Municipal Water And Wastewater Treatment Equipment Market Size 2025-2029

The municipal water and wastewater treatment equipment market size is forecast to increase by USD 13.05 billion at a CAGR of 5.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for reclaimed water and the introduction of advanced membrane technologies. The need for water and wastewater treatment infrastructure is a primary driver for market expansion, as governments and municipalities worldwide invest in upgrading and expanding their systems to meet growing population demands and stricter regulatory requirements. However, regulatory hurdles impact adoption, as stringent regulations and lengthy approval processes can delay project timelines and increase costs. Furthermore, supply chain inconsistencies temper growth potential, as raw material availability and price fluctuations can impact production and delivery schedules. To capitalize on market opportunities and navigate challenges effectively, companies must focus on innovation, regulatory compliance, and supply chain resilience.

- Moreover, the market is experiencing significant growth due to the increasing demand for reclaimed water and the introduction of advanced technologies such as ultrafiltration, activated carbon, and dissolved air flotation systems. Membrane technologies, including nanofiltration and reverse osmosis, are gaining popularity due to their ability to remove contaminants and produce high-quality water. By investing in research and development of new technologies and collaborating with suppliers to ensure a reliable and consistent supply chain, market participants can differentiate themselves and thrive in this dynamic and growing market.

What will be the Size of the Municipal Water And Wastewater Treatment Equipment Market during the forecast period?

- The market is experiencing significant activity and trends, driven by the need for water infrastructure rehabilitation and the integration of smart cities. Data-driven operations and remote monitoring are becoming essential for ensuring water equity and meeting stringent water quality standards. Water security is a top priority, leading to the adoption of advanced process control and membrane bioreactors (MBR) for sustainable wastewater treatment. Agricultural wastewater and industrial wastewater are key challenges, requiring innovative solutions for renewable energy integration and process optimization. Public-private partnerships (PPP) and asset management are crucial for water supply resilience and financing models. Green infrastructure, circular economy, and low-impact development (LID) are gaining traction in urban water management.

- Water stress, stormwater runoff, and non-revenue water are major concerns, driving the demand for water conservation technologies. Water footprint, financing models, and water treatment chemicals are essential components of water management plans. Wastewater discharge permits and water reuse regulations are shaping the industry landscape. Water audits and water affordability are critical for ensuring water management efficiency and equity. Wet weather flow and water quality modeling are essential for maintaining water infrastructure resilience.

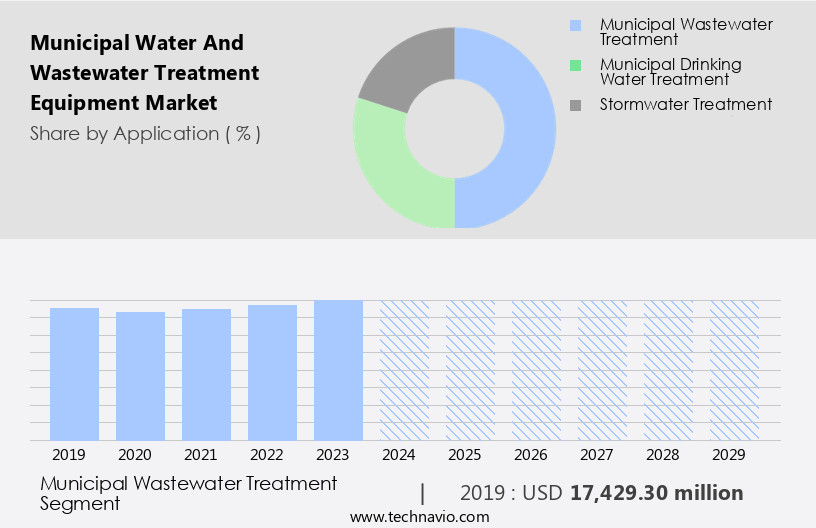

How is this Municipal Water And Wastewater Treatment Equipment Industry segmented?

The municipal water and wastewater treatment equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Municipal wastewater treatment

- Municipal drinking water treatment

- Stormwater treatment

- Type

- Secondary treatment

- Tertiary treatment

- Primary treatment

- Advanced treatment

- Product

- Filtration equipment

- Disinfection equipment

- Biological treatment equipment

- Sludge treatment equipment

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The municipal wastewater treatment segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing demand for water across various sectors, particularly in light of water scarcity and climate change. Inadequate water infrastructure in many developing countries leads to untreated wastewater being released into the environment, while developed nations invest in advanced treatment technologies such as membrane filtration, anaerobic digestion, and activated sludge. Water treatment plants employ a range of methods, including biological treatment, chemical dosing, and UV disinfection, to purify wastewater before it is returned to the environment or reused. Pumping systems and process control technologies are essential components of these plants, ensuring efficient energy use and effective treatment processes.

Water softening and corrosion control are crucial for maintaining water quality and extending the life of water distribution networks and treatment equipment. Digital water technologies, such as smart water and big data analytics, enable real-time monitoring and optimization of water treatment processes. Municipal wastewater sources include institutions, households, and commercial buildings, which release nutrients, trace elements, and dissolved salts into the wastewater stream. Stormwater management is another critical area, with greywater treatment and sludge treatment essential for reducing the environmental impact of stormwater runoff. The market for municipal water and wastewater treatment equipment is expected to grow moderately as countries invest in water infrastructure to address water scarcity and comply with regulatory requirements.

Artificial intelligence and biomimicry are emerging trends in the market, with AI-powered systems offering improved efficiency, accuracy, and cost savings.

The Municipal wastewater treatment segment was valued at USD 17.43 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In Asia Pacific (APAC), population growth and urbanization are driving the need for advanced water and wastewater treatment solutions. The expansion of municipal water and wastewater treatment infrastructure is a response to the increasing demand for clean water and sanitation services in urban areas. Governments in APAC countries are prioritizing investments in water infrastructure to address water scarcity, pollution, and public health challenges. This investment focus includes national water security initiatives, sanitation programs, and urban development plans, leading to substantial funding for water and wastewater treatment projects. Energy efficiency is a key consideration in the design and implementation of these projects, with technologies such as membrane filtration, reverse osmosis, and anaerobic digestion gaining popularity due to their energy savings.

Process control, water metering, and chemical dosing systems are essential components of these projects, ensuring optimal treatment plant performance and reducing operational costs. Climate change and its impact on water resources further highlight the importance of water conservation and reuse. Digital water technologies, such as smart water networks and big data analytics, are increasingly being adopted to improve water distribution efficiency and optimize treatment processes. Water filtration, including biological treatment and UV disinfection, plays a crucial role in ensuring water quality, while solids handling and sludge treatment are essential for effective wastewater treatment. Stormwater management is another area of focus, with the integration of green infrastructure and advanced treatment systems to mitigate the impacts of extreme weather events.

The use of artificial intelligence (AI) and activated sludge systems enhances treatment plant performance and enables predictive maintenance, ensuring the long-term sustainability of water and wastewater treatment infrastructure.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Municipal Water And Wastewater Treatment Equipment market drivers leading to the rise in the adoption of Industry?

- The increasing demand for reclaimed water serves as the primary market driver. This trend is influenced by various factors, including water scarcity, stringent regulations, and the growing recognition of water reuse as a sustainable solution for mitigating water shortages. The market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing demand for reclaimed water, which is advanced treated and recycled water used for various purposes, including irrigation and even human and domestic consumption. With freshwater resources declining due to rising demand and changing climatic conditions, many countries are promoting the use of reclaimed water as a sustainable alternative. Additionally, the growing global population necessitates an increased demand for consumable water for basic needs. Energy efficiency is another critical factor influencing market growth, as advanced treatment technologies and smart water management systems are becoming increasingly popular to reduce energy consumption and costs.

- Greywater treatment, activated sludge processes, and big data analytics are also gaining traction in the market to enhance water quality and optimize operational efficiency. Water metering is another essential component of the market, enabling accurate billing and water usage monitoring. Overall, the market is poised for continued growth as the demand for sustainable water management solutions increases.

What are the Municipal Water And Wastewater Treatment Equipment market trends shaping the Industry?

- Advanced membrane technologies are gaining significant traction in the market due to their introduction. This trend reflects the growing demand for innovative water treatment solutions. The market is witnessing significant growth due to the increasing water scarcity issues and the development of residential areas. Advanced technologies, such as membrane filtration and wastewater filtration, are driving the demand for municipal water and wastewater treatment equipment. Membrane water treatment technology, which includes high-pressure and low-pressure membranes, has gained popularity and affordability over the last three decades. This technology is crucial for processing and recycling water from various water resources for drinking and domestic purposes. Moreover, water reuse and water conservation are becoming essential, leading to an increased focus on sludge treatment and water quality improvement.

- Trickling filters are also widely used in wastewater treatment processes to enhance water quality before distribution. The market is expected to continue growing as municipalities invest in upgrading their water infrastructure to meet the demands of their growing populations.

How does Municipal Water And Wastewater Treatment Equipment market faces challenges face during its growth?

- The growth of the industry is significantly impacted by the essential requirement for advanced water and wastewater treatment infrastructure. The market faces a significant challenge due to the inadequate infrastructure for water and wastewater treatment. In the water treatment process, water from natural sources undergoes various stages, including flocculation, coagulation, sedimentation, filtration, and disinfection using techniques such as UV Disinfection and Biological Treatment. Wastewater treatment involves processes like Anaerobic Digestion and Sludge Dewatering. The selection of treatment technologies depends on water quality objectives, operational and maintenance requirements, and flexibility of operations. Reverse Osmosis and Fluidized Bed Reactor are among the advanced technologies used in water treatment. Process Control plays a crucial role in optimizing the treatment process and ensuring consistent water quality.

- Artificial Intelligence (AI) integration in treatment plants enhances automation, improves efficiency, and reduces operational costs. The design and implementation of these systems require a thorough understanding of the specific water characteristics and regulatory requirements. The market dynamics continue to evolve with ongoing research and advancements in treatment technologies.

Exclusive Customer Landscape

The municipal water and wastewater treatment equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the municipal water and wastewater treatment equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, municipal water and wastewater treatment equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company offers municipal water and wastewater treatment equipment such as 3M Fully Automatic Water Softener SFT 200 and 3M Fully Automatic Water Softener SFT 200Fe.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Alfa Laval AB

- American Water Works Co. Inc.

- Aquatech International LLC

- Cogent Co.

- Culligan International Co.

- DuPont de Nemours Inc.

- Ecolab Inc.

- Ecologix Environmental Systems LLC

- Fluence Corp. Ltd.

- General Electric Co.

- Ovivo Inc.

- Pentair Plc

- SUEZ SA

- Thermax Ltd.

- Toray Industries Inc.

- VA Tech Wabag Ltd.

- Veolia Environnement SA

- Veralto Corp.

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Municipal Water And Wastewater Treatment Equipment Market

- In March 2024, Xylem Inc., a leading global water technology company, introduced the new Flygt Concerto MRD submersible wastewater pump, designed to optimize energy efficiency and reduce lifecycle costs for municipalities (Xylem Inc. Press release, 2024). This innovative product launch signified a significant advancement in energy-efficient wastewater treatment solutions.

- In July 2025, Veolia Water Technologies and Suez Water Technologies & Solutions announced a strategic partnership to create a joint venture, WaterTech, focusing on water and wastewater treatment solutions (Veolia Water Technologies press release, 2025). This collaboration aimed to enhance their combined expertise and expand their market presence, providing comprehensive services to municipalities worldwide.

- In September 2024, Siemens Water Technologies Corporation received a major contract from the Metropolitan Water Reclamation District of Greater Chicago to upgrade its Jardine Water Purification Plant with advanced membrane filtration technology (Siemens AG press release, 2024). This significant project represented a substantial investment in upgrading municipal water infrastructure and improving water quality for the city's residents.

- In December 2025, the European Union approved the Horizon Europe research and innovation program, which includes a focus on water research, including advanced wastewater treatment technologies (European Commission press release, 2025). This initiative signified a strong commitment from the EU to invest in research and development, driving innovation in the market.

Research Analyst Overview

The market continues to evolve, driven by the ever-changing dynamics of water infrastructure and energy efficiency requirements. Pumping systems and process control technologies play a crucial role in optimizing water treatment processes, while water softening solutions mitigate corrosion and extend asset life. Climate change and water scarcity fuel the demand for advanced wastewater filtration technologies, such as membrane filtration and anaerobic digestion. Biological treatment processes, including activated sludge and trickling filters, remain a cornerstone of wastewater treatment. Water reuse and municipal wastewater treatment are gaining traction as essential components of sustainable water management. Chemical dosing and sludge dewatering systems ensure efficient and cost-effective treatment, while reverse osmosis and UV disinfection technologies address water quality concerns.

Digital water technologies, such as smart water networks and big data analytics, are revolutionizing water distribution and management. Solids handling and fluidized bed reactors are integral to the efficient processing of wastewater and sludge. The ongoing integration of water treatment technologies with AI and IoT is transforming the industry, enabling real-time monitoring and predictive maintenance. Water conservation and water distribution remain critical areas of focus, with greywater treatment and stormwater management gaining prominence. The market's continuous evolution reflects the growing importance of water as a precious resource and the need for innovative, sustainable solutions to meet the evolving demands of various sectors.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Municipal Water And Wastewater Treatment Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 13.04 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, China, Germany, Russia, Australia, Japan, Canada, India, UK, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Municipal Water And Wastewater Treatment Equipment Market Research and Growth Report?

- CAGR of the Municipal Water And Wastewater Treatment Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the municipal water and wastewater treatment equipment market growth and forecasting

We can help! Our analysts can customize this municipal water and wastewater treatment equipment market research report to meet your requirements.