Commercial Aircraft Oxygen System Market Size 2024-2028

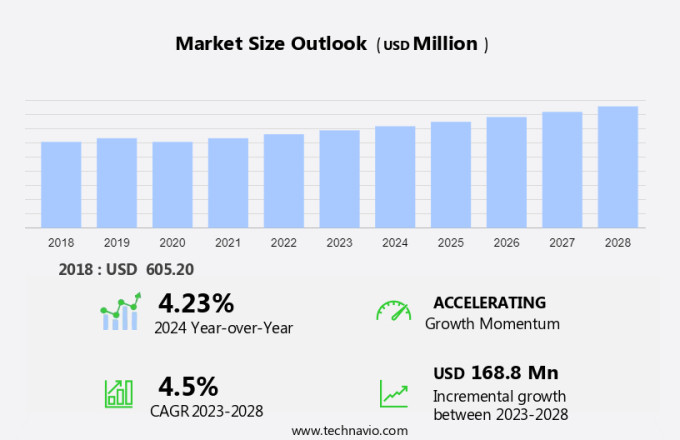

The commercial aircraft oxygen system market size is forecast to increase by USD 168.8 million at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing preference for aircraft equipped with advanced technologies. Aerospace technology innovations, such as oxygen generation systems, are gaining traction in the aviation industry. Narrow-body aircraft are a major focus for these advancements, as they account for a substantial portion of commercial aviation. The emergence of new Maintenance, Repair, and Overhaul (MRO) hubs in the Asia Pacific region is driving demand for these systems. However, the delay in aircraft delivery poses a challenge for market growth. Aircraft manufacturers are under pressure to meet the increasing demand for fuel-efficient and technologically advanced aircraft, which in turn is leading to the integration of advanced portable oxygen systems in their designs. The human body requires a certain level of cabin air pressure to maintain optimal health during flight, and oxygen systems play a crucial role in ensuring this requirement is met.

What will be the Size of the Market During the Forecast Period?

The commercial aircraft industry is a critical sector that prioritizes passenger safety and comfort. One essential aspect of ensuring safe air travel at high altitudes is the use of oxygen systems. Oxygen delivery mechanisms play a vital role in maintaining the health and well-being of both passengers and crew members during flights. Aircraft oxygen systems encompass various components, including oxygen masks, storage systems, and generating systems. These mechanisms are designed to deliver oxygen to passengers and crew members when necessary, ensuring they can breathe easily at altitudes where the air pressure is lower than at ground level.

Moreover, oxygen masks, a crucial component of these systems, are designed to deliver oxygen to passengers during emergency situations, such as rapid decompression. Two primary types of oxygen delivery systems are used in commercial aircraft: continuous flow systems and demand flow systems. Continuous flow systems deliver a constant supply of oxygen to passengers, while demand flow systems provide oxygen only when the passenger activates the mask. Both systems play a vital role in ensuring passenger safety during air travel.

Furthermore, chemical oxygen generators and compressed oxygen systems are the two primary types of oxygen-generating systems used in commercial aircraft. Chemical oxygen generators produce oxygen through a chemical reaction, while compressed oxygen systems store oxygen in tanks and release it as needed. The mechanism behind these oxygen systems is intricate and involves precise pressure regulation to ensure a steady supply of oxygen at the correct pressure. Oxygen storage systems are also essential, as they provide a backup supply of oxygen in case of emergencies. Stringent regulations govern the design, manufacturing, and implementation of aircraft oxygen systems. Original equipment manufacturers (OEMs) must adhere to these regulations to ensure the safety and reliability of their products.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Aircraft Type

