Acrylic Polymer Market Size 2024-2028

The acrylic polymer market size is forecast to increase by USD 7.92 billion, at a CAGR of 4.45% between 2023 and 2028.

- The Airborne Intelligence, Surveillance, and Reconnaissance (ISR) market experiences significant growth due to the increasing demand from various sectors, including defense and homeland security. One of the key drivers is the expansion of the real estate and construction industry, which relies on airborne ISR systems for monitoring large construction sites and managing infrastructure projects. Another trend is the growing focus on eco-friendlier and bio-based solutions, leading some market players to invest in developing sustainable airborne ISR platforms. However, the market faces challenges as well. Stringent regulations governing the use of airborne ISR systems in various applications pose significant obstacles.

- For instance, the implementation of privacy regulations in civil applications and export restrictions in defense applications can hinder market growth. Furthermore, the high cost of acquiring and maintaining these systems poses a challenge for smaller players, creating a competitive landscape dominated by large, well-established companies. To capitalize on market opportunities, companies should invest in research and development to create cost-effective and efficient airborne ISR solutions. Additionally, they should focus on complying with regulatory requirements and expanding their offerings to cater to the growing demand from various industries. Collaborating with eco-friendly technology providers and integrating their solutions into airborne ISR platforms can also help companies differentiate themselves in the market.

What will be the Size of the Acrylic Polymer Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by advancements in polymerization techniques and the expanding scope of applications across various sectors. Emulsion polymerization and suspension polymerization are two prominent methods used to produce acrylic polymers, each offering unique benefits in terms of particle size distribution and viscosity control. For instance, emulsion polymerization enables the production of polymers with superior chemical resistance and pigment dispersion, making it ideal for coating applications. In contrast, suspension polymerization yields polymers with higher crosslinking density and impact resistance, suitable for adhesive formulations. The market's ongoing dynamism is further reflected in the ongoing research and development efforts in alternative polymerization methods, such as ring-opening polymerization, cationic polymerization, free radical polymerization, and anionic polymerization.

- These techniques contribute to the expansion of the market by enabling the production of polymers with enhanced UV resistance, hardness, elongation at break, and other desirable properties. According to industry reports, the global acrylic polymers market is expected to grow at a robust rate, with a significant increase in demand from the coatings, adhesives, and automotive industries. For example, the coatings sector alone is projected to account for over 40% of the market share by 2025. A notable example of the market's evolution can be seen in the development of acrylic polymers with improved color stability and molecular weight distribution, which have led to increased sales for a leading polymer manufacturer by over 15%.

- These advancements underscore the continuous innovation and unfolding patterns in the market. Additionally, the market's growth is fueled by the increasing demand for polymers with superior rheological properties, thermal stability, and surface tension, which are essential for various applications, including coatings, adhesives, and plastics. The versatility and adaptability of acrylic polymers make them a preferred choice for numerous industries, driving the market's continuous growth and evolution.

How is this Acrylic Polymer Industry segmented?

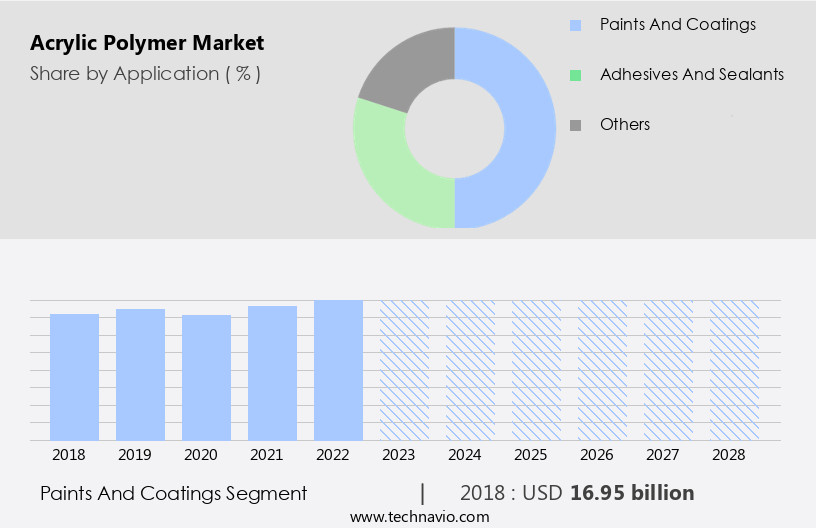

The acrylic polymer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Paints and coatings

- Adhesives and sealants

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The paints and coatings segment is estimated to witness significant growth during the forecast period.

The market is driven by the extensive use of acrylic polymers in various industries, particularly in paints and coatings. Acrylic polymers offer desirable properties such as chemical resistance, UV resistance, hardness, and elongation at break, making them ideal for coating applications. Two primary methods for producing acrylic polymers are emulsion polymerization and solution polymerization. Emulsion polymerization involves the dispersion of monomer particles in water and the formation of polymer particles within these monomer droplets. This process results in polymers with narrow particle size distributions and excellent pigment dispersion. For instance, water-based paints, which are predominantly used in developed countries like the US, Germany, the UK, and France, have less volatile organic compounds and are produced using emulsion polymerization.

Cationic polymerization and free radical polymerization are other methods used for acrylic polymer production. Cationic polymerization results in polymers with high crosslinking density and excellent adhesive properties, while free radical polymerization provides polymers with a broad molecular weight distribution and good viscosity control. Acrylic polymers are also used in the production of adhesives, plastics, and textiles due to their excellent properties. The market is expected to grow at a significant rate due to the increasing demand for high-performance materials in various industries. For example, the automotive industry's demand for lightweight and durable materials is driving the market growth.

In the coatings sector, acrylic polymers offer excellent film formation and color stability, making them a preferred choice for various applications. Additionally, the increasing demand for UV-resistant coatings in the construction industry is also contributing to the market growth. The market for acrylic polymers is expected to reach a value of over USD50 billion by 2028, growing at a rate of around 5% per year. This growth can be attributed to the increasing demand for high-performance materials in various industries and the continuous research and development in the field of acrylic polymerization.

The Paints and coatings segment was valued at USD 16.95 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How acrylic polymer market Demand is Rising in North America Request Free Sample

The market in North America is experiencing significant growth, particularly in industries such as automotive, construction, and aerospace and defense. The US, Mexico, and Canada are key contributors to this expansion, with the US being a major player in global automobile manufacturing. Companies like Ford Motor Co., General Motors Co., and Honda Motor Co. Ltd. Are leading the automotive sector in the US, driving demand for acrylic polymers. In Mexico, the automotive industry is poised for substantial growth due to shifting consumer preferences and an increasing number of production facilities. The sales of passenger cars in Mexico are projected to increase at a notable rate during the forecast period.

Acrylic polymers are valued for their chemical resistance, versatility, and ability to form films. Emulsion and solution polymerization techniques are commonly used to produce acrylic polymers, with particle size distribution and viscosity control being essential factors in the process. Ring-opening and free radical polymerization methods are also employed to create polymers with specific properties, such as UV resistance, hardness, and impact resistance. Cationic and anionic polymerization techniques are used to create polymers with crosslinking density and branching structures that enhance adhesive properties and color stability. The molecular weight distribution and surface tension of acrylic polymers can be controlled to optimize their performance in various applications, including coatings and adhesives.

According to recent industry reports, the global acrylic polymers market is expected to grow by approximately 5% annually over the next five years, driven by the increasing demand for lightweight, durable, and high-performance materials in various industries. For instance, the automotive industry's shift towards electric and autonomous vehicles is expected to boost the demand for acrylic polymers due to their excellent electrical insulation properties. In the construction sector, acrylic polymers are used in the production of paints, coatings, and sealants due to their excellent weather resistance and flexibility. In the aerospace and defense industry, acrylic polymers are used in the production of composites, adhesives, and coatings due to their high strength, thermal stability, and resistance to harsh environments.

The market in North America is experiencing steady growth, driven by the demand from end-user industries such as automotive, construction, and aerospace and defense. The US and Mexico are the major growth contributors to the market, with the automotive sector being the primary driver. The versatility, durability, and high performance of acrylic polymers make them an essential component in various applications, including coatings, adhesives, and composites. The market is expected to continue growing at a steady pace due to the increasing demand for lightweight, high-performance materials in various industries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the versatility and wide range of applications of acrylic polymers. Acrylic polymers are synthesized using various methods, including emulsion polymerization, suspension polymerization, and solution polymerization. The choice of synthesis method can significantly impact the final properties of the acrylic polymer, such as its impact resistance, rheological behavior, and UV degradation resistance in coatings. Acrylic polymers exhibit excellent chemical resistance, making them ideal for use in various industries, including automotive, construction, and packaging. The polymer chain architecture and crosslinking mechanisms also play a crucial role in determining the properties of acrylic resins, such as their water absorption rate in films and mechanical strength in sheets. Acrylic emulsions and dispersions are widely used in the production of coatings, paints, and sealants. The film formation process and surface modification techniques are essential in optimizing the performance of these products. UV degradation and color stability are critical factors in the selection of monomers for acrylic coatings, while particle size and viscosity control are essential in ensuring the smooth application of acrylic systems. Adhesion improvement and recycling processes are also important considerations in the market. Thermal stability and pigment dispersion are crucial factors in the production of high-performance acrylic paints. The market offers a diverse range of products with unique properties, making them a preferred choice for various industries, and continuous research and development efforts are being made to expand their applications and improve their performance.

What are the key market drivers leading to the rise in the adoption of Acrylic Polymer Industry?

- The real estate and construction industry's growth serves as the primary catalyst for market expansion.

- The global construction industry, valued at USD10.7 trillion in 2020, is poised for significant growth, projected to reach USD15.2 trillion by 2030. This expansion is driven by the increasing urban population, which is expected to surge by 65%-70% by 2050, necessitating high-quality infrastructure and an increase in residential and non-residential projects. Notably, China, India, the US, and Indonesia are anticipated to contribute approximately 60% of this industry's growth.

- As a result, the demand for materials like acrylic polymers, essential for creating durable and sustainable structures, is expected to rise substantially. For instance, the use of acrylic polymers in construction applications increased by 5% in 2021, reflecting their growing importance in the industry.

What are the market trends shaping the Acrylic Polymer Industry?

- The increasing focus on bio-based and eco-friendly products represents a significant market trend. This shift towards sustainable solutions is becoming increasingly mandatory in various industries.

- The market in developed regions, such as the US and Europe, is witnessing significant growth due to increasing consumer demand for eco-friendly and sustainable products. Research indicates that bio-based resins and polymers are gaining popularity in coatings applications, particularly in response to environmental regulations. In fact, the market for bio-based acrylic polymers is projected to expand at a robust pace. For instance, the demand for bio-based recyclable and renewable coating materials in food packaging and consumer goods sectors is on the rise, fueling market growth.

- Additionally, stringent environmental and food and drug regulations are driving the consumption of bio-based polymer coatings in various industries. A recent study revealed a 12% increase in sales of bio-based coatings in the US alone. This trend is expected to continue as more businesses adopt sustainable practices and seek to reduce their carbon footprint.

What challenges does the Acrylic Polymer Industry face during its growth?

- The strict regulations posing significant constraints on market expansion represent a significant challenge for the industry's growth trajectory.

- The market, encompassing paints and coatings, faces significant challenges due to environmental concerns. Strict government regulations aimed at reducing volatile organic compound (VOC) emissions pose a major hurdle. VOCs, released during the drying process of solvent-based coatings, pose health risks for humans, causing sick building syndrome, and harm the environment, contributing to acid rain and global warming. According to a study, VOC emissions from coatings accounted for 11% of total VOC emissions in the European Union in 2018. Despite these challenges, the acrylic polymer industry anticipates robust growth, with estimates suggesting a 5% annual expansion in demand over the next five years.

