Antioxidant Market Size 2024-2028

The antioxidant market size is forecast to increase by USD 1.50 billion at a CAGR of 6.4% between 2023 and 2028. The market is experiencing significant growth due to the increasing global population and rising demand for processed foods. The manufacturing facilities for antioxidants are facing challenges from supply chain disruptions and trade barriers. To mitigate these issues, strategic alliances and collaborations are being formed to ensure a steady supply of antioxidants. The market is also witnessing a trend towards the production of antioxidant-enriched cosmetic products and anti-aging products, further boosting market growth. In addition, the use of antioxidants in personal care products is becoming more prominent, as consumers seek skincare solutions that offer anti-aging benefits and promote overall skin health. Moreover, antioxidants are increasingly being incorporated into plastic additives, contributing to the development of more durable and longer-lasting plastic products. Despite these opportunities, the high cost of antioxidants remains a significant challenge for market participants. In summary, the market is witnessing growth due to increasing demand from various industries, including personal care and plastic additives, as well as new extraction techniques, but is facing challenges from supply chain disruptions and high costs.

What will be the Size of the Market During the Forecast Period?

Antioxidants are substances that inhibit or neutralize the damaging effects of free radicals, unstable molecules formed during an oxidation process. These reactive species can cause harm to organisms' cells, leading to various health issues and food spoilage. Free radicals are naturally produced in the body during metabolic processes, but they can also originate from external sources such as pollution, UV radiation, and certain foods. In the food industry, antioxidants play a crucial role in preserving the quality and extending the shelf life of various products. Fruits and vegetables are rich sources of natural antioxidants, including vitamin C, vitamin E, polyphenols, carotenoids, and flavonoids. Raspberries, spinach, and eggplant are some examples of nutrient-dense produce that offer significant antioxidant benefits. However, the demand for antioxidants extends beyond fresh produce. Artificially produced antioxidants are used as additions in processed food, fuel, plastics, latex, pharmaceutical items, cosmetic products, and animal feeds. In the food and beverages sector, antioxidants act as preservatives, preventing oxidation and rancidity that can lead to food waste.

Vitamin C-based, vitamin E-based, polyphenols-based, carotenoids-based, and nutraceutical antioxidants are popular choices for food manufacturers. The antioxidants market is driven by the growing awareness of their health benefits and the increasing demand for extended shelf life and reduced food waste. The market is expected to grow significantly due to the expanding application areas and the continuous research and development in antioxidant technology. In conclusion, antioxidants are essential in preventing oxidation and protecting organisms' cells from damage. Their role goes beyond fresh produce, extending to various industries such as food and beverages, pharmaceuticals, cosmetics, and more. Natural antioxidants derived from fruits, vegetables, and other sources continue to be in high demand, while synthetic antioxidants offer solutions for specific applications where natural alternatives may not suffice. The antioxidants market is poised for growth as the demand for extended shelf life, reduced food waste, and health benefits continues to increase.

Market Segmentation

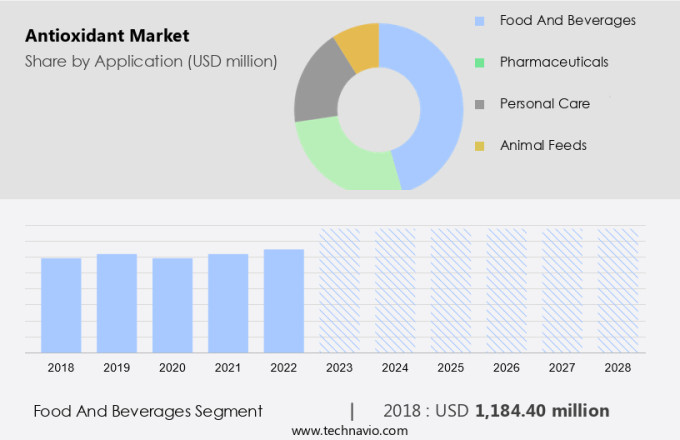

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food and beverages

- Pharmaceuticals

- Personal care

- Animal feeds

- Type

- Vitamin C-based

- Vitamin E-based

- Polyphenols-based

- Carotenoids-based

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Application Insights

The food and beverages segment is estimated to witness significant growth during the forecast period. Antioxidants play a significant role in the food and beverage industry, serving both nutritional and functional purposes. These compounds help prevent food deterioration, which can lead to spoilage and undesirable flavors, primarily due to oxidation. In response, antioxidants are extensively used to inhibit oxidation and extend the shelf life of various food products. For instance, BHA (butylated hydroxyanisole), BHT (butylated hydroxytoluene), and TBHQ (tertiary butylhydroquinone) are commonly used antioxidants in beverages to maintain their freshness.

However, processed food and beverages require added antioxidants to extend their shelf life and maintain desirable taste and texture. Antioxidants, such as BHA (butylated hydroxyanisole), BHT (butylated hydroxytoluene), and TBHQ (tertiary butylhydroquinone), are widely used in the food and beverage industry to inhibit oxidation. For instance, raspberries and spinach are naturally rich in antioxidants, but added antioxidants help preserve the quality of beverages like fruit juices and carbonated drinks. By preventing oxidation, antioxidants ensure that food and beverages maintain their freshness, flavor, and nutritional value for an extended period.

Get a glance at the market share of various segments Request Free Sample

The Food and beverages segment accounted for USD 1.18 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

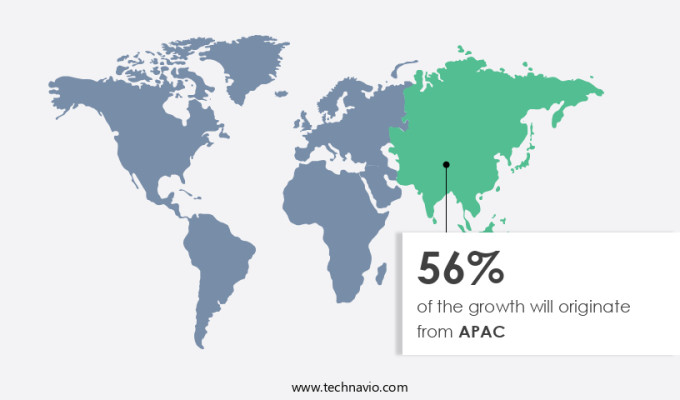

APAC is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market experienced significant growth in 2023, with Asia Pacific (APAC) leading the charge. This region held the largest market share and is projected to expand at the fastest rate during the forecast period. Factors contributing to this growth include the increasing disposable incomes of consumers and the rising population of elderly individuals in APAC. In this region, there is a high demand for antioxidant-based food and beverages, animal feeds, and nutraceutical products. For instance, there is a strong preference for antioxidant-infused skincare products, such as skin whitening creams and anti-aging serums, due to growing consumer awareness about personal hygiene and wellness.

Additionally, the increasing geriatric population in economies like China, Japan, and South Korea has fueled the demand for sun protection products that contain antioxidants. Polyphenols, vitamin C, vitamin E, carotenoids, and other nutraceutical antioxidants are widely used in various industries, including food and beverages, animal feeds, and pharmaceuticals, to enhance product quality and shelf life. As the demand for clean label products continues to rise, there is a growing focus on natural antioxidant sources, such as plant extracts and