Alternative Finance Market Size 2024-2028

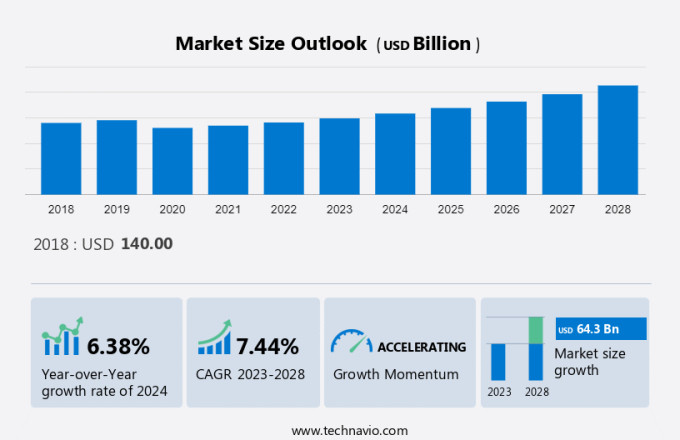

The alternative finance market size is estimated to increase by USD 64.3 billion at a CAGR of 7.44% between 2023 and 2028. The key factor driving the market forward is the potential for higher returns for investors. Alternative finance channels offer significantly greater returns compared to traditional investment options like fixed deposits (FDs) or government bonds from conventional financial institutions. Another important contributor to market growth is the rapid expansion in the APAC region and the increasing focus on structured finance. Alternative finance platforms, such as P2P lending, crowdfunding, and invoice trading, are gaining traction in APAC, driven by the presence of numerous small and medium-sized enterprises (SMEs).

What will be the Size of the Alternative Finance Market During the Forecast Period?

To learn more about this alternative finance market report, Download Report Sample

Alternative Finance Market Segmentation

The alternative finance market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Type Outlook

- P2P lending

- Crowdfunding

- Invoice trading

- End-User Outlook

- Individual

- Organization

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

By Type

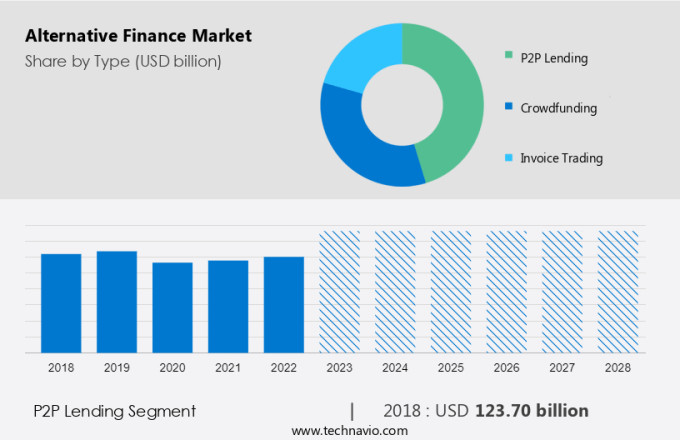

The alternative financing market share growth in the segment of P2P lending will be significant during the forecast period. The P2P consumer lending sub-segment holds a major share of the P2P lending segment due to the growth in the number of online consumer lending platforms and the increasing use of technology in financial transactions. Some popular P2P lending platforms include LendingClub, Zopa, Bondora Capital, Prosper Marketplace, and Upstart Network. However, P2P lending is associated with a high risk of defaults as the loans are unsecured. Therefore, large investors usually maintain a spread portfolio of their investments. P2P lending is also associated with challenges such as platform failures, the risk of fraud, hacking, and data theft. These factors are expected to augment the demand of the P2P lending segment hence driving the growth of the market in focus during the forecast period.

Get a glance at the market contribution of various segments. Request PDF Sample

The P2P lending segment was valued at USD 123.70 billion in 2018. In this segment, P2P lending is similar to credit obtained from financial institutions. However, the funds are raised from one or more independent investors. P2P borrowers must make weekly or monthly repayments of the principal amount with interest. P2P lending is usually carried out through online platforms. Investors directly select businesses to fund, or the lending platforms provide the terms of credit. Some variations in the model allow investors to bid on loan amounts and interest rates through an online auction. P2P lending is popular among individual borrowers and SMEs, as small to medium-scale loans can be obtained easily. Several individuals opt for P2P loans for debt consolidation, which allows them to pay debts accrued from credit cards or loans from financial institutions.

By Region

For more insights on the market share of various regions, Request PDF Sample now!

North America is estimated to contribute 70% to the global alternative financing market during the forecast period. Technavio's analysts have elaborately explained the regional market growth and trends that shape the market during the forecast period. The growth of P2P lending and crowdfunding has increased significantly in North America. The increasing number of students, growing awareness about clearing personal debt, rising Internet penetration, technological advances, the rise of online trading platforms and finance platforms, and the presence of prominent companies are the major factors driving the market in North America. The number of SMEs has grown significantly in North America. Therefore, a growing number of SMEs in this region are boosting the growth in North America.

Alternative Finance Market Dynamics

The market is reshaping the landscape traditionally dominated by conventional big banks and regulated banks. Instead of relying solely on traditional finance systems, entrepreneurs and investors are increasingly turning to alternative lenders and innovative financial services solutions. Online lenders offer streamlined access to capital, while reward-based crowdfunding and equity-based crowdfunding present opportunities for funding without giving up equity. Social impact bonds and SME mini-bonds provide options for investors looking to support specific causes or small businesses. Community shares and private placement are also emerging as viable channels. Additionally, shadow banking and disintermediation are shifting how finance is managed. This diverse ecosystem of financial channels and procedures highlights a significant departure from conventional instruments and approaches.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Enhanced returns for investors stand out as a primary catalyst propelling alternative finance market growth. Alternative finance avenues offer notably superior returns compared to conventional investment options such as fixed deposits (FDs) or government bonds provided by traditional financial entities. While the average yield on FDs or 10-year government bonds in developed nations like the UK and the US typically ranges from 1% to 3%, platforms like LendingClub and Funding Circle boast theoretical average returns of approximately 7%. Even in developing countries where bank savings and bond yield rates mirror those offered by such platforms, the allure of quicker return on investment (ROI) is attracting a new wave of investors.

Furthermore, operators in the alternative finance sphere, such as online financing platforms for SMBs, can afford to offer higher ROI owing to their streamlined operational framework and reduced overhead costs compared to traditional banks and financial institutions. Online platforms operate without significant physical assets like offices, incur minimal human resource and operational expenses, and benefit from lower capital acquisition, collection, and billing costs due to conducting transactions entirely online. Consequently, these operators can furnish investors with more attractive returns. Such dynamics are poised to drive sustained market growth throughout the forecast period, attracting both investors seeking better returns and SMBs looking for efficient and accessible financing solutions.

Significant Market Trend

Another key factor influencing alternative finance market growth is the rapid growth in APAC. Alternative finance platforms, including P2P lending, crowdfunding, and invoice trading, are growing in APAC due to the presence of several SMEs. The number of SMEs has increased significantly in Asian countries. For instance, the number of SMEs in China was approximately 18.07 million by the end of 2018. Similarly, according to the data published by the Ministry of Micro, Small and Medium Enterprises (MSMEs), as of March 2020, there were 63.3 million (6.33 Crore) SMEs present across India. The growing number of SMEs in APAC is increasing the demand for alternative financial services and platforms for business growth.

The solutions and service providers are helping SMEs by strengthening their access to credit and equity, which, in turn, enables SMEs to invest in growth. Moreover, growing Internet penetration, coupled with the use of smartphones, is encouraging people in APAC to use P2P lending and crowdfunding platforms. This, in turn, is expected to propel the growth of the market during the forecast period.

Major Market Challenge

The high risk of credit default is one of the key challenges hindering alternative finance market growth. Alternative finance funds borrowers lack collateral assets and credit history or have poor credit ratings. Therefore, they do not qualify for loans from traditional financial institutions as the chance of defaulting is high. The high risk of credit default discourages many financers from investing in these solutions, which forces the intermediaries and operators to decline many borrowers or charge a higher rate of interest. The rate of credit default for almost all major lenders, such as Prosper Marketplace, LendingClub, and Funding Circle has been significantly higher than their initial projections.

For instance, the default rates for LendingClub and Prosper Marketplace on loans with a payback period of three years or more average at around 10%-14%. High-risk lenders such as Bondora Capital, which provide loans to customers with very poor creditworthiness, have a credit default rate of up to 25%-30% of their overall loan volume. The high risk of credit default may discourage potential investors from investing, which could affect the growth of the alternative financing market industry during the forecast period.

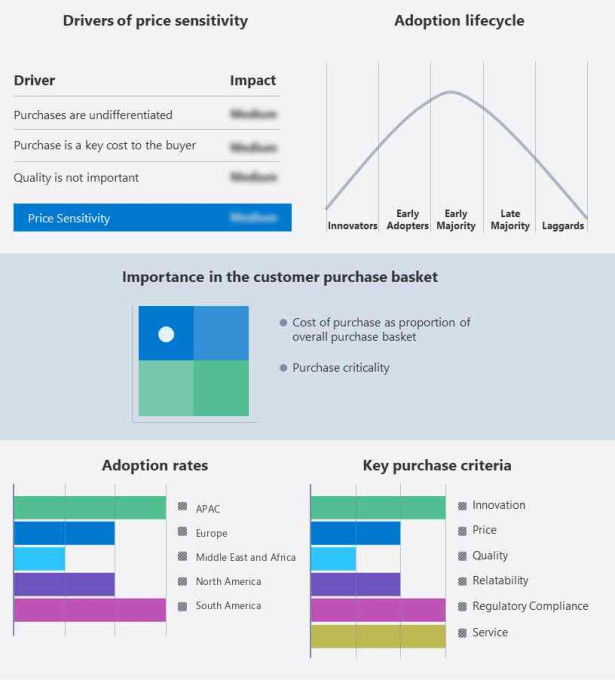

Customer Landscape

The alternative finance market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the alternative finance market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Alternative Finance Market Players?

companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Bondora Capital OU - The company offers alternative finance loans which invest in business ventures and provide capital for startups that need quick funding. The company is involved in offering consumer loans in continental Europe regions such as Finland, Spain, and Estonia through a fully digital process, supported by advanced credit analytics and in-house servicing.

The alternative finance trends and forecasting report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- CircleUp Network Inc.

- ConnectionPoint Systems Inc.

- Crowdfunder Ltd.

- Fundable LLC

- Funding Circle Holdings Plc

- Funding Options Ltd.

- Fundrise LLC

- GoFundMe Inc.

- Indiegogo Inc.

- Invoice Interchange Pvt. Ltd.

- Kickstarter PBC

- Kriya Finance Ltd.

- Lending Crowd

- LendingClub Corp.

- OFB Tech Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In November 2024, Funding Circle launched a new platform aimed at small businesses, offering access to peer-to-peer lending and alternative finance solutions. This initiative targets the increasing demand for non-traditional financing options as businesses seek faster, more flexible funding sources.

-

In October 2024, SoFi introduced a new product offering focused on fractional investing, allowing retail investors to participate in alternative finance markets with smaller investments. This launch is designed to meet the growing interest in democratizing access to investment opportunities, particularly in private equity and venture capital.

-

In September 2024, LendingClub expanded its offerings by launching a digital marketplace for personal loans, connecting borrowers directly with investors. This move reflects the increasing shift toward online platforms that facilitate peer-to-peer lending and provide greater flexibility for borrowers and investors alike.

-

In August 2024, Square Capital partnered with a leading fintech company to integrate blockchain technology into its lending platform, aiming to offer faster and more secure loans. This collaboration is in response to the rising demand for innovative and secure financing solutions in the alternative finance sector.

Market Analyst Overview

The alternative finance market is experiencing notable growth driven by various factors, such as the emergence of third-party payment platforms, advancements in technologies like the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML). The lending industry is evolving rapidly, driven by founders and innovative models such as equity crowdfunding and debt-based crowdfunding. Platforms are revolutionizing access to capital by offering peer-to-peer lending solutions. As economic uncertainty persists, microfinance institutions and digital currencies are becoming crucial in addressing credit risk and providing alternative funding avenues.

The market is experiencing rapid growth, fueled by factors such as increased venture capital investment and the expansion of financial products beyond traditional banking systems. Industry professionals are capitalizing on emerging trends like cryptocurrencies such as bitcoin and ethereum, as well as the rise of fintech companies. The regulatory environment is adapting to this growth, with standardization efforts shaping the future. Benchmarking and estimations are essential for evaluating success and guiding industry expansion. Millennials and young adults are particularly influential, favoring these new models over the traditional finance system. Additionally, start-up ranking is increasingly reflective of these disruptive trends, highlighting the dynamic shift in financial practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.44% |

|

Market growth 2024-2028 |

USD 64.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.38 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 70% |

|

Key countries |

US, UK, Germany, China, and Indonesia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Bondora Capital OU, CircleUp Network Inc., ConnectionPoint Systems Inc., Crowdfunder Ltd., Fundable LLC, Funding Circle Holdings plc, Funding Options Ltd., Fundrise LLC, GoFundMe Inc., Indiegogo Inc., Invoice Interchange Pvt. Ltd., Kickstarter PBC, Kriya Finance Ltd., Lending Crowd, LendingClub Corp., OFB Tech Pvt. Ltd., RealCrowd Inc., Sancus Lending Group Ltd, Trade Ledger Pty. Ltd., and Upstart Network Inc. |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our alternative finance market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Alternative Finance Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this alternative finance market research and growth report to meet your requirements. Get in touch