Travel Technologies Market Size 2025-2029

The travel technologies market size is forecast to increase by USD 6.29 billion, at a CAGR of 9.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing use of smartphones and mobile applications in travel planning and booking. This trend is transforming the industry, enabling real-time booking, price comparisons, and personalized recommendations. Another key driver is the rise of Artificial Intelligence (AI) and Machine Learning (ML) in the travel sector, which is enhancing customer experiences through personalized services and predictive analytics. However, the market also faces challenges. Security and piracy concerns continue to pose significant threats to travel technologies. As travelers increasingly rely on digital platforms for booking and managing their trips, ensuring the security of their personal information becomes paramount.

- Additionally, the risk of piracy and data breaches can result in significant financial and reputational damage for travel companies. Addressing these challenges through robust cybersecurity measures and implementing data protection policies will be crucial for companies seeking to capitalize on the opportunities presented by the market.

What will be the Size of the Travel Technologies Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic innovations shaping the industry landscape. Leisure travel planning and business trips are increasingly being facilitated by advanced technologies, including travel itinerary management systems, cloud-based solutions, and personalized travel recommendations. Travel insurance services and flight search engines streamline the booking process, while travel content marketing engages consumers with compelling stories and visuals. Destination management systems and hotel reservation systems have become essential tools for travel industry professionals, enabling seamless organization and optimization of travel experiences. Mobile travel apps and mobile payments offer convenience and flexibility, while travel metasearch engines help consumers compare offerings across various platforms.

Travel industry partnerships and travel technology integration have become key drivers of growth, with companies collaborating to offer integrated solutions. Biometric authentication and accessibility features enhance the travel experience for all passengers. Travel marketing automation, sustainable tourism solutions, travel influencer marketing, and travel affiliate marketing are among the emerging trends shaping the market. The ongoing integration of these technologies across various sectors underscores the continuous evolution of the market, as companies strive to meet the evolving needs and expectations of consumers and industry professionals alike.

How is this Travel Technologies Industry segmented?

The travel technologies industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Travel industry

- Tourism industry

- Hospitality industry

- Product

- Global distribution system

- Airline and hospitality IT solutions

- Type

- Leisure

- Business

- Group

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

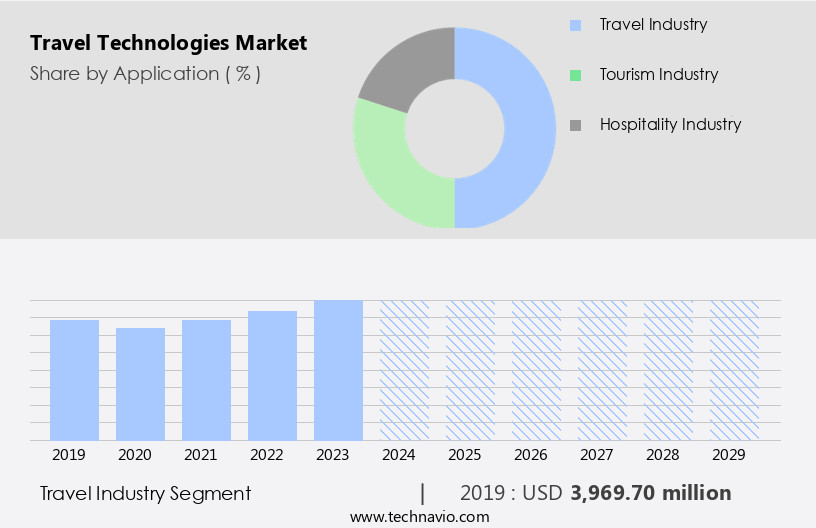

By Application Insights

The travel industry segment is estimated to witness significant growth during the forecast period.

The travel industry is a significant contributor to the market, introducing innovative solutions that optimize and improve the travel experience. This sector comprises various technologies, including travel loyalty programs, hotel reservation systems, mobile travel apps, and destination management systems, among others. The market's expansion in the travel industry segment is driven by the increasing number of online travel agencies (OTAs). These platforms have transformed the way people plan and book trips by offering personalized recommendations and tailored options based on user preferences. Travel technology investment continues to grow, with advancements in travel metasearch engines, mobile payments, and biometric authentication enhancing the overall travel experience.

Travel industry partnerships and travel influencer marketing are also playing a crucial role in shaping travel trends. Furthermore, sustainable tourism solutions and cloud-based travel solutions are gaining popularity as consumers demand more eco-friendly and convenient travel options. The travel industry forecast predicts continued growth in this sector, with business travel management, personalized travel recommendations, and travel marketing automation being key areas of focus. Travel content marketing and travel itinerary management are also essential components of the market, ensuring seamless trip planning and execution. Overall, the market is evolving to meet the changing needs of consumers, offering immersive, harmonious, and accessible travel experiences.

The Travel industry segment was valued at USD 3.97 billion in 2019 and showed a gradual increase during the forecast period.

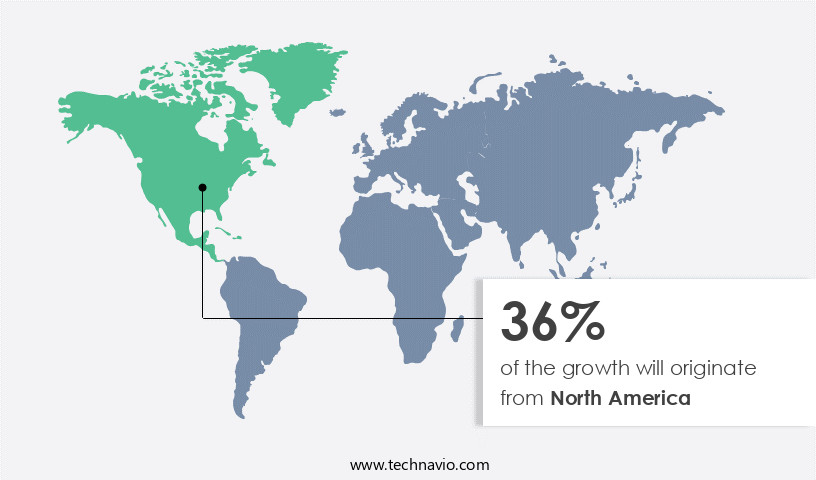

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is at the forefront of global innovation, driven by advanced infrastructure and industry-leading companies. Expedia, Booking.Com, and Airbnb are key players, revolutionizing trip planning and booking through seamless online platforms. These solutions enable users to efficiently search for flights, hotels, and vacation rentals. Destination management systems, hotel reservation systems, mobile travel apps, and mobile payments are integral components of this market, enhancing traveler experience. Travel technology investment continues to surge, fueling the integration of biometric authentication, personalized travel recommendations, and sustainable tourism solutions. Travel industry partnerships and travel marketing automation further boost growth, while cloud-based travel solutions and travel itinerary management streamline business travel management.

The market trends also include the rise of travel metasearch engines, travel influencer marketing, and travel affiliate marketing. Travel content marketing and flight search engines cater to leisure travel planning, while travel insurance services ensure peace of mind for travelers. Travel technology innovation is a constant focus, with a growing emphasis on accessibility features and trip planning tools.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Travel Technologies Industry?

- The escalating trend of smartphone adoption and the subsequent rise in utilization of mobile applications serve as the primary catalyst for market growth.

- The market has experienced notable growth due to the widespread adoption of mobile devices, particularly mobile travel apps. These applications offer numerous benefits to both travelers and industry players. Travelers appreciate the convenience of accessing a wealth of information and services directly on their smartphones, enhancing their travel experiences. Communication apps, such as WhatsApp and Skype, enable travelers to stay connected with loved ones and colleagues, adding to the convenience. Moreover, travel metasearch engines facilitate the comparison of prices and offerings from various travel service providers, ensuring the best deals for consumers. Mobile payments have also gained popularity, allowing for seamless transactions during travel.

- Travel industry partnerships have led to the integration of biometric authentication technology, streamlining the check-in process and improving security. Travel accessibility features, such as real-time language translation and disability accommodations, cater to diverse traveler needs. Trip planning tools, including itinerary management and recommendation engines, further enhance the overall travel experience. These advancements underscore the significant impact of technology on the travel industry.

What are the market trends shaping the Travel Technologies Industry?

- The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies is a significant market trend shaping the travel industry. These advanced technologies are transforming various aspects of travel, from personalized recommendations and customer service to streamlined operations and improved efficiency.

- The travel technology market has experienced substantial growth due to the integration of Artificial Intelligence (AI) and Machine Learning (ML) in various travel applications. These technologies have transformed the industry by enabling travel companies to offer personalized experiences to customers and optimize their operations. For instance, Air France-KLM's collaboration with Google Cloud in December 2024 signifies the potential of AI in analyzing passenger data to predict travel patterns and optimize aircraft maintenance. This partnership aims to provide personalized travel recommendations and improve overall efficiency.

- Cloud-based travel solutions, travel itinerary management, travel content marketing, travel insurance services, and business travel management are some areas where AI and ML are making a significant impact. The integration of these technologies is expected to revolutionize the travel industry further, offering more immersive and harmonious travel experiences.

What challenges does the Travel Technologies Industry face during its growth?

- The growth of the travel industry is significantly impacted by security and piracy concerns in travel technologies. These issues pose a significant challenge and require urgent attention from industry professionals to ensure the safe and secure implementation and use of technology solutions.

- The market faces significant security challenges as technology advances. With an increasing amount of personal and financial information being stored on travel technology platforms, these systems have become prime targets for cybercriminals. Travelers' sensitive data, such as passports, credit card details, and travel itineraries, are at risk of being stolen for malicious purposes. A security breach in a travel technology platform can result in financial loss for customers and erode their trust in the industry. Travel affiliate marketing, marketing automation, sustainable tourism solutions, influencer marketing, and booking platforms are all key components of the market. Innovation in these areas continues to drive growth and transformation in the sector.

- However, it is crucial that travel technology providers prioritize security measures to protect customer data and mitigate the risk of cyber attacks. By implementing robust security protocols and staying informed about the latest threats, the industry can continue to thrive while ensuring the safety and privacy of travelers.

Exclusive Customer Landscape

The travel technologies market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the travel technologies market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, travel technologies market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amadeus IT Group SA - The company specializes in travel technology solutions, including the Amadeus airline platform and selling platform connect.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amadeus IT Group SA

- Avani Cimcon Technologies

- BCD Group

- CRS Technologies India Pvt. Ltd.

- Digitrips

- DirectVision SRL

- Dolphins Dynamics Ltd.

- ecare Technology Labs Pvt. Ltd.

- Expedia Group Inc.

- Fareportal Inc.

- Kaptio

- Lemax d.o.o.

- Pc Voyages 2000 Inc.

- Qtech Software Pvt. Ltd.

- Sabre Corp.

- Technoheaven

- Tecnologia e Sistemas de Distribuicao Lda

- Tramada Systems Pty Ltd.

- Travelport LP

- Trip Solutions

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Travel Technologies Market

- In March 2023, Amadeus IT Group, a leading travel technology company, announced the launch of its new artificial intelligence (AI) solution, Amadeus Selling Platform Intelligent Decisioning. This advanced technology uses AI to analyze historical data and real-time market trends, enabling travel sellers to offer personalized pricing and services to their customers (Amadeus IT Group press release, 2023).

- In July 2024, Sabre Corporation, another major travel technology provider, entered into a strategic partnership with Google to integrate Sabre's travel marketplace into Google Flights. This collaboration allows Google to offer a more comprehensive range of travel options to its users, expanding its reach in the travel sector (Sabre Corporation press release, 2024).

- In October 2024, Travelport Worldwide, a global technology company specializing in the travel industry, completed its acquisition of Orbitz Worldwide. This deal significantly expanded Travelport's presence in the online travel agency (OTA) market, providing the company with a larger customer base and a broader range of travel offerings (Travelport Worldwide press release, 2024).

- In February 2025, International Air Transport Association (IATA) announced the implementation of its New Distribution Capability (NDC) standard. This technological advancement enables airlines to sell their products and services directly to travel agents and corporations through a more modern, XML-based platform, enhancing the overall travel purchasing experience (IATA press release, 2025).

Research Analyst Overview

- In the dynamic market, personalized travel experiences are at the forefront of innovation, with trip optimization algorithms tailoring itineraries based on individual preferences. Travel crisis management solutions ensure seamless response during disruptions, while travel customer support leverages location-based services for real-time assistance. Travel revenue management and pricing strategies employ travel analytics dashboards and big data to optimize yields. Travel sentiment analysis and risk management tools help mitigate potential issues, and travel APIs facilitate seamless integration of various travel services.

- Travel gamification engages customers, while travel sales strategies and marketing channels enhance reach. Travel customer experience, loyalty programs, and rewards schemes foster repeat business, and travel virtual assistants offer 24/7 assistance. Geolocation technology enhances distribution channels, enabling on-demand services and real-time tracking.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Travel Technologies Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.5% |

|

Market growth 2025-2029 |

USD 6288.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.4 |

|

Key countries |

US, UK, China, Germany, Canada, France, India, UAE, Brazil, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Travel Technologies Market Research and Growth Report?

- CAGR of the Travel Technologies industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the travel technologies market growth of industry companies

We can help! Our analysts can customize this travel technologies market research report to meet your requirements.