Amines Market Size 2024-2028

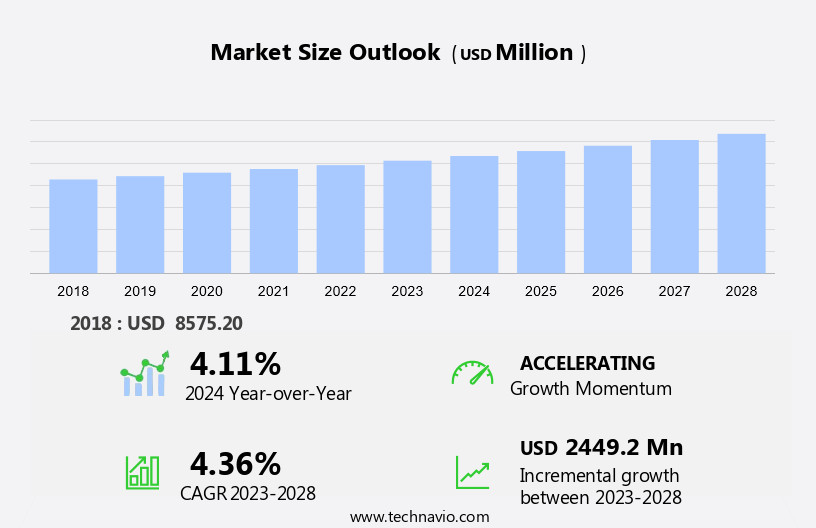

The amines market size is forecast to increase by USD 2.45 billion at a CAGR of 4.36% between 2023 and 2028.

What will be the Size of the Amines Market During the Forecast Period?

How is this Amines Industry segmented and which is the largest segment?

The amines industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Ethanolamine

- Fatty amines

- Specialty amines

- Ethyleneamines

- Application

- Pesticides

- Surfactants

- Personal care

- Lubricants

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Product Insights

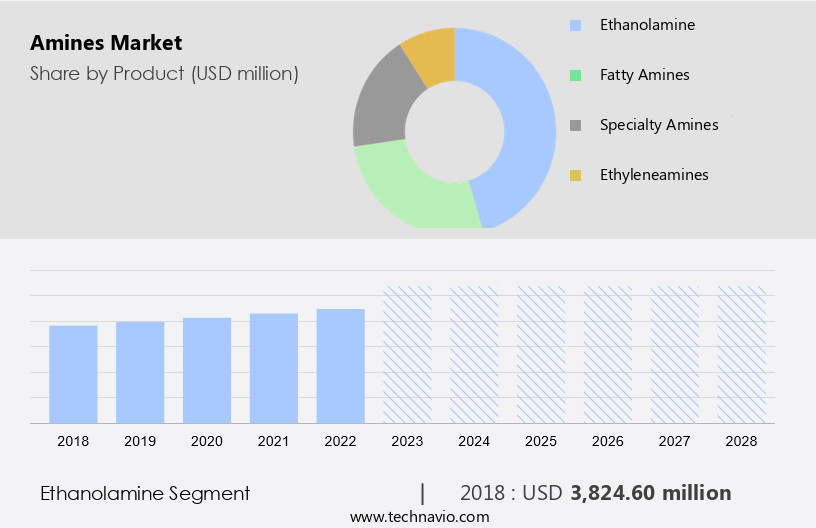

- The ethanolamine segment is estimated to witness significant growth during the forecast period.

Ethanolamine, chemically known as 2-aminoethanol, is a viscous, alkaline liquid with an unpleasant ammonia-like odor. It is miscible with water and several oxygenated organic solvents, such as methanol, acetone, and glycerol. Ethanolamine plays a significant role in various industries. In the chemical sector, it functions as a gas scrubber, removing carbon dioxide, hydrogen sulfide, and other acidic pollutants from waste gas streams. It is also used as a starting material for manufacturing surfactants, chelating agents, and pharmaceuticals. In the personal care industry, ethanolamines act as cleansing agents, removing dirt and oil from the skin by dissolving grease and blending other essential ingredients.

Ethanolamines find extensive applications in end-use industries, including crop protection, paints and coatings, cosmetics, industrial cleaners, asphalt additives, and insulation materials. They are integral to the production of Methylene diphenyl isocyanate (MDI), a crucial component In the manufacture of polyurethane, plastic, polymer, rubber, and agrochemicals. Ethanolamine's versatility extends to various applications, including water treatment, gas treatments, and the production of epoxy coatings, industrial maintenance, and civil engineering. Ethanolamine's derivatives, such as monoethanolamine and triethanolamine, serve as corrosion inhibitors, lubricants, and coolants in various industries. The demand for ethanolamine is driven by its extensive applications in surfactant production and the growing demand for personal care and crop protection products.

