Photography Services Market Size 2025-2029

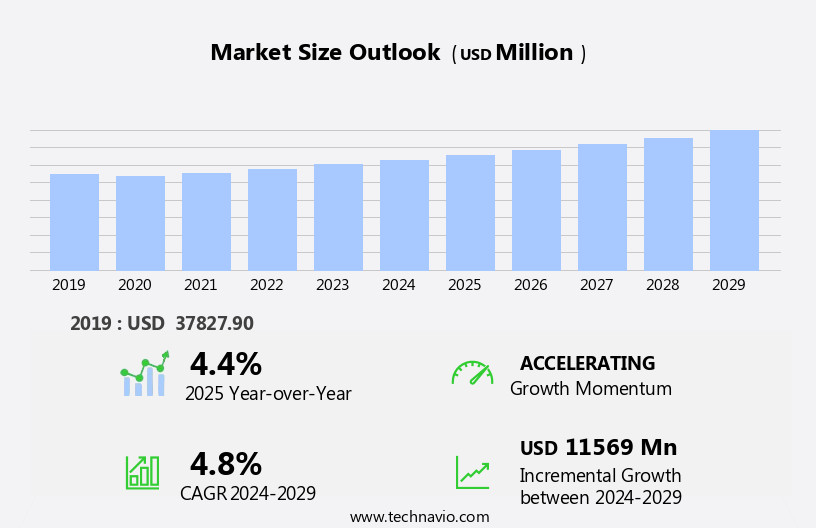

The photography services market size is forecast to increase by USD 11.57 billion, at a CAGR of 4.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the burgeoning sports events industry and the increasing popularity of photography in digital media platforms. The sports industry's continuous expansion creates an immense demand for high-quality photography services to capture and distribute images of events to fans and media outlets. In parallel, digital media's ubiquity has fueled the public's appetite for visual content, leading to a surge in demand for professional photography services. However, this market landscape is not without challenges. Profit margins for photography services are declining, putting pressure on businesses to find innovative ways to differentiate themselves and maintain competitive pricing.

- This trend is driven by increasing competition, as more photographers enter the market and offer their services at lower prices. To navigate these challenges, photography businesses must focus on providing unique value propositions, such as exceptional customer service, niche expertise, or advanced technology, to justify their pricing and retain clients. By capitalizing on the growing demand for photography services and addressing the market's challenges effectively, businesses can thrive in this dynamic and evolving industry.

What will be the Size of the Photography Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Image retouching, once a niche service, is now an essential offering for many photography businesses. Studio lighting, a staple in professional photography, is being complemented by the rise of natural light photography. Industry standards for image licensing and marketing strategies are constantly evolving, requiring professional development and client management skills. Camera equipment, including mirrorless cameras and DSLRs, are increasingly sophisticated, offering higher image resolution, greater depth of field control, and improved ISO sensitivity. White balance and color correction techniques are essential for ensuring consistent image quality.

Lighting equipment and accessories are also advancing, with more energy-efficient and environmentally friendly options becoming available. Event photography, commercial photography, wedding photography, product photography, real estate photography, and aerial photography each present unique challenges and opportunities. Photography communities and online courses offer valuable resources for professional development and networking. Industry conferences provide a platform for staying abreast of the latest trends and innovations. Online presence is crucial for photography businesses, with social media marketing and digital asset management tools essential for effective client communication and efficient workflow management. The continuous dynamism of the market demands ongoing adaptation and innovation.

How is this Photography Services Industry segmented?

The photography services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Consumer

- Commercial

- Type

- Shooting service

- After sales service

- Service Type

- In-studio photography

- On-location photography

- Service

- Small and medium enterprise

- Large enterprise

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

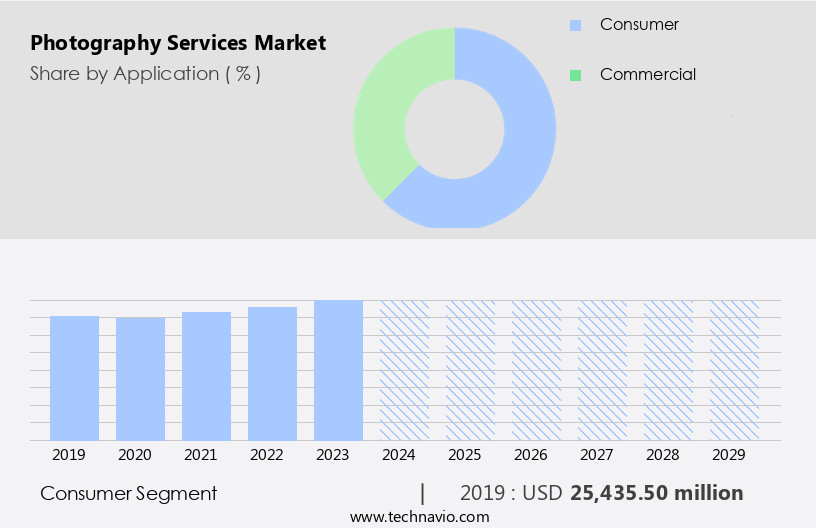

The consumer segment is estimated to witness significant growth during the forecast period.

