Anti-Slip Coatings Market Size 2024-2028

The anti-slip coatings market size is forecast to increase by USD 21.7 million at a CAGR of 3.15% between 2023 and 2028. The market is witnessing significant growth due to the increasing demand for safety in various industries such as offices, restaurants, warehouses, and marine decks. Epoxy resin-based anti-slip coatings are gaining popularity due to their durability and effectiveness. However, the market faces challenges from volatile organic compounds (VOC) emissions, which are a concern for environmental regulations. Consolidation through mergers and acquisitions is a trend in the market as companies seek to expand their product offerings and geographical reach. IThese coatings offer a high coefficient of friction, making them ideal for preventing slips and falls on surfaces like concrete, stone, and wood. n the aerospace and industrial equipment sectors, anti-slip coatings are essential for ensuring safety and compliance with regulations. Despite these growth factors, the market faces stiff competition from alternative solutions such as textured paints and grit-blasted surfaces.

What will be the Size of the Market During the Forecast Period?

The market is a significant industry that caters to the demand for safety solutions in various sectors. These coatings play a crucial role in reducing the risk of slips and falls, particularly in industrial facilities and public places. Flooring surfaces are a common cause of accidents, especially in environments with heavy foot traffic or wheeled vehicles. Anti-slip coatings provide an essential layer of protection against such incidents. The coatings are available in various types, including water-based and solvent-based, each with its unique advantages. Safety regulations mandate the use of anti-slip coatings in industrial facilities to ensure a safe working environment.

Moreover, these coatings help prevent workplace accidents, which can lead to significant downtime and financial losses. Moreover, they are increasingly being adopted in public places, such as schools, hospitals, and shopping malls, to ensure the safety of pedestrians. Water-based anti-slip coatings are gaining popularity due to their low VOC (Volatile Organic Compounds) content. They offer the same level of safety as solvent-based coatings but with the added benefit of being environmentally friendly. These coatings are suitable for various applications, including roofing and siding, where water repellency is essential. The market also caters to the needs of industries that deal with corrosive chemicals, acids, and alkalis.

Furthermore, these coatings offer resistance to such substances, ensuring the safety of workers and extending the life of the flooring. Slips and falls can occur due to various reasons, including wet floors, uneven surfaces, and oil spills. Anti-slip coatings provide a textured surface that enhances traction, reducing the risk of accidents. They are effective in preventing slips and falls in both indoor and outdoor environments, making them an essential safety solution for various industries. In conclusion, the market is an essential industry that provides safety solutions for various sectors. These coatings help prevent slips and falls, ensuring the safety of workers and pedestrians.

Market Segmentation

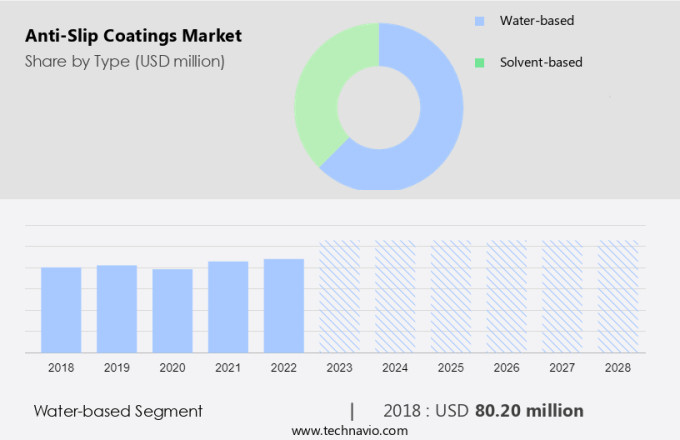

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Water-based

- Solvent-based

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

The water-based segment is estimated to witness significant growth during the forecast period. Water-based anti-slip coatings are a popular choice for enhancing safety in various industries and commercial establishments, such as offices, restaurants, and warehouses. The quick-drying, semi-gloss finish adds an attractive appearance to the coated areas. Moreover, water-based anti-slip coatings are in compliance with safety regulations due to their low Volatile Organic Compound (VOC) content. With over 80% water in their formulation, these coatings have minimal solvents, typically below 10%, which meets VOC-related regulations. This feature reduces health concerns compared to solvent-based coatings.

Furthermore, the versatility of water-based anti-slip coatings extends to various applications, including factory floors, ramps, walkways, and warehouse floors. Their excellent impact resistance and non-toxic nature make them suitable for use in industries such as marine decking, aerospace, and industrial equipment manufacturing. By choosing water-based anti-slip coatings, businesses prioritize safety while adhering to regulatory requirements.

Get a glance at the market share of various segments Request Free Sample

The water-based segment was valued at USD 80.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the Asia Pacific (APAC) region, the market for functional anti-slip coatings is experiencing significant growth due to their essential role in preventing slips and falls in various industries. These coatings, which include PE coatings and functional water-based coatings, are widely used in applications such as plastic film lamination for pharmaceuticals, cosmetics, and food packaging. The importance of safety in industries like construction, automobile, and chemical manufacturing has led to a high demand for these coatings, which offer superior strength, durability, and a high coefficient of friction. Countries like China, India, Indonesia, the Philippines, Japan, and Australia are major consumers of anti-slip coatings due to the increasing number of commercial and residential construction projects and investments in infrastructure development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for anti-slip coatings in APAC is the key driver of the market. The market is experiencing significant expansion in various sectors, particularly in public places and residential buildings. The importance of safety and prevention of slips and falls has led to the increased adoption of these coatings. Anti-slip coatings offer water repellency, making them ideal for wet surfaces in public areas such as swimming pools, showers, and water parks.

