Mushroom Market Size 2024-2028

The mushroom market size is valued to increase USD 24.17 billion, at a CAGR of 6.78% from 2023 to 2028. Medicinal values associated with mushrooms will drive the mushroom market.

Major Market Trends & Insights

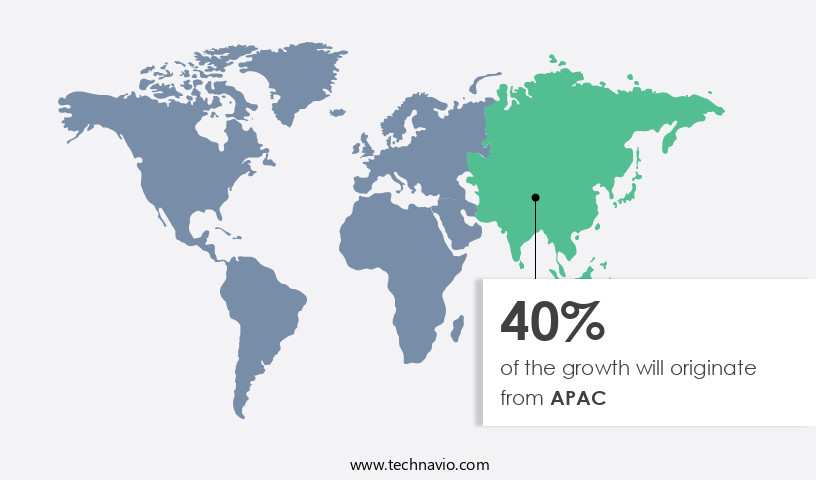

- APAC dominated the market and accounted for a 40% growth during the forecast period.

- By Type - Fresh mushroom segment was valued at USD 43.51 billion in 2022

- By Product - Button Mushroom segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 76.89 billion

- Market Future Opportunities: USD 24171.80 billion

- CAGR : 6.78%

- APAC: Largest market in 2022

Market Summary

- The market encompasses the production, distribution, and consumption of various edible and medicinal mushroom species worldwide. This dynamic market is driven by the increasing demand for functional foods and natural health supplements, with core technologies such as biotechnology and automation playing a significant role in enhancing production efficiency and product quality. For instance, automation in mushroom harvesting has gained traction, reducing labor costs and improving yield. However, challenges persist in the form of supply chain complexities and labor shortages, particularly in developing countries.

- According to a recent study, the medicinal the market is projected to grow at a steady pace, with an estimated 10% of the global population consuming these fungi for health benefits. The regulatory landscape is also evolving, with stricter regulations on the cultivation and sale of Medicinal mushrooms in several regions.

What will be the Size of the Mushroom Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Mushroom Market Segmented and what are the key trends of market segmentation?

The mushroom industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Fresh mushroom

- Canned mushroom

- Dried mushroom

- Product

- Button Mushroom

- Oyster Mushroom

- Shiitake Mushroom

- Portobello Mushroom

- Cremini Mushroom

- Enoki Mushroom

- Specialty Mushrooms

- Application

- Food Service (Restaurants, Hotels)

- Retail (Supermarkets, Hypermarkets, Online)

- Pharmaceutical & Nutraceutical

- Cosmetics

- End-use

- Culinary

- Medicinal/Health Supplements

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The fresh mushroom segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with the fresh mushroom segment particularly thriving due to increasing consumer demand for organic and unprocessed foods. Farmers worldwide cultivate various mushroom types, including Shiitake, Maitake, Reishi, and Chaga, recognizing the market's profitability. The consumer base for fresh mushrooms has expanded globally, driving market growth. Research and development initiatives and advancements in mushroom cultivation techniques contribute to the market's rapid expansion. Oxygen levels, packaging technologies, lighting systems, and nutrient management play crucial roles in optimizing mushroom production efficiency. Waste reduction strategies, such as substrate sterilization and automation, are essential for reducing carbon footprint and improving resource efficiency.

Disease resistance, mycelium morphology, and temperature regulation are vital factors in maintaining high-quality mushrooms. Automated harvesting, CO2 levels, and growth parameters are essential for maximizing yield and minimizing water usage. Hygiene protocols, biomass production, and humidity control are essential for post-harvest handling and maintaining the freshness of mushrooms. Energy consumption and environmental control are critical aspects of cultivation, with a focus on minimizing carbon footprint and improving resource efficiency. Future industry growth is expected to be robust, with innovations in mushroom genetics and genetic improvement driving advancements in cultivation automation, shelf life extension, and quality assessment. Spawn running, substrate composition, and mycelial growth are essential aspects of mushroom cultivation that require continuous optimization for improved production efficiency and yield optimization.

Market dynamics are constantly evolving, with a focus on improving production processes, reducing contamination, and enhancing the overall quality of mushrooms. The industry's ongoing research and development efforts aim to address the challenges of temperature regulation, water usage, and energy consumption while maintaining high-quality standards. In conclusion, the market is a thriving industry with significant growth potential. Farmers and researchers worldwide are continuously innovating and optimizing cultivation techniques to meet the increasing demand for fresh, organic mushrooms. The market's future growth is expected to be driven by advancements in genetics, automation, and sustainability, with a focus on improving production efficiency, reducing waste, and enhancing product quality.

The Fresh mushroom segment was valued at USD 43.51 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Mushroom Market Demand is Rising in APAC Request Free Sample

The European the market is characterized by intense competition, with market survival hinging on supplying consumers with top-quality fresh, dried, and canned mushrooms at competitive prices. Eurostat data reveals that Italy, Spain, France, Poland, Romania, Germany, and the Netherlands were the leading mushroom producers in 2023. A noteworthy trend has emerged in the consumption of exotic mushrooms, driven by imports from China, which commenced in 2018.

For instance, Spain's Shiitake mushroom consumption has surged since 2020. With the industry's dynamic nature, staying updated on market patterns and consumer preferences is crucial for businesses.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses the production and distribution of various edible and medicinal mushroom species. This market witnesses continuous growth due to the increasing demand for optimal temperature fruiting bodies and mycelium growth rate substrates. The effect of substrate moisture content on mycelium growth and mushroom yield sustainability is a significant focus in mushroom cultivation, with environmental parameters playing a crucial role. Post-harvest preservation techniques are essential to maintain mushroom quality, with improving shelf-life being a key concern for producers. Substrate sterilization methods' effectiveness and the relationship between CO2 levels and mushroom growth are essential research areas.

Nutrient requirements for mushroom growth and the impact of humidity control on mushroom quality are also vital factors shaping the market. Advanced genetic techniques are being employed for mushroom breeding to enhance mycelium morphology and yield. Sustainable practices, such as waste reduction in mushroom farms, are gaining importance in the market. Automated harvesting systems and analysis of different substrate types are transforming mushroom production, while controlling contamination in mushroom farms remains a challenge. The industrial application segment accounts for a significantly larger share in the market compared to the academic segment. Light intensity's impact on mushroom growth is an area of ongoing research, with controlling contamination being a critical concern for producers.

Adoption of advanced technologies, such as automated harvesting systems and improved packaging solutions, is on the rise, extending the shelf life of mushroom products and enhancing their market value. The market is expected to witness robust growth, driven by the increasing demand for high-quality mushroom products and the adoption of sustainable practices in mushroom cultivation.

What are the key market drivers leading to the rise in the adoption of Mushroom Industry?

- The medicinal properties attributed to mushrooms serve as the primary catalyst for the market's growth.

- Mushrooms have gained significant attention in the Health And Wellness industry due to their nutritional and medicinal properties. These fungi are rich in antioxidants and essential minerals, such as selenium, which plays a crucial role in liver enzyme function and aids in combating cancer-causing compounds in the body. Furthermore, mushrooms contain vitamin C, and Vitamin D fiber, and potassium, all contributing to cardiovascular health. Mushrooms classified as medicinal have additional functional and therapeutic benefits. They are used for disease prevention, alleviation, and healing, making them a valuable addition to various sectors, including healthcare and nutrition. The ongoing research and development in the medicinal the market reveal new applications and discoveries, continually expanding their reach and significance.

- Comparatively, the demand for Functional Foods And Beverages incorporating medicinal mushrooms has seen a noticeable increase, reflecting consumers' growing interest in natural health solutions. This trend is particularly prominent in the food and beverage industry, where innovative product offerings catering to this demand continue to emerge. In summary, the medicinal the market is a dynamic and evolving sector, with ongoing research and applications across various industries. Its potential for disease prevention, alleviation, and healing, combined with their nutritional benefits, make medicinal mushrooms a valuable asset in the health and wellness landscape.

What are the market trends shaping the Mushroom Industry?

- Automation is increasingly becoming a market trend in mushroom harvesting. Mushroom harvesting processes are being automated to enhance efficiency and productivity.

- Mushroom farming is experiencing a significant labor challenge as demand for their products continues to rise. Approximately 20% of the labor gap and 40% annual labor turnover exist in this sector. Training a new harvester takes up to six months. Indoor mushroom cultivation, which accounts for 80% of the global market, necessitates consistent labor due to year-round growth. New technologies are revolutionizing mushroom farming with automated indoor solutions.

- Robotic harvesting systems are among these innovations, continually picking, packing, and weighing mushrooms to meet fresh market requirements. This automation addresses labor shortages and improves overall efficiency. Despite these advancements, the industry's reliance on labor remains a challenge, as mushrooms double in size daily and require constant attention.

What challenges does the Mushroom Industry face during its growth?

- The growth of the industry is significantly impacted by the complexities of the supply chain and the labor shortages that persist as a major challenge.

- The market has experienced significant labor challenges, with the COVID-19 pandemic exacerbating existing shortages. For instance, Pennsylvania, known as the mushroom capital of the world, faced a record-breaking labor crunch as winter approached in 2021, with some businesses reporting a shortage of up to one-third of their workforce. This labor shortage came at a time when demand for mushrooms increased post-pandemic.

- The US Food Supply Chain was impacted as a result, with mushroom production struggling to meet the surging demand. The labor shortage in the mushroom industry is a pressing issue that continues to evolve, requiring innovative solutions to maintain productivity and meet consumer demands.

Exclusive Customer Landscape

The mushroom market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mushroom market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Mushroom Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, mushroom market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bonduelle Group - This company specializes in the cultivation and distribution of various edible mushroom varieties, including White, Crimini, and Shiitake. Their product offerings cater to the growing demand for nutrient-rich and flavorful fungi in the global market. The company's commitment to quality and innovation sets it apart in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bonduelle Group

- Cargill, Inc.

- Champignon Brands Inc.

- Dole Food Company, Inc.

- Drinkwater Mushrooms

- Giorgio Fresh Co.

- Green Giant (B&G Foods, Inc.)

- Highline Mushrooms

- Monaghan Mushrooms

- Monterey Mushrooms, Inc.

- MycoTechnology Inc.

- Nature's Way Products, LLC

- Oakshire Mushrooms

- Phillips Mushroom Farms

- Purdue Farms, Inc.

- Scelta Mushrooms B.V.

- Shanghai Fengke Biological Technology Co., Ltd.

- South Mill Champs

- Whitecrest Mushrooms Limited

- Xtian (Mushroom Culture)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mushroom Market

- In January 2024, MycoTechnology, a leading biotechnology company specializing in mushroom-based ingredients, announced the launch of their new product, "ClearTaste," a mushroom-derived bitter blocker, at the International Food Technology Event (IFTE). ClearTaste aims to improve the taste and sensory experience of various food and beverage products (MycoTechnology Press Release, 2024).

- In March 2024, Shiitake Corporation, a prominent mushroom grower, entered into a strategic partnership with BlueNova, a leading biotech firm, to develop and commercialize a new line of Functional Mushroom supplements. This collaboration combines Shiitake's expertise in mushroom cultivation with BlueNova's advanced biotechnology (Shiitake Corporation Press Release, 2024).

- In May 2024, Monaghan Mushrooms, a global mushroom producer, completed a €100 million (USD115 million) expansion project, increasing their production capacity by 50%. This expansion will enable Monaghan Mushrooms to meet the growing demand for mushrooms in Europe and beyond (Monaghan Mushrooms Press Release, 2024).

