Ophthalmic Femtosecond Lasers Market Size 2024-2028

The ophthalmic femtosecond lasers market size is forecast to increase by USD 180.9 million, at a CAGR of 5.9% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing awareness and popularity of LASIK surgeries. This minimally invasive procedure, which uses femtosecond lasers to reshape the cornea, has gained widespread acceptance due to its ability to correct various vision issues, including nearsightedness, farsightedness, and astigmatism. Moreover, the adoption of femtosecond laser-assisted cataract surgeries is on the rise, offering advantages such as precise incisions and reduced surgical time. However, potential risks of complications, such as corneal perforation and intraocular lens dislocation, pose a challenge to market growth.

- To capitalize on the market opportunities and navigate these challenges effectively, companies must focus on enhancing the safety and efficacy of their femtosecond laser technologies, while also investing in research and development to expand their product offerings and cater to evolving patient needs.

What will be the Size of the Ophthalmic Femtosecond Lasers Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The ophthalmic femtosecond laser market continues to evolve, driven by advancements in technology and expanding applications across various sectors. These lasers, which employ computer-aided design for surgical planning, enable precise lenticule extraction and intrastromal corneal incisions. Patient safety protocols are a top priority, with laser energy delivery systems ensuring accurate tissue ablation depth and treatment efficacy. Cataract surgery lasers utilize femtosecond technology for laser-assisted procedures, enhancing surgical precision. Refractive error correction and laser-assisted keratoplasty also benefit from this technology, allowing for astigmatism correction and anterior capsulotomy. Laser wavelength selection and pulse duration control are critical factors, with laser keratomileusis and presbyopia treatment applications requiring careful consideration.

Femtosecond laser technology continues to revolutionize laser refractive surgery, from corneal flap creation to laser-induced keratopathy prevention. High-frequency ultrasound and eye tracking systems are integrated into automated laser systems, ensuring optimal surgical outcomes. Surgical planning software and laser ablation parameters are continually refined, enabling improved tissue visualization and laser-tissue interaction. Corneal crosslinking and laser ablation parameters are essential components of the femtosecond laser market, with ongoing research and development efforts aimed at enhancing treatment efficacy and patient safety. The dynamic nature of this market underscores the importance of staying informed about the latest advancements and trends.

How is this Ophthalmic Femtosecond Lasers Industry segmented?

The ophthalmic femtosecond lasers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Consumable and accessories

- Equipment

- Distribution Channel

- Direct Sales

- Distributors

- Online Retail

- Technology Specificity

- Full Femtosecond

- Assisted Femtosecond

- Application

- Refractive Surgery

- Cataract Surgery

- Corneal Surgery

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

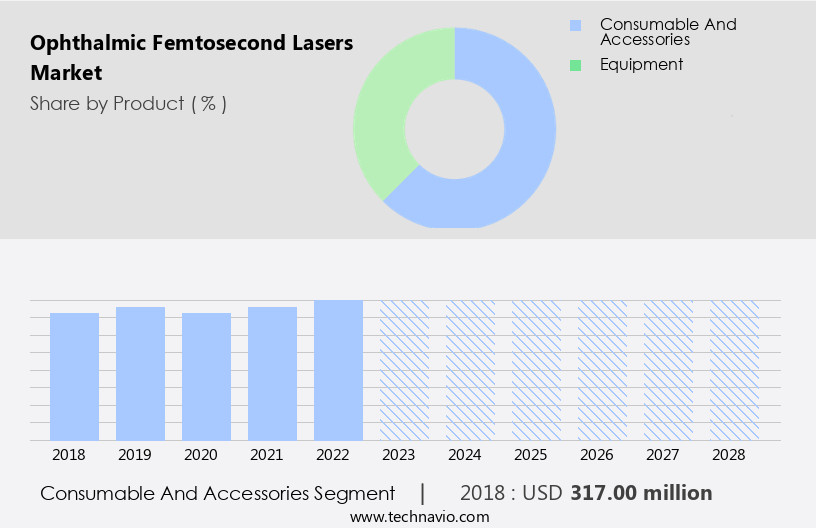

By Product Insights

The consumable and accessories segment is estimated to witness significant growth during the forecast period.

The ophthalmic femtosecond laser market experiences significant growth, driven by advancements in technology and increasing demand for minimally invasive ophthalmic procedures. Computer-aided design and lenticule extraction facilitate precise refractive error correction and cataract surgery, enhancing treatment efficacy. Patient safety protocols ensure optimal outcomes, while laser energy delivery systems enable customized laser wavelength selection for various applications, including laser-assisted keratoplasty and presbyopia treatment. Femtosecond laser technology offers surgical precision, minimizing risks associated with high-frequency ultrasound or astigmatism correction. Laser-induced keratopathy and anterior capsulotomy are addressed through pulse duration control and refractive index profile adjustments.

In laser-assisted cataract surgery, automated laser systems and eye tracking systems streamline procedures, while corneal flap creation and corneal crosslinking expand indications. Laser ablation parameters and surgical planning software optimize treatment planning and execution, ensuring consistent results. The market's evolution is marked by continuous innovation, with ongoing research focusing on improving laser-tissue interaction and tissue visualization.

The Consumable and accessories segment was valued at USD 317.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for ophthalmic femtosecond lasers is experiencing significant growth, driven by the increasing prevalence of refractive errors and cataracts among the region's aging population. With approximately 18% of the North American population aged 65 and above, according to The World Bank Group, there is a rising demand for advanced eye care solutions. This demographic trend, coupled with the increasing availability of healthcare resources and technological advancements, is fueling the adoption of ophthalmic femtosecond laser technology. These lasers are utilized in various ophthalmic procedures, including cataract surgery, laser-assisted keratoplasty, and refractive error correction. Femtosecond laser technology offers numerous advantages, such as precise incision creation, improved patient safety through reduced human error, and enhanced treatment efficacy.

The technology's ability to provide customized laser wavelength selection and tissue ablation depth allows for personalized treatment plans. Femtosecond laser systems are also employed in presbyopia treatment, anterior capsulotomy, astigmatism correction, and corneal flap creation. Additionally, laser-induced keratopathy and pulse duration control are essential considerations in the application of femtosecond laser technology. Furthermore, surgical planning software, femtosecond laser parameters, and automated laser systems facilitate more efficient and accurate procedures. High-frequency ultrasound and corneal crosslinking are complementary techniques used in conjunction with femtosecond lasers to enhance treatment outcomes. As the technology continues to evolve, advancements in laser-tissue interaction and tissue visualization are expected to further improve surgical precision and patient safety.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to advancements in laser technology and its application in various eye surgeries. One of the most common procedures utilizing femtosecond lasers is laser refractive surgery, which includes techniques such as Small Incision Lenticule Extraction (SMILE) and Laser-Assisted Keratoplasty (LAK). Femtosecond laser corneal incisions depth control is crucial in laser refractive surgery for accurate refractive outcomes. Patient selection criteria, including optical coherence tomography imaging, help ensure ideal candidates for these procedures. The impact of laser parameters, such as energy settings and wavelength, on refractive outcomes is a subject of ongoing research. Complications from SMILE procedures include over- or under-correction, diffuse lamellar keratitis, and interface fluid leak. Laser-assisted cataract surgery energy settings require careful optimization to minimize complications and improve visual acuity. Femtosecond laser technology advancements include automated safety features, improved surgical planning software, and optimization of laser energy delivery methods. Clinical trial results demonstrate the effectiveness of LAK in treating various corneal diseases. Assessment of laser ablation depth accuracy and laser-induced keratopathy risk factors are essential for ensuring patient safety. Patient satisfaction with femtosecond laser procedures is high, with many reporting improved visual acuity. Femtosecond laser system maintenance procedures and quality control measures are essential to ensure accurate and safe laser delivery. Surgical training requirements for ophthalmic femtosecond lasers are rigorous, with ongoing education and certification programs to maintain market research report standards. In conclusion, the market is continuously evolving, driven by advancements in technology, clinical research, and patient safety protocols. These lasers offer significant benefits in various eye surgeries, including improved accuracy, safety, and patient satisfaction.

What are the key market drivers leading to the rise in the adoption of Ophthalmic Femtosecond Lasers Industry?

- LASIK surgery market growth is primarily driven by the increasing awareness and understanding of this corrective eye procedure among consumers.

- The ophthalmic femtosecond laser market is witnessing significant growth due to the increasing awareness and adoption of advanced eye surgical procedures. LASIK (laser-assisted in situ keratomileusis) surgeries, which utilize femtosecond lasers for precise corneal incisions, have gained popularity for their faster recovery time and higher precision. These procedures can correct a wider range of eye defects and offer improved vision outcomes, with most patients achieving 20/20 or better vision and reduced dependence on corrective eyewear. Femtosecond lasers enable surgeons to customize laser ablation parameters and surgical planning through sophisticated software, ensuring a more personalized approach to each patient's treatment.

- Tissue visualization and automated laser systems further enhance the procedure's accuracy and safety. The laser-tissue interaction during LASIK procedures is crucial, and femtosecond lasers offer better control over this interaction, leading to improved patient satisfaction and outcomes. Incorporating eye tracking systems into LASIK procedures ensures greater accuracy and safety, as the laser is precisely aligned with the patient's eye. Corneal crosslinking, another application of femtosecond lasers, strengthens the cornea and is increasingly being used to treat conditions like keratoconus and post-LASIK ectasia. With advancements in technology and growing awareness, the ophthalmic femtosecond laser market is poised for continued growth.

What are the market trends shaping the Ophthalmic Femtosecond Lasers Industry?

- The rising preference for femtosecond laser-assisted cataract surgeries represents a significant market trend. This advanced procedure offers improved precision and efficiency compared to traditional methods.

- Femtosecond lasers have revolutionized ophthalmic surgeries, particularly in cataract procedures, over the past decade. This technology, which uses computer-aided design and laser energy delivery, offers precise and controlled incisions for lenticule extraction and refractive error correction. The laser's accuracy is crucial in creating intrastromal corneal incisions for laser-assisted keratoplasty, ensuring patient safety protocols are met. Femtosecond lasers have expanded the surgeon's toolkit, allowing for better control in making primary and side port surgical incisions, performing anterior capsulotomies, and initiating lens fragmentation.

- The technology's integration into phacoemulsification equipment enhances surgical precision and outcomes. By automating and refining traditional manual cataract surgery techniques, femtosecond lasers have become an essential component in modern ophthalmic procedures.

What challenges does the Ophthalmic Femtosecond Lasers Industry face during its growth?

- The potential risk of complications poses a significant challenge to the growth of the industry, requiring continuous efforts from professionals to mitigate and manage these risks effectively.

- Ophthalmic femtosecond lasers have revolutionized various ophthalmic procedures due to their superior tissue ablation depth and treatment efficacy. Femtosecond laser technology is utilized in laser keratomileusis for presbyopia treatment and laser-assisted cataract surgery, providing surgical precision that traditional methods cannot match. However, there are potential risks associated with these procedures. The formation of an opaque bubble layer, Traction Lens Subluxation Syndrome (TLSS), rainbow glare, and lamellar keratitis are known complications. Gas bubbles may dissect into the deep stroma through the trabecular meshwork, leading to extreme photophobia and good visual acuity post-procedure. Rainbow glare, a common complication, is characterized by the appearance of colored bands of light radiating from a white light source.

- Lamellar keratitis in the flap interface may be induced due to photo disruption-induced microscopic tissue injury. Despite these risks, the benefits of femtosecond laser technology continue to outweigh the challenges, making it a valuable tool in the field of ophthalmology.

Exclusive Customer Landscape

The ophthalmic femtosecond lasers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ophthalmic femtosecond lasers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ophthalmic femtosecond lasers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alcon - The company specializes in ophthalmic femtosecond lasers, featuring the LenSx Laser model.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alcon

- Carl Zeiss Meditec

- Johnson & Johnson Vision

- Bausch + Lomb

- Nidek

- Ziemer Ophthalmic Systems

- Lensar

- Schwind eye-tech-solutions

- Technolas Perfect Vision

- Heidelberg Engineering

- Topcon

- OptiMedica

- WaveLight

- IntraLase

- Ellex Medical Lasers

- Kowa

- IRIDEX

- LightMed

- Reichert

- Oculentis

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ophthalmic Femtosecond Lasers Market

- In January 2024, Alcon, a leading global ophthalmic company, announced the US Food and Drug Administration (FDA) approval of its new femtosecond laser system, the LenSx Laser System Enhancement. This upgrade enables the LenSx system to perform advanced laser-assisted cataract surgery, marking a significant technological advancement in the market (Alcon press release, 2024).

- In March 2024, Lumenis, a global leader in the field of minimally-invasive procedural solutions, entered into a strategic partnership with EssilorLuxottica, the world's largest ophthalmic lens manufacturer. The collaboration aimed to integrate Lumenis' S2 iLASIK femtosecond laser with EssilorLuxottica's Transitions lenses, expanding the reach of laser vision correction procedures (Lumenis press release, 2024).

- In May 2024, Ziemer Ophthalmic Systems AG, a Swiss ophthalmic technology company, raised CHF 50 million (USD53 million) in a financing round. The funds were earmarked for the development and commercialization of their new femtosecond laser platform, the Ziemer Femto LDV Z8, further solidifying their position in the market (Ziemer press release, 2024).

- In April 2025, the European Commission granted marketing authorization for the LenSx Laser System Enhancement in all European Union countries. This approval expanded Alcon's reach in the European market and increased the adoption of laser-assisted cataract surgery (Alcon press release, 2025).

Research Analyst Overview

- In the ophthalmic market, femtosecond lasers have emerged as a game-changer in laser eye surgery. Clinical studies continue to validate the efficacy and safety of this technology, with surgical training programs integrating it into their curricula. Topographic analysis and regulatory approvals have paved the way for wider adoption, enabling personalized treatment plans based on individual corneal geometry. Beam profile optimization and laser energy density are crucial factors in ensuring surgical outcome measures and patient satisfaction scores. Quality control measures, surgical workflow optimization, and safety features are essential for laser system maintenance and reducing complication rates. Laser technology advancements, such as image guidance systems and aberration correction, enhance surgical precision.

- Keratometer readings and laser energy profiles are critical in optimizing treatment personalization. Visual acuity improvement and optical zone size expansion are key benefits, making femtosecond laser ablation a preferred choice for many patients. With treatment time reduction and a focus on safety, this technology continues to revolutionize laser eye surgery.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ophthalmic Femtosecond Lasers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2024-2028 |

USD 180.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ophthalmic Femtosecond Lasers Market Research and Growth Report?

- CAGR of the Ophthalmic Femtosecond Lasers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ophthalmic femtosecond lasers market growth of industry companies

We can help! Our analysts can customize this ophthalmic femtosecond lasers market research report to meet your requirements.