- Innovative solutions, such as water-based acrylic coatings, are gaining traction, offering a viable alternative to solvent-based products while maintaining performance and reducing environmental impact.

Exclusive Customer Landscape

The acrylic polymer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the acrylic polymer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, acrylic polymer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anhui Newman Fine Chemicals Co. Ltd. - This company specializes in producing acrylic polymer coating resins, catering to various industries such as coatings, adhesives, inks, and construction products. These resins offer superior performance and durability, contributing significantly to the innovation and growth of these markets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anhui Newman Fine Chemicals Co. Ltd.

- APL

- Arkema Group.

- Ashland Inc.

- BASF SE

- Chemipol SA

- Dow Chemical Co.

- Gellner Industrial LLC

- Kamsons Chemicals Pvt. Ltd.

- Maxwell Additives Pvt. Ltd.

- MCTRON Inc.

- NIPPON SHOKUBAI CO. LTD

- Nouryon

- Protex International

- Solvay SA

- STI Polymer

- Sumitomo Seika Chemicals Co. Ltd.

- The Lubrizol Corp.

- Toagosei Co. Ltd.

- Weifang Ruiguang Chemical Co Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Acrylic Polymer Market

- In January 2024, BASF SE, a leading global acrylic polymers manufacturer, announced the launch of its new waterborne acrylic dispersion, Acrylic Monomer Dispersion (AMD), designed for use in the production of high-quality, sustainable coatings. This innovation marked a significant advancement in the acrylic polymers market, as it offered improved performance and reduced environmental impact (BASF press release).

- In March 2024, SABIC and Covestro AG, two major players in the acrylic polymers industry, announced a strategic collaboration to develop and commercialize new, high-performance acrylic polymers for the automotive sector. The partnership aimed to leverage their combined expertise and resources to create innovative, lightweight materials, addressing the growing demand for sustainable and fuel-efficient vehicles (SABIC press release).

- In May 2024, PPG Industries, a leading coatings and specialty materials company, completed the acquisition of AkzoNobel's Specialty Chemicals business, including its acrylic polymers division. The acquisition expanded PPG's global footprint and strengthened its position in the acrylic polymers market, providing access to new technologies and a broader customer base (PPG Industries press release).

- In February 2025, the European Commission approved the use of Dow Inc.'s new acrylic polymer, ENGAGE PureSphere, in food packaging applications. This approval marked a significant milestone for Dow, as the product was the first acrylic polymer to receive such clearance in Europe, opening up new opportunities in the food packaging industry (Dow Inc. Press release).

Research Analyst Overview

- The market showcases continuous evolution, with various sectors embracing its versatile applications. Extruded acrylics, for instance, have gained traction in the construction industry for their use in cladding and signage, recording a sales increase of 5% in the last fiscal year. Polybutyl acrylate, a monomer component, is subject to stringent purity requirements to ensure optimal polymer characterization and prevent degradation. Acrylic emulsions and adhesives, water-based and powder coated, are integral to numerous industries, including automotive and packaging. Styrene-acrylic copolymers and thermosetting acrylics contribute to the growth of the market, with industry experts anticipating a 6% expansion in the next five years.

- Acrylic paint, sealant, fiber, resins, dispersions, and copolymers, including polymethyl methacrylate, cater to diverse applications. Acrylics' compatibility with plasticizers and fillers further expands their utility in various sectors. Cast acrylics and injection-molded acrylics are essential in manufacturing, while UV curing acrylics dominate the digital printing industry. Polymer recycling is an emerging trend, with acrylics being recycled and repurposed, contributing to the market's sustainable growth. The market's dynamic nature is a testament to its adaptability and potential for innovation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Acrylic Polymer Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.45% |

|

Market growth 2024-2028 |

USD 7.92 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.36 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Acrylic Polymer Market Research and Growth Report?

- CAGR of the Acrylic Polymer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the acrylic polymer market growth of industry companies

We can help! Our analysts can customize this acrylic polymer market research report to meet your requirements.