Aircraft Micro Turbine Engines Market Size 2024-2028

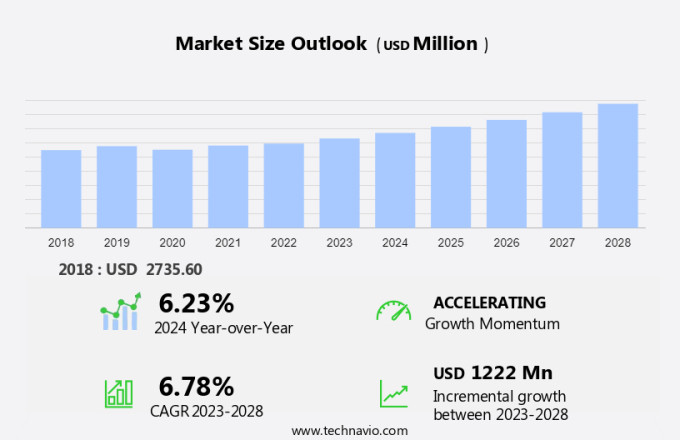

The aircraft micro turbine engines market size is forecast to increase by USD 1.22 billion at a CAGR of 6.78% between 2023 and 2028. Aircraft micro turbine engines have gained significant traction in the aviation industry due to their high efficiency and compact size. These engines are utilized in various applications, including Air Taxis, Air Cargo Vehicles, UAVs, and Light aircraft. One of the key trends driving the market is the adoption of specialized cooling methods, which enhance engine performance and durability. Mechanization of engine manufacturing processes is another trend, reducing production costs and increasing efficiency. However, high production costs and delays in engine deliveries pose challenges to market growth. Spare part suppliers play a crucial role in maintaining the operational efficiency of these engines. The market landscape is diverse, with applications ranging from Turbojet to Turboprop and Turboshaft engines. The integration of 3D printing systems for engine components is a promising development, offering potential cost savings and improved customization. In conclusion, the market is poised for growth, driven by technological advancements and the increasing demand for efficient and compact power solutions in the aviation sector.

Aircraft micro turbine engines have gained significant attention in various industries due to their unique features and benefits. These engines, which are compact in size, offer quick installation and high-speed operation, making them an attractive option for various applications in commercial and civil aviation, unmanned aerial vehicles (UAVs), telecommunications, agriculture, light aircrafts, military unmanned vehicles, and criminal prevention. One of the primary advantages of micro turbine engines is their low vibration and noise levels. This feature is crucial in aviation applications, as it enhances passenger comfort and reduces environmental impact. Moreover, the use of micro turbine engines in UAVs and military unmanned vehicles ensures stealth and quiet operation, which is essential for surveillance and reconnaissance missions.

Additionally, another significant advantage of micro turbine engines is their variable speed capability. This feature enables them to operate efficiently at different speeds, making them suitable for a wide range of applications. Additionally, their cheap maintenance requirements and low Nox emissions make them an environmentally friendly and cost-effective solution. Micro turbine engines are available in both original equipment manufacturer (OEM) and aftermarket segments. The OEM segment caters to the demand for new engines from aircraft manufacturers and original buyers, while the aftermarket segment serves the demand for replacement engines and spare parts. The commercial aviation sector is a major consumer of micro turbine engines, as they offer fuel efficiency and reduced emissions.

Moreover, civil aviation, including regional and business jets, also utilizes micro turbine engines due to their quick installation and low maintenance requirements. In the military sector, micro turbine engines are used in unmanned aerial vehicles and military aviation applications. Their compact size, low noise, and high power output make them an ideal choice for military applications. The use of micro turbine engines in telecommunications and agriculture sectors is growing due to their ability to provide continuous power supply in remote locations. In the agriculture sector, micro turbine engines are used to power irrigation systems and other agricultural machinery. Micro turbine engines can operate on various fuels, including jet fuel and diesel.

In conclusion, this flexibility in fuel options makes them a versatile solution for different applications. In conclusion, the market is witnessing significant growth due to their unique features and benefits. The trend towards fuel efficiency, low emissions, and quiet operation is driving the demand for micro turbine engines in various industries, including commercial and civil aviation, UAVs, telecommunications, agriculture, and military applications. The market is segmented into OEM and aftermarket segments, with the OEM segment catering to new engine sales and the aftermarket segment serving the demand for replacement engines and spare parts.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Platform

