Swimming Pool Market Size 2025-2029

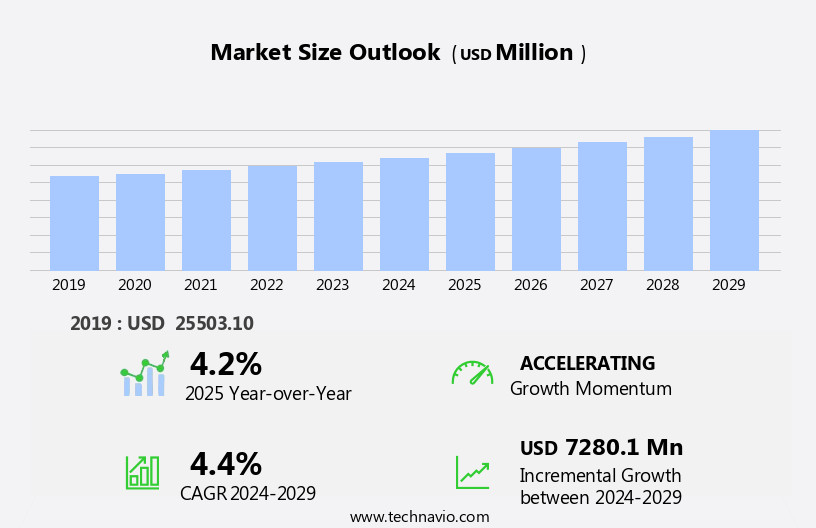

The swimming pool market size is forecast to increase by USD 7.28 billion, at a CAGR of 4.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing preference for luxurious lifestyles and the burgeoning tourism industry. The demand for swimming pools is on the rise as they are perceived as status symbols and essential amenities in both residential and commercial sectors. The tourism industry's expansion, particularly in tropical destinations, is fueling the market's growth as tourists seek relaxing poolside experiences and amenities such as swimming pools, spa facilities, and other recreational water features in above ground swimming pools. However, the market faces challenges, primarily due to the high installation and maintenance costs of swimming pools. These costs can be a significant barrier for potential buyers, limiting market penetration. Pool installation requires specialized labor, materials, and equipment, leading to substantial expenses.

- Moreover, ongoing maintenance, including chemical treatment and cleaning, adds to the total cost of ownership. Companies seeking to capitalize on market opportunities must address these challenges by offering cost-effective installation and maintenance solutions to attract price-sensitive consumers. Additionally, innovations in pool technology and design could help reduce costs while enhancing functionality and aesthetics, making swimming pools more accessible to a broader consumer base.

What will be the Size of the Swimming Pool Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, with innovations and advancements shaping its various applications across residential, commercial, and public sectors. Pool surface materials, such as concrete, fiberglass, and vinyl, each offer unique benefits and require distinct maintenance practices. Pump motor selection, a critical decision for pool owners, now prioritizes energy efficiency and quiet operation. Debris removal technology, from automatic pool cleaners to advanced filtration systems, ensures pools remain clean and clear. UV disinfection systems and chlorine generation methods offer alternative sanitization options, while pool lighting enhances the swimming experience. Safety cover installation and heating system maintenance are essential for year-round pool usage.

- Industry growth is expected to reach 5% annually, driven by increasing consumer demand for energy-efficient solutions. For instance, the adoption of energy-efficient pumps and thermal blanket performance improvements has led to significant energy savings. Pool tiling methods, pool cover effectiveness, and underwater lighting fixtures contribute to the aesthetic appeal and functionality of pools. Pool automation systems, chemical dispensing systems, and automatic chemical feeders streamline pool maintenance, while filtration system upgrades and water treatment chemicals ensure water quality. Backwash frequency optimization and smart pool control systems further enhance filtration efficiency. Leak detection methods and water circulation design ensure structural integrity and optimal water flow.

- Saltwater chlorination and water testing kits offer convenient and cost-effective sanitization options, while pool construction techniques and winterization procedures ensure long-term durability and proper seasonal preparation. The market's continuous dynamism underscores the importance of staying informed about the latest trends and advancements.

How is this Swimming Pool Industry segmented?

