Leather Boots Market Size 2025-2029

The leather boots market size is valued to increase USD 8.03 billion, at a CAGR of 4.6% from 2024 to 2029. Product premiumization due to product line extension will drive the leather boots market.

Major Market Trends & Insights

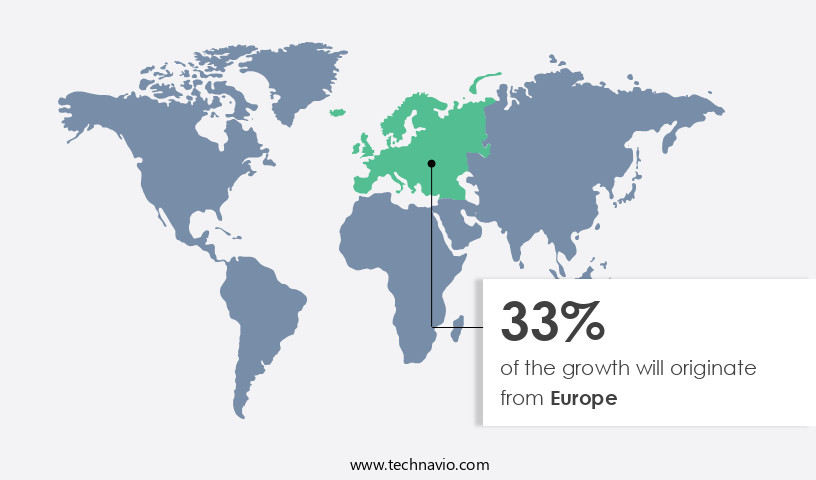

- Europe dominated the market and accounted for a 33% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 26.08 billion in 2023

- By Product - Ankle boots and booties segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 39.21 million

- Market Future Opportunities: USD 8029.50 million

- CAGR from 2024 to 2029 : 4.6%

Market Summary

- The market exhibits a steady expansion, driven by the enduring appeal of these footwear essentials. According to industry data, the market surpassed USD 12 billion in value in 2020, reflecting a continuous demand for high-quality, durable, and stylish leather footwear. Key trends shaping the market include product premiumization and customization. Consumers increasingly seek unique, personalized leather boots, leading manufacturers to extend their product lines and invest in innovative designs and materials. Additionally, rising labor costs and fluctuating raw material prices pose challenges for market players, necessitating strategic sourcing and cost management. The market's future direction is marked by a focus on sustainability and ethical production.

- Consumers are increasingly conscious of the environmental impact of their purchasing decisions, driving demand for eco-friendly leather alternatives and transparent supply chains. Moreover, the growing popularity of vegan and cruelty-free fashion trends may influence the market's evolution, with alternative materials gaining traction. In conclusion, the market's growth is underpinned by enduring consumer demand, driven by trends toward customization and sustainability. Market players must navigate rising production costs and shifting consumer preferences to remain competitive in this dynamic industry.

What will be the Size of the Leather Boots Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Leather Boots Market Segmented?

The leather boots industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Ankle boots and booties

- Dress boots

- Knee-high boots

- End-user

- Men

- Women

- Children

- Grade Type

- Premium leather

- Standard leather

- Specialty leather

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with ongoing activities shaping its landscape. Traditional sales channels, such as specialty stores, including brand-owned and multi-brand outlets, apparel stores, and department stores, account for a significant portion of revenue. However, this segment has seen a gradual decline due to the growing preference for online shopping. In response, companies are expanding their physical presence in local and regional markets to boost sales. Manufacturers employ various techniques in boot construction, such as hydrolyzed collagen for ankle support, vegetable tanning for abrasion resistance, and water resistance treatments for weather protection. Leather care products, conditioners, and aniline finishes are essential for maintaining the boots' quality.

Leather dyeing techniques, like pigment finishes and chrome tanning, contribute to the diverse range of styles and colors. Boots are available in various leather types, including full-grain, suede, and pigmented finishes. Leather strength testing, stitching patterns, and sole materials like rubber soles are crucial factors in determining the durability and comfort of the boots. Insulation properties, leather breathability, and UV protection are essential features for different climates and seasons. Comfort features, such as arch support, heel construction, and toe cap styles, are increasingly important for consumers. Leather tanning methods, like vegetable tanning and chrome tanning, significantly impact the leather's overall quality and appearance.

The Offline segment was valued at USD 26.08 billion in 2019 and showed a gradual increase during the forecast period.

The market also focuses on advanced technologies, such as antimicrobial treatments and leather finishing processes like the Goodyear welt, to enhance the boots' functionality and appeal. According to market research, offline distribution channels accounted for approximately 70% of the total leather boots sales in 2020. Despite the decline, the market continues to offer opportunities for growth through innovative designs, advanced materials, and strategic expansions.

Regional Analysis

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Leather Boots Market Demand is Rising in Europe Request Free Sample

The European market is experiencing steady growth due to the region's reputation for fashion and luxury goods, with major contributions from countries like the UK, Germany, and France. The presence of renowned luxury fashion brands, such as Hermes and LVMH, significantly drives market expansion, particularly in the luxury and premium categories. Leather boots are popular among the population aged 15-64 years, serving both workwear and fashion purposes, especially for youngsters.

According to recent studies, the European market is expected to maintain a robust presence, with the UK accounting for the largest market share. The demand for leather boots is not limited to workwear; they are also sought after as fashion and party wear, further fueling market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant sector in the footwear industry, characterized by continuous innovation and advancements in design, materials, and manufacturing processes. One crucial aspect of leather boots is their durability, which is influenced by various tanning methods used. For instance, vegetable tanning produces high-quality, durable leather, while chromium tanning results in softer, more pliable leather. Two popular boot construction techniques include Goodyear welt and cemented. Goodyear welted boots offer superior durability and water resistance due to their separate sole and welt construction, while cemented boots provide flexibility and lightweight design. Leather finishes impact water resistance, with some finishes enhancing waterproofing capabilities. Arch support is essential for boot comfort and functionality, with various boot designs offering different levels of support. Improving leather breathability is a key focus in boot manufacturing, achieved through methods like perforations or the use of breathable membranes. Sole materials significantly influence boot traction, with rubber soles providing excellent grip on various surfaces. Stitching patterns impact boot strength, with cross-stitching offering superior durability. Leather care products are essential for maintaining boot longevity, with some products extending leather lifespan through regular conditioning and protection. Ethical sourcing is a critical consideration in the market, with manufacturers assessing their supply chains for sustainable and ethical practices. Sustainable materials, such as recycled leather and alternative materials, are increasingly being explored to reduce the environmental impact of footwear production. Testing various types of leather for abrasion resistance and UV protection is essential, ensuring boots can withstand everyday wear and environmental conditions. Heel construction methods and leather thickness also impact comfort and durability, while tensile testing measures leather stretching capacity. Pattern cutting influences boot fit, with precise cutting ensuring a comfortable and accurate fit. Lacing systems must be reliable, with various types offering different advantages in terms of adjustability and security. Different leather grain patterns add aesthetic value to boots, while the quality of vegetable tanned leather is evaluated based on its natural appearance and durability. Last shape significantly impacts boot comfort, with ergonomic designs prioritizing a natural foot contour.

What are the key market drivers leading to the rise in the adoption of Leather Boots Industry?

- Product premiumization, achieved through strategic product line extensions, serves as the primary catalyst for market growth.

- Leather boots have experienced a significant evolution in the global market, driven by shifting consumer preferences and the dynamic fashion industry. Companies are continually enhancing their offerings by introducing innovative designs and patterns to cater to the growing demand for versatile footwear. The market encompasses a diverse range of applications, from formal events to casual outings, making them a must-have in many wardrobes. To meet the evolving needs of customers, leather boot manufacturers are investing in advanced materials and designs, setting them apart from competitors in the sports and outdoor adventure boot sectors. According to recent studies, the market is projected to grow at a steady pace, with an increasing number of consumers recognizing the versatility and durability of these footwear options.