Additionally, their acid resistance, alkalis resistance, and corrosive chemicals resistance make them suitable for industrial applications, including car parking areas and sports grounds. In the construction industry, anti-slip coatings are used for floor marking and in the marine industry for boat decks, ramps, and walkways due to their high strength and excellent resistance to abrasion and harsh chemicals. Anti-slip coatings provide a cost-effective solution for enhancing safety and reducing the risk of accidents. With the increasing focus on safety and the growing demand for durable and chemical-resistant coatings, the market for anti-slip coatings is expected to continue its growth trajectory.

Market Trends

Market consolidation through merger and acquisition is the upcoming trend in the market. The market witnesses continuous growth as companies adopt mergers and acquisitions (M&A) to expand their reach and enhance their product portfolios. In June 2022, Sherwin-Williams finalized the acquisition of Gross & Perthun GmbH, broadening its product offerings and providing access to innovative technologies. This strategic move is expected to strengthen Sherwin-Williams' position in the market and expand its distribution network in North America. Similarly, in August 2021, Sherwin-Williams acquired Sika AG's industrial coating business, aiming to streamline assets and boost production efficiency through the utilization of resources such as machinery and equipment. These strategic acquisitions underscore the competitive landscape of the market, with key players seeking to fortify their market presence and capitalize on emerging opportunities.

Market Challenge

The high threat of substitutes is a key challenge affecting the market growth. The market for anti-slip coatings in the United States is witnessing significant growth due to the increasing demand for safety measures on stairs, workshop floors, and scaffolds. Anti-slip panels, a type of anti-slip coating, are gaining popularity as they offer superior traction and durability. These panels are installed on existing slippery floors to prevent accidents caused by slips and falls. The benefits of anti-slip panels include excellent water resistance, ease of installation, electrical insulation, and chemical resistance, making them suitable for various applications in construction and marine industries. Two commonly used materials for manufacturing anti-slip panels are reinforced plastic (FRP) and glass-fiber reinforced plastic (GRP).

These materials provide enhanced durability and strength, making the panels ideal for heavy-duty use. Furthermore, the ease of cleaning and high scratch resistance of anti-slip panels have contributed to their increasing popularity. Overall, the demand for anti-slip coatings, particularly anti-slip panels, is expected to continue growing due to their essential role in ensuring safety and preventing accidents.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers anti-slip tapes and treads 600 series for heavy shoe traffic areas.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Akzo Nobel NV

- Amstep Products

- Anti Slip Anywhere

- Axalta Coating Systems Ltd.

- Diamond Safety Concepts

- Halo Surfaces International Ltd

- Hempel AS

- Illinois Tool Works Inc.

- Industrial Applications Inc

- Lysis Technologies Ltd

- No Skidding Products Inc

- PPG Industries Inc.

- Randolph Products Co

- RPM International Inc.

- Safemate Anti Slip

- SkidProof Ltd

- Ter Group

- The Sherwin Williams Co.

- Wooster Products Inc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Anti-slip coatings are essential for ensuring safety in various industries and applications. These coatings provide enhanced traction on flooring surfaces, reducing the risk of slips and falls, especially in industrial facilities, manufacturing plants, offices, restaurants, and warehouses. The market for anti-slip coatings is diverse, catering to different industries and applications. Epoxy resin, polyurethane, polyaspartic, acrylic, water-based, and solvent-based are some of the popular types of anti-slip coatings. Industrial equipment, marine decks, aerospace, and safety regulations are significant end-users of anti-slip coatings. Anti-slip coatings are also used in roofing and siding, antibacterial tiles, water-based adhesives, and functional water-based coatings. Topshield, PE coatings, plastic film lamination, and pharmaceuticals, cosmetics, and food packaging are other emerging applications.

Furthermore, anti-slip coatings offer various benefits, including water repellency, acid resistance, alkalis resistance, and corrosive chemicals resistance. They are suitable for car parking areas, sports grounds, floor marking, stairs, workshop floors, scaffolds, and anti-slip panels. Anti-slip coatings are crucial for ensuring workplace safety in industries with heavy wheeled traffic and pedestrian footfall. Water-based anti-slip coatings have gained popularity due to their low VOC content, making them an eco-friendly alternative to solvent-based coatings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.15% |

|

Market growth 2024-2028 |

USD 21.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.01 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 38% |

|

Key countries |

China, US, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Akzo Nobel NV, Amstep Products, Anti Slip Anywhere, Axalta Coating Systems Ltd., Diamond Safety Concepts, Halo Surfaces International Ltd, Hempel AS, Illinois Tool Works Inc., Industrial Applications Inc, Lysis Technologies Ltd, No Skidding Products Inc, PPG Industries Inc., Randolph Products Co, RPM International Inc., Safemate Anti Slip, SkidProof Ltd, Ter Group, The Sherwin Williams Co., and Wooster Products Inc |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch