Anti-CD20 Monoclonal Antibodies Market Size 2025-2029

The anti-CD20 monoclonal antibodies (MABs) market size is forecast to increase by USD 15.64 billion at a CAGR of 12.3% between 2024 and 2029.

-

The market is experiencing significant growth due to the increasing use of combination therapies In the treatment of various diseases. These mAbs, which target the CD20 protein found on the surface of B cells, are increasingly being used in immunology and inflammatory bowel disease therapies. The market is driven by the rising awareness of therapeutic areas and the potential benefits of mAb treatments. However, the market also faces challenges, including the adverse effects associated with anti-CD20 mAbs, such as infusion reactions and the risk of developing neutralizing antibodies. These factors may limit the market growth and require ongoing research and development efforts to mitigate their impact. Ambulatory surgical centers and blood banks are key institutions where the demand for anti-CD20 mAbs is increasing due to the convenience and cost-effectiveness of outpatient treatments. Overall, the market for anti-CD20 mAbs is expected to continue growing, driven by the increasing demand for targeted therapies and ongoing research and development efforts to address the challenges associated with their use.

What will be the Size of the market During the Forecast Period?

-

The market encompasses a range of immunotherapeutic agents used primarily in the treatment of B-cell malignancies and certain autoimmune diseases. These mAbs target the CD20 marker found on the surface of mature and malignant B cells, as well as macrophages. The market's growth is driven by the increasing prevalence of B-cell malignancies, such as lymphoma, and autoimmune diseases, including rheumatoid arthritis, systemic lupus erythematosus, inflammatory bowel disease, and multiple sclerosis. The prognosis for patients with these conditions has significantly improved due to the efficacy of anti-CD20 mAbs, leading to increased demand.

-

In the realm of oncology, anti-CD20 mAbs are utilized extensively In the neuroscience and immunology sectors. Notable anti-CD20 mAbs include ofatumumab and ocrelizumab. The market is expected to continue expanding due to the ongoing research and development efforts In the immunotherapy space.

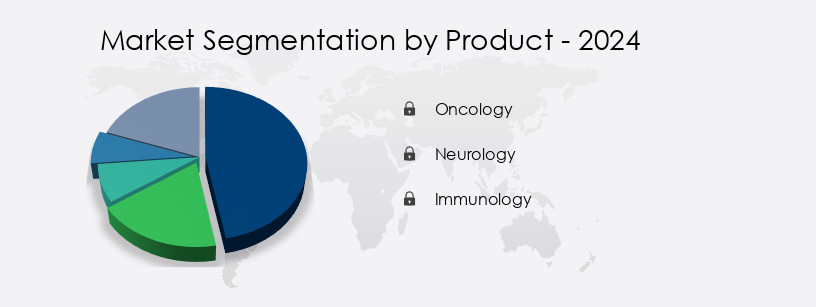

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Oncology

- Neurology

- Immunology

- Type

- First generation

- Second generation

- Third generation

- End-user

- Hospitals and clinics

- Academic and research institutions

- Contract research organizations

- Drug Class

- Rituximab

- Ofatumumab

- Obinutuzumab

- Ublituximab

- Others

- Route Of Administration

- Intravenous

- Subcutaneous

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Asia

- Rest of World (ROW)

- North America

By Product Insights

The oncology segment is estimated to witness significant growth during the forecast period. The market is primarily driven by the oncology segment due to the approval of these mAbs for treating prevalent cancer indications. Four out of five anti-CD20 mAbs are authorized for various cancer types, including non-Hodgkin's lymphoma (NHL), chronic lymphocytic leukemia (CLL), and follicular lymphoma. The high incidence and prevalence of cancer, with an estimated 20 million new cases and 9.7 million deaths in 2022 (NCI), are expected to fuel market growth. Anti-CD20 mAbs target mature and malignant B cells, macrophages, and autoimmune disorders. These mAbs are used in immunotherapy for treating B-cell malignancies and autoimmune diseases such as rheumatoid arthritis, systemic lupus erythematosus, inflammatory bowel disease, and multiple sclerosis.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our Anti-Cd20 Monoclonal Antibodies (Mabs) Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Anti-CD20 Monoclonal Antibodies (Mabs) Market?