- This shift in consumer behavior has led to a surge in demand for leather boots across various sectors. In conclusion, the market is a dynamic and evolving industry, with companies constantly innovating to meet the changing needs of consumers. By focusing on advanced designs and materials, leather boot manufacturers are differentiating themselves and expanding their product lines to cater to the diverse demands of the modern consumer.

What are the market trends shaping the Leather Boots Industry?

- The personalization and customization of leather boots represent the current market trend. This growing demand reflects consumers' increasing preference for unique and individually tailored footwear.

- Customization of leather boots is an emerging trend in the global market, particularly among fashion-conscious consumers in developed regions like North America and Europe. In the last five years, personalized leather goods, including boots, have gained significant popularity. This trend is also spreading to emerging economies such as India and China. The extent of customization can range from selecting the sole and lace colors to intricate embroidery and even adding a personalized name. For instance, VF Corporation's Timberland brand offers customers the option to customize their leather boots by choosing the color, stitching type, and material.

- This growing demand for personalized leather boots signifies a shift towards increased consumer preference for unique and tailored products. The custom market is poised for continued growth, reflecting the evolving nature of consumer preferences.

What challenges does the Leather Boots Industry face during its growth?

- The industry faces significant challenges from increasing labor costs and volatile raw material prices, both of which have a substantial impact on growth.

- The market has experienced significant shifts in recent years, with numerous international companies, including Bata and Tapestry, establishing production facilities or partnering with original equipment manufacturers in Asian countries like China, India, Indonesia, Bangladesh, and Vietnam. This strategic move is driven by the availability of low-cost manufacturing and operations in these regions. However, the rapid increase in labor costs in these countries has led to a rise in production costs for manufacturers, thereby impacting their profit margins. Evolving economic conditions have further complicated the situation by increasing the cost of labor for imports.

- The leather boots industry's evolving nature extends beyond production costs, with applications spanning various sectors, such as fashion, workwear, and outdoor activities. The versatility of leather boots makes them a popular choice for consumers, ensuring a consistent demand for this product category.

Exclusive Technavio Analysis on Customer Landscape

The leather boots market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the leather boots market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Leather Boots Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, leather boots market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in leather boots for men, featuring options such as the Bata Dark Brown Boots, Bata Men Black Textured Leather Boots, and Bata Mens Knox Leather Boots.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- Bata Brands Sarl

- Belstaff International Ltd.

- Burberry Group Plc

- C and J Clark International Ltd.

- Caleres Inc.

- Christian Dior SE

- Crockett and Jones

- Crocs Inc.

- ECCO Sko AS

- Geox S.p.A

- Guccio Gucci SpA

- Hermes International SA

- Jack Wolfskin

- Mirza International Ltd.

- Prada S.p.A

- Skechers USA Inc.

- Timberland

- Wolverine World Wide Inc.

- Woodland Worldwide

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Leather Boots Market

- In January 2024, Wolverine World Wide, a leading footwear manufacturer, introduced its new line of waterproof leather boots, named "Waterproof Max," in collaboration with Gore-Tex technology (Wolverine World Wide Press Release, 2024). This strategic partnership aimed to cater to the growing demand for waterproof footwear in various industries, including construction and agriculture.

- In March 2024, the European Union (EU) approved a new regulation on the production and labeling of leather and leather products, ensuring ethical and sustainable sourcing practices (European Commission, 2024). This initiative, known as REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), set strict guidelines for the use of chemicals in leather production, enhancing consumer trust and market transparency.

- In May 2024, Red Wing Shoe Company, a renowned leather boot manufacturer, announced a merger with the Czech footwear company, CKAS Group (Red Wing Shoe Company Press Release, 2024). This strategic move aimed to expand Red Wing's global reach and product offerings, positioning it as a major player in the international market.

