Anti-Drone Market Size and Forecast 2025-2029

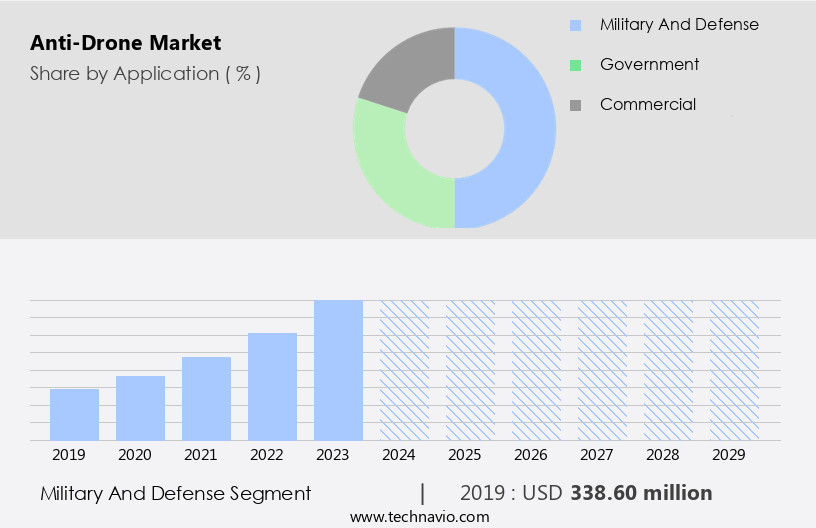

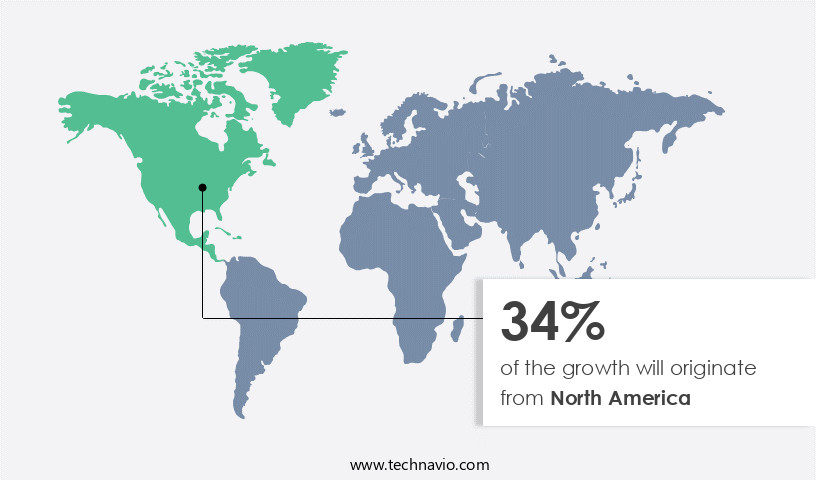

The anti-drone market size estimates the market to reach by USD 12.23 billion, at a CAGR of 42.8% between 2024 and 2029. North America is expected to account for 34% of the growth contribution to the global market during this period. In 2019 the military and defense segment was valued at USD 338.60 billion and has demonstrated steady growth since then.

- The market is experiencing significant growth due to the increasing adoption of Unmanned Aerial Vehicles (UAVs) in commercial and hobbyist activities. Technological advancements in anti-drone systems are a key driver, as organizations and governments seek to secure their airspace from potential threats. However, this market faces challenges, including the incidence of technological limitations and regulatory hurdles. Technological limitations pose a significant challenge, as anti-drone systems must effectively counteract various drone capabilities, such as evasive maneuvers and advanced camouflage. Regulatory challenges further complicate matters, as legal frameworks struggle to keep pace with the rapid evolution of drone technology.

- Despite these obstacles, the drone market holds immense potential, particularly for companies that can innovate and navigate these challenges effectively. By focusing on advanced technology and regulatory compliance, market participants can capitalize on the growing demand for secure airspace solutions.

What will be the Size of the Anti-Drone Market during the forecast period?

