Secondary Packaging Market Size 2025-2029

The secondary packaging market size is valued to increase USD 86.9 billion, at a CAGR of 4.5% from 2024 to 2029. Growing e-commerce industry will drive the secondary packaging market.

Major Market Trends & Insights

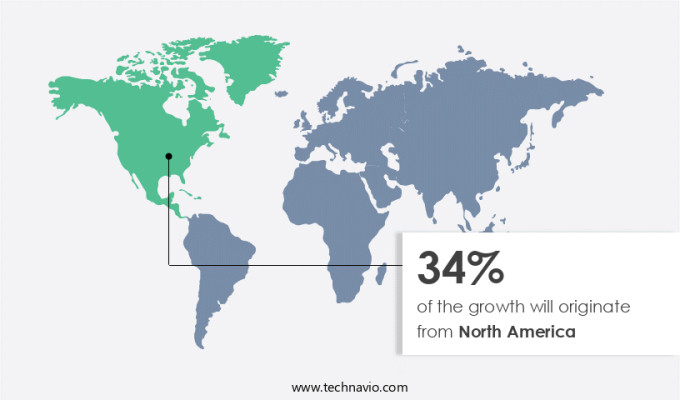

- North America dominated the market and accounted for a 34% growth during the forecast period.

- By Type - Paper segment was valued at USD 200.10 billion in 2023

- By Application - Food segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 42.30 billion

- Market Future Opportunities: USD 86.90 billion

- CAGR from 2024 to 2029: 4.5%

Market Summary

- The market is experiencing significant expansion, driven by the escalating demand for efficient and protective packaging solutions. According to recent market intelligence, the market is projected to surpass USD 120 billion by 2026, reflecting a steady growth trajectory. This expansion is fueled by the increasing mergers and acquisitions among key players, as well as the rising cost of raw materials. Secondary packaging serves a crucial role in the supply chain by safeguarding primary packaged goods during transportation, storage, and distribution. The market's evolution is marked by the adoption of advanced technologies, such as automation and digitalization, to streamline processes and enhance product protection.

- Moreover, the growing e-commerce sector is propelling the demand for innovative and sustainable secondary packaging solutions, as consumers increasingly seek convenient and eco-friendly options. Despite these opportunities, the market faces challenges, including the need for cost-effective and customizable solutions, as well as the increasing pressure to reduce waste and minimize environmental impact. To meet these demands, market participants are focusing on developing lightweight, recyclable, and biodegradable materials, while also investing in research and development to create more efficient and automated packaging systems. In conclusion, the market is poised for continued growth, driven by the e-commerce boom, technological advancements, and the increasing focus on sustainability.

- Companies that can effectively address these trends and challenges will be well-positioned to capitalize on the market's expansion and maintain a competitive edge.

What will be the Size of the Secondary Packaging Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Secondary Packaging Market Segmented?

The secondary packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Paper

- Plastic

- Application

- Food

- Beverages

- Pharmaceuticals

- Personal and home care

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The paper segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with paper-based packaging gaining significant traction due to its eco-friendly nature. This segment encompasses a variety of solutions, including corrugated cardboard boxes, cartons, paperboard packaging, and protective wrap. The demand for sustainable packaging is surging, driven by increasing environmental consciousness and regulations. For instance, e-commerce businesses are prioritizing paper-based packaging for its product protection, transport optimization, and distribution network efficiency. Paper-based materials, sourced from renewable resources like responsibly managed forests, are easily recycled or biodegraded.

The Paper segment was valued at USD 200.10 billion in 2019 and showed a gradual increase during the forecast period.

The growth is attributed to advancements in packaging design software, automation, and waste reduction technologies, enabling more efficient packaging lines and improved product traceability. Additionally, the market is witnessing innovations in protective cushioning, label printing, and barcode scanning systems, ensuring product safety and quality control.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Secondary Packaging Market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth, fueled by the increasing demand for lightweight and eco-friendly solutions. Corrugated boxes, a popular choice in secondary packaging, are gaining traction due to their biodegradable properties. The surge in import and export activities in North America necessitates superior packaging, thereby driving the regional market's expansion. Furthermore, the rise of e-commerce and the organized sector is also contributing to the market's growth. Additionally, the push for sustainable packaging is increasing the demand for corrugated boxes, which are not only recyclable but also available in various shapes and dimensions to cater to diverse packaging needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as businesses seek to enhance their product offerings and streamline operations. High-performance corrugated board continues to dominate the market due to its durability and cost-effectiveness, but there is a growing trend towards sustainable flexible packaging materials to reduce environmental impact. Automated case erecting systems and improved pallet load stability are key areas of investment for companies looking to optimize their supply chain logistics and reduce packaging material costs. Advanced packaging machinery and innovative packaging design solutions are also driving growth in the market, with a focus on enhanced product protection methods and improved tamper-evident packaging.

The integration of advanced barcode scanning technology and effective inventory management systems enables more efficient warehouse layout design and robust quality control procedures. More than 70% of new product developments in the market are focused on optimizing packaging for e-commerce, reflecting the increasing importance of online sales channels. Companies are also exploring design for recyclability packaging and packaging material traceability systems to meet growing consumer demand for sustainable and transparent supply chains. Efficient packaging line operation is a major priority for businesses looking to remain competitive, with a shift towards integrated packaging automation and reduced reliance on manual labor.

The use of advanced technology, such as machine learning algorithms and predictive analytics, is helping to improve production speeds and reduce waste. In comparison to traditional packaging methods, the adoption of high-tech solutions in secondary packaging is resulting in significant cost savings and operational efficiencies. By investing in the latest packaging technologies and design trends, businesses can not only enhance their product offerings but also gain a competitive edge in their respective markets.

What are the key market drivers leading to the rise in the adoption of Secondary Packaging Industry?

- The e-commerce sector's robust growth serves as the primary catalyst for market expansion.

- The global e-commerce sector has experienced remarkable expansion over the last decade, with online retail sales increasing from 15% to 21% of the total retail market between 2019 and 2021. This trend is set to continue, leading to a heightened demand for secondary packaging solutions, such as corrugated boxes, in the e-commerce sector. The convenience of online shopping has driven a significant shift in consumer behavior, resulting in a surge in e-commerce transactions.

- E-retailers cater to various product types, necessitating the use of diverse secondary packaging options. For instance, fragile items require protective packaging, while bulkier goods may necessitate larger boxes. This dynamic market continues to evolve, presenting numerous opportunities for businesses involved in secondary packaging production and distribution.

What are the market trends shaping the Secondary Packaging Industry?

- The trend in the market is toward an increase in mergers and acquisitions. Mergers and acquisitions are on the rise in the current market scenario.

- Companies in the market are actively pursuing strategies such as mergers and acquisitions (M&A) to expand their market presence and cater to the growing demand for sustainable packaging solutions. This trend is particularly prominent in regions like North America and Europe, where there is a heightened focus on eco-friendly packaging. For instance, in January 2023, Amcor, a leading player, announced the acquisition of MDK, a Shanghai-based provider of medical device packaging. This strategic move strengthens Amcor's leadership in the APAC medical packaging segment, which now includes four manufacturing sites serving China, India, and Southeast Asian markets.

- Another notable acquisition was that of Sonoco's flexible packaging business by Novolex in 2022. This acquisition significantly expanded Novolex's product portfolio and geographical reach, enabling the company to cater to a broader customer base. These strategic moves underscore the dynamic nature of the market and the ongoing efforts of companies to stay competitive and meet evolving consumer demands.

What challenges does the Secondary Packaging Industry face during its growth?

- The escalating costs of raw materials pose a significant challenge to the industry's growth trajectory.

- Paper pulp, a fundamental raw material for manufacturing secondary packaging solutions like corrugated boxes, experiences volatile pricing due to fluctuating demand and supply dynamics. Over the past five years, the gap between demand and supply has widened, leading to an increase in paper pulp costs. Furthermore, the primary source of paper pulp, wood, has seen a price surge of over 10% since 2014. This upward trend in wood prices significantly impacts the cost of paper pulp production. Kraft paper, which constitutes over 70% of the total input cost in manufacturing paper-based secondary packaging solutions, has also experienced a price hike of over 12% since 2013.

- As a professional, it's essential to acknowledge the continuous evolution of this market and its applications across various sectors. The price fluctuations in paper pulp and its impact on secondary packaging solutions underline the importance of staying informed about market trends and dynamics.

Exclusive Technavio Analysis on Customer Landscape

The secondary packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the secondary packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Secondary Packaging Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, secondary packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - This company specializes in providing diverse secondary packaging options, including flexible packaging, rigid containers, and custom cartons, catering to various industries' needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Ball Corp.

- Berry Global Inc.

- Catalent Inc.

- Crown Holdings Inc.

- Daio Paper Corp.

- DS Smith Plc

- Graphic Packaging Holding Co.

- Huhtamaki Oyj

- International Paper Co.

- Mondi Plc

- Packaging Corp. of America

- Rengo Co. Ltd.

- Salzgitter AG

- Sealed Air Corp.

- Smurfit Kappa Group

- Sonoco Products Co.

- Stora Enso Oyj

- Tetra Laval SA

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Secondary Packaging Market

- In January 2024, Amcor, a global packaging company, announced the launch of its new PET bottle for carbonated soft drinks with a 100% recycled content. This innovative product, named "PlanetBottle," is a significant step in the market towards more sustainable solutions (Amcor Press Release, 2024).

- In March 2024, Schneider Electric and Ball Corporation entered into a strategic partnership to develop and commercialize smart packaging solutions. This collaboration combines Schneider Electric's energy management and IoT expertise with Ball Corporation's packaging technology, aiming to create more efficient and connected supply chains (Schneider Electric Press Release, 2024).

- In May 2024, Sonoco, a leading provider of consumer packaging, announced the acquisition of European flexible packaging company, Tetra Laval's Carton Packaging business. This acquisition strengthens Sonoco's position in the market and expands its product offerings (Sonoco Press Release, 2024).

- In April 2025, the European Union's Single Use Plastics Directive came into full effect, banning single-use plastic packaging for certain products. This regulatory change is expected to significantly impact the market, driving demand for alternative, sustainable packaging solutions (European Commission Press Release, 2020).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Secondary Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

219 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 86.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.1 |

|

Key countries |

US, Germany, China, Canada, UK, Japan, France, India, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the ever-evolving landscape of product manufacturing and distribution, secondary packaging plays a pivotal role in safeguarding products during transportation and ensuring their market readiness. The market encompasses a diverse range of solutions, from e-commerce packaging and paperboard cartons to tamper evident seals and shrink wrap films. One key trend shaping this market is the increasing emphasis on product protection and distribution network optimization. According to recent studies, the use of protective cushioning in secondary packaging has surged by 15% in the last five years, underscoring the importance of damage prevention in the supply chain. Moreover, the implementation of advanced material handling systems and packaging automation has streamlined distribution processes, enhancing efficiency and reducing lead times.

- Another significant aspect of secondary packaging is the growing focus on sustainability. The demand for eco-friendly solutions, such as recycled paperboard cartons and biodegradable shrink wrap films, has been on the rise. Furthermore, many companies are investing in recycling programs and implementing sustainable packaging design software to minimize their environmental footprint. In the realm of regulatory compliance, secondary packaging solutions must adhere to stringent food safety standards and packaging regulations. Barcode scanning and product traceability systems enable efficient inventory management and ensure accurate tracking of goods throughout the supply chain. As the market continues to evolve, innovation in areas like flexible packaging films, custom packaging solutions, and packaging line efficiency will remain crucial.

- By leveraging the latest technologies and best practices, businesses can optimize their secondary packaging strategies, enhance product protection, and ultimately, strengthen their competitive edge.

What are the Key Data Covered in this Secondary Packaging Market Research and Growth Report?

-

What is the expected growth of the Secondary Packaging Market between 2025 and 2029?

-

USD 86.9 billion, at a CAGR of 4.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Paper and Plastic), Application (Food, Beverages, Pharmaceuticals, Personal and home care, and Others), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing e-commerce industry, Rising cost of raw materials

-

-

Who are the major players in the Secondary Packaging Market?

-

Amcor Plc, Ball Corp., Berry Global Inc., Catalent Inc., Crown Holdings Inc., Daio Paper Corp., DS Smith Plc, Graphic Packaging Holding Co., Huhtamaki Oyj, International Paper Co., Mondi Plc, Packaging Corp. of America, Rengo Co. Ltd., Salzgitter AG, Sealed Air Corp., Smurfit Kappa Group, Sonoco Products Co., Stora Enso Oyj, Tetra Laval SA, and WestRock Co.

-

Market Research Insights

- The market encompasses a diverse range of solutions, including folding cartons, tray packaging, bottle packaging, can packaging, and various types of shipping containers. These packaging formats prioritize both performance and shelf impact, with material selection and printing technologies playing crucial roles. For instance, the use of sustainable materials has gained significant traction, contributing to a 10% increase in recycling rates over the past decade. Meanwhile, load securing methods and pallet configurations have become essential for efficient unit loading and reduced shipping costs.

- Consumer behavior influences packaging design, with ergonomics and brand identity becoming increasingly important. In the realm of labeling, pouch packaging and blister packs have emerged as popular choices for point-of-sale presentations. The continuous evolution of the market is marked by advancements in packaging machinery and the integration of technology, ensuring that businesses remain competitive.

We can help! Our analysts can customize this secondary packaging market research report to meet your requirements.