- General aviation

- Commercial aviation

- Military aviation

- Advanced air mobility

- End-user

- Propulsion

- Auxiliary power

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- APAC

- Japan

- Middle East and Africa

- South America

- North America

By Platform Insights

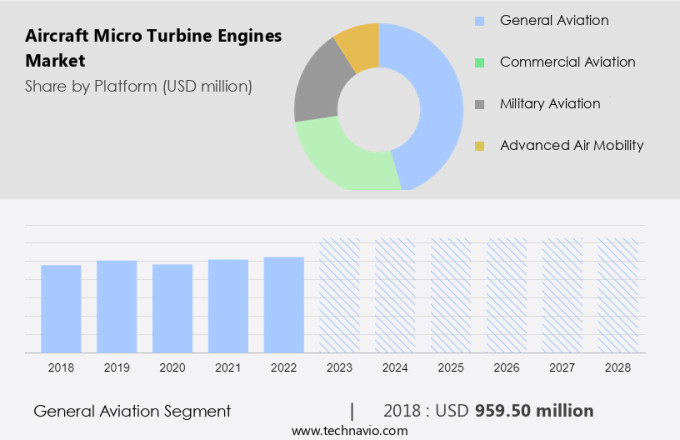

The general aviation segment is estimated to witness significant growth during the forecast period. The market for aircraft micro turbine engines is projected to experience substantial growth in the revenue share compared to other segments within the forecast period. Micro turbine engines are utilized in various types of aircraft, including general aviation and commercial aviation. In the context of the US market, general aviation refers to the transportation of individuals or cargo between different locations. This category includes both general aviation and scheduled airline services. The primary components of general aviation include engines, wings, power plants, fuselage, tail or empennage, and landing gear. These aircraft are employed for diverse purposes, such as tourism, passenger travel, business travel, and freight transportation.

Get a glance at the market share of various segments Request Free Sample

The general aviation segment was valued at USD 959.50 million in 2018 and showed a gradual increase during the forecast period. Further, factors contributing to the growth of the market for aircraft micro turbine engines include the expanding disposable income of the middle class population and the emergence of low-cost airline companies. These trends have led to a rise in air travel demand, thereby increasing the need for general aviation. Micro turbine engines are preferred for their compact size, quick installation, and high-speed operation. They produce minimal vibration and noise, making them suitable for use in general aviation. Furthermore, micro turbine engines offer cheap maintenance costs and low NOX emissions, making them an eco-friendly and cost-effective alternative to traditional engines. These engines are ideal for the market due to its large general aviation sector and the increasing focus on reducing carbon emissions in the aviation industry.

Regional Insights

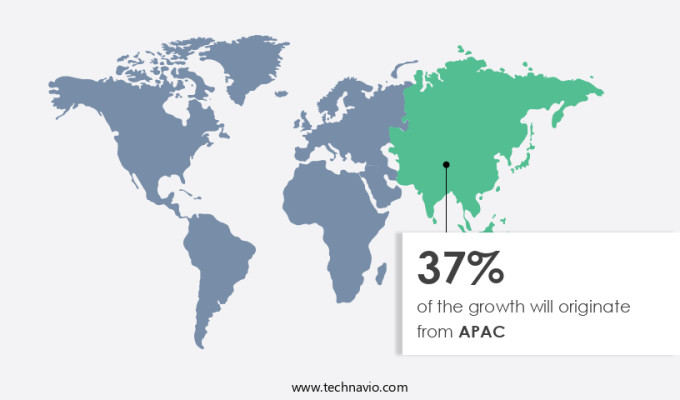

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American region dominated the market in 2023, driven by the presence of advanced aviation industries in countries like the United States and Canada. The region's significant logistical activity and supply chains, particularly in the US, have bolstered market growth. The large aircraft fleet in North America, especially in the US, is another contributing factor. The region's technologically advanced countries have been instrumental in driving the aviation sector. The US defense sector, in particular, benefits from this growth due to increased government investment in research and development and the procurement of advanced fighter jets, helicopters, and transport and training aircraft from local and global manufacturers.

Additionally, recent news of collaboration and partnerships between leading aircraft original equipment manufacturers (OEMs) and micro turbine engine suppliers in North America further strengthens the market's position. The passenger load factor and air traffic in North America continue to rise, indicating a positive outlook for the market in the region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The advancements in engine technologies is the key driver of the market. In the realm of aviation, there is a growing emphasis on utilizing aircraft engines that offer enhanced fuel efficiency and lower operational costs for US airlines. The European market for Aircraft Micro Turbine Engines is witnessing significant growth due to the integration of innovative technologies, such as lightweight and potent microturbine generators, in Unmanned Aerial Vehicles (UAVs).

However, regulatory restrictions pose challenges to market expansion. Fusionflight, a leading player, is at the forefront of developing microturbine engines that meet safety standards while minimizing exhaust gases. Sensors are instrumental in monitoring engine performance, with real-time data collection on temperature, pressure, vibration, and oil debris. These sensors, integrated into engines like the Trent XWB from Rolls-Royce, operate at a frequency of 40 times per second, ensuring prompt detection of any faults or errors. This advanced technology not only enhances engine efficiency but also contributes to the overall safety and reliability of aircraft operations.

Market Trends

The adoption of 3D printing systems for engine components is the upcoming trend in the market. Three-dimensional (3D) printing technology plays a significant role in the manufacturing of micro turbine engines for various aerial vehicles, including Military Unmanned Vehicles and civilian aircraft. This process involves the creation of successive layers of materials based on the specifications in the associated Computer-Aided Design (CAD) file, utilizing an electron beam or laser. 3D printing offers numerous advantages, such as reduced manufacturing time, minimized material wastage, and the ability to make quick design alterations to the internal features of components.

Additionally, in the realm of military aviation and aerial vehicles, 3D printing is increasingly being adopted to mitigate supply chain challenges, minimize storage requirements, and eliminate excess materials from conventional manufacturing processes. The quick fabrication of aircraft parts according to market demand leads to substantial savings in terms of time and resources. Original Equipment Manufacturers (OEMs) and the aftermarket sector in both civil and defense industries benefit from this technology. 3D printing enables the production of intricate engine components using alternative fuels like Jet Fuel and Diesel, further enhancing the versatility and efficiency of aircraft micro turbine engines.

Market Challenge

The high production costs and delay in engine deliveries is a key challenge affecting the market growth. Aircraft micro turbine engines represent a significant investment for specialized aircraft, including Air Taxis, Cargo Aerial Vehicles, and Light Aircrafts. The cost of these engines is comprised of research and development (R&D) expenses and production costs. An increase in either segment can lead to unexpected price hikes and extended delivery times. Advancements in engine technology, such as specialized cooling methods and mechanization, are the result of extensive R&D efforts. These innovations open new avenues for research and development, pushing the boundaries of what is possible in aircraft engine design. The development process is meticulous, involving rigorous testing and documentation to ensure the highest standards are met before commercial release.

Similarly, spare part suppliers play a crucial role in the aircraft engine market, providing essential components for Turbojet, Turboshaft, and Turboprop engines. Their role is vital in ensuring the continued operation of aircraft fleets and minimizing downtime. The intricacy of engine components necessitates a high level of expertise and precision from these suppliers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Stuttgart Engineering Propulsion Technologies UG - The company offers aircraft micro turbine engines such as RR300, and RR50

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AeroDesignWorks GmbH

- AMT Netherlands B.V.

- Bowman Power Group Ltd.

- Ebara Corp.

- General Electric Co.

- Hawk Turbine AB

- Honeywell International Inc.

- Ingenieurburo CAT M.Zipperer GmbH

- Jets Munt S.L.

- Kratos Defense and Security Solutions Inc.

- MTT bv

- PBS Group AS

- RTX Corp.

- Rolls Royce Holdings Plc

- Safran SA

- The Williams Co. Inc

- TURBOTECH SAS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Aircraft micro turbine engines have gained significant attention in the aviation industry due to their compact size, quick installation, and high-speed operation. These engines offer operational benefits, including low operating costs, maintenance costs, and efficiency. They are suitable for various applications in commercial and civil aviation, such as unmanned aerial vehicles (UAVs), criminal prevention, telecommunications, agriculture, disaster management, real-time reconnaissance, and remote sensing. Small-scale combustion turbines, including micro combustion engines, are increasingly being used in cogeneration systems for heat and electricity production. These engines can operate on various fuels, including jet fuel and diesel, making them versatile for different applications.

Also, the European market for aircraft micro turbine engines is expected to grow due to innovative technologies and collaboration and partnerships among key players. Safety is a critical factor in the design of these engines, with specialized cooling methods and mechanization used to minimize vibration and noise. Aircraft cancellations and logistical activity can impact the supply chains and manufacturing facilities of original equipment manufacturers (OEMs) and aftermarket suppliers. The OEM segment and aftermarket segment are significant markets for aircraft micro turbine engines in civil and defense applications, including air taxis, cargo aerial vehicles, light aircrafts, military unmanned vehicles, and turbojet, turboshaft, and turboprop aircraft.

Thus, recent news highlights the use of lightweight, potent microturbine generators in the aviation industry, offering low NOx emissions and cheap maintenance. Regulatory restrictions and safety concerns continue to shape the market for these engines, with FusionFlight and other companies developing advanced technologies to meet industry demands.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 1.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.23 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 37% |

|

Key countries |

US, Germany, France, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AeroDesignWorks GmbH, AMT Netherlands B.V., Bowman Power Group Ltd., Ebara Corp., General Electric Co., Hawk Turbine AB, Honeywell International Inc., Ingenieurburo CAT M.Zipperer GmbH, Jets Munt S.L., Kratos Defense and Security Solutions Inc., MTT bv, PBS Group AS, RTX Corp., Rolls Royce Holdings Plc, Safran SA, Stuttgart Engineering Propulsion Technologies UG, The Williams Co. Inc, and TURBOTECH SAS |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch