Anchor Handling Tug Supply (AHTS) Vessels Market 2024-2028

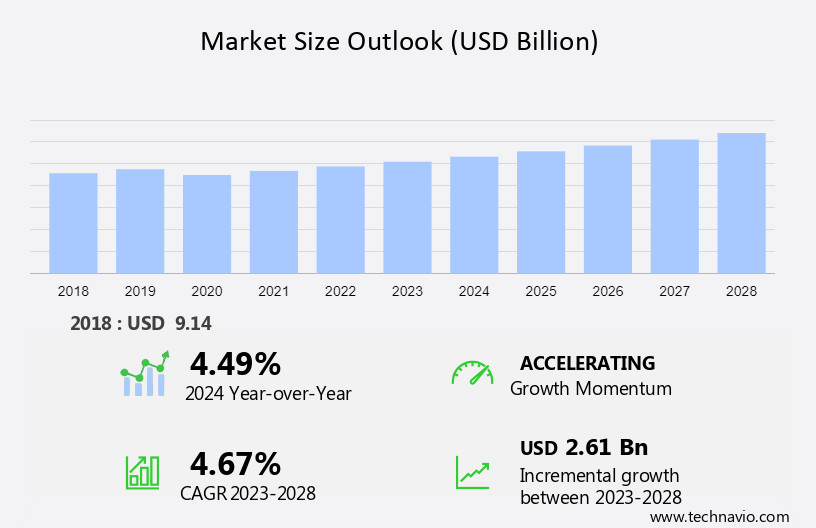

The anchor handling tug supply (AHTS) vessels market size is forecast to increase by USD 2.61 billion and grow at a CAGR of 4.67% between 2023 and 2028. Several factors play a crucial role in the market's growth, such as the rise in global demand for oil and natural gas, the rise in deep-water and ultra-deep-water E&P activities, and the increase in global offshore oil and gas exploration activities.

The report includes a comprehensive outlook on the Anchor Handling Tug Supply Vessels Market, offering forecasts for the industry segmented by Application, which comprises oil and gas, industrial, and others. Additionally, it categorizes Engine Capacity into 5000-9999 HP, <5000 HP, and >10000 HP, and covers Regions, including APAC, Europe, North America, South America, and Middle East and Africa. The report provides market size, historical data spanning from 2018 to 2022, and future projections, all presented in terms of value in USD billion for each of the mentioned segments.

What will be the size of the Anchor Handling Tug Supply Vessels Market During the Forecast Period?

For More Highlights About this Report, Download Free Sample in a Minute

Anchor Handling Tug Supply Vessels Market: Key Drivers, Trends and Challenges

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Anchor Handling Tug Supply Vessels Market Driver

The rise in global demand for oil and natural gas is the key factor driving the market growth. ATHS are used as multipurpose work boats in the oil and gas offshore field. The ATHS vessels are widely used in performing towing operations, rig moves, and executing general supply duties by carrying dry and liquid cargo such as fuel oil and others for offshore installations. Such factors make the ATHS vessels critical for sub-sea mooring operations in the offshore oil and gas fields, surging the demand for ATHS vessels.

Furthermore, the increasing demand for oil and natural gas will drive the growth of E&P activities. Though the costs involved in the production of oil and gas from offshore locations are higher than those of onshore locations, the proven reserves in offshore wells are far higher compared with those of onshore wells. These vast reserves are likely to attract upstream companies to exploit and produce oil and gas. The rise in demand for oil and gas will drive the demand for AHTS vessels and the growth of the market during the forecast period.

Key Anchor Handling Tug Supply Vessels Market Trends

The increase in investment in port infrastructure is the primary trend shaping market growth. An increase in port infrastructure development, such as the construction of offshore installations, including oil rigs and renewable energy structures, directly correlates with an increase in demand for AHTS vessels. Furthermore, to meet the challenge faced by port operators in managing the cascading effect of vessel sizes, highly advanced gantry cranes and berthing space are required. In addition, several public-private partnership (PPP) projects are encouraged across different countries of the world to increase the flow of money in the development of new ports.

For example, the Government of India is planning to develop four new major projects in Tamil Nadu, Maharashtra, and West Bengal at an investment of USD 5 billion under the PPP model. Construction of a rail link between Addis Ababa and Djibouti will reduce the draft in the Port of Durban. Investment in port infrastructure will require manpower to support various activities. This will also create job opportunities in APAC. Thus, such investments will propel the growth of the global anchor-handling tug supply vessels market during the forecast period.

Key Anchor Handling Tug Supply Vessels Market Challenge

Volatility in oil prices is a challenge that affects market growth. High volatility in the oil prices reduces exploration activities and production spending and delayed or canceled projects. Such factors result in a decline in the demand for AHTS vessels. For example, a steep decline in the price of crude oil was observed from over USD 100/barrel in 2014 to below USD 35/barrel in May 2020. This indicates the volatile nature of the global crude oil industry. The prices of crude oil influence the demand for AHTS.

Additionally, heavy taxes imposed on the sales of fuel can result in fluctuations in the prices of fuel. Some taxes imposed on fuel across the world include goods and services tax, gross receipts tax, oil inspection fees, and emission trading levies. Thus, such factors may impede the growth of the market in focus during the forecast period.

Anchor Handling Tug Supply Vessels Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Anchor Handling Tug Supply Vessels Market Customer Landscape

Who are the Major Anchor Handling Tug Supply Vessels Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Aquashield Oil and Marine Services Ltd.: The company offers anchor handling tug supply vessels for Marine Fleet Services which includes Anchor Handling Tug Support, Vessels Tugs Diving Support, Platform Supply Vessels and others.

The research report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- AP Moller Maersk AS

- BOURBON Maritime

- Damen Shipyards Group

- DNV Group AS

- Edison Chouest Offshore Co.

- Fairway Offshore Ltd.

- Harmony Marine Shipbrokers Ltd.

- Harvey Gulf International Marine LLC

- Hornbeck Offshore Services Inc.

- Kuok Group

- MMA Offshore Ltd.

- Petromarine Nigeria Ltd.

- Seacontractors

- SEACOR Marine Holdings Inc.

- Solstad Offshore ASA

- Swire Pacific Ltd.

- Tethys Plantgeria Ltd.

- Tidewater Inc.

- Wartsila Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

What is the Largest-Growing Segments in the Anchor Handling Tug Supply Vessels Market?

The oil and gas segment is estimated to witness significant growth during the forecast period. The demand for offshore support vessels in the oil and gas segment is expected to increase mainly due to the rising demand for oil and gas E and P projects. The growth is because of the shift in oil and gas operations from onshore activities to locations such as deep-water zones, which are farther away from end consumers. The rise in the demand for liquid fuels is attributed to the increase in demand from developing Asian nations, such as China and India

Get a glance at the market contribution of various segments Download the PDF Sample

The oil and gas segment was the largest segment and was valued at USD 6.60 billion in 2018. Furthermore, production from the onshore oil and gas segment has increased owing to growing investments in unconventional exploration and production activities. For example, the capital expenditure in the oil and gas industry in the US increased from USD 131.9 billion in 2018 to USD 144.1 billion in 2021. Therefore, the increase in fuel demand and a rise in offshore E&P activities are expected to drive the growth of this segment in the global anchor handling tug supply vessels market during the forecast period.

Which are the Key Regions for the Anchor Handling Tug Supply Vessels Market?

For more insights on the market share of various regions Download PDF Sample now!

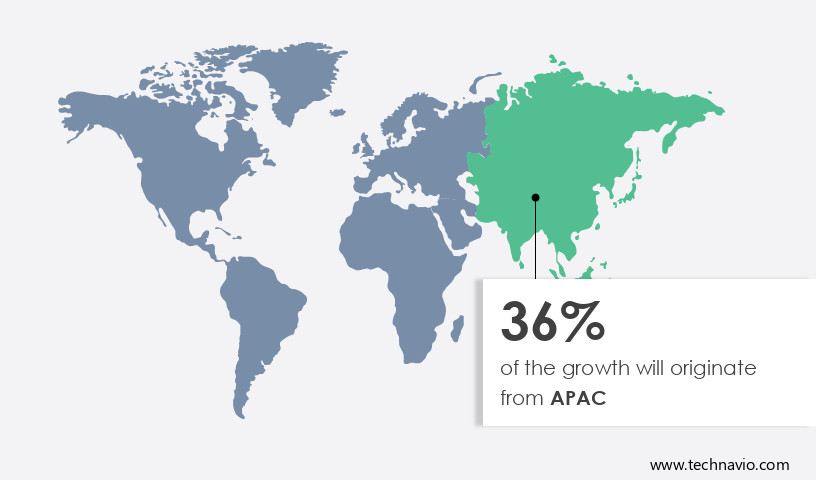

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The growth in the regional anchor handling tug supply (AHTS) vessels market is driven by factors such as the increase in demand from oil and gas, industrial, and other sectors in various countries, including China, India, Japan, and South Korea. In addition, the increase in offshore projects in countries such as Indonesia and Malaysia is expected to further enhance the growth of the anchor-handing tug supply vessels market in the region.

In addition, the regional anchor handling tug supply (AHTS) vessels market players are manufacturing technologically advanced AHTS vessels. The technological advancements in AHTS vessels, such as the incorporation of hybrid propulsion systems and the use of advanced automation and control systems help in improving the efficiency and effectiveness of AHTS operations, leading to the increased demand for these vessels in the region. Therefore, such factors are expected to drive the growth of the anchor-handing tug supply vessels market in the region during the forecast period.

Segment Overview

The anchor handling tug supply vessels market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2018 to 2028.

- Application Outlook

- Oil and gas

- Industrial

- Others

- Engine Capacity Outlook

- 5000-9999 HP

- <5000 HP

- >10000 HP

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

|

Anchor Handling Tug Supply Vessels Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.67% |

|

Market Growth 2024-2028 |

USD 2.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.49 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 36% |

|

Key countries |

US, Canada, United Arab Emirates, China, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AP Moller Maersk AS, Aquashield Oil and Marine Services Ltd., BOURBON Maritime, Damen Shipyards Group, DNV Group AS, Edison Chouest Offshore Co., Fairway Offshore Ltd., Harmony Marine Shipbrokers Ltd., Harvey Gulf International Marine LLC, Hornbeck Offshore Services Inc., Kuok Group, MMA Offshore Ltd., Petromarine Nigeria Ltd., Seacontractors, SEACOR Marine Holdings Inc., Solstad Offshore ASA, Swire Pacific Ltd., Tethys Plantgeria Ltd., Tidewater Inc., and Wartsila Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data you are looking for, you can reach out to our analysts and get customized segments. |

What are the Key Data Covered in this Anchor Handling Tug Supply Vessels Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.