Get a glance at the Amines Industry report of share of various segments Request Free Sample

The Ethanolamine segment was valued at USD 3.82 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

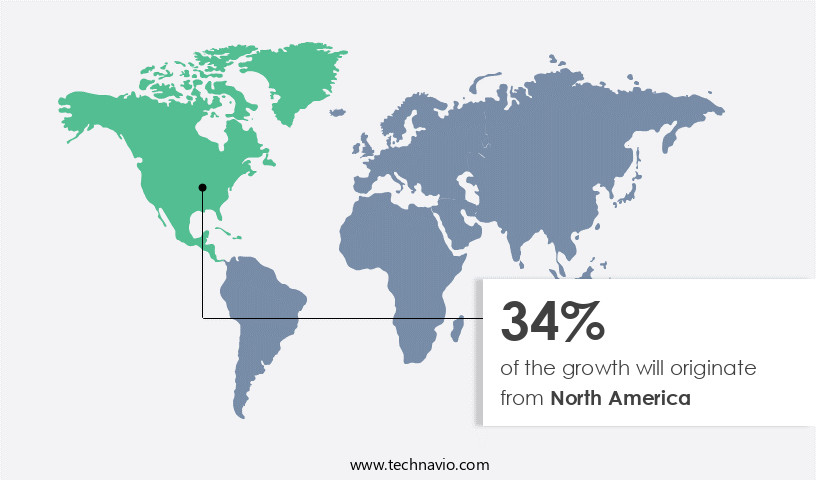

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region holds substantial growth opportunities for The market, given their extensive applications. Globally, APAC leads the market in terms of demand and innovation. Key drivers for the APAC the market include advancements in end-use industries, such as water treatment, agrochemicals, oilfield chemicals, and asphalt additives. Major manufacturers have established their presence in APAC due to factors like relaxed regulations, a large customer base, and low labor costs. The APAC the market is projected to exhibit a higher Compound Annual Growth Rate (CAGR) compared to other regions, primarily due to the increasing utilization of amines In the production of cleaning agents, pesticides, and personal care products.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Amines Industry?

Burgeoning demand for amines in agrochemicals is the key driver of the market.

What are the market trends shaping the Amines Industry?

Increasing demand from pharmaceutical industry is the upcoming market trend.

What challenges does the Amines Industry face during its growth?

Hazardous nature of amines is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The amines market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the amines market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, amines market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Akzo Nobel NV - Amines, including ethylene amines and their derivatives, are among the offerings from the company. These organic compounds are widely used in various industries, such as pharmaceuticals, agrochemicals, and polymers, due to their versatile chemical properties. Ethylene amines, specifically, are primary raw materials for producing polyamides, elastomers, and solvents. The market for amines is expected to grow significantly due to increasing demand from end-use industries and ongoing research and development activities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Arkema Group.

- Ascensus Specialties LLC

- BASF SE

- Biosynth Ltd.

- Celanese Corp.

- ChemImpex International Inc.

- Dow Chemical Co.

- Eastman Chemical Co.

- Enamine Ltd

- Huntsman International LLC

- INEOS AG

- LGC Science Group Holdings Ltd.

- Merck KGaA

- Otsuka Holdings Co. Ltd.

- Solvay SA

- SynQuest Laboratories Inc

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co. Ltd.

- Toronto Research Chemicals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of organic compounds that contain a nitrogen atom bonded to one or more carbon atoms, forming alkyl and aryl groups. These versatile chemicals play a crucial role in various industries, including surfactants, crop protection, and end-use sectors such as plastics, polymers, rubber, and adhesives. Amines are integral to the production of surfactants, which are essential in various applications, including industrial and personal care. In the industrial sector, they serve as critical components in water and gas treatment processes, enhancing their effectiveness and efficiency. In the personal care industry, they are used In the manufacture of various products, including foaming agents, cosmetics, and personal hygiene items.

The crop protection segment is another significant market for amines, where they serve as intermediates and additives In the production of pesticides and herbicides. In the agricultural sector, amines are used as fertilizers and nutrient sources, contributing to increased crop yields and productivity. The demand for amines is driven by various factors, including the rising demand for surfactants in water and gas treatment applications, the growing need for crop protection, and the expanding personal care sector. Innovation and the development of new solutions continue to fuel growth In the market, with applications in industries such as pharmaceuticals, construction, and refining.

Despite the numerous benefits of amines, there are also challenges that hinder their widespread adoption. Regulatory environments and environmental concerns, including the potential impact on water resources and arable land, are among the key restraining factors. The market is diverse and dynamic, with various types of amines, including ethanolamines, alkylamines, fatty amines, and specialty amines, each with unique properties and applications. Ethanolamines, for instance, are used as corrosion inhibitors, lubricants, and solvents, while alkylamines are used as emulsifiers, stabilizers, and scrubbing agents. In the industrial sector, amines are used in various applications, including as corrosion inhibitors in cooling systems, as lubricants in machining fluids, and as epoxy hardeners in coatings.

They are also used In the production of oleo chemical products and as additives In the oil field. The market for amines is expected to continue growing, driven by the increasing demand for surfactants, the expanding personal care sector, and the growing need for crop protection. The development of bio-based products and the adoption of chemically resistant systems in various industries are also expected to fuel growth In the market. In conclusion, the market is a dynamic and diverse industry that plays a crucial role in various sectors, including surfactants, crop protection, and end-use industries. The market is driven by various factors, including the rising demand for surfactants, the expanding personal care sector, and the growing need for crop protection.

Despite the challenges, the market is expected to continue growing, driven by innovation and the development of new solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 2449.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

China, US, UK, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Amines Market Research and Growth Report?

- CAGR of the Amines industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the amines market growth of industry companies

We can help! Our analysts can customize this amines market research report to meet your requirements.