- In February 2025, the European Commission approved the use of Pleurotus ostreatus (oyster mushroom) as a functional ingredient in food supplements. This approval marks a significant milestone for the mushroom industry, expanding the market potential for mushroom-derived products (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mushroom Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 24.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, characterized by continuous advancements in various aspects of production. Spore production is a crucial element, with ongoing research focusing on optimizing oxygen levels and refining packaging technologies to ensure optimal growth conditions. Lighting systems and cultivation techniques are also undergoing significant developments, with nutrient management and waste reduction strategies becoming increasingly important for production efficiency. Disease resistance is another key area of focus, with mycelium morphology and genetic improvement playing essential roles. Automated harvesting and substrate sterilization are also gaining traction, improving production efficiency and reducing the risk of contamination. Substrate composition, carbon footprint reduction, and yield optimization are also significant concerns, with research centered around optimizing growth parameters, water usage, and temperature regulation.

- Environmental control is a critical aspect of mushroom cultivation, with air exchange rates, humidity control, and energy consumption being closely monitored to ensure resource efficiency. Post-harvest handling and quality assessment are also essential, with the industry exploring shelf life extension and biomass production strategies. Furthermore, advances in mushroom genetics, cultivation automation, and CO2 levels are transforming the industry. Growth parameters, such as water usage and temperature regulation, are being optimized to enhance fruiting body development and energy consumption. Hygiene protocols are also being rigorously implemented to maintain optimal production conditions and reduce contamination risks. In conclusion, the market is a vibrant and evolving industry, with ongoing research and innovation driving advancements in various aspects of production, from spore production and nutrient management to cultivation techniques and post-harvest handling.

- These developments are aimed at improving production efficiency, reducing waste, enhancing product quality, and minimizing the industry's carbon footprint.

What are the Key Data Covered in this Mushroom Market Research and Growth Report?

-

What is the expected growth of the Mushroom Market between 2024 and 2028?

-

USD 24.17 billion, at a CAGR of 6.78%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Fresh mushroom, Canned mushroom, and Dried mushroom), Product (Button Mushroom, Oyster Mushroom, Shiitake Mushroom, Portobello Mushroom, Cremini Mushroom, Enoki Mushroom, and Specialty Mushrooms), Geography (Europe, APAC, North America, South America, and Middle East and Africa), Application (Food Service (Restaurants, Hotels), Retail (Supermarkets, Hypermarkets, Online), Pharmaceutical & Nutraceutical, and Cosmetics), and End-use (Culinary and Medicinal/Health Supplements)

-

-

Which regions are analyzed in the report?

-

Europe, APAC, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Medicinal values associated with mushrooms, Supply chain challenges and labor shortages

-

-

Who are the major players in the Mushroom Market?

-

Key Companies Bonduelle Group, Cargill, Inc., Champignon Brands Inc., Dole Food Company, Inc., Drinkwater Mushrooms, Giorgio Fresh Co., Green Giant (B&G Foods, Inc.), Highline Mushrooms, Monaghan Mushrooms, Monterey Mushrooms, Inc., MycoTechnology Inc., Nature's Way Products, LLC, Oakshire Mushrooms, Phillips Mushroom Farms, Purdue Farms, Inc., Scelta Mushrooms B.V., Shanghai Fengke Biological Technology Co., Ltd., South Mill Champs, Whitecrest Mushrooms Limited, and Xtian (Mushroom Culture)

-

Market Research Insights

- The market encompasses a diverse range of products, including those with high nutritional value and medicinal properties. Spawn production, a crucial aspect of mushroom cultivation, continues to evolve with advancements in quality standards and sustainable practices. According to industry estimates, The market size was valued at USD45 billion in 2020, with an anticipated compound annual growth rate of 6% from 2021 to 2026. Functional mushrooms, such as reishi and chaga, are gaining popularity due to their disease prevention and medicinal benefits. In contrast, the yield of traditional button mushrooms averages around 15-20 kg per square meter.

- With the implementation of rigorous quality control and safety protocols, pinning induction, and yield prediction techniques, mushroom cultivators can optimize their production and ensure consistent quality. Sustainable practices, including crop rotation, pest management, and waste valorization, are increasingly important in mushroom cultivation systems. Process optimization, substrate preparation, and cost optimization are essential for economic viability. Furthermore, mushroom extracts and value-added products offer opportunities for growth modeling and indoor farming techniques, expanding the market's potential.

We can help! Our analysts can customize this mushroom market research report to meet your requirements.