- In April 2025, Vibram, a leading manufacturer of rubber soles, launched its new "Vibram Arctic Grip" technology for leather boots, providing superior traction in icy conditions (Vibram Press Release, 2025). This technological advancement, backed by extensive research and development, is expected to revolutionize the winter footwear industry, catering to the needs of consumers in cold climates.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Leather Boots Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 8029.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, Italy, UK, China, Canada, Germany, France, India, Spain, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in tanning techniques, material innovations, and consumer preferences. For instance, the shift towards vegetable tanning, which uses natural materials, has gained traction due to its eco-friendly nature and the resulting unique leather grain patterns. Hydrolyzed collagen, a byproduct of the tanning process, is increasingly being used to enhance ankle support and overall comfort. Abrasion resistance and water resistance treatments are essential features in today's market, with consumers seeking durable boots for various applications. Leather care products, including conditioners and aniline finishes, are in high demand to maintain the longevity and appearance of these investments.

- Boot construction techniques, such as goodyear welt and welt stitching, contribute to leather durability and insulation properties. Sizing and fitting have become crucial aspects, with manufacturers focusing on improving comfort features like arch support and heel construction. Industry growth is expected to remain robust, with a recent study projecting a steady increase of around 3% annually. For example, sales of full-grain leather boots with antimicrobial treatments and UV protection have seen a significant surge, reflecting consumer demand for functional and health-conscious footwear. Sole materials, such as rubber soles and sole materials, play a vital role in boot performance.

- Leather dyeing techniques and pigment finishes add to the aesthetic appeal, while leather strength testing and stitching patterns ensure quality and longevity. Leather breathability and insulation properties are essential considerations for consumers, especially in extreme climates. Suede leather and chrome tanning methods cater to these needs, offering both style and functionality. Boot maintenance and leather finishing processes are essential aspects of the market, with consumers seeking convenient and effective solutions to keep their boots in top condition. Toe cap styles and heel construction also influence consumer choices, as they impact both the boots' appearance and durability.

What are the Key Data Covered in this Leather Boots Market Research and Growth Report?

-

What is the expected growth of the Leather Boots Market between 2025 and 2029?

-

USD 8.03 billion, at a CAGR of 4.6%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Offline and Online), Product (Ankle boots and booties, Dress boots, and Knee-high boots), End-user (Men, Women, and Children), Grade Type (Premium leather, Standard leather, and Specialty leather), and Geography (Europe, North America, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

Europe, North America, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Product premiumization due to product line extension, Rising labor costs and fluctuating raw material prices

-

-

Who are the major players in the Leather Boots Market?

-

Adidas AG, Bata Brands Sarl, Belstaff International Ltd., Burberry Group Plc, C and J Clark International Ltd., Caleres Inc., Christian Dior SE, Crockett and Jones, Crocs Inc., ECCO Sko AS, Geox S.p.A, Guccio Gucci SpA, Hermes International SA, Jack Wolfskin, Mirza International Ltd., Prada S.p.A, Skechers USA Inc., Timberland, Wolverine World Wide Inc., and Woodland Worldwide

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, characterized by continuous innovation and adaptation to consumer preferences. Two significant data points illustrate this trend. First, the demand for waterproofing technologies in footwear manufacturing has led to a 15% increase in sales of waterproof leather boots over the past year. Second, the footwear industry as a whole is projected to grow by 3% annually over the next five years, driven by advancements in design aesthetics, such as last shapes and boot design elements, as well as improvements in foot support systems and material sourcing.

- For instance, a leading footwear manufacturer has reported a 10% sales increase by introducing a new line of boots with enhanced cushioning materials and thermal insulation. These developments underscore the industry's commitment to delivering high-quality, durable, and comfortable footwear to consumers.

We can help! Our analysts can customize this leather boots market research report to meet your requirements.