Space Habitat Market Size 2025-2029

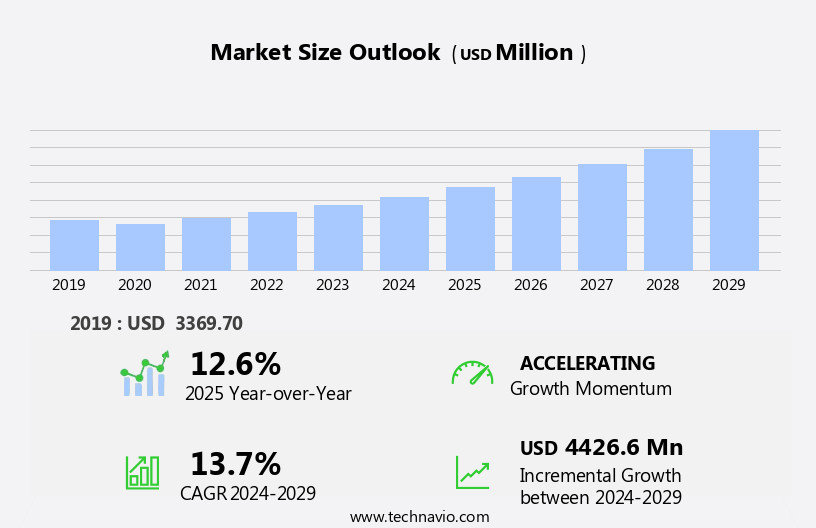

The space habitat market size is forecast to increase by USD 4.43 billion at a CAGR of 13.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by key trends such as the adoption of reusable launch vehicles and the provision to recycle resources in space. These advancements are crucial for the expansion of human presence in space and the development of long-term space colonization. However, challenges remain, including insufficient infrastructure and integrated technology for space colonization. The space habitat industry is poised for product innovation and technological breakthroughs, with potential applications in both civil and military sectors. Modular building methods and advanced life support technologies are key trends, with innovations in artificial gravity, inflatable space habitats, and closed loop systems. Addressing these challenges will require continued innovation and investment In the space industry. The market analysis report provides an in-depth examination of these factors and their impact on the growth of the market.

What will be the Size of the Space Habitat Market During the Forecast Period?

- The market encompasses the development and deployment of sustainable homes and research stations in space, with a focus on the Moon and Mars. These habitats provide radiation protection shielding and life support systems for astronauts and researchers, enabling extended stays and exploration missions. The market is driven by the growing demand for lunar and Mars expeditions, as well as the pursuit of sustainable ecosystems and resource extraction outposts.

- Product development is also influenced by material science advancements and the need for sustainable energy sources. The market includes both commercial and defense industry applications, with a long-term goal of creating self-sufficient space colonies on Earth's celestial neighbors.

How is this Space Habitat Industry segmented and which is the largest segment?

The space habitat industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Non-inflatable

- Inflatable

- End-user

- Government

- Private

- Type

- Scientific research

- Long-term space missions

- Manufacturing and production

- Space tourism

- Sector

- Chemical propulsion

- Electric propulsion

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- Italy

- Rest of World (ROW)

- North America

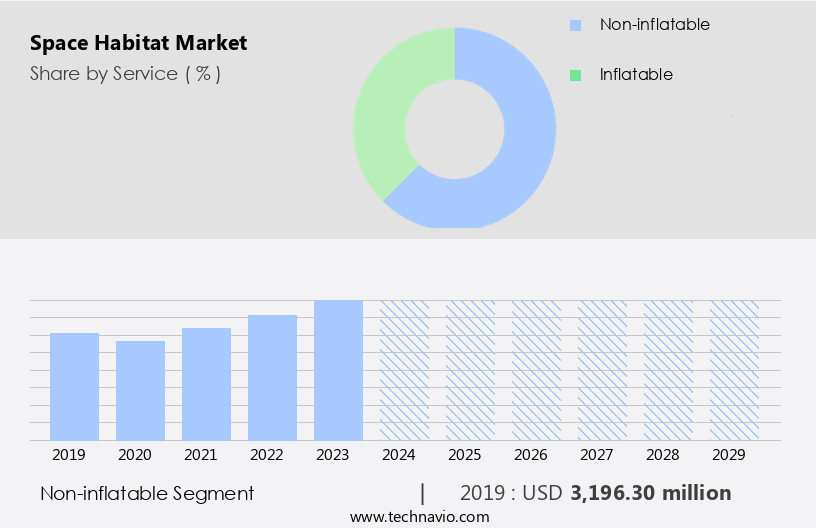

By Service Insights

- The non-inflatable segment is estimated to witness significant growth during the forecast period.

Space habitats are essential infrastructure for extended human presence in space, particularly on the Moon and Mars. Non-inflatable space habitats offer structural integrity, making them suitable for long-duration missions. Their solid walls provide resistance to micrometeoroid impacts and space hazards, ensuring the safety of astronauts and equipment. These habitats can support sustainable homes, research stations, and resource extraction outposts. Life support systems, radiation protection shielding, and thermal protection systems are integral components of these habitats. Modular building methods and advanced life support technologies enable the creation of sustainable ecosystems withIn these habitats. Closed loop systems ensure efficient resource utilization, reducing the need for resupply missions.

Inflatable space habitats offer flexibility but may have shorter operational lifespans due to potential wear and tear. Non-inflatable space habitats are versatile and can cater to various sectors, including military, civil, commercial, and scientific research. They can be designed using traditional or advanced techniques, such as 3D printing, and can be integrated with reusable rockets, such as SpaceX's Starliner and the International Space Station. Space tourism and CubeSats can also benefit from these habitats. The space habitat industry is witnessing significant product innovation and technological breakthroughs. Key areas of focus include radiation shielding, artificial gravity, and sustainable ecosystems. International collaboration among commercial entities, governments, and research institutions is essential for the development and deployment of these habitats. Investment in this sector is expected to grow as space exploration continues to expand beyond Earth.

Get a glance at the market report of share of various segments Request Free Sample

The non-inflatable segment was valued at USD 3.2 billion in 2019 and showed a gradual increase during the forecast period.

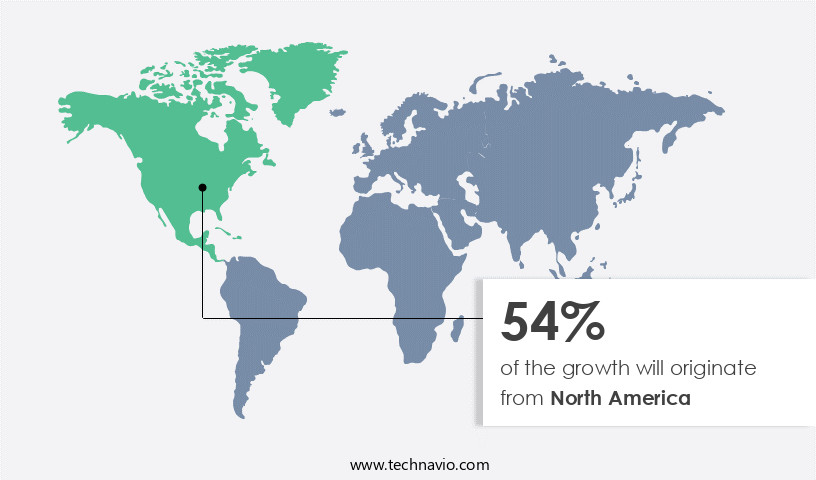

Regional Analysis

- North America is estimated to contribute 54% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is in its developmental stage, with NASA spearheading collaborations with private entities to create inflatable and non-inflatable habitats for human exploration and survival in space. The Next Step-2 project, led by NASA, focuses on designing a full-scale prototype for testing and functionality. Space tourism's emergence is anticipated to fuel the advancement of space habitat technology in North America, where major players such as Virgin Galactic, Blue Origin, and SpaceX are headquartered. This technology encompasses life support systems, radiation protection shielding, and sustainable ecosystems, enabling the establishment of research stations, resource extraction outposts, and even colonies on the Moon and Mars.

Modular building methods, advanced life support technologies, and reusable rockets are integral to creating sustainable homes in space. Key technologies include thermal protection systems, hybrid propulsion systems, and 3D printing. International collaboration is essential to advancing this field, as space exploration and scientific research expand beyond Earth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Space Habitat Industry?

Adoption of reusable launch vehicles is the key driver of the market.

- The Space Habitat industry is experiencing significant advancements with the development of reusable launch vehicles. These systems, which include the Starliner and traditional rockets, offer substantial cost savings, time efficiency, and resource preservation. By eliminating the need to design and build a new launch system for each mission, resources are conserved, and the risk of errors is reduced. Reusable rockets have proven successful in supplying resources for the International Space Station, with the added benefit of increased launch success rates compared to expendable rockets. Space habitats, such as those intended for lunar and Mars expeditions, require advanced life support systems and radiation protection shielding. Modular building methods and closed loop systems are essential for creating sustainable homes in space.

- Inflatable Space Habitats are being explored for their potential to provide artificial gravity and accommodate larger research stations. Life support technologies, including thermal protection systems and hybrid propulsion systems, are crucial components of these habitats. Material science research and sustainable ecosystems are also vital for the long-term success of space exploration. The Space habitat industry is a collaborative effort between military, civil, and commercial entities, with international cooperation playing a significant role. Product innovation and technological breakthroughs continue to drive the industry forward, with advancements in 3D printing, human spaceflight, and space-based activities. CubeSats and NanoRacks offer opportunities for smaller entities to participate in space exploration and research. As the industry evolves, investment in advanced life support systems, habitat design, and construction techniques will be essential for the success of future space missions and colonies.

What are the market trends shaping the Space Habitat Industry?

Provision to recycle resources in space is the upcoming market trend.

- The Space Habitat industry is experiencing significant advancements as sustainability becomes a priority in space exploration. Reusable resources are being implemented in spacecraft design, including the conversion of waste materials into fuel. Mining techniques are being explored for obtaining water and energy on the Moon and Mars, reducing the need to transport large quantities of these resources from Earth. Modular building methods are utilized for constructing space habitats, such as inflatable structures, which offer radiation protection shielding and life support systems. These habitats are essential for sustaining human life during lunar and Mars expeditions, as well as for research stations and resource extraction outposts.

- Advanced life support technologies, including closed loop systems, are integrated into these habitats to maintain sustainable ecosystems. The space habitat industry is witnessing technological breakthroughs in areas such as artificial gravity, thermal protection systems, and hybrid propulsion systems. Both civil and military entities are investing in this industry, with commercial entities playing an increasingly significant role. Space tourism and CubeSats are also contributing to the growth of the industry. The collaboration between various countries and commercial entities is driving innovation in habitat design and construction techniques.

What challenges does the Space Habitat Industry face during its growth?

Insufficient infrastructure and integrated technology for space colonization is a key challenge affecting the industry growth.

- The market encompasses the development and implementation of advanced technologies for creating self-sustaining human environments in space, specifically on the Moon and Mars. Space habitats are essential for supporting life during lunar and Mars expeditions, as well as for establishing sustainable homes and research stations. These structures require radiation protection shielding and sophisticated life support systems, including water recycling, air filtration, and temperature control. Modular building methods and life support technologies are crucial for creating inflatable space habitats that can withstand the harsh conditions of space. Resource extraction outposts on the Moon and Mars will provide essential resources, reducing the need for frequent resupply missions from Earth.

- Advanced space habitats also incorporate artificial gravity and closed loop systems to mimic Earth's environment. The Space habitat industry is experiencing significant product innovation and technological breakthroughs, driven by the demands of the military, civil, and commercial sectors. Reusable rockets, such as SpaceX's Starliner, and advanced propulsion systems are revolutionizing space travel. In addition, space tourism, CubeSats, and nano-satellites are expanding the scope of space-based activities. International collaboration and investment in space habitat design and construction techniques are essential for advancing this field. 3D printing technology offers promising possibilities for creating habitable structures in space. As human spaceflight and scientific research continue to expand, the need for advanced space habitats will become increasingly important.

Exclusive Customer Landscape

The space habitat market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the space habitat market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, space habitat market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AI SpaceFactory: The company offers space habitat solutions such as Lina, Marsha, and Tera.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AI SpaceFactory

- Axiom Space Inc.

- Foster and Partners Group Ltd.

- Gravitics

- ILC Dover LP

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- Sierra Nevada Corp.

- The Boeing Co.

- VAST SPACE LLC

- VOYAGER

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the design, construction, and operation of sustainable homes and research stations in space, with a focus on the Moon and Mars. These habitats cater to various sectors, including military, civil, and commercial entities, and are essential for advancing space exploration and scientific research. Space habitats serve multiple purposes, such as radiation protection shielding, life support systems, and the provision of artificial gravity. They are crucial for lunar and Mars expeditions, enabling extended stays and facilitating the establishment of sustainable ecosystems. Modern space habitats are designed using advanced life support technologies and modular building methods. These closed-loop systems recycle waste and provide essential resources, ensuring the inhabitants' survival In the harsh space environment.

Inflatable space habitats offer a cost-effective and efficient solution, providing ample living space with minimal material requirements. Material science plays a significant role In the development of space habitats, with a focus on thermal protection systems and hybrid propulsion systems. The space habitat industry has witnessed numerous product innovations and technological breakthroughs, driven by the need for sustainable and cost-effective solutions. Reusable rockets and advanced spacecraft, such as Starliner, have revolutionized space travel and opened up new opportunities for space-based activities. The International Space Station (ISS) serves as a prime example of international collaboration and the potential for long-term space habitation.

Space tourism is an emerging market, with companies like SpaceX and Blue Origin offering suborbital flights and plans for orbital tours. The integration of cubesats and nanoracks in space habitats has facilitated research and development, providing opportunities for commercial entities to invest In the space industry. Military applications of space habitats include defense and security operations, while civil applications focus on scientific research and sustainable living. The development of advanced space habitats is crucial for the success of future space missions and the eventual colonization of Mars. Thus, the market is a dynamic and evolving industry, driven by the need for sustainable and cost-effective solutions for space exploration, scientific research, and habitation. The integration of advanced technologies, international collaboration, and commercial entities is essential for the continued growth and success of this industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.7% |

|

Market growth 2025-2029 |

USD 4.43 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

12.6 |

|

Key countries |

US, China, Russia, Japan, Germany, France, Italy, Canada, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Space Habitat Market Research and Growth Report?

- CAGR of the Space Habitat industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the space habitat market growth of industry companies

We can help! Our analysts can customize this space habitat market research report to meet your requirements.