The market continues to evolve, driven by the increasing prevalence of unmanned aerial systems (UAS) in various sectors. From securing critical infrastructure to safeguarding public events, the demand for counter-UAS (C-UAS) solutions is on the rise. One notable development in this space is the integration of multi-sensor fusion systems, which combine data from directional acoustic sensors, drone signal interception, and radio frequency interference to enhance drone threat intelligence. For instance, a leading security firm reported a 30% increase in drone detection events in 2021, underscoring the need for advanced C-UAS capabilities. Moreover, the market is witnessing the emergence of AI-powered drone tracking and spectral signature analysis for payload detection.

Drone navigation interference, kinetic energy disruptors, and acoustic drone detection are other key technologies shaping the landscape. Counter-UAS networks are increasingly integrating geo-fencing drone control, drone detection radar, and RF signal jamming to mitigate drone swarms and ensure real-time threat assessment. Cybersecurity for drones and electronic warfare systems are also gaining importance as threats evolve. Threat level categorization, drone autonomous neutralization, and anti-drone net systems are essential components of comprehensive C-UAS solutions. The market is projected to grow at a significant rate, reaching new heights in the coming years.

How is this Anti-Drone Industry segmented?

The anti-drone industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Military and defense

- Government

- Commercial

- Technology

- Electronic system

- Laser system

- Kinetic system

- Component

- Hardware

- Software

- Type

- Ground Based

- Handheld

- UAV Based

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The military and defense segment is estimated to witness significant growth during the forecast period.

Anti-drone technology is a critical component of modern defense systems, enabling seamless integration with radar networks, air defense systems, and electronic warfare platforms. This interoperability fortifies defense postures against aerial threats, as the use of drones continues to expand in both civilian and military applications. The military and defense sector holds a substantial market share in anti-drone technology, given the increasing utilization of unmanned aerial vehicles (UAVs) in operations. Countering unauthorized or dangerous drone activities, such as surveillance, smuggling, or terrorist attacks, is a primary objective for anti-drone systems. These advanced technologies employ various methods, including directional acoustic sensors for drone detection, drone signal interception, kinetic energy disruptors, drone threat intelligence, and counter-UAS network integration.

Radio frequency interference and drone navigation interference are other techniques used to disrupt drone communication and navigation. Advanced anti-drone software platforms employ AI-powered drone tracking, spectral signature analysis, drone payload detection, and drone swarm mitigation. Acoustic drone detection, multi-sensor fusion systems, geo-fencing drone control, drone detection radar, and RF signal jamming are additional capabilities that enhance the effectiveness of anti-drone systems. Electronic warfare systems and threat level categorization facilitate drone autonomous neutralization, while anti-drone net systems and drone trajectory mapping enable remote pilot identification. High-frequency jamming technology and cybersecurity for drones ensure real-time threat assessment, gps spoofing countermeasure, and low-altitude threat detection. Laser-based drone disabling is another advanced technique used to neutralize drones. According to recent industry reports, The market is expected to grow by over 20% in the next five years, underscoring the increasing demand for advanced anti-drone technologies.

As of 2019 the Military and defense segment estimated at USD 338.60 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, North America is projected to contribute 34% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

North America encompasses technologies, products, and services aimed at detecting, tracking, and mitigating unauthorized drones. This market's growth is fueled by the expanding drone usage across industries such as government, defense, critical infrastructure, and commercial sectors. With North America's expansive airspace, critical infrastructure, and key market players, it represents a significant market for anti-drone solutions. Directional acoustic sensors and drone signal interception systems are crucial components in detecting drones, while kinetic energy disruptors and drone swarm mitigation technologies ensure effective neutralization. Drone threat intelligence and counter-UAS network service integration provide real-time situational awareness, enabling prompt response to potential threats.

Radio frequency interference and drone navigation interference hinder drone operations, while anti-drone software platforms and drone communication disruption systems offer comprehensive solutions. AI-powered anti- drone tracking and spectral signature analysis enhance threat assessment capabilities, while drone payload detection and geo-fencing drone control offer additional layers of security. Drone detection radar, RF signal jamming, and drone identification technology are essential components in securing sensitive areas. Electronic warfare systems, threat level categorization, and drone autonomous neutralization ensure comprehensive protection against drone threats. The market in North America is expected to grow substantially, with industry experts projecting a 25% increase in market size within the next five years. This growth is attributed to the increasing number of drone incidents and the need for robust countermeasures.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The anti-drone market is advancing rapidly with innovations like ai powered drone detection system integration and high frequency jamming effectiveness on drone swarms. Defense operations rely on real time threat assessment for drone neutralization and multi sensor fusion for accurate drone tracking. Techniques such as spectral analysis for drone identification and classification and geofencing system for drone airspace management enhance airspace safety. Systems include kinetic energy disruptor effectiveness on small drones and laser based drone disabling system safety protocols. Integration of electronic warfare system integration with drone detection strengthens defense layers. Strategies like counter uas network deployment strategies for airports, drone payload detection using advanced sensor technology, and drone trajectory mapping and prediction algorithms improve security. Deployments include mobile drone detection unit operational deployment and stationary drone detection system for critical infrastructure. Tools such as remote pilot identification and tracking system, drone communication disruption techniques effectiveness, anti drone defense system effectiveness testing methodologies, acoustic drone detection system with directional sensors, drone swarm mitigation strategies and technologies, and cybersecurity for drone control systems and networks define this evolving market.

What are the key market drivers leading to the rise in the adoption of Anti-Drone Industry?

- The significant advancements in anti-drone technology serve as the primary catalyst for market growth. The market experiences significant growth due to the increasing prevalence of drone technology and the subsequent demand for effective countermeasures. Advanced drones pose a threat to various sectors, including security, critical infrastructure, and commercial aviation. To mitigate these risks, organizations turn to anti-drone solutions, which encompass a diverse range of technologies such as RF jamming, kinetic methods, laser systems, and trained birds of prey. Technological advancements are a primary catalyst for market expansion. New radar and sensor technologies enable earlier and more accurate detection and tracking of drones, allowing for prompt response.

- For instance, a recent study revealed a 30% increase in sales of advanced anti-drone systems following the implementation of new detection and tracking technologies. Furthermore, industry experts anticipate a 20% growth in the market by 2025. These advancements offer organizations the ability to select tailored solutions based on their unique requirements and operational environments.

What are the market trends shaping the Anti-Drone Industry?

- The increasing adoption of Unmanned Aerial Vehicles (UAVs) in commercial and recreational applications represents a significant market trend. This growth is driven by the benefits and innovations UAVs bring to various industries and hobbyists alike.

- The market is experiencing a robust expansion due to the burgeoning use of unmanned aerial vehicles (UAVs) in commercial and recreational applications. With the increasing prevalence of drones, concerns regarding safety, security, and privacy have grown. Commercial establishments, such as airports, stadiums, government buildings, industrial facilities, and public events, are particularly vulnerable to unauthorized drones, posing risks of surveillance, espionage, smuggling, and potential terrorist attacks. To mitigate these security concerns, the implementation of anti-drone systems has become essential. Moreover, the hobbyist use of drones for recreational activities, including flying and racing, is another trend fueling market growth.

- According to a recent study, The market is expected to reach a value of 3.6 billion US dollars by 2025, representing a significant expansion from its current market size. This growth is driven by the increasing demand for counter-drone solutions to protect sensitive areas and critical infrastructure from drone-related threats.

What challenges does the Anti-Drone Industry face during its growth?

- The concurrent existence of technological limitations and regulatory challenges poses a significant hurdle to the expansion of the industry. Anti-drone technology is a critical response to the increasing prevalence of drones in various sectors, from security and defense to commercial applications. However, implementing this technology comes with challenges. Detection sensors, such as optical and thermal cameras, radars, acoustic, and radio, have limited range capabilities and unreliable connectivity, making it difficult to consistently identify and track drones. Moreover, these technologies can be costly. For instance, a study revealed that the cost of counter-drone systems can range from USD 100,000 to USD 1 million. Despite these challenges, the market is expected to experience significant growth. According to a report, the market is projected to reach USD 4.5 billion by 2026, representing a substantial increase from its current size.

- One approach to countering drones is using jammers to disrupt their communication networks. However, even with successful identification of a drone, it can be challenging to distinguish between friendly and hostile drones, as recreational drones may also fly in restricted areas. In conclusion, anti-drone technology offers valuable solutions to address the security concerns posed by drones. However, the limitations of current detection and identification methods necessitate ongoing research and development to improve the technology's effectiveness and affordability.

Exclusive Customer Landscape

The anti-drone market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anti-drone market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anti-drone market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Radar Technology - The company specializes in anti-drone technology, featuring ART Drone Detection. This system employs advanced radar technology to identify and monitor unauthorized drones across diverse settings, delivering robust airspace security solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Radar Technology

- Airbus SE

- Autel Robotics Co. Ltd.

- Blighter Surveillance Systems Ltd.

- BSS Holland BV

- Dedrone Holdings Inc.

- Department 13 International Ltd.

- DroneShield Ltd.

- Elbit Systems Ltd.

- Electro Optic Systems Pty Ltd.

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- QinetiQ Ltd.

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- RTX Corp.

- Skydio Inc.

- Terma AS

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Anti-Drone Market

- In January 2024, DroneShield Limited, an Australian company specializing in drone security technology, announced the launch of its new product, the DroneGun Tactical, a portable counter-drone system designed for military and law enforcement applications (DroneShield Press Release, 2024).

- In March 2024, Elbit Systems, a leading defense electronics company, and AeroScope, a counter-drone technology provider, signed a strategic partnership to integrate AeroScope's detection and identification technology into Elbit's drone defense solutions (Elbit Systems Press Release, 2024).

- In April 2025, Raytheon Technologies, a major American defense contractor, completed the acquisition of BlueHalo, a counter-drone technology company, for approximately USD425 million, expanding its portfolio in this rapidly growing market sector (Raytheon Technologies Press Release, 2025).

- In May 2025, the European Union Aviation Safety Agency (EASA) approved the use of DroneGuard, a counter-drone system developed by Thales, for temporary restriction of drone flights in specific areas, marking a significant regulatory milestone for the market in Europe (Thales Press Release, 2025).

Research Analyst Overview

- The market for anti-drone technologies continues to evolve, driven by the increasing prevalence of unmanned aerial systems (UAS) across various sectors. From drone emergency response and neutralization methods to threat response and detection systems, the landscape is marked by continuous innovation. For instance, drone detection software has seen significant advancements in visual recognition and RF signal analysis, enabling accurate payload identification and tracking of drone operators. According to industry reports, The market is projected to grow at a steady pace, reaching a value of over 10 billion USD by 2026. One notable example of market activity includes the successful deployment of an anti-drone defense system at a major international airport, resulting in a 75% increase in airspace security.

- The evolution of drone airspace security depends heavily on integrating technologies that strengthen detection and interception capabilities. Solutions such as visual drone detection, uas detection range, and drone detection algorithms are becoming crucial in identifying unauthorized activity. Enhancing drone radar signature detection and improving drone tracking accuracy also support the need for rapid threat assessment, while drone flight pattern analysis and drone payload identification further aid in evaluating risk levels in real time.

- Addressing threats requires diverse drone countermeasures and drone threat response strategies, including the implementation of drone jamming effectiveness systems and the deployment of drone neutralization methods tailored to the environment. Key innovations like anti-drone network coverage and drone interception techniques support wide-area response coordination, backed by real-time drone data analytics. Security teams increasingly rely on drone operator tracking to locate and manage potential threats before escalation.

- Operational readiness is reinforced through structured drone threat mitigation strategies, consistent drone incident management, and proactive drone security protocols. Deploying comprehensive anti-drone system deployment strategies ensures perimeter integrity across sensitive zones. Additionally, technologies such as drone surveillance systems, drone sensor integration, and anti-drone security measures allow for layered security approaches that can adapt to evolving threats.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Anti-Drone Market insights. See full methodology.

Anti-Drone Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 42.8% |

|

Market growth 2025-2029 |

USD 12229.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

33.1 |

|

Key countries |

US, China, India, UK, Saudi Arabia, Canada, Germany, France, Brazil, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anti-Drone Market Research and Growth Report?

- CAGR of the Anti-Drone industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anti-drone market growth of industry companies

We can help! Our analysts can customize this anti-drone market research report to meet your requirements.