The market is characterized by various applications, including consumer, commercial, and industrial segments. In the consumer sector, photography is extensively utilized for events such as schools, preschools, graduations, marriages, and birthdays. The demand for photography services in educational institutions, particularly in developing countries like China and India, is escalating due to the growing focus on documenting memories and organizing various events. Schools, adhering to international standards, prioritize capturing moments through videos and photographs, leading to a substantial demand for professional photography service providers. Additionally, advancements in technology, including mirrorless cameras, digital asset management, and online courses, have influenced photography trends.

Industry conferences and workshops offer opportunities for professional development and networking. Client management, marketing strategies, and pricing models are crucial aspects of the business, with ISO sensitivity, shutter speed, and image resolution being essential considerations for image quality. Commercial photography applications encompass product, portrait, and event photography, while wedding photography and real estate photography are popular niches. Professional development, social media marketing, and environmental impact are emerging trends. Flash photography, white balance, and color correction are essential techniques, while camera equipment, camera accessories, and lighting equipment are vital investments. Image licensing and depth of field are other significant aspects of the market.

The Consumer segment was valued at USD 25.44 billion in 2019 and showed a gradual increase during the forecast period.

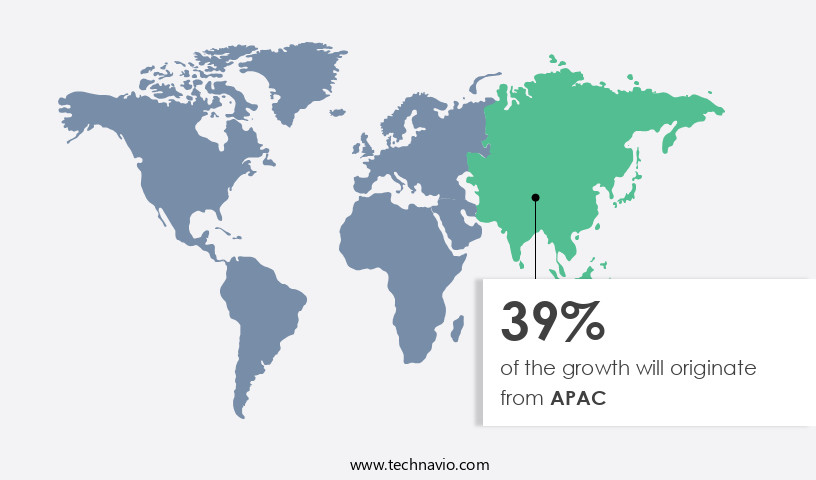

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, with key contributors being the US and Mexico. Advanced technology is driving innovation in photography services, from image retouching and color correction to studio lighting and flash photography. Photography communities and industry standards continue to shape best practices, while marketing strategies and client management tools facilitate business growth. Pricing strategies and digital asset management systems enable efficient image licensing and distribution. Mirrorless cameras and DSLRs, along with camera accessories, offer enhanced capabilities for photographers. Professional development opportunities, such as photography workshops and online courses, equip professionals with the latest skills.

White balance and shutter speed are essential elements of image quality, while depth of field and natural light photography cater to diverse client needs. Aerial photography, real estate photography, and event photography are popular applications, with social media marketing and online presence increasingly important for business success. Environmental impact and client communication are crucial considerations, as is ISO sensitivity and image resolution. The commercial photography segment, including product photography and wedding photography, is experiencing increased competition due to the availability of advanced visual content. Despite this, the demand for personalized and customized services continues to fuel market growth.

The market in North America remains dynamic and evolving, with industry conferences and continuing professional development opportunities providing valuable insights.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Photography Services Industry?

- The sports events industry's continued growth serves as the primary market driver.

- The market encompasses various applications, with sports events being a significant segment. The global sports industry's expansion, driven by an increase in the number of events and revenue from ticketing, media, and marketing, fuels the demand for professional photography services. At sports events, photographers are hired to capture on-field action for promotional and marketing purposes, historical record-breaking moments, and to promote upcoming events. Moreover, the digital age has transformed photography services, with the adoption of digital asset management systems allowing for easier organization, storage, and distribution of images. Natural light photography, depth of field techniques, and ISO sensitivity are essential skills for photographers in this digital era.

- Portrait and product photography are other essential applications in the market. Effective client communication is crucial in portrait photography to ensure the client's vision is met, while product photography requires a keen eye for detail and an understanding of lighting to showcase products in their best light. Social media marketing has also emerged as a significant application for photography services, with businesses recognizing the importance of visually appealing content to engage audiences and build brand awareness. Real estate photography is another growing application, with high-quality images being essential for property listings to attract potential buyers.

- Professional development and continuing education are essential for photography service providers to stay updated with the latest trends, techniques, and technology in the industry. By focusing on client needs, leveraging technology, and continuously improving skills, photography service providers can differentiate themselves and succeed in this competitive market.

What are the market trends shaping the Photography Services Industry?

- The increasing prevalence of photography in digital media is a notable market trend. This trend reflects the growing demand for visual content in various online platforms.