- Increased use of combination therapies is the key driver of the market. The market is experiencing substantial growth due to the increasing utilization of combination therapies for treating various indications. Anti-CD20 mABs are the preferred choice for targeted therapy in CD20 antigen-expressing diseases across therapeutic areas like oncology, immunology, and neurology. Combination therapy is favored when monotherapy products exhibit low efficacy and poor tolerability. In the realm of comorbidity diseases, the application of anti-CD20 mABs in conjunction with other drugs is on the rise. These combination drugs target distinct pathways to combat diseases with minimal adverse effects. B-cell malignancies, autoimmune diseases such as rheumatoid arthritis, systemic lupus erythematosus, inflammatory bowel disease, multiple sclerosis, and lymphoma therapy are significant areas where anti-CD20 mABs are employed.

- The immune system, including mature B cells, malignant B cells, macrophages, and autoimmune disorders, plays a crucial role in the market's growth. The CD20 protein, found on the surface of B cells and blood plasma cells, is a critical marker for targeting these cells. Ofatumumab and Ocrelizumab are notable anti-CD20 mABs used in various therapeutic applications. Healthcare research continues to uncover new applications for anti-CD20 mABs, particularly in organ transplant recipients and immunology. Private and public sector investments in healthcare and research further fuel the market's expansion.

What are the market trends shaping the Anti-CD20 Monoclonal Antibodies (Mabs) Market?

- Increasing awareness about therapeutic areas is the upcoming trend in the market. The market is experiencing significant growth due to advancements in immunotherapy for various diseases in oncology, immunology, and neurology. B-cell malignancies, autoimmune disorders such as rheumatoid arthritis, systemic lupus erythematosus, inflammatory bowel disease, and multiple sclerosis are among the indications for anti-CD20 mABs. The epidemiology of these diseases and the increasing morbidity rates and cancer cases are driving market growth. Hospitals, specialty clinics, and ambulatory surgical centers are key end-users. The CD20 protein is a transmembrane antigen found on the surface of mature and malignant B cells, macrophages, and plasma cells. Anti-CD20 mABs work by binding to the CD20 protein, leading to cell damage and subsequent elimination.

- These drugs are used in lymphoma therapy and for organ transplant recipients to prevent graft-versus-host disease. The healthcare research sector is witnessing increased private and public sector investments in the development of new anti-CD20 mABs, such as Ofatumumab and Ocrelizumab. The CD20 marker is essential for the diagnosis and treatment of various diseases, making it a significant area of focus for research and development. The immune system plays a crucial role in maintaining health, and any disruption can lead to various disorders. Anti-CD20 mABs offer a promising solution for managing these conditions.

What challenges doesAnti-Cd20 Monoclonal Antibodies (Mabs) Market face during the growth?

- The adverse effects of anti-CD20 mABs is a key challenge affecting the market growth. The market is experiencing significant growth due to their effectiveness in treating CD20-positive diseases, including B-cell malignancies and autoimmune disorders. However, the market faces challenges from severe adverse effects associated with these therapies. For instance, Rituximab, a widely used anti-CD20 mAB, can cause chest pain, irregular heartbeats, and kidney problems. Obinutuzumab is linked to hepatitis B virus reactivation, progressive multifocal leukoencephalopathy, tumor lysis syndrome, thrombocytopenia, and hyponatremia. Ocrelizumab increases the risk of respiratory tract infections, skin infections, herpes infections, and breast cancer. These side effects have led patients to explore alternative treatment options, negatively impacting the market's growth during the forecast period.

- The anti-CD20 mABs target mature and malignant B cells, as well as macrophages, making them essential in immunology for various conditions, such as lymphoma therapy, rheumatoid arthritis, systemic lupus erythematosus, inflammatory bowel disease, multiple sclerosis, and oncology. The neuroscience and immunology sectors have also shown interest in these therapies. Despite the challenges, private and public sector investments continue to drive research and development in this field, with notable investments in Ofatumumab and Ocrelizumab. The CD20 protein is a crucial marker for identifying B cells, which are essential components of the immune system. The damage caused by these therapies to hematopoietic stem cells and plasma cells can lead to morbidity rates and cancer cases.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

Acrotech Biopharma Inc. - The company offers anti-CD20 monoclonal antibodies such as Beleodaq, Folotyn, Evomela, and Zevalin.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amgen Inc.

- AstraZeneca Plc

- Celltrion Healthcare Co. Ltd.

- F. Hoffmann La Roche Ltd.

- Fosun International Ltd.

- Genmab AS

- IGM Biosciences Inc.

- JSC BIOCAD

- LFB SA

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Spectrum Pharmaceuticals Inc.

- TG Therapeutics Inc.

- United BioPharma Inc.

- ZHEJIANG HISUN PHARMACEUTICAL Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a significant segment of the broader immunotherapy landscape, with applications in various medical fields, including but not limited to hematology and oncology, neuroscience, and immunology. These mAbs are designed to target mature and malignant B cells expressing the CD20 protein, playing a crucial role in the treatment of B-cell malignancies and autoimmune disorders. The CD20 protein is a transmembrane glycoprotein found on the surface of normal and malignant B lymphocytes, as well as macrophages. The binding of anti-CD20 mAbs to this protein facilitates various therapeutic interventions, such as cell damage, complement-dependent cytotoxicity, and antibody-dependent cellular cytotoxicity.

Moreover, the demand for anti-CD20 mAbs is driven by the increasing prevalence of B-cell malignancies and autoimmune diseases. According to healthcare research, B-cell malignancies account for approximately 20% of all hematological malignancies, with non-Hodgkin lymphoma being the most common subtype. Moreover, autoimmune diseases, such as rheumatoid arthritis, systemic lupus erythematosus, inflammatory bowel disease, and multiple sclerosis, affect millions of people worldwide, necessitating effective treatment options. The treatment landscape for B-cell malignancies and autoimmune diseases has evolved significantly in recent years, with the introduction of various anti-CD20 mAbs, including ofatumumab and ocrelizumab. These mAbs have demonstrated impressive therapeutic efficacy, leading to improved patient outcomes and reduced morbidity rates.

For instance, in oncology, anti-CD20 mAbs have become a cornerstone of lymphoma therapy, with high response rates and manageable side effects. The anti-CD20 mAbs market is influenced by various factors, including epidemiology, healthcare research, and investments in both the private and public sectors. The increasing number of cancer cases and the growing knowledge of the underlying mechanisms of autoimmune disorders have fueled significant research and development efforts in this area. Furthermore, public and private sector investments have played a crucial role in advancing the field, with notable progress In the development of novel anti-CD20 mAbs and the optimization of existing treatments.

Furthermore, in the context of organ transplantation, anti-CD20 mAbs have emerged as valuable tools for managing complications arising from the presence of donor-specific antibodies. These antibodies can lead to graft rejection, necessitating the use of immunosuppressive therapies. Anti-CD20 mAbs offer a more targeted approach, minimizing the risk of side effects associated with traditional immunosuppressive drugs. These mAbs have demonstrated impressive therapeutic efficacy in various applications, including oncology, neuroscience, and immunology, and are poised to continue shaping the future of healthcare.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

255 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.3% |

|

Market growth 2025-2029 |

USD 15.64 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.5 |

|

Key countries |

US, Canada, China, UK, Germany, Italy, India, South Korea, Japan, France, |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, Rest of World (ROW),

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch