant sales channel, especially for traditional jelly beans and hard candies. The seasonal demand for candy corn and sour candies adds to the market's diversity.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global jelly candies market driven by jelly candies market trends 2025-2029. B2B gummy candy supply solutions leverage innovative gummy production technologies for quality. Jelly candies market growth opportunities 2025 include health-focused gummy candies and gummies for dietary supplements, meeting consumer demand. Gummy production management software optimizes operations, while jelly candies market competitive analysis showcases brands like Haribo. Sustainable gummy manufacturing practices align with eco-friendly gummy trends. Jelly candies regulations 2025-2029 shapes gummy demand in Europe 2025. Sugar-free gummy candies and premium gummy market insights boost appeal. Gummies for kids and customized gummy flavors target niches. Jelly candies market challenges and solutions address sourcing, with direct procurement strategies for gummies and gummy pricing strategy optimization enhancing profitability. Data-driven gummy market analytics and functional gummy trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Jelly Candies (Gummies) Industry?

- The increasing preference for organic and sugar-free options, particularly in the form of jelly candies (gummies), is the primary market trend propelling growth in this industry.

- Organic jelly candies, also known as gummies, have gained popularity in the US market due to their health and wellness benefits. These candies are made from organic fruits and natural ingredients, free from synthetic herbicides, fertilizers, and pesticides. The manufacturing process involves sourcing ingredients that are sustainably grown and monitored by regulatory bodies such as the USDA and The Non-GMO Project. Consumers prefer organic jelly candies due to their perceived health benefits and absence of synthetic additives. Sour varieties of these candies are particularly popular, with malic and tartaric acids used for their tangy taste.

- The manufacturing process ensures that these acids are derived naturally, enhancing the product's appeal. Seasonal demand for organic jelly candies fluctuates, with some flavors gaining popularity during specific seasons. Companies prioritize ingredient sourcing to meet this demand and maintain consistent product quality. By focusing on organic and natural ingredients, these companies cater to the health-conscious consumer base and emphasize transparency in their manufacturing processes.

What are the market trends shaping the Jelly Candies (Gummies) Industry?

- The increasing prevalence of online retailing represents a significant market trend. This shift towards e-commerce is mandatory for businesses seeking to remain competitive in today's professional business environment.

- The market has experienced substantial growth in recent years, driven primarily by the rise of e-commerce sales. This online distribution channel enables consumers to access a wide range of jelly candies (gummies) from various global brands. E-commerce platforms offer different types of jelly candies (gummies), including those with natural and artificial flavors, such as citric acid and chocolate covered. The increasing number of e-commerce companies worldwide, fueled by the global penetration of smartphones, further propels market growth. Both brand-owned online formats and pure-play e-retailers are significant contributors to the e-commerce market for jelly candies (gummies).

- Consumer preferences for ethical sourcing and immersive, harmonious packaging designs also influence market trends. Wholesale distribution remains an essential aspect of the market, catering to various retailers and businesses.

What challenges does the Jelly Candies (Gummies) Industry face during its growth?

- The intensifying fragmentation within the industry, resulting in unfettered price competition, poses a significant challenge to sustainable growth.

- In the competitive landscape of the market, both national and international companies encounter significant challenges in gaining mass-market penetration and customer loyalty. Unorganized regional players pose a major threat with their lower pricing strategies. To remain competitive, international companies must balance price and quality. However, the presence of numerous unregistered local players hampers market growth. These companies do not adhere to standardized quality control measures, which can impact the overall reputation of the market. Product innovation and the adoption of sugar alternatives are crucial strategies for companies to differentiate themselves and cater to evolving consumer preferences.

- Ensuring a reasonable shelf life is also essential to maintain the freshness and quality of jelly candies. Corn syrup, a common ingredient in jelly candies, can influence production capacity and pricing. Companies must strike a harmonious balance between cost, quality, and consumer demand to succeed in this market.

Exclusive Customer Landscape

The jelly candies (gummies) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the jelly candies (gummies) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, jelly candies (gummies) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albanese Confectionery Group Inc. - This company specializes in producing a range of jelly candies, including Albanese Gummi Worms and Sugar-Free Gummi Bears, utilizing high-quality ingredients and innovative production methods to elevate consumer experience

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albanese Confectionery Group Inc.

- Arcor Group

- AUGUST STORCK KG

- Bazooka Candy Brands

- Cloetta AB

- Decoria Confectionery Co. Ltd.

- Ferrero International S.A.

- Giant Gummy Bears

- HARIBO GmbH and Co. KG

- House of Candy

- Jelly Belly Candy Co.

- Mars Inc.

- Mederer GmbH

- Mondelez International Inc.

- Nestle SA

- Perfetti Van Melle Group BV

- The Hershey Co.

- Vidal Golosinas

- YILDIZ HOLDING

- Yupi Indo Jelly Gum Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Jelly Candies (Gummies) Market

- In January 2024, Hershey's Chocolate announced the launch of its new line of fruit-flavored jelly beans, expanding its gummy candy offerings (Source: Hershey's Press Release).

- In March 2024, Wrigley, a Mars, Inc. Company, entered into a strategic partnership with Sweets and Treats Gourmet, a leading online candy retailer, to boost its e-commerce presence (Source: Mars, Inc. Press Release).

- In April 2025, Trolli, a Ferrero Group brand, secured a significant investment of USD50 million from PE firm L Catterton, to boost its production capacity and expand its market share in the gummy candies market (Source: L Catterton Press Release).

- In May 2025, the European Union's Food Safety Agency approved the use of plant-based gelatin alternatives for jelly candies, paving the way for more sustainable and ethical gummy candy production (Source: European Food Safety Authority Press Release).

Research Analyst Overview

- The jelly candies, or gummies, market exhibits dynamic trends and intricate market activities. Brands strive for enhanced recognition, leveraging product differentiation through unique flavors and shapes. Ingredient traceability is crucial, with consumers demanding transparency regarding confectionery coatings, high-fructose corn syrup, gum arabic, and carnauba wax. Product lifecycle management plays a significant role, as companies navigate the various stages of candy molds, cost analysis, and profit margins. Consumer demographics influence market direction, with customer loyalty programs targeting specific age groups and preferences. Food processing equipment and risk assessment are essential for efficient production and minimizing product recalls.

- Supply chain management and sales forecasting are critical components of a successful business strategy. Candies with inclusions and candy packaging materials also impact market trends, with innovative designs and sustainable materials attracting consumer attention. Retail shelf placement, point-of-sale displays, social media marketing, and online advertising are key marketing strategies to boost sales. Food labeling regulations and inversion sugar are regulatory considerations, necessitating careful cost analysis and compliance. Candy manufacturers must balance these factors to maximize return on investment while catering to evolving consumer demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Jelly Candies (Gummies) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 1388 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, Germany, China, Russia, UK, Italy, Spain, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Jelly Candies (Gummies) Market Research and Growth Report?

- CAGR of the Jelly Candies (Gummies) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the jelly candies (gummies) market growth of industry companies

We can help! Our analysts can customize this jelly candies (gummies) market research report to meet your requirements.