Aluminum Extrusion Market Size 2025-2029

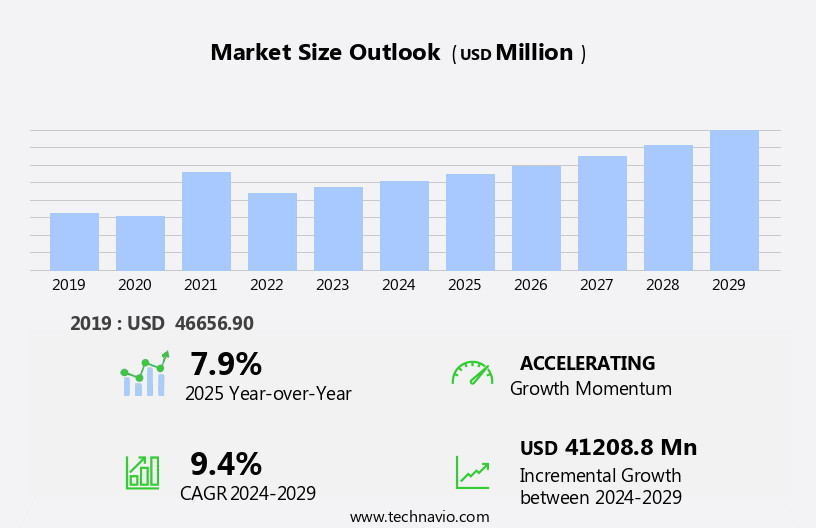

The aluminum extrusion market size is forecast to increase by USD 41.21 billion, at a CAGR of 9.4% between 2024 and 2029. The market is experiencing significant growth, driven primarily by the increasing demand in the automotive industry. This sector's expansion is attributed to the lightweight properties of aluminum extrusions, which contribute to improved fuel efficiency and reduced emissions.

Major Market Trends & Insights

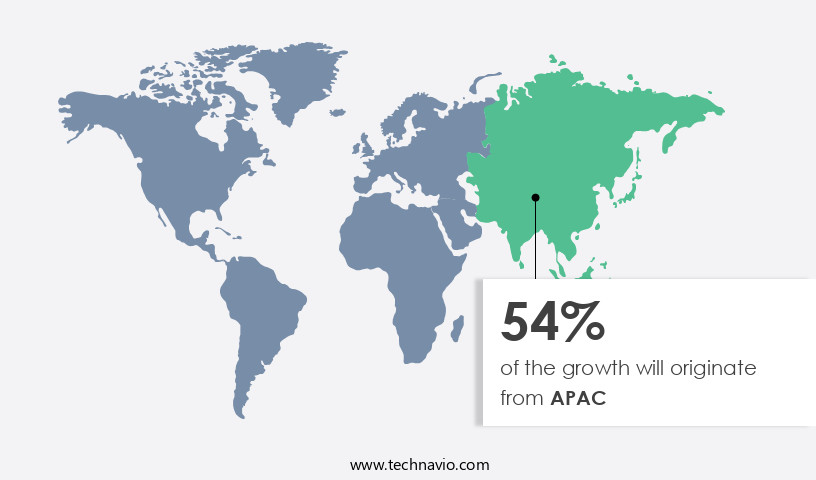

- APAC dominated the market and contributed 54% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

