Ophthalmic Lens Market Size 2025-2029

The ophthalmic lens market size is forecast to increase by USD 14.39 billion at a CAGR of 4.5% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing prevalence of refractive errors worldwide. According to the World Health Organization, approximately 1.1 billion people live with refractive errors, and this number is projected to increase due to aging populations and rising prevalence of lifestyle-related factors. Another key trend influencing market growth is the increasing adoption of daily disposable Contact Lenses, which offer convenience, comfort, and improved eye health. However, the high cost of ophthalmic lenses remains a significant challenge for both manufacturers and consumers. Regulatory hurdles, including stringent approval processes and ongoing compliance requirements, also impact adoption and add to the overall cost structure.

- Supply chain inconsistencies, particularly in emerging markets, temper growth potential and require careful management by market participants. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on innovation, cost reduction, and strategic partnerships. By addressing these issues, they can differentiate themselves in a competitive landscape and meet the evolving needs of consumers.

What will be the Size of the Ophthalmic Lens Market during the forecast period?

-

The market continues to evolve, driven by advancements in lens technology and rising eye health awareness. Customization and personalization are key trends, with consumers seeking lenses tailored to their specific vision needs and lifestyle. Corrective lenses, including prescription eyewear, remain a significant segment, while vision improvement solutions gain traction due to increasing computer use and digital eye fatigue. Ophthalmic optics prioritize lens performance, durability, safety, and comfort, addressing eye strain relief and vision enhancement. The eye care industry also recognizes the importance of lens aesthetics, offering various styles to cater to diverse preferences.

-

An emerging trend shaping the market is the integration of smart glass technology, intelligent lenses that adapt to environmental conditions, provide digital displays, or offer connectivity features. These innovations blur the lines between traditional eyewear and wearable tech, appealing to consumers seeking both vision correction and smart functionality. Vision care market growth is further fueled by breakthroughs in vision correction technology and the compelling value proposition of high-quality, comfortable lenses. Lens clarity, technology, and perceived value are essential factors influencing consumer decisions. The eyewear market continues to adapt, ensuring that lens offerings meet both functional and aesthetic demands while embracing the possibilities enabled by smart glass.

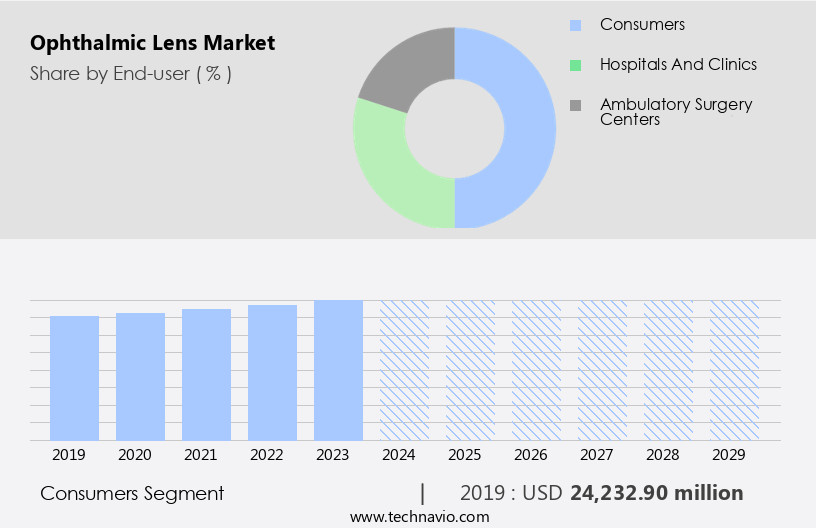

How is this Ophthalmic Lens Industry segmented?

The ophthalmic lens industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Consumers

- Hospitals and clinics

- Ambulatory surgery centers

- Product

- Spectacle lens

- Contact lens

- IOLs

- Material

- Plastic lenses

- Polycarbonate lenses

- Glass lenses

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The consumers segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing prevalence of vision disorders, particularly among aging populations and tech-savvy younger demographics. Presbyopia and cataracts, age-related conditions, are driving the demand for corrective lenses. Simultaneously, the extensive use of digital devices has led to a wave in digital eye strain and myopia cases, further fueling the need for lenses. Major market players, such as EssilorLuxottica and Zeiss, cater to diverse consumer requirements. EssilorLuxottica offers Varilux progressive lenses, ensuring clear vision at all distances for presbyopic individuals. Zeiss, on the other hand, provides DuraVision BlueProtect lenses, which minimize blue light exposure from digital screens, addressing concerns related to digital eye strain.

Advanced lens technologies, including machine learning, digital imaging, adaptive optics, and artificial intelligence, are revolutionizing the industry. These innovations enable personalized vision care, addressing individual needs effectively. Lens materials, such as trivex and polycarbonate, offer enhanced durability and safety. Additionally, lens care, lens fitting, and lens replacement services ensure optimal lens performance and user comfort. Ophthalmic lens manufacturing processes have evolved, incorporating cylinder correction, spherical correction, and high index lenses, among others, to cater to various prescriptions and eye health concerns. Intraocular lenses, contact lenses, and refractive surgery are alternative solutions for vision correction. Overall, the market is characterized by continuous innovation, driven by consumer needs and advancements in technology.

The Consumers segment was valued at USD 24.23 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market holds the largest share in the global ophthalmic lens industry, driven by the increasing prevalence of refractive errors, a growing aging population, rising healthcare expenditure, and the demand for advanced lenses. The US is the major revenue contributor in this region, followed by Canada. Advanced healthcare infrastructure and the strong market presence of key players also fuel the market growth. Furthermore, the increasing disposable income has led to an uptick in the demand for premium lenses, such as photochromic, progressive, and high-index lenses. These lenses cater to various vision correction needs, including astigmatism, presbyopia, and myopia control.

Advanced technologies, like digital imaging, machine learning, and adaptive optics, are increasingly integrated into ophthalmic lenses, enhancing their functionality and personalized vision care. Eye care professionals play a crucial role in the lens dispensing process, ensuring proper lens fitting and lens care. Lens materials, such as glass, trivex, and polycarbonate, offer varying benefits, including lightweight, impact resistance, and UV protection. Additionally, lens coatings, like scratch-resistant and blue light filtering, extend the longevity and functionality of the lenses. The market encompasses various sub-segments, including intraocular lenses, prescription lenses, contact lenses, and lens replacement. Cataract surgery and refractive surgery are significant growth areas, with a rising number of procedures performed each year.

Eye health remains a top priority, leading to the adoption of advanced lens technologies and personalized vision care solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Ophthalmic Lens market drivers leading to the rise in the adoption of Industry?

- The rising prevalence of refractive errors serves as the primary market driver. Refractive errors, such as myopia, hyperopia, presbyopia, and astigmatism, affect approximately 60% of the global population, yet only half receive treatment. Myopia, the most common refractive error, typically manifests in children and progresses until around age 20. Digital imaging technology plays a crucial role in diagnosing and correcting refractive errors. Single vision lenses, including spherical and cylinder corrections, are commonly used for vision correction. Advanced technologies like adaptive optics and artificial intelligence are revolutionizing personalized vision care. Lens materials, coatings, and cleaning methods have also evolved to enhance visual clarity and durability.

- Eyewear retailers are exploring new technologies like 3D printing and cataract surgery to meet the growing demand for vision correction solutions. The market dynamics are driven by the increasing prevalence of refractive errors, advancements in technology, and the growing awareness of the importance of eye health.

What are the Ophthalmic Lens market trends shaping the Industry?

- The use of daily disposable contact lenses is gaining significant traction in the market, representing a notable trend. This trend is driven by several factors, including convenience, improved eye health, and increased consumer preference for disposable options. Daily disposable contact lenses are gaining popularity in the market due to their numerous benefits. Unlike bi-weekly and monthly lenses, daily disposables are single-use and require no cleaning or storage. This eliminates the risk of calcium or hairspray deposits and contact lens-related eye infections. Additionally, less chair time is needed for patient education as there is no requirement for instructions on lens care. The advantages of daily disposables extend to various lens materials such as Trivex and high index lenses. These materials offer superior comfort and crystal-clear vision. Moreover, daily disposables can be fitted with UV protection and scratch-resistant coatings, ensuring eye health and lens durability.

- Lens diameter and base curve are essential factors in lens fitting, and daily disposables cater to a wide range of prescriptions. Furthermore, daily disposables are suitable for various lens designs, including bifocals and lenses for refractive surgery patients. Overall, daily disposable contact lenses offer convenience, comfort, and enhanced eye health, making them a preferred choice for many consumers.

How does Ophthalmic Lens market faces challenges face during its growth?

- The escalating costs of producing ophthalmic lenses pose a significant challenge to the growth of the industry. Ophthalmic lenses have seen a notable price increase due to technological advancements. The cost discrepancy depends on the type of lens. For example, high-definition spectacle glass lenses cost 25-30% more than conventional spectacle glass lenses. Multifocal glasses are approximately 30% pricier than single-vision glasses. Progressive glass lenses carry a price tag double that of single-vision glasses. Additional features such as non-glare coatings and changeable tint lenses further hike up the cost. Annual expenses for daily disposable soft contact lenses, toric contact lenses, and bifocal contact lenses are 2-3 times higher than the cost of normal disposable soft contact lenses that are replaced every two weeks.

Exclusive Customer Landscape

The ophthalmic lens market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ophthalmic lens market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ophthalmic lens market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alcon Inc. -The company offers ophthalmic lenses such as Plano-Convex Lenses, Double-Convex Lenses, Plano-Concave Lenses, Laser Lenses, and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alcon Inc.

- Alpine Research Optics

- Bausch Health Companies Inc.

- Bod Lenses

- CAMAX OPTICAL CORP.

- Carl Zeiss AG

- Corning Inc.

- EssilorLuxottica

- Halma Plc

- HOYA CORP.

- Jiangsu Hongchen Optical Co. Ltd.

- Johnson and Johnson Services Inc.

- Mitsui Chemicals Inc.

- Nikon Corp.

- Privo

- Rodenstock GmBH

- Shamir Ltd.

- The Cooper Companies Inc.

- The Walman Optical Co.

- VISION EASE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ophthalmic Lens Market

- In January 2024, Carl Zeiss AG, a leading global technology company, introduced the new AT LARA progressive lens, designed to provide enhanced visual comfort and clarity for individuals with presbyopia (1). This innovation marks a significant advancement in the market, as it combines individualized lens designs with advanced technology to cater to the unique visual needs of each wearer.

- In March 2025, EssilorLuxottica, the world's largest ophthalmic lens manufacturer, announced a strategic partnership with Google to develop Smart Glasses with advanced lens technology (2). This collaboration represents a major shift in the market, as it merges the realms of eyewear and technology to create innovative products that cater to both vision correction and augmented reality needs.

- In August 2024, Hoya Corporation, a Japanese ophthalmic lens manufacturer, completed the acquisition of Vufine, a leading developer of wearable displays for virtual and augmented reality applications (3). This strategic move expands Hoya's product portfolio and strengthens its presence in the growing market for advanced lens technologies, particularly in the areas of virtual and augmented reality.

- In October 2025, the European Union granted marketing authorization for Alcon Laboratories' new panretinal photocoagulation (PRP) laser system, which features an innovative lens design that enhances the efficacy and safety of PRP treatments for diabetic retinopathy patients (4). This regulatory approval marks a significant development in the market, as it highlights the growing importance of advanced lens technologies in medical applications and underscores the increasing role of regulatory bodies in driving innovation in the sector.

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and the growing demand for vision correction solutions. Eye care professionals are at the forefront of this dynamic industry, utilizing various lens types to address a range of vision needs. Photochromic Lenses, for instance, adapt to changing light conditions, offering convenience and visual comfort. Progressive lenses cater to presbyopia, ensuring clear vision at various distances. Digital eye strain, a growing concern in today's digital age, is addressed through blue light filtering lenses and computer vision syndrome solutions. Lens manufacturing processes, including ophthalmic lensometry and advanced lens technologies like adaptive optics and machine learning, contribute to the industry's ongoing innovation.

Lens materials, such as glass, Trivex, and polycarbonate, offer varying benefits in terms of weight, durability, and optical clarity. Personalized vision care is a key trend, with customized lens designs, cylinder correction, spherical correction, and lens powers tailored to individual needs. Lens care, including cleaning and warranty, is essential to ensure the longevity and effectiveness of these solutions. Eyewear retailers and lens dispensing services play a crucial role in bringing these innovations to consumers. The integration of digital imaging, 3D printing, and AI in lens design and manufacturing further enhances the industry's capabilities. Intraocular lenses, contact lenses, and refractive surgery are alternative vision correction methods that continue to gain popularity.

UV protection coating, scratch-resistant coatings, and high index lenses are essential features that enhance the functionality and durability of ophthalmic lenses. The market's continuous dynamism is reflected in the ongoing unfolding of market activities and evolving patterns. As technology advances and consumer needs evolve, the ophthalmic lens industry remains a vibrant and innovative sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ophthalmic Lens Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 14.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, China, Germany, Canada, Japan, France, India, UK, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ophthalmic Lens Market Research and Growth Report?

- CAGR of the Ophthalmic Lens industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ophthalmic lens market growth of industry companies

We can help! Our analysts can customize this ophthalmic lens market research report to meet your requirements.