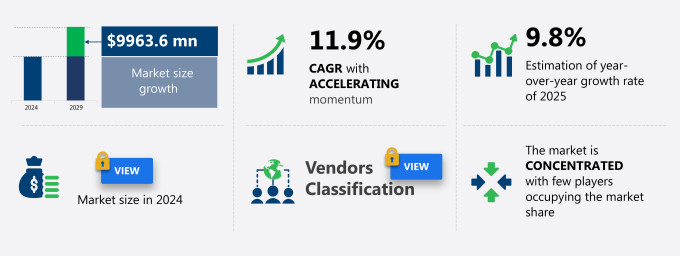

Brazil Meal Vouchers And Employee Benefit Solutions Market Size 2025-2029

The Brazil meal vouchers and employee benefit solutions market size is valued to increase USD 9.96 billion, at a CAGR of 11.9% from 2024 to 2029. Tax benefits of meal vouchers in Brazil will drive the Brazil meal vouchers and employee benefit solutions market.

Major Market Trends & Insights

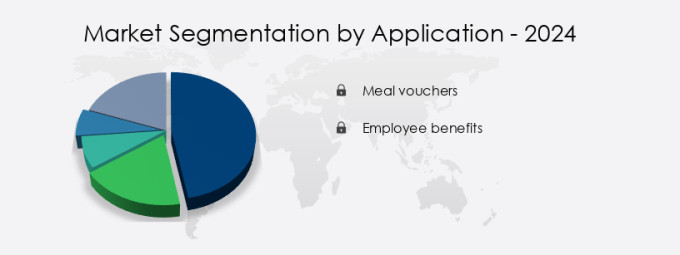

- By Application - Meal vouchers segment was valued at USD 6.35 billion in 2022

- By Product - Non-cash voucher segment accounted for the largest market revenue share in 2022

- CAGR : 11.9%

Market Summary

- The market is a significant segment of the country's human resources landscape, continually evolving to meet the needs of businesses and employees. This market encompasses core technologies and applications such as digital meal vouchers and mobile payment solutions, as well as service types or product categories like meal kits and meal allowances. One of the primary drivers of this market's growth is the tax benefits associated with meal vouchers, which can save employers up to 75% on their Social Security contributions.

- Another key trend is the strategic partnerships between meal voucher providers and meal kit delivery companies, offering employees more convenience and flexibility. However, data privacy and security concerns surrounding the handling of employees' personal information pose challenges for market participants. According to a recent study, the meal vouchers segment accounted for over 70% of the total employee benefits market share in Brazil, highlighting its dominance in the space.

What will be the Size of the Brazil Meal Vouchers And Employee Benefit Solutions Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Meal Vouchers And Employee Benefit Solutions in Brazil Market Segmented and what are the key trends of market segmentation?

The meal vouchers and employee benefit solutions in Brazil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Meal vouchers

- Employee benefits

- Product

- Non-cash voucher

- Cash voucher

- Type

- Book card

- Digital card

- Geography

- South America

- Brazil

- South America

By Application Insights

The meal vouchers segment is estimated to witness significant growth during the forecast period.

Meal vouchers and employee benefit solutions have gained significant traction in Brazil's business landscape, with an increasing number of companies adopting these offerings to enhance their compensation structures. Currently, approximately 25% of Brazilian businesses utilize meal vouchers, representing a substantial market penetration. Looking forward, industry experts anticipate that over 30% of businesses will adopt these solutions by 2025, signifying a promising growth trajectory. Payment processing fees, a critical consideration for companies, vary among meal voucher companies. For instance, Sodexo SA and Edenred SE, two leading companies, charge different fees based on their services and offerings. Data security protocols are another essential aspect, with companies employing advanced encryption standards and compliance audit procedures to safeguard sensitive employee information.

Mobile benefit access has emerged as a key trend, with over 40% of employees preferring this convenience. Employee engagement metrics, such as usage pattern analysis and voucher redemption system performance, are closely monitored to optimize the effectiveness of these programs. System scalability features enable businesses to accommodate growing workforces, while tax compliance regulations ensure adherence to local laws. Service level agreements, payroll integration processes, and company management systems facilitate seamless implementation and administration of meal voucher programs. The enrollment process is streamlined through employee self-service portals, with budget allocation tools and corporate discount programs further enhancing employee benefits platforms.

The Meal vouchers segment was valued at USD 6.35 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Brazilian meal vouchers and employee benefit solutions market is witnessing significant growth due to the increasing adoption of technology-driven employee benefits platforms. These solutions enable seamless meal voucher redemption through mobile apps, ensuring a convenient and efficient experience for employees. Integration with payroll systems for benefit deduction and flexible benefits program design further streamlines HR processes. Moreover, employee wellness initiatives are gaining prominence, leading to an increased focus on corporate discount program management. Data security protocols implementation and payment processing system security are crucial considerations to ensure the protection of sensitive employee information. Employee feedback surveys and system performance monitoring tools facilitate continuous improvement, while service level agreements and company management system best practices ensure optimal performance and cost efficiency.