- The market has experienced significant growth due to the increasing use of digital media platforms, particularly social media. With rising Internet penetration and the widespread adoption of smart devices, the visibility of still images has increased, providing ample opportunities for photography service providers. Social media has emerged as a major advertising, marketing, and customer acquisition channel. For instance, Shutterfly, a company in the industry, leverages social media platforms to capitalize on the popularity of photographs. Image resolution and shutter speed are essential factors in delivering high-quality photography services. Camera accessories, such as lenses and tripods, are crucial for enhancing the functionality of DSLR cameras.

- Color correction and lighting equipment are also vital for producing professional-grade images. Event photography is a significant segment of the market, requiring specialized skills and equipment. Moreover, photo editing plays a crucial role in enhancing the visual appeal of images. The growing demand for immersive and harmonious visuals has emphasized the importance of lighting and color correction in photography. Camera accessories, such as tripods and lenses, are essential for capturing high-quality images, especially in event photography. In conclusion, the market is driven by the increasing popularity of digital media platforms, particularly social media, and the growing demand for high-quality images.

- Factors such as image resolution, shutter speed, and camera accessories are essential for delivering professional-grade photography services. The market is expected to continue growing as the demand for visually appealing content increases.

What challenges does the Photography Services Industry face during its growth?

- The industry's growth is negatively impacted by shrinking profit margins, which represents a significant challenge for businesses in this sector.

- The market has undergone significant transformations in recent years due to advancements in technology and changes in consumer behavior. The rise of digital cameras and the Internet have led to an increase in the supply of photographs and a decline in the demand for printed formats. This shift has affected the traditional distribution network and industry standards, requiring photographers to adapt to new business models. Image retouching and editing have become essential services in the market, with studio lighting and flash photography continuing to be popular techniques. Client management and marketing strategies have taken on greater importance as competition intensifies.

- Industry standards for image licensing and pricing strategies have evolved to reflect these changes. Camera equipment remains a crucial investment for photographers, with ongoing advancements in technology driving continuous innovation. The market dynamics are complex, and professionals must stay informed to remain competitive. Despite the challenges, the market offers opportunities for growth and creativity.

Exclusive Customer Landscape

The photography services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the photography services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, photography services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Angle Platform - This esteemed organization specializes in providing customized photography solutions for significant life events, such as weddings and holidays.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Angle Platform

- Bella Baby Photography

- Ben Jenkins

- BSTRO

- Carma Media Productions

- Cherry Hill Programs Inc.

- DE Photo (Franchising) Ltd.

- Epic Photo Studios

- Fisher Studios Ltd.

- Getty Images Inc.

- Global Media Desk

- H Tempest Ltd.

- Hammerhead Interactive Ltd.

- INDIGO STUDIO

- Mom365 Inc.

- Rocket Studio

- Teddy Bear Portraits Nationwide Studios Inc.

- TRG Multimedia

- Vital Design

- Wiggle Media

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Photography Services Market

- In January 2024, Canon Inc. introduced its latest mirrorless camera, the EOS R5 C, designed specifically for cinematography and still photography, marking a significant expansion of its product offerings in the market (Canon Press Release, 2024).

- In March 2024, Getty Images and Google Cloud announced a strategic partnership to make Getty Images' extensive collection of visual content more accessible to Google Cloud customers, enhancing the latter's AI capabilities for image search and analysis (Google Cloud Blog, 2024).

- In April 2024, Shutterstock, a leading global provider of creative platforms and marketplaces, completed the acquisition of PicFair, a UK-based platform offering affordable, royalty-free images, expanding Shutterstock's reach and product offerings (Shutterstock Press Release, 2024).

- In May 2025, Adobe Systems received regulatory approval from the European Commission for its acquisition of Fotomatik, a leading European photo editing and printing services provider, further strengthening Adobe's position in the market (European Commission Press Release, 2025).

Research Analyst Overview

- The market encompasses a diverse range of genres, including fashion, street, infrared, drone, slow shutter, macro, documentary, photo contests, underwater, image optimization, light painting, SEO for photographers, photo restoration, panorama, referral programs, beauty retouching, photoshop actions, high-dynamic-range (HDR), portrait, wildlife, 360-degree, fine art, photography websites, and time-lapse photography. Fashion photography continues to set trends in the industry, while street photography offers a raw, authentic perspective. Infrared photography adds a unique, otherworldly dimension, and drone photography captures breathtaking aerial perspectives. Photo editing software, such as Lightroom and Photoshop, are essential tools for enhancing and optimizing images. Client testimonials play a crucial role in building credibility, and photography contests provide opportunities for recognition and growth.

- Light painting, SEO, and photo restoration offer additional services that cater to specific client needs. Wildlife photography showcases the beauty of nature, while fine art photography offers a creative outlet for expression. Photography websites and social media platforms provide a platform for showcasing and selling work, and time-lapse photography adds a dynamic element to storytelling. The market is constantly evolving, with new trends and technologies shaping the landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Photography Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2025-2029 |

USD 11.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Germany, UK, Japan, Canada, India, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Photography Services Market Research and Growth Report?

- CAGR of the Photography Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the photography services market growth of industry companies

We can help! Our analysts can customize this photography services market research report to meet your requirements.