Antenna Market Size 2024-2028

The antenna market size is forecast to increase by USD 7.52 billion at a CAGR of 7.7% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for wireless connectivity in various industries and consumer electronics. Key trends In the market include the emergence of beamforming and beam steering technologies, which enhance signal quality and improve network efficiency. Additionally, the adoption of millimeter (mm)-Wave antennas is on the rise, providing higher data transfer rates and enabling advanced applications such as industrial automation, satellite communication, and 5G technology. However, challenges persist, including interference and spectrum congestion issues, which require the development of innovative solutions. In the consumer electronics sector, the demand for antennas is driven by the proliferation of smartphones, tablets, laptops, and gaming devices, as well as the rise of virtual reality and cloud gaming. Furthermore, the digital transformation of industries, including healthcare and smart cities, is fueling the need for industrial sensors and wireless connectivity, leading to increased demand for antennas. In summary, the market is poised for growth, driven by technological advancements and the increasing demand for wireless connectivity in various industries and consumer electronics.

What will be the Size of the Antenna Market During the Forecast Period?

- The market encompasses a diverse range of wireless communication technologies, including consumer electronics, satellite communications, and the space sector. With the increasing reliance on wireless connectivity solutions for various applications, such as internet usage, smart cities, Automated Driving Systems (ADAS), and digital transformation, the market's growth is driven by the demand for high-speed, network resiliency, and frequency range expansion. Antennas play a crucial role in transmitting and receiving electromagnetic waves, such as radio frequencies (RF), microwaves, and light, essential for communication systems. The market includes various types, including flat panel antennas and dual-polarized antennas, catering to different frequency ranges and applications.

- The market's sizeable growth can be attributed to the proliferation of wireless communication technologies, including the 5G cellular network, which requires advanced antenna technologies for optimal performance and coverage. The market's direction is towards miniaturization, increased efficiency, and multi-band capabilities, enabling seamless integration into various applications and infrastructure development.

How is this Antenna Industry segmented and which is the largest segment?

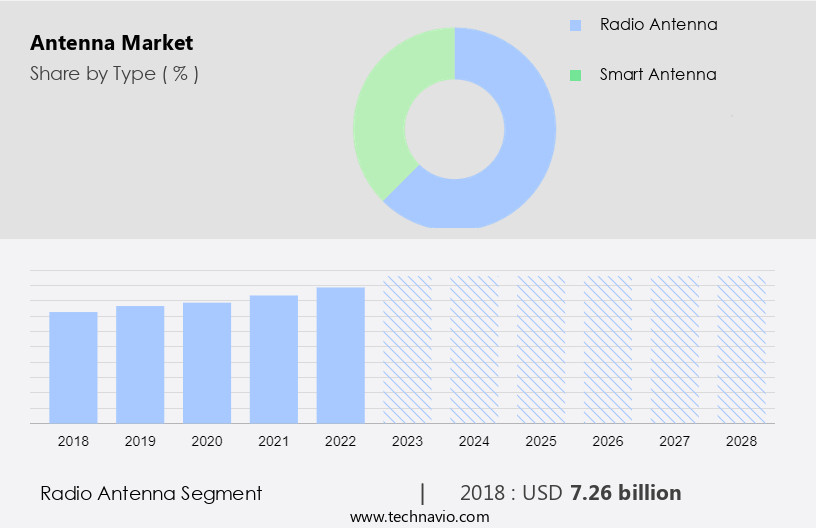

The antenna industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Radio antenna

- Smart antenna

- End-user

- Communication or telecommunication

- Aerospace and defense or military

- Automotive

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

- The radio antenna segment is estimated to witness significant growth during the forecast period.

The market is driven by the expansion of wireless communication technologies, including radio frequencies (RF), microwaves, and electromagnetic waves. The increasing usage of the Internet and the emergence of smart cities require advanced wireless connectivity solutions, leading to an increase in demand for high-performance antennas, such as multi-band and stamping process antennas. The automotive industry's adoption of Advanced Driver-Assistance Systems (ADAS) and the development of 5G technology fuel the demand for antenna technology in applications like Active Antenna Systems, Multi-radio Environments, and 5G networks. The Internet of Things (IoT) and various industries' digital transformation necessitate real-time monitoring and communication systems, further boosting market growth.

Get a glance at the market report of share of various segments Request Free Sample

The radio antenna segment was valued at USD 7.26 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market In the Asia Pacific (APAC) region is witnessing significant growth due to increasing urbanization and population expansion, leading to heightened demand for advanced telecommunication services. Governments and telecom operators are investing in upgrading and expanding infrastructure, such as 5G networks, fiber-optic broadband, and wireless communication systems. This trend is fueled by the region's large and growing population of mobile device users, including smartphones, tablets, and wearable devices. As mobile device penetration continues to rise, there is a corresponding increase in demand for high-performance antennas that support wireless connectivity, voice communication, and data transmission. Furthermore, the rollout of 5G networks in APAC offers substantial opportunities for antenna manufacturers and suppliers.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Antenna Industry?

Emergence of beamforming and beam steering technologies is the key driver of the market.

- Antenna technology plays a crucial role in wireless communication, particularly In the context of Internet usage, Smart Cities, Automotive Application Systems (ADAS), and Digital Transformation. Beamforming and beamsteering technologies are key innovations that enhance antenna performance. These technologies enable antennas to focus electromagnetic waves toward specific users, areas, or objects, thereby improving signal coverage, capacity, and quality. Beamforming and beamsteering technologies allow antennas to dynamically adjust the direction of radio signals, optimizing transmission and reception. This results in extended range, enhanced signal quality, and improved network capacity and throughput. These advancements are essential for meeting the growing demand for bandwidth-intensive applications and services, including 5G Technology, the Internet of Things (IoT), and various communication systems.

- High-performance antennas, such as multi-band and electronically adjustable antennas, are critical components of wireless connectivity solutions. These antennas support various frequency ranges, including those used in satellite communications, wireless networks, and radio frequencies. They are employed in various industries, including Consumer Electronics, Space Sector, and Military and Defense. Advanced antenna technologies, such as SIMO (Single Input Multiple Output), MIMO (Multiple Input Multiple Output), and MISO (Multiple Input Single Output), are used in cellular systems, WiFi systems, and flat panel antennas. These technologies enable high-speed, network resiliency, and 5G infrastructure development. Additionally, technologies like beamforming, 5G networks, and parabolic antennas contribute to the advancement of communication systems.

What are the market trends shaping the Antenna Industry?

Emergence of millimeter (mm)-Wave antennas is the upcoming market trend.

- MmWave antennas, operating In the frequency range above 24 GHz, are a pivotal component of 5G networks, providing ultra-fast data speeds and handling bandwidth-intensive applications. These antennas support high-capacity, short-range communication in densely populated urban areas and crowded environments. With mmWave technology, operators can deliver multi-gigabit data speeds and low-latency connectivity, essential for 5G applications such as augmented reality, virtual reality, and cloud gaming. Compared to traditional microwave antennas, mmWave antennas offer significantly higher data capacity, making them suitable for managing the increasing demand for data-intensive applications and services. This technology empowers operators to provide ultra-fast broadband access, video streaming, and IoT connectivity, enhancing user experience and enabling new use cases.

- High-performance antennas, including multi-band and electronically adjustable antennas, are crucial in various industries, including wireless communication, consumer electronics, satellite communications, and the space sector. Antenna technology advances, such as beamforming, SIMO, MIMO, and MISO, contribute to the growth of the market. Wireless connectivity solutions, including WiFi systems, cellular systems, and radio frequencies, rely on antenna technology for efficient communication and data exchange. Antenna technology plays a vital role in various applications, including automation, traffic management, smart home gadgets, industrial sensors, and communication systems. Antenna technology's role extends to various industries, including military and defense, medical imaging, security screening, wireless power transfer, and space exploration missions.

What challenges does the Antenna Industry face during its growth?

Interference and spectrum congestion issues in antennas is a key challenge affecting the industry growth.

- The market plays a crucial role in wireless communication by facilitating the transmission and reception of electromagnetic waves, including radio frequencies, microwaves, and light electrical signals. However, interference from neighboring networks, devices, and electromagnetic sources can degrade antenna performance, leading to signal quality issues. This interference affects reliability and coverage, resulting in dropped calls, reduced data rates, and connectivity problems for users. Spectrum congestion, driven by the increasing demand for bandwidth-intensive applications like video streaming, gaming, and IoT connectivity, further exacerbates these challenges. The finite nature of the radio frequency spectrum and the growing demand for wireless services contribute to spectrum scarcity and allocation difficulties.

- High-performance antennas, such as multi-band and electronically adjustable antennas, are essential to mitigate these issues and improve network resiliency. Wireless connectivity solutions, including 5G technology, satellite communications, and wireless networks, rely on advanced antenna technology to deliver high-speed, reliable communication and real-time monitoring capabilities. Market dynamics, including the demand for digital transformation, smart cities, ADAS, and the Internet of Things, continue to drive the growth of the market. Antenna technology applications span various industries, including consumer electronics, automotive, military and defense, and space exploration missions. The market players invest in research and development, focusing on improving radio frequency performance, miniaturization, and integration with communication systems.

Exclusive Customer Landscape

The antenna market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the antenna market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, antenna market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AAC Technologies Holdings Ltd.

- Airgain Inc.

- Alpha Wireless Ltd.

- Amphenol Corp.

- AT and T Inc.

- Baylin Technologies Inc.

- Cisco Systems Inc.

- Comba Telecom Systems Holdings Ltd.

- CommScope Holding Co. Inc.

- Dongguan Luxshare Technology Co. Ltd

- DuPont de Nemours Inc.

- Fujikura Ltd.

- Huawei Technologies Co. Ltd.

- Huizhou SPEED Wireless Technology Co. Ltd.

- Molex LLC

- Murata Manufacturing Co. Ltd.

- Panorama Antennas

- Qualcomm Inc.

- Taoglas Group Holdings Ltd.

- TE Connectivity Ltd.

- Texas Instruments Inc.

- Shenzhen Sunway Communication Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of wireless communication technologies that facilitate the transmission and reception of electromagnetic waves. These waves, which include radio frequencies (RF), microwaves, and light, are essential for various applications in consumer electronics, satellite communications, and the space sector. The increasing reliance on wireless connectivity solutions in our daily lives, driven by digital transformation and the proliferation of smart cities, has fueled the demand for high-performance antennas. Multi-band antennas, for instance, are becoming increasingly popular due to their ability to support multiple frequencies, making them suitable for use in multi-radio environments. The market is also witnessing significant growth In the area of 5G technology.

In addition, with the increasing number of 5G subscriptions, the need for antennas that can support high-speed, network resiliency, and high radio frequency performance is becoming more critical. Active antenna systems, for example, are gaining popularity due to their ability to electronically adjust to changing environments, ensuring optimal signal quality. Moreover, the Internet of Things (IoT) is driving the demand for antennas in various industries, from industrial sensors to smart home gadgets. External antennas are often used to improve the signal strength and reliability of these devices. Simulation tools and cloud collaboration are also being used to optimize antenna design and performance.

Moreover, the market is also witnessing innovation in areas such as beamforming, which allows for more precise and efficient transmission and reception of signals. Flat panel antennas, for instance, are being used in 5G networks to improve network coverage and capacity. Dual-polarized antennas are also gaining popularity due to their ability to transmit and receive signals in multiple directions, making them suitable for use in various applications. The market is also witnessing innovation in materials science, with the use of metamaterials in antenna design. These materials have unique electromagnetic properties that can be used to design antennas with enhanced performance and functionality.

Furthermore, the market is a dynamic and evolving one, with new applications and technologies emerging constantly. From wireless power transfer to security screening, antennas play a crucial role in enabling various applications and driving innovation in wireless communication. The market is expected to continue growing, driven by the increasing demand for wireless connectivity and the ongoing digital transformation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

160 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2024-2028 |

USD 7.52 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.08 |

|

Key countries |

US, China, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Antenna Market Research and Growth Report?

- CAGR of the Antenna industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the antenna market growth of industry companies

We can help! Our analysts can customize this antenna market research report to meet your requirements.