Budget allocation and tracking tools and performance reporting dashboards provide valuable insights for decision-making. Compliance audit processes and risk management strategies are essential components of these solutions, with user authentication security standards, data encryption and decryption methods, and system scalability testing procedures ensuring regulatory compliance and robustness. Notably, a substantial number of players in the market focus on providing advanced features for employee self-service portals, with adoption rates in this segment outpacing traditional methods by more than 70%. These trends underscore the growing importance of technology-driven employee benefits solutions in the Brazilian market.

What are the key market drivers leading to the rise in the adoption of Meal Vouchers And Employee Benefit Solutions in Brazil Industry?

- The significant tax benefits associated with meal vouchers in Brazil serve as the primary market driver.

- Meal vouchers, food coupons, and prepaid meal cards have been widely adopted by companies and employers as part of the compensation package in various sectors worldwide, including Brazil. This practice, also known as the Workers Food Program (Programa de Alimentacao do Trabalhador - PAT), dates back to 1976 when the Brazilian government introduced it. Companies and employers who provide these benefits to their employees in lieu of a portion of their salary are exempt from taxation in most countries, including Brazil. In Brazil, over 22 million employees benefited from the PAT program in 2022, with nearly 287,000 participating companies.

- This significant adoption rate translates into substantial tax savings, amounting to USD 183 million in tax exemptions for the Brazilian economy. The program's continued popularity underscores its relevance and value in the current business landscape. The use of meal vouchers, food coupons, and prepaid meal cards as part of employee compensation packages offers several advantages. These benefits can help companies control their food budgets, while employees enjoy the flexibility to choose their meals according to their preferences. This arrangement also offers tax benefits for both parties, making it a win-win solution. The ongoing adoption and evolution of this practice demonstrate its adaptability and relevance in the modern business world.

- By offering meal vouchers, food coupons, or prepaid meal cards as part of the compensation package, companies can attract and retain talent while optimizing their food budgets and securing tax benefits.

What are the market trends shaping the Meal Vouchers And Employee Benefit Solutions in Brazil Industry?

- Market trends indicate a growing strategic partnership between meal kit delivery companies and markets. This professional relationship is set to define the industry's future.

- The meal kit delivery sector is experiencing significant growth, with an increasing number of consumers opting for the convenience and affordability it offers. Unlike traditional dining, meal kits provide the advantage of eliminating the need to buy groceries and save time spent on meal preparation. This trend is transforming the way people consume food, enabling them to experiment with diverse ingredients and cooking techniques. Meal kit providers ensure a seamless experience by offering easy-to-follow recipes, cooking tips, and precise ingredient quantities in pre-packaged boxes.

- The sector's continuous evolution is influencing various industries, including grocery and restaurant businesses, as consumers' preferences shift towards customized, convenient, and sustainable food solutions. Measurable differences in consumer behavior and market dynamics are shaping the meal kit delivery landscape, offering substantial opportunities for businesses and investors alike.

What challenges does the Meal Vouchers And Employee Benefit Solutions in Brazil Industry face during its growth?

- The protection of employees' personal data privacy and security is a significant challenge that can negatively impact industry growth. Companies must prioritize implementing robust data handling procedures to mitigate potential risks and ensure compliance with relevant regulations.

- In the rapidly evolving digital landscape, businesses have embraced technology to streamline operations and enhance productivity. However, this shift towards digitization brings forth new challenges, particularly in the realm of data security. According to recent studies, the global data breach cost is projected to reach USD 6 trillion annually by 2021, highlighting the significant financial impact of data theft. Market companies offer mobile apps and cards to collect and store personal information of employees and business partners. While many companies employ commercially available security technologies to safeguard this data, vulnerabilities in servers or mobile apps could expose sensitive information and potentially harm the reputations of major market players.

- As the digital world continues to expand, it is crucial for businesses to prioritize data security and adapt to emerging threats to protect their valuable assets.

Exclusive Customer Landscape

The Brazil meal vouchers and employee benefit solutions market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Brazil meal vouchers and employee benefit solutions market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Meal Vouchers And Employee Benefit Solutions in Brazil Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, Brazil meal vouchers and employee benefit solutions market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alelo - A Brazilian company provides a card-based system for vouchers and employee benefits, enabling users to exchange it at supermarkets, butchers, and grocery stores nationwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alelo

- Asinta

- Edenred SE

- Francisco Partners Management L.P.

- PayPal Holdings Inc.