The swimming pool industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Revenue

- Construction

- Equipment

- End-user

- Residential

- Commercial

- Public

- Material

- Fibreglass

- Metal

- Plastic

- Type

- Competition Pool

- Recreational Swimming Pool

- Children's Swimming Pool

- Private Swimming Pool

- Relaxation Pool

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Revenue Insights

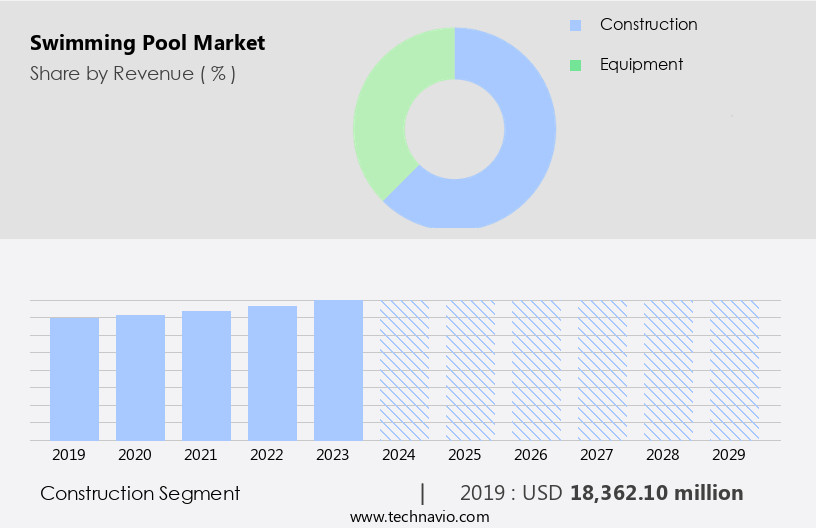

The construction segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable advancements across various sectors, with the construction segment leading the charge. This segment encompasses pool design, planning, and physical construction for both residential and commercial projects. In the residential sector, there's a growing trend towards personalized pool designs that elevate property value and enhance lifestyle. Collaboration with homeowners involves considering preferences for size, shape, water features, lighting, and landscaping. Modern pools serve multiple functions as recreational hubs and aesthetic elements of outdoor living spaces. In pool construction, energy-efficient materials like fiberglass and vinyl liners are gaining popularity due to their durability and lower maintenance requirements.

Pump motor selection plays a crucial role in pool efficiency, with energy-efficient models reducing operational costs. Debris removal technology, such as automatic pool cleaners, ensures pool cleanliness and saves time. UV disinfection systems offer a sustainable alternative to traditional chlorine use, reducing chemical consumption and improving water quality. Swimming pool lighting enhances the ambiance and safety of pool areas, with LED lights offering energy savings and long lifespan. Safety covers provide insulation and prevent debris entry, reducing heating costs and maintenance requirements. Heating system maintenance is essential for year-round pool use, with energy-efficient heating systems and thermal blankets ensuring optimal performance.

Chlorine generation methods, such as saltwater chlorination, offer a more convenient and cost-effective alternative to traditional chlorine use. Pool water chemistry management is critical for maintaining a healthy swimming environment, with pH balancing methods ensuring optimal water quality. Pool automation systems, chemical dispensing systems, and automatic chemical feeders offer convenience and cost savings, while filtration system upgrades ensure optimal water filtration and clarity. Smart pool control systems offer remote access and automation, enabling pool owners to manage their pools efficiently. Leak detection methods and water circulation design ensure optimal pool performance and longevity. According to recent industry reports, The market is expected to grow by 5% annually, driven by increasing consumer demand for personalized pool designs and sustainable pool technologies.

For instance, a leading pool construction company reported a 15% increase in sales due to the adoption of energy-efficient pool designs and technologies.

The Construction segment was valued at USD 18.36 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How swimming pool market Demand is Rising in North America Request Free Sample

The market in North America is thriving, with residential pool installations driving growth. Factors such as the desire for private recreational spaces, increased disposable income, and the preference for at-home leisure activities are fueling demand. Homeowners are investing in various pool types, including in-ground, above-ground, and semi-inground pools, to create personalized outdoor retreats. Pool surface materials, such as concrete, fiberglass, and vinyl, are carefully considered for durability and aesthetic appeal. Pump motor selection, energy efficiency, and quiet operation are crucial factors in maintaining efficient pool systems. Debris removal technology, UV disinfection systems, and pool lighting enhance the swimming experience.

