Algorithmic Trading Market Size 2025-2029

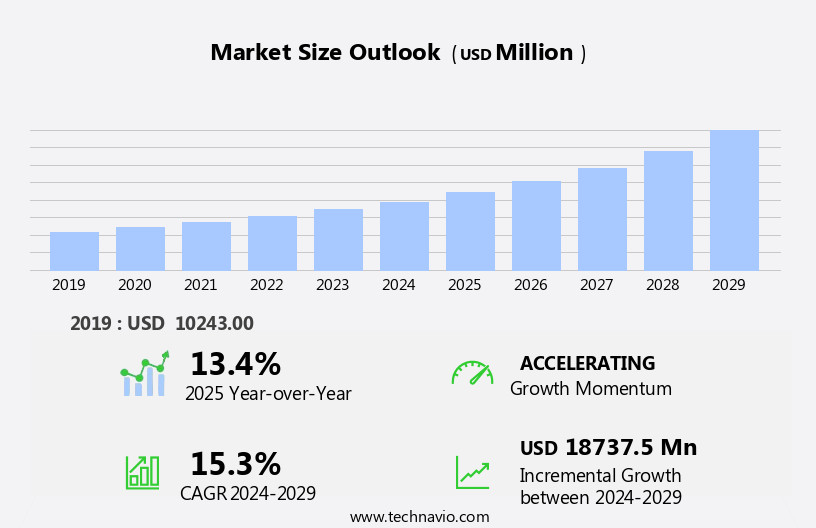

The algorithmic trading market size is forecast to increase by USD 18.74 billion, at a CAGR of 15.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for market surveillance and regulatory compliance. Advanced technologies, such as machine learning and artificial intelligence, are revolutionizing trading strategies, enabling faster and more accurate decision-making. However, this market's landscape is not without challenges. In the Asia Pacific region, for instance, the widening bid-ask spread poses a significant obstacle for algorithmic trading firms, necessitating innovative solutions to mitigate this issue. As market complexity increases, players must navigate these challenges to capitalize on the opportunities presented by this dynamic market.

- Companies seeking to succeed in this space must invest in advanced technologies, maintain regulatory compliance, and develop strategies to address regional challenges, ensuring their competitive edge in the ever-evolving algorithmic trading landscape.

What will be the Size of the Algorithmic Trading Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic and ever-evolving world of algorithmic trading, market activities continue to unfold with intricacy and complexity. Order management systems, real-time data processing, and sharpe ratio are integral components, enabling traders to optimize returns and manage risk tolerance. Regulatory frameworks and compliance regulations shape the market landscape, with cloud computing and order routing facilitating seamless integration of data analytics and algorithmic strategies. Natural language processing and market data feeds inform trading decisions, while trading psychology and sentiment analysis provide valuable insights into market sentiment. Position sizing, technical analysis, and profitability metrics are essential for effective portfolio optimization and asset allocation.

Market making, automated trading platforms, and foreign exchange are sectors that significantly benefit from these advancements. Return on investment, risk management, and execution algorithms are crucial for maximizing profits and minimizing losses. Machine learning models and deep learning algorithms are increasingly being adopted for trend following and mean reversion strategies. Trading signals, latency optimization, and trading indicators are essential tools for high-frequency traders, ensuring efficient trade execution and profitability. Network infrastructure and api integration are vital for ensuring low latency and reliable connectivity, enabling traders to capitalize on market opportunities in real-time. The ongoing integration of these technologies and techniques continues to reshape the market, offering new opportunities and challenges for traders and investors alike.

How is this Algorithmic Trading Industry segmented?

The algorithmic trading industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Solutions

- Services

- End-user

- Institutional investors

- Retail investors

- Long-term investors

- Short-term investors

- Deployment

- Cloud

- On-premise

- Cloud

- On-premise

- Type

- Foreign Exchange (FOREX)

- Stock Markets

- Exchange-Traded Fund (ETF)

- Bonds

- Cryptocurrencies

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Component Insights

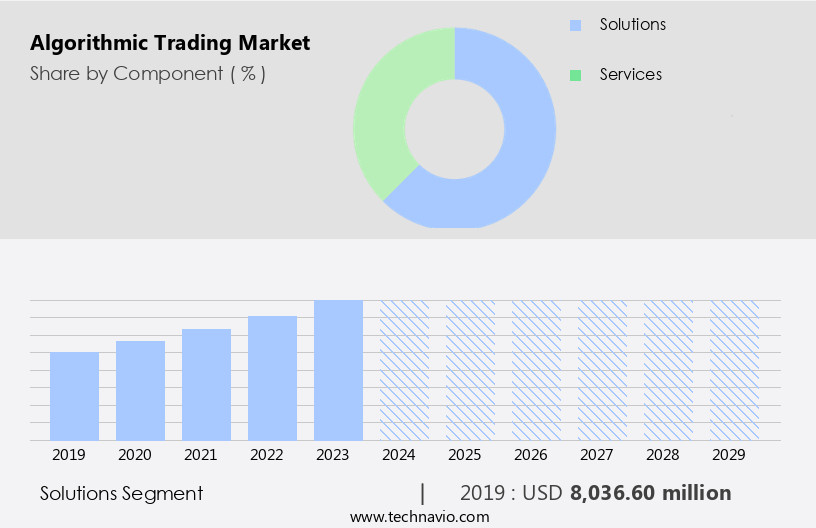

The solutions segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of solutions, primarily software, employed by traders for automated trading. Algorithmic trading, characterized by the execution of large orders using pre-programmed software, is a common practice among proprietary trading firms, hedge funds, and investment banks. High-frequency trading (HFT) relies heavily on these software solutions for speed and efficiency. The integration of advanced software in trading systems allows traders to optimize price, timing, and quantity, ultimately increasing profitability. companies offer a diverse array of software solutions, catering to various investment objectives and risk tolerances. Market making, mean reversion, trend following, and machine learning models are among the algorithmic strategies employed.

Real-time data processing, sentiment analysis, and position sizing are integral components of these solutions. Network infrastructure, latency optimization, and order routing are crucial elements ensuring seamless trade execution. Regulatory frameworks and compliance regulations are addressed through robust order management systems and API integrations. Deep learning algorithms and natural language processing enhance market analysis and trading indicators. Data analytics plays a pivotal role in portfolio optimization and risk management. Return on investment, sharpe ratio, and profitability metrics are essential performance metrics. Asset allocation, technical analysis, and market data feeds further contribute to informed trading decisions. Trading psychology, trading bots, and execution algorithms are additional features that facilitate efficient trade execution.

Foreign exchange and financial instruments are common applications for algorithmic trading. Overall, the market continues to evolve, driven by the integration of advanced technologies and the increasing demand for automated trading solutions.

The Solutions segment was valued at USD 8.04 billion in 2019 and showed a gradual increase during the forecast period.

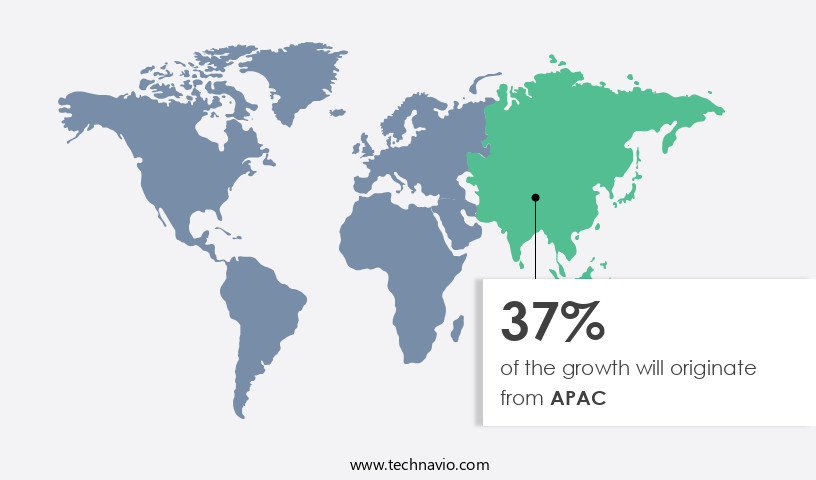

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing substantial growth, driven by continuous trade monitoring and surveillance, the presence of retail and institutional traders, and a focus on advanced technology, AI, and machine learning tools. Companies in this sector are investing heavily in network infrastructure, trading signals, position sizing, sentiment analysis, latency optimization, market making, automated trading platforms, data analytics, order management systems, real-time data processing, and risk management. Regulatory frameworks play a crucial role in the market, ensuring compliance with stringent regulations to prevent market manipulations. In North America, Commodity Trading Advisory (CTA) firms help establish cost-effective quant funds for trading.

The National Futures Association (NFA), a self-regulatory organization, oversees CTAs and other traders. Advanced techniques like mean reversion, profitability metrics, and risk management are essential for successful algorithmic trading strategies. Execution algorithms, trade execution, foreign exchange, API integration, high-frequency trading, trading indicators, deep learning algorithms, asset allocation, trend following, and machine learning models are integral components of these strategies. Trading psychology, trading bots, portfolio optimization, financial instruments, investment objectives, and regulatory compliance are essential considerations for traders. Natural language processing and order routing are also vital for effective communication and efficient trade execution. Overall, the market in North America is a dynamic and complex ecosystem, requiring a deep understanding of various factors and trends to succeed.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Algorithmic Trading Industry?

- The substantial demand for market surveillance is the primary catalyst fueling market growth.

- The market is witnessing significant growth due to increasing demand for advanced market surveillance to ensure compliance with investment patterns and trading activities. Market participants are focusing on optimizing data management strategies and addressing system gaps to remain competitive. International and regional interdependencies are essential for companies to provide the best assets to market players, leading to the development of high-risk infrastructures and the augmentation of the equity market. Companies in the market are investing in network infrastructure, trading signals, position sizing, sentiment analysis, latency optimization, and market making to enhance their automated trading platforms.

- Data analytics plays a crucial role in enabling market players to make informed decisions based on historical and real-time market data. With the focus on return on investment, market participants are leveraging advanced technologies to improve their trading strategies and minimize risks. In conclusion, the market is evolving rapidly, with a focus on optimizing trading systems and enhancing market surveillance to meet regulatory requirements and improve overall market efficiency. Market players are investing in advanced technologies and strategies to gain a competitive edge and maximize returns.

What are the market trends shaping the Algorithmic Trading Industry?

- The current market trend is shaped by technological advancements. It is essential to stay informed about the latest innovations to maintain a competitive edge in any industry.

- Algorithmic trading, fueled by advanced technologies, has significantly transformed the financial markets. Order management systems and real-time data processing enable traders to execute trades more efficiently, reducing risks and optimizing returns. One key performance metric, the Sharpe ratio, helps assess risk tolerance and return on investment. Regulatory frameworks ensure compliance with rules and regulations, while cloud computing facilitates the deployment of complex algorithmic strategies. Order routing systems streamline the process of sending orders to multiple marketplaces, ensuring the best possible price. Natural language processing (NLP) technologies enable automated analysis of news and market data, providing valuable insights for algorithmic strategies.

- In the forex market, for instance, advanced algorithms like Viper, Iguana, and Chameleon, part of BNP Paribas SA's Rex trading system, have improved operational efficiency for hedge funds and corporate treasurers, solidifying BNP's position as a leading player. The integration of these technologies has led to increased market turnover and enhanced market access for a broader range of participants.

What challenges does the Algorithmic Trading Industry face during its growth?

- The widening bid-ask spread in the APAC region poses a significant challenge to industry growth, as this economic disparity can impede efficient trading and negatively impact market liquidity.

- The market in Asia Pacific (APAC) presents unique challenges due to wider bid-ask spreads in various stocks. For instance, in markets like Singapore, the average dealing spread of stocks hovers around 0.75%. Although market data feeds indicate substantial liquidity, the significant spreads make trading a complex process. Moreover, some financial instruments, particularly those with high volatility and low turnover, are less suitable for algorithmic trading. Despite these challenges, there is a growing interest in replicating the popularity of algorithms in the US and European markets in APAC. Market participants are exploring ways to optimize trading strategies, enhance portfolio performance, and implement risk management techniques using algorithmic trading.

- Technical analysis plays a crucial role in this context, as it provides valuable insights into market trends and price patterns. Trading bots and automated trading systems are increasingly being adopted to improve profitability metrics and enhance trading efficiency. Portfolio optimization and mean reversion strategies are popular techniques used to maximize returns while minimizing risk. Effective risk management is essential to ensure the sustainability of algorithmic trading strategies in the volatile markets of APAC. In conclusion, the market in APAC is still in its nascent stages, but it holds immense potential for enhancing investment objectives and improving overall market efficiency.

- Despite the challenges, the focus on automating trading strategies, optimizing portfolios, and implementing robust risk management techniques is driving the growth of algorithmic trading in the region.

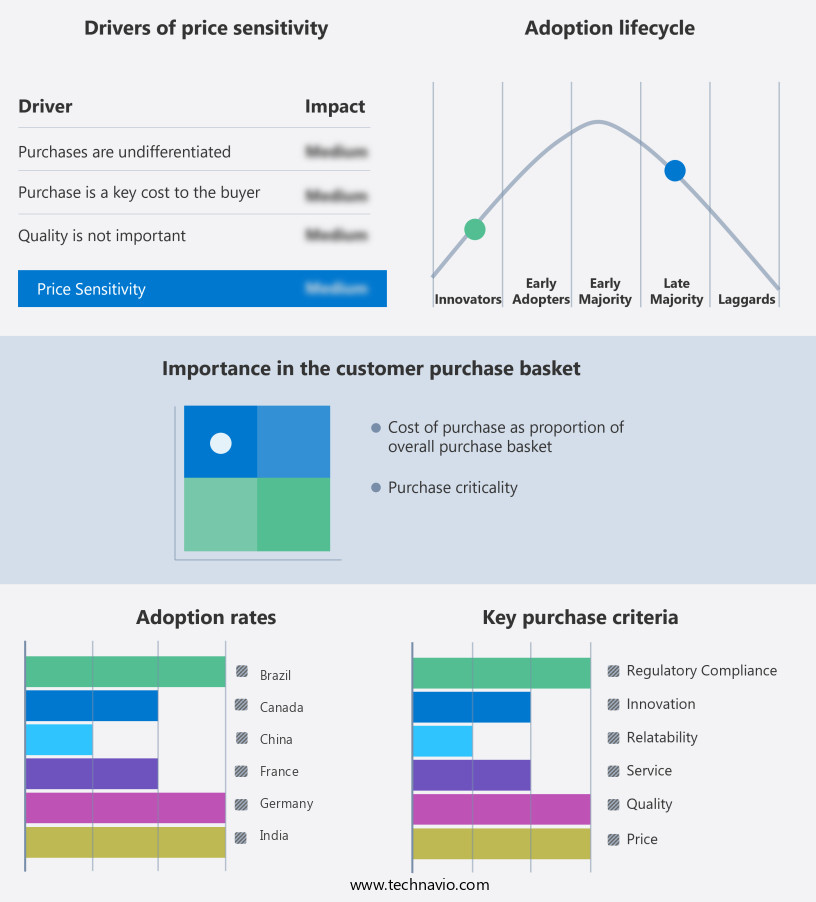

Exclusive Customer Landscape

The algorithmic trading market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the algorithmic trading market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, algorithmic trading market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

63 Moons Technologies Ltd. - The company provides an advanced algorithmic trading solution via its platform, ODIN.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 63 Moons Technologies Ltd.

- AlgoBulls Technologies Pvt. Ltd.

- AlpacaDB Inc.

- Argo SE

- Auros

- CRYPTO TECHFIN

- InfoReach Inc.

- iRageCapital Advisory Pvt. Ltd.

- MetaQuotes Ltd.

- QuantConnect Corp.

- QuantCore Capital Management LLC

- Refinitiv

- Software AG

- Symphony Fintech Solutions Pvt. Ltd.

- Tata Consultancy Services Ltd.

- Thomson Reuters Corp.

- Trading Technologies International Inc.

- uTrade

- Virtu Financial Inc.

- Wyden AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Algorithmic Trading Market

- In January 2024, QuantConnect, a leading algorithmic trading platform, announced the launch of its new machine learning module, "Cheetah," which uses deep learning techniques to analyze market data and develop trading strategies (QuantConnect press release). This development signified a significant technological advancement in the market, enabling traders to create more sophisticated and adaptive trading algorithms.

- In March 2024, Interactive Brokers, a global electronic trading firm, entered into a strategic partnership with Trade Ideas, a popular algorithmic trading software provider. This collaboration allowed Interactive Brokers' clients to access Trade Ideas' advanced scanning and trading tools directly from the Interactive Brokers platform (Interactive Brokers press release). This move expanded Interactive Brokers' offering and catered to the growing demand for advanced trading tools.

- In May 2024, JPMorgan Chase & Co. Revealed a USD100 million investment in Quantlab Financial, a quantitative trading firm specializing in algorithmic trading strategies. This funding round marked a significant strategic move for JPMorgan, as it aimed to strengthen its presence in the market and leverage Quantlab's expertise in advanced trading algorithms (Bloomberg).

- In February 2025, the European Securities and Markets Authority (ESMA) approved the use of algorithmic trading in European markets, subject to certain conditions. This approval represented a key regulatory milestone, as it paved the way for the widespread adoption of algorithmic trading in Europe and boosted market liquidity (ESMA press release).

Research Analyst Overview

- In the dynamic world of algorithmic trading, investment management firms employ various techniques to gain an edge in the market. These methods include Monte Carlo simulation for risk assessment, predictive modeling to forecast market trends, and quantitative analysis for identifying trading opportunities. Market microstructure analysis, utilizing order book data and sentiment indicators, assists in understanding trading psychology and cognitive biases. Risk management software and trading terminal platforms are essential tools for managing portfolios and rebalancing positions. Decentralized finance and blockchain technology are revolutionizing trading by enabling peer-to-peer transactions and smart contracts. Trading education and performance evaluation are crucial for staying updated on the latest trading strategies development, such as statistical arbitrage and news sentiment analysis.

- Trading strategies are backtested using historical data, while behavioral finance research informs the development of cognitive bias-aware algorithms. Social media sentiment and time series analysis provide valuable insights into market trends, complementing traditional news sources. Trading journaling and sentiment indicators help traders reflect on their performance and adjust their strategies accordingly. Investment management firms leverage these advanced techniques to stay competitive, with a focus on data visualization, financial modeling, and order book analysis to optimize their trading strategies. Algorithmic portfolio management and cognitive biases research continue to shape the future of trading, as the market evolves and adapts to new technologies and trends.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Algorithmic Trading Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.3% |

|

Market growth 2025-2029 |

USD 18737.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.4 |

|

Key countries |

US, China, Germany, Canada, Japan, India, UK, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Algorithmic Trading Market Research and Growth Report?

- CAGR of the Algorithmic Trading industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the algorithmic trading market growth of industry companies

We can help! Our analysts can customize this algorithmic trading market research report to meet your requirements.