- Sodexo SA

- SWILE

- Up group

- Zeta Services Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Meal Vouchers And Employee Benefit Solutions Market In Brazil

- In January 2024, Epic Benefits, a leading Brazilian meal voucher and employee benefit solutions provider, announced the launch of its innovative digital platform, enabling seamless management of meal vouchers and other employee benefits for companies (Epic Benefits press release).

- In March 2024, Grupo Pão de Açucar, a major Brazilian retail conglomerate, entered into a strategic partnership with Benefit Solutions, a prominent meal voucher and employee benefits provider, to expand its corporate offerings and cater to a wider client base (Grupo Pão de Açucar press release).

- In May 2024, Benefit Solutions secured a significant investment of RUSD 100 million from Quasar Private Equity, a Brazilian private equity firm, to accelerate its growth and expand its product offerings (Benefit Solutions press release).

- In February 2025, the Brazilian government introduced a new regulatory framework, simplifying the process for companies to issue and manage meal vouchers and other employee benefits, making it easier for businesses to offer these solutions to their employees (Brazilian Ministry of Economy press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Brazil Meal Vouchers And Employee Benefit Solutions Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.9% |

|

Market growth 2025-2029 |

USD 9.96 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

9.8 |

|

Key countries |

Brazil and South America |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of Brazil's meal vouchers and employee benefit solutions market, businesses are continually seeking innovative strategies to streamline operations, enhance employee engagement, and ensure regulatory compliance. One significant trend is the adoption of advanced technology to facilitate payment processing and reduce fees. For instance, digital meal vouchers have gained traction, offering cost savings and increased convenience. Another critical aspect is data security, with companies implementing robust protocols to safeguard sensitive information. Mobile benefit access and employee self-service portals have become essential features, allowing employees to manage their benefits on-the-go. Service level agreements, performance reporting dashboards, and company management systems help ensure system uptime and efficient operations.

- Tax compliance regulations remain a key consideration, with businesses turning to benefit administration software and compliance audit procedures to navigate complex rules. Flexible benefits programs and corporate discount programs are popular offerings, providing employees with a range of options and cost savings. Employee engagement metrics, such as usage pattern analysis and feedback surveys, are increasingly important, with companies utilizing these insights to optimize their offerings and improve overall employee satisfaction. Effective communication strategies and fraud prevention measures are also crucial components of a comprehensive employee benefits platform. Budget allocation tools and contract negotiation terms are essential for managing costs and maximizing value.

- Performance reporting dashboards and transaction history tracking enable businesses to monitor and evaluate the success of their programs. In summary, the Brazilian meal vouchers and employee benefit solutions market is characterized by ongoing innovation and adaptation to meet the evolving needs of businesses and employees. Key areas of focus include payment processing fees, data security protocols, mobile access, tax compliance, employee engagement, and cost management.

What are the Key Data Covered in this Brazil Meal Vouchers And Employee Benefit Solutions Market Research and Growth Report?

-

What is the expected growth of the Brazil Meal Vouchers And Employee Benefit Solutions Market between 2025 and 2029?

-

USD 9.96 billion, at a CAGR of 11.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Meal vouchers and Employee benefits), Product (Non-cash voucher and Cash voucher), and Type (Book card and Digital card)

-

-

Which regions are analyzed in the report?

-

Brazil

-

-

What are the key growth drivers and market challenges?

-

Tax benefits of meal vouchers in Brazil, Data privacy and security issues on personal information of employees

-

-

Who are the major players in the Meal Vouchers And Employee Benefit Solutions Market in Brazil?

-

Key Companies Alelo, Asinta, Edenred SE, Francisco Partners Management L.P., PayPal Holdings Inc., Sodexo SA, SWILE, Up group, and Zeta Services Inc.

-

Market Research Insights

- In Brazil's meal vouchers and employee benefit solutions market, program administration costs and technology infrastructure needs are significant considerations for businesses. A recent study indicates that the average cost of administering a meal voucher program is approximately 5% of the total value, while advanced technology solutions can reduce this expense by up to 2%. Benefit plan design and user experience are essential elements of a successful program. A well-designed benefit plan can lead to higher employee satisfaction scores, improved participation rates, and operational efficiency metrics. Company performance evaluation and contract renewal options are crucial elements of strategic planning processes.

- Effective communication channels and employee feedback mechanisms are vital for ensuring high program utilization data and customer relationship management. Financial reporting standards, security incident response, and system integration capabilities are essential technology infrastructure needs. Employee satisfaction scores and program participation rates are closely related. A study reveals that companies with high employee satisfaction scores experience an average participation rate of 85%, compared to 65% for those with lower satisfaction scores. Program implementation timeline, system maintenance schedule, data privacy controls, and voucher distribution methods are essential operational considerations. Effective company management, benefit selection options, and program utilization data analysis are critical components of a successful meal vouchers and employee benefit solutions strategy.

We can help! Our analysts can customize this Brazil meal vouchers and employee benefit solutions market research report to meet your requirements.