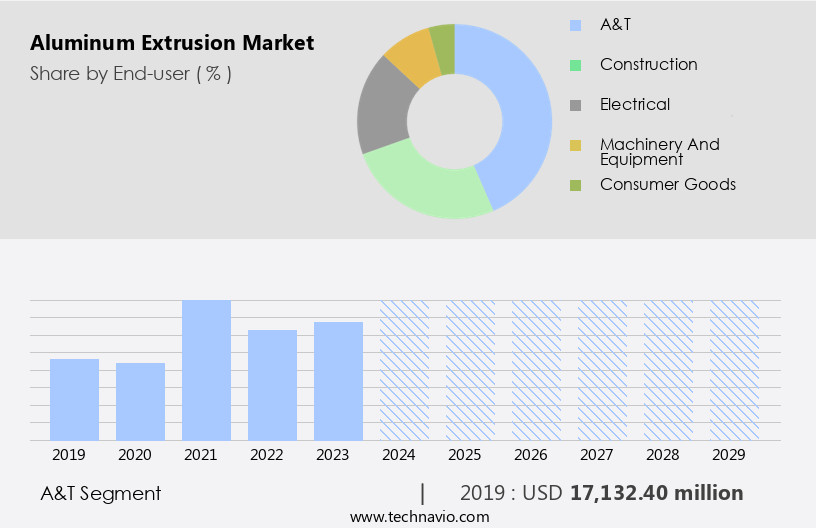

- Based on the End-user, the A & T segment led the market and was valued at USD 24.91 billion of the global revenue in 2023.

- Based on the Product, the mill-finished segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 143.56 Million

- Future Opportunities: USD 41.21 Billion

- CAGR (2024-2029): 9.4%

- APAC: Largest market in 2023

The renewable energy sector, particularly solar energy, is another key market for aluminum extrusions due to their use in solar panel frames and other supporting structures. However, the market faces challenges as well. Growing competition from substitutes, such as steel and other lightweight materials, puts pressure on aluminum extrusion manufacturers to maintain their market share.

Additionally, the volatility of raw material prices, especially aluminum, can impact the profitability of aluminum extrusion businesses. Companies in this market must navigate these challenges by focusing on innovation, cost efficiency, and diversification to remain competitive and capitalize on the market's growth opportunities.

What will be the Size of the Aluminum Extrusion Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the diverse applications across various sectors, including automotive, construction, and packaging. Elongation measurement and surface roughness metrics play crucial roles in ensuring the quality of aluminum alloy extrusions. Robotic handling systems and predictive maintenance enhance production efficiency, while precision extrusion control and hardness testing methods ensure consistent mechanical properties. Safety protocols compliance, material flow simulation, and quality control standards are essential for maintaining a competitive edge in the market. The heat treatment process, including quenching and aging, significantly impacts the strength and durability of aluminum alloy extrusions. Impact resistance testing, surface finishing methods, automation integration, and anodizing process parameters further optimize the extrusion process.

Production yield optimization through process optimization strategies and extrusion tooling design is a continuous focus for market participants. Defect detection systems, tensile strength testing, and corrosion resistance testing are integral to maintaining high-quality standards. Extrusion line efficiency, waste reduction techniques, and production line monitoring are essential for reducing costs and improving energy efficiency. For instance, a leading aluminum extrusion manufacturer increased its sales by 15% through the implementation of a comprehensive production line monitoring system. The industry is expected to grow at a steady pace, with expectations of a 5% annual increase in demand. The continuous advancements in technology, such as energy efficiency improvements and fatigue life prediction, further strengthen the market's position in various industries.

How is this Aluminum Extrusion Industry segmented?

The aluminum extrusion industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- A&T

- Construction

- Electrical

- Machinery and equipment

- Consumer Goods

- Industrial

- Others

- Product

- Mill-finished

- Anodized

- Powder coated

- Process

- Direct Extrusion

- Indirect Extrusion

- Alloy Type

- 1000 Series

- 2000 Series

- 3000 Series

- 5000 Series

- 6000 Series

- 7000 Series

- Form

- Shapes

- Rods & Bars

- Pipes & Tubes

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The A&T segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 24.91 billion in 2023. It continued to the largest segment at a CAGR of 7.09%.

In the market, elongation measurement and surface roughness metrics play crucial roles in ensuring the quality of aluminum alloy extrusions. Robotic handling systems and predictive maintenance optimize production efficiency, while precision extrusion control and hardness testing methods ensure consistency in product quality. The automotive industry, a significant market for aluminum extrusions, continues to prioritize safety protocols compliance and mechanical property testing. Material flow simulation and quality control standards further enhance production yield optimization. The heat treatment process, including quenching and aging, significantly impacts the strength and durability of aluminum alloy extrusions. Impact resistance testing, surface finishing methods, and automation integration further improve product performance and efficiency.

Anodizing process parameters, tensile strength testing, and process optimization strategies are essential for producing high-quality aluminum extrusions. Corrosion resistance testing, extrusion line efficiency, waste reduction techniques, and production line monitoring are essential for maintaining a competitive edge in the market. Dimensional accuracy control, yield strength variation, and powder coating thickness are critical factors in ensuring customer satisfaction and repeat business. Energy efficiency improvements and profile extrusion processes are key trends driving market growth, with the market expected to grow by 5% annually. For instance, a leading automotive manufacturer reported a 15% increase in fuel efficiency by using aluminum-extruded parts in their vehicles.

This trend is expected to continue as the automotive industry shifts towards lighter, stronger, and more sustainable materials.

The A&T segment was valued at USD 17.13 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 41.20 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the APAC region, which accounted for the largest share in 2024. This expansion is driven by the abundant consumer base, easy access to raw materials, and low-cost labor in APAC. The market's dynamic nature is reflected in various trends, including the adoption of advanced technologies such as robotic handling systems, predictive maintenance, and precision extrusion control. These innovations enhance production efficiency and improve product quality. Mechanical property testing, safety protocols compliance, and material flow simulation are essential aspects of the aluminum extrusion process, ensuring consistent product performance.

In the automotive industry, aluminum alloy extrusion is increasingly used to manufacture components like chassis, vehicle bodies, and heat exchangers due to its high strength-to-weight ratio and excellent corrosion resistance. The APAC market's growth is further fueled by the presence of major automotive manufacturers in countries like China, India, Japan, and South Korea. For instance, the automotive sector in China is projected to grow at a compound annual growth rate of 10% between 2021 and 2026. The market also focuses on optimizing production yield, reducing waste, and improving energy efficiency through process optimization strategies. Heat treatment processes, such as quenching and aging, and surface finishing methods, like anodizing, are crucial in enhancing the mechanical properties and durability of aluminum extruded products.

Additionally, defect detection systems, tensile strength testing, and dimensional accuracy control ensure consistent product quality. In conclusion, the market is witnessing a surge in demand, with APAC leading the growth. The market's evolution is characterized by the integration of advanced technologies, a focus on process optimization, and the adoption of sustainable practices. The automotive industry's increasing reliance on aluminum extrusion for manufacturing lightweight and durable components further propels market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Aluminum Extrusion Market thrives on precision and efficiency. Predictive maintenance aluminum extrusion and aluminum extrusion production line automation enhance operational reliability, while robotic handling systems aluminum extrusion streamline handling. Optimization strategies aluminum extrusion process and aluminum extrusion material flow simulation boost productivity. Aluminum extrusion defect detection methods, measuring dimensional accuracy aluminum extrusions, and quality control standards aluminum extrusion ensure product consistency. Cost reduction strategies aluminum extrusion and aluminum extrusion waste reduction techniques improve profitability. Energy efficient aluminum extrusion processes and sustainable aluminum extrusion practices align with environmental goals. Aluminum alloy selection extrusion process, high-strength aluminum extrusion alloys, and aluminum extrusion die design software refine output quality. Aluminum extrusion surface finish techniques, impact resistance testing aluminum extrusions, improving extrusion line efficiency, advanced aluminum extrusion process control, and safety protocols aluminum extrusion industry drive market competitiveness.

What are the key market drivers leading to the rise in the adoption of Aluminum Extrusion Industry?

- The automotive industry's growing requirement for aluminum extrusion serves as the primary market driver.

- The market is experiencing significant growth due to increasing demand from the automotive industry. Over the past five years, the use of aluminum-extruded products has expanded beyond traditional applications such as engine mounts and brake components. Today, automotive original equipment manufacturers (OEMs) incorporate these materials into high-end equipment like safety components, crash management systems, body-in-white structures, and decorative parts. This shift is driven by the rising trend of producing lightweight vehicles to improve fuel efficiency and reduce emissions.

- Furthermore, economic growth and foreign investments in emerging countries like India, Brazil, and Argentina have led to increased per capita income, thereby boosting demand for automobiles and, consequently, aluminum-extruded products. According to industry reports, the market is projected to expand by approximately 5% annually over the next decade.

What are the market trends shaping the Aluminum Extrusion Industry?

- The increasing demand for solar energy represents a significant market trend. Solar energy is gaining increasing popularity due to its numerous benefits and the growing concern for environmental sustainability.

- The shift towards renewable energy sources is driving the demand for aluminum extrusion in the manufacturing of solar energy equipment. With the world's fossil fuel reserves dwindling, countries are increasingly relying on renewable energy to reduce their dependence on imported crude oil and enhance energy security. Solar energy, in particular, is gaining popularity due to its environmental benefits and the absence of emissions during generation. Aluminum extrusion is extensively used in the production of solar panel frames, making it a crucial component of the renewable energy sector.

- The global market for aluminum extrusion is poised for significant growth as governments continue to provide incentives and subsidies for the adoption of solar power. According to recent studies, the global solar energy market is projected to expand by 20% in the next five years, indicating a promising outlook for the aluminum extrusion industry.

What challenges does the Aluminum Extrusion Industry face during its growth?

- The intensifying competition from substitutes poses a significant challenge to the expansion of the industry.

- The market faces intensifying competition from various alternative materials, including steel, iron, PE, HDPE, ductile iron, copper, stainless steel, black steel, magnesium, and plastics. Consumers and end-users increasingly prefer these alternatives due to their cost-effectiveness and competitive pricing. For instance, the construction industry's shift towards using copper products for their superior properties in electric and electronics, commercial, and household applications has impacted the market's growth.

- Plastics and composite products, in particular, pose a significant challenge, accounting for a substantial market share. According to industry reports, the market is projected to grow at a robust rate, with expectations of a 7% increase in demand over the next five years.

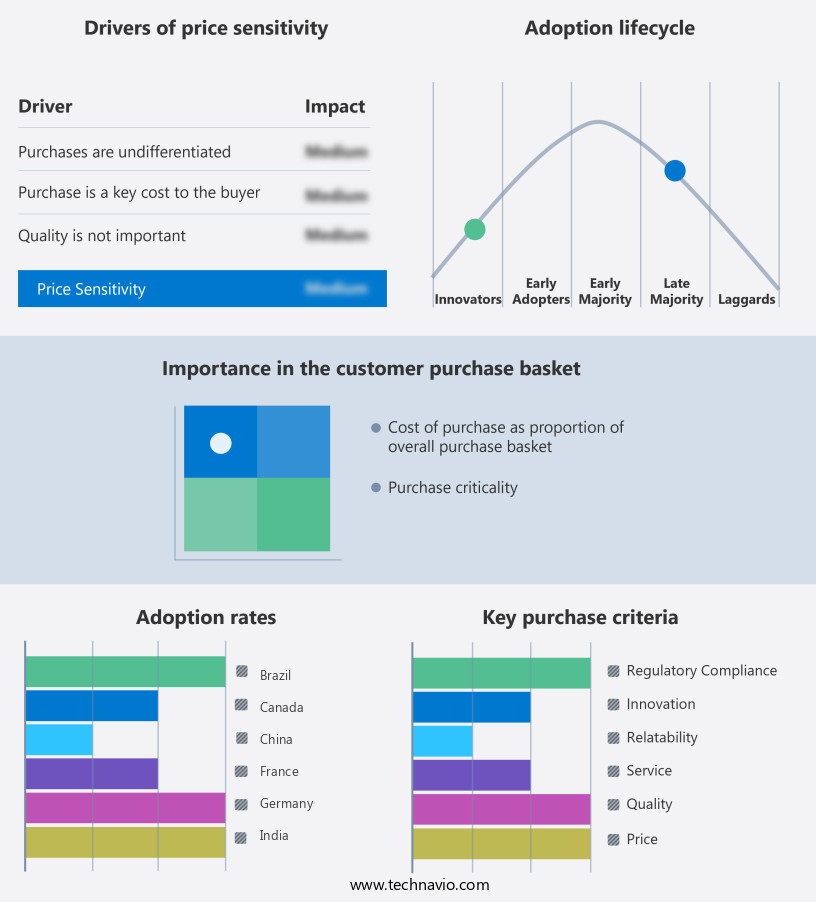

Exclusive Customer Landscape

The aluminum extrusion market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aluminum extrusion market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aluminum extrusion market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Birla Management Corp. Pvt. Ltd.

- Al Ghurair Group

- Arconic Corp.

- Bahrain Aluminum Extrusion Co.

- Century Aluminum Co.

- China Zhongwang Holdings Ltd.

- Constellium SE

- Global Aluminium Pvt. Ltd.

- Guang Ya Aluminium

- Guangdong Xingfa Aluminium Co. Ltd

- Henan Chalco

- Jindal Aluminium Ltd.

- Kaiser Aluminum Corp.

- National Material L.P.

- Norsk Hydro ASA

- Qatar Aluminum Extrusion Co.

- Rio Tinto Ltd.

- Sankyo Tateyama Inc.

- Tajik Aluminium Co.

- Tredegar Corp.

- UACJ Corp.

- United Co. RUSAL

- Vimetco NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aluminum Extrusion Market

- In January 2024, Hydro Aluminum, a leading aluminum extrusion company, announced the launch of its new sustainable aluminum product line, GreenLITE, in collaboration with Infinitum, a circular aluminum company (Hydro press release, 2024). This innovative product line utilizes recycled aluminum, reducing the carbon footprint of aluminum extrusion production.

- In March 2024, Novelis, a global leader in aluminum rolling and recycling, entered into a strategic partnership with LG Chem to develop and commercialize automotive aluminum-lithium alloys for lightweight vehicle components (Novelis press release, 2024). This collaboration aims to enhance the competitiveness of aluminum in the automotive industry by improving fuel efficiency and reducing emissions.

- In May 2024, Constellium, a global aluminum manufacturer, completed the acquisition of Alcan Extrusion International from Rio Tinto for approximately USD 3.4 billion (Constellium press release, 2024). This acquisition significantly expanded Constellium's aluminum extrusion capabilities and market presence in Europe and North America.

- In April 2025, the European Union (EU) approved the Aluminum Stewardship Initiative (ASI) Standard, a global, voluntary sustainability standard for the aluminum value chain (ASI press release, 2025). This approval marks a significant step forward in promoting sustainable and responsible production, sourcing, and recycling practices within the aluminum industry.

Research Analyst Overview

- The market for aluminum extrusion continues to evolve, driven by advancements in technology and increasing demand across various sectors. Environmental impact assessments and aging furnace control are critical areas of focus, with process capability studies and supply chain management optimizing production efficiency. Quality assurance metrics, such as defect analysis methods and non-destructive testing, ensure product consistency, while order fulfillment processes and cost reduction initiatives streamline operations. Market demand forecasting and statistical process control inform strategic planning, with lean manufacturing principles and technology adoption rate shaping the industry's future. Hydraulic press systems and profile design software enable customized solutions, while lubricant selection and industry best practices ensure optimal performance.

- Aluminum billet heating and cooling system design enhance production capabilities, with material traceability and anodizing bath chemistry ensuring regulatory compliance. Customer service standards and continuous improvement initiatives further strengthen market competitiveness. According to industry reports, the market is projected to grow by over 5% annually, fueled by these ongoing activities and evolving patterns. For instance, a leading aluminum extrusion company successfully implemented a cost reduction initiative, reducing production costs by 10% through lean manufacturing principles and optimized inventory control systems.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aluminum Extrusion Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.4% |

|

Market growth 2025-2029 |

USD 41208.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.9 |

|

Key countries |

China, Japan, US, India, Germany, UK, Canada, France, Italy, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aluminum Extrusion Market Research and Growth Report?

- CAGR of the Aluminum Extrusion industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aluminum extrusion market growth of industry companies

We can help! Our analysts can customize this aluminum extrusion market research report to meet your requirements.