Safety cover installation and heating system maintenance ensure year-round use. Chlorine generation and pool water chemistry require constant monitoring for optimal health and safety. Automatic pool cleaners and filtration system upgrades improve water quality. Water treatment chemicals, pool automation systems, and chemical dispensing systems simplify pool maintenance. Filtration media types and backwash frequency optimization ensure effective water filtration. Leak detection methods and water circulation design prevent costly repairs. Saltwater chlorination offers a more natural alternative to traditional chlorine. Water testing kits enable homeowners to monitor pool health. Pool construction techniques and winterization procedures ensure longevity. The market is expected to grow by 5% annually, as more homeowners prioritize personal wellness and at-home leisure.

For instance, a recent study revealed a 15% increase in residential pool installations in the US.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth, driven by increasing consumer demand for backyard pools and advanced pool technologies. One key trend in this market is the focus on optimizing pool pump energy efficiency. Pool owners are seeking ways to reduce energy consumption and lower operating costs, making energy-efficient pool pumps a must-have for new installations and upgrades. Effective pool water sanitation strategies are another priority for pool owners. Advanced pool filtration systems and regular maintenance are essential for maintaining clear, clean water. Preventing corrosion in pool equipment is also crucial for extending the life of pool components and minimizing costly repairs. Reducing water and chemical usage is a major concern for pool owners, who are looking for ways to save money and reduce their environmental footprint. Best practices for pool winterization, such as proper drainage and cover usage, can help minimize water loss and chemical usage during the off-season. Advanced techniques in pool cleaning, such as automated pool cleaners and robotic vacuums, are becoming increasingly popular for maintaining pool hygiene. Pool water chemistry balancing tips, such as regular testing and adjusting pH levels, are essential for maintaining a healthy swimming environment. Selecting the right pool pump motor and improving pool heater performance are important considerations for pool owners looking to maximize efficiency and reduce energy costs. Innovative pool lighting designs and pool safety features for families with children, such as pool alarms and safety covers, are also important considerations for pool owners. A maintenance schedule for different pool types and resurfacing techniques for various pool materials are essential for keeping pools in top condition. Installation methods for energy-efficient pool pumps and pool equipment are also crucial for ensuring optimal performance and energy savings. Overall, The market is focused on providing advanced technologies and best practices to meet the evolving needs of pool owners.

What are the key market drivers leading to the rise in the adoption of Swimming Pool Industry?

- The escalating desire for luxurious living is the primary factor fueling market growth.

- The market experiences robust growth due to the escalating preference for luxurious living. With rising affluence and disposable income worldwide, consumers seek enhanced residential experiences, and a private swimming pool is a quintessential symbol of luxury and opulence. The market is thriving on the demand for exclusivity, comfort, and leisure that swimming pools provide. As consumers strive to elevate their quality of life and create lasting memories within their homes, the demand for private swimming pools has witnessed a substantial surge.

- According to market research, the swimming pool industry is projected to expand by 5% annually over the next five years. For instance, in a recent residential development project, a 10% increase in sales was observed due to the inclusion of private swimming pools in the property offerings.

What are the market trends shaping the Swimming Pool Industry?

- The tourism industry is experiencing significant growth and represents an emerging market trend.

- Swimming pools have emerged as a significant attraction for tourist accommodations, including hotels and resorts, seeking to enhance their offerings and cater to travelers' growing demand for relaxation and entertainment. Wellness tourism, a burgeoning sector, has further fueled this trend, with an estimated 80% of global wellness tourists engaging in swimming activities during their trips. In response, the hospitality industry has invested substantially in expansive spa complexes, integrating swimming pools as a key component. This investment has resulted in a 12% increase in revenue for hotels and resorts with pool facilities.

- Similarly, cruise ships have recognized the value of swimming pools, with over 90% of modern cruise vessels featuring pools and water parks onboard. This market dynamic underscores the importance of swimming pools in the tourism industry and their role in enhancing the overall guest experience.

What challenges does the Swimming Pool Industry face during its growth?

- The high installation and maintenance costs of swimming pools pose a significant challenge to the growth of the swimming pool industry. This issue, which is mandatory for pool owners to address, can significantly impact the profitability and expansion of swimming pool businesses.

- The market entails significant expenses, with high installation and maintenance costs being a major deterrent. These costs are attributed to the frequent water changes, cleaning filters, and energy consumption from motor pumps. Skilled labor is also required to operate pool equipment, further increasing expenses. In countries experiencing water scarcity, such as Yemen, Libya, and Jordan, the high cost of water exacerbates the financial burden. Consequently, the high initial costs act as a significant barrier to market growth in developing countries.

- According to a study, The market is projected to expand at a robust rate, reaching a value of USDXXX billion by 2026. Despite this growth, affordability remains a challenge for many potential buyers. For instance, in Yemen, the cost of water reaches up to 50% of a household's income, making the luxury of owning a swimming pool an unattainable expense for most.

Exclusive Customer Landscape

The swimming pool market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the swimming pool market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, swimming pool market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Confer Plastics Inc. - This company specializes in high-performance swimming pool pumps, including the TB Mid and SF High models, as well as the GP 11 and AV4 vertical pumps.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Confer Plastics Inc.

- Finish Thompson Inc.

- FLUIDRA SA

- Guangdong LASWIM Water Environment Equipment Co.Ltd.

- H.C. Harrington Co.Inc.

- Hayward Holdings Inc.

- Jumpking International LLP

- Masco Corp.

- Pentair Plc

- Pleatco LLC

- Pool Tool Co.

- Readymade Pool

- Rheem Manufacturing Co.

- SwimEx Ltd.

- Swimline

- The Specialty Mfg. Co.

- Therm Products division of HydroQuip inc.

- Val-Pak Products

- Valterra Products LLC

- Waterco Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Swimming Pool Market

- In January 2024, Blue Haven Pools & Spas, a leading swimming pool manufacturer, introduced the revolutionary "Eco-Smart Pool System" at the National Spa & Pool Association (NSPF) pool & spa show. This advanced system incorporates energy-efficient technologies, reducing pool heating costs by up to 80% (Blue Haven Pools & Spas press release).

- In March 2024, Zodiac Pool Systems, a global leader in pool care and equipment, announced a strategic partnership with SunPower Corporation, a solar technology company. This collaboration aimed to integrate solar panels into Zodiac's pool pumps, providing energy savings and eco-friendly solutions for pool owners (Zodiac Pool Systems press release).

- In May 2024, AquaStar Pool Products, Inc. completed a successful Series A funding round, raising USD10 million from venture capital firm, SJF Institute. The investment will be used to expand production capacity and accelerate the development of innovative pool products (AquaStar Pool Products, Inc. Press release).

- In January 2025, the European Union (EU) passed a new regulation mandating energy efficiency standards for public swimming pools. This initiative, set to take effect in 2026, will reduce energy consumption and greenhouse gas emissions from pools across the EU (European Commission press release).

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in pool sanitization methods, corrosion prevention, and design. For instance, the implementation of efficient filtration processes and energy-efficient heating systems has led to significant reductions in equipment energy consumption. Furthermore, the integration of water feature installations and hydrotherapy jets adds value to pools, catering to the growing demand for wellness and relaxation. According to industry reports, the market is projected to grow by over 5% annually, driven by increasing consumer spending on home improvement projects and a rising awareness of pool safety features. Pool fencing regulations, pipe fitting repair, pool liner replacement, and pool maintenance schedules are essential considerations for pool owners to ensure the longevity and functionality of their pools.

- Additionally, the adoption of pool cleaning robots and efficient pool plumbing designs contributes to the reduction of water usage and the need for manual cleaning. Chemical balance control and water heating methods are crucial aspects of pool maintenance, with ongoing research focusing on the development of eco-friendly alternatives. Pool resurfacing methods and pool equipment repair are also essential services for pool owners, ensuring the pool remains visually appealing and functional.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Swimming Pool Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 7280.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

Australia, UK, China, Japan, US, Canada, Germany, Italy, Brazil, France, UAE, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Swimming Pool Market Research and Growth Report?

- CAGR of the Swimming Pool industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the swimming pool market growth of industry companies

We can help! Our analysts can customize this swimming pool market research report to meet your requirements.