- Narrow body aircraft

- Wide body aircraft

- Regional aircraft

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Aircraft Type Insights

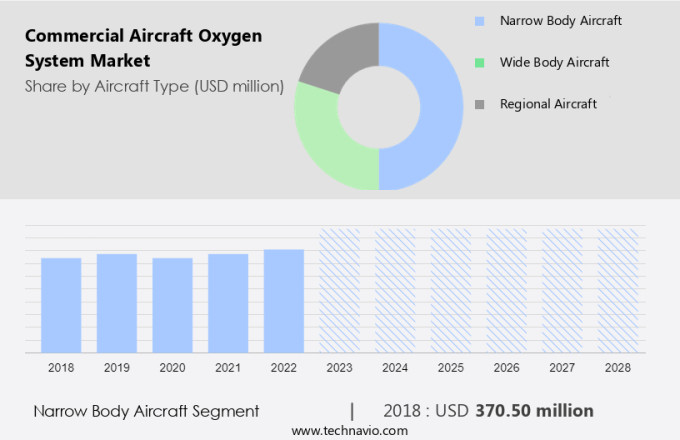

The narrow body aircraft segment is estimated to witness significant growth during the forecast period. The market caters to the requirements of both crew members and passengers in various types of aircraft, including military and business jets. National regulations mandate the provision of adequate oxygen supply systems for flight safety. These systems are essential for crew members at their flight duty stations and for passengers in the passenger compartment during emergencies. Two primary types of oxygen systems exist: fixed and portable. Fixed systems are integrated into the aircraft structure and provide a continuous supply of oxygen to the crew and passengers. In contrast, portable systems, such as smoke goggles, are designed for emergency use and are carried by individuals.

Furthermore, both military aircraft and business jets rely on these oxygen systems for the safety and well-being of their occupants. The increasing demand for fuel-efficient narrow body commercial aircraft, produced by major Original Equipment Manufacturers (OEMs) like Boeing and Airbus, also necessitates the need for advanced oxygen systems. As older fleets become more expensive to maintain and less reliable due to aging, the demand for replacement aircraft is growing. Ensuring the availability of reliable oxygen systems is crucial for both the safety of the crew and the passengers and for the overall operational efficiency of the aircraft.

Get a glance at the market share of various segments Request Free Sample

The narrow body aircraft segment was valued at USD 370.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

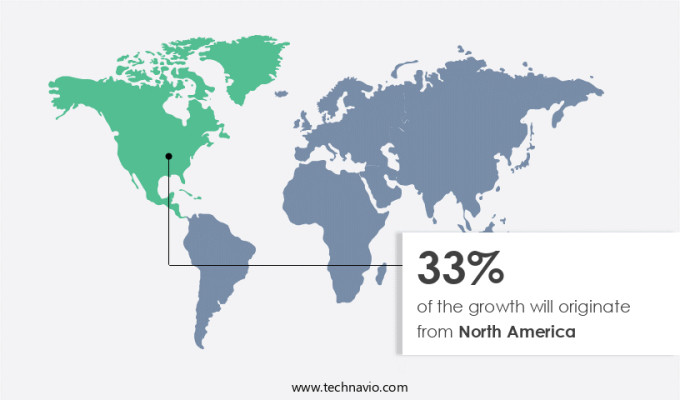

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American region houses the largest commercial aircraft fleet due to its advanced aerospace infrastructure and thriving air travel industry. Major players in the region's commercial aircraft market include Boeing and Bombardier, who compete with European and Asian OEMs for market share. This competition drives tier-1 and tier-2 suppliers in North America to enhance their manufacturing capabilities. Foreign suppliers and component companies are also investing in expanding their presence in the region, collaborating with major OEMs to meet the increasing demand for commercial aircraft.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Preference for aircraft with advanced technologies is the key driver of the market. The aircraft manufacturing business is experiencing a significant surge in demand due to the anticipated growth in air travel, particularly in countries like China, Russia, India, Indonesia, and the United States. To meet this increasing demand, commercial aircraft Original Equipment Manufacturers (OEMs) are investing in the development of new-generation aircraft that offer improved fuel efficiency and enhanced reliability. Safety remains a top priority in the aviation industry, and regulatory bodies such as the European Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) impose stringent regulations.

In response, aircraft OEMs and their suppliers are upgrading their production facilities to ensure timely deliveries. An essential component of aircraft safety is the oxygen system. The oxygen delivery system is crucial for both crew and passengers during flight, especially during emergencies. Two primary types of oxygen systems are in use: Compressed Oxygen Systems and Chemical Oxygen Generators. The former stores oxygen in cylinders, while the latter generates oxygen onboard using a chemical reaction. Both systems have their advantages and are used depending on the aircraft's size and specifications. The oxygen mask is an integral part of the oxygen delivery system.

Market Trends

The emergence of new MRO hubs in APAC is the upcoming trend in the market. In the aviation industry, Maintenance, Repair, and Overhaul (MRO) is a critical process that ensures the safety and compliance of commercial aircraft with regulatory authorities. This process involves significant financial investments by airlines, with maintenance expenditures accounting for a substantial portion of their operational costs. Historically, aircraft manufacturers have focused primarily on aircraft development and production, missing out on the potential of the aftermarket business. However, component suppliers, including those for oxygen generation systems, have an opportunity to expand their role in the aerospace technology sector. These suppliers provide essential parts and components to both aircraft manufacturers and their competitors, acting as sub-tier suppliers.

In the context of commercial aviation, narrow body aircraft types, such as those used for short-haul flights, rely on aviation oxygen systems to maintain cabin air pressure and ensure the well-being of passengers and crew during flight. As the demand for air travel continues to grow, the importance of these systems and their suppliers will only increase. To stay competitive and meet the evolving needs of the market, it is crucial for aircraft manufacturers and component suppliers to collaborate and innovate. By exploring new technologies and improving existing systems, they can enhance the overall performance and safety of commercial aircraft, ultimately benefiting the aviation industry as a whole.

Market Challenge

Delay in aircraft delivery is a key challenge affecting the market growth. In the evolving aviation sector, manufacturers of aircraft components, including oxygen systems, face mounting challenges such as stringent regulations, escalating demand, and budget constraints. The aviation industry's expansion, driven by rising passenger traffic and growing economies in regions like the Middle East, Sub-Saharan Africa, North Africa, and APAC, necessitates the acquisition of new and refurbished aircraft. Consequently, there is a surge in orders for fuel-efficient planes and the need to replace aging fleets. Aircraft oxygen systems, a critical safety feature, come in various types, including continuous flow systems and demand flow systems. These systems provide oxygen to crew members and passengers during flight, ensuring their safety at high altitudes.

Oxygen masks are an essential component of these systems. With the increasing number of passenger aircraft, the importance of these systems in maintaining safety standards cannot be overstated. Manufacturers must navigate these challenges while maintaining quality and adhering to aviation technology advancements. The continuous evolution of aircraft oxygen systems necessitates staying updated with the latest technology and regulatory requirements. By focusing on these aspects, manufacturers can meet the growing demand for efficient, safe, and cost-effective solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Adams Rite Aerospace Inc. - The company offers oxygen products to the aerospace industry which includes oxygen regulators, masks, control panels, cylinders as well as specialty products for emergency breathing air.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adams Rite Aerospace Inc.

- AMETEK Inc.

- CASP Aerospace Inc.

- Cobham Ltd.

- East/West Industries Inc.

- Essex Industries Inc.

- Meggitt Plc

- Mountain High E and S

- Precise Flight Inc.

- RTX Corp.

- Rostec

- Safran SA

- Ventura Aerospace Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The commercial aircraft oxygen system market is a critical component of the aircraft manufacturing business, ensuring the safety of passengers and crew members during air travel. Bloomberg Businessweek reports that the demand for oxygen delivery systems in commercial aviation continues to grow, driven by the increasing numbers of passenger aircraft and stringent regulations. Aircraft oxygen systems include various mechanisms such as chemical oxygen generators, compressed oxygen systems, and oxygen storage systems. These systems provide supplemental oxygen to passengers and crew members at high altitudes, where cabin air pressure is lower than atmospheric pressure. Passenger oxygen systems and crew oxygen systems are essential for passenger safety during air travel.

Furthermore, continuous flow systems and demand flow systems are two types of oxygen delivery systems used in aircraft. Oxygen masks, quick-donning masks, and emergency oxygen generators are essential components of these systems. The aviation industry and aircraft manufacturers prioritize safety standards, and aviation technology continues to evolve to meet these requirements. Oxygen generation systems, including emergency oxygen generators, are crucial for ensuring the safety of flight crew members and passengers in various aircraft types, including narrow body aircrafts, military aircraft, and business jets. National regulations and aviation authority regulations play a significant role in the design and implementation of aircraft oxygen systems. These regulations cover various aspects, including oxygen system pressure, cabin altitude, and safety presentations for passengers. In summary, the commercial aircraft oxygen system market is a critical segment of the aerospace technology industry, ensuring the safety of passengers and crew members during air travel by providing supplemental oxygen at high altitudes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 168.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Adams Rite Aerospace Inc., AMETEK Inc., CASP Aerospace Inc., Cobham Ltd., East/West Industries Inc., Essex Industries Inc., Meggitt Plc, Mountain High E and S, Precise Flight Inc., RTX Corp., Rostec, Safran SA, and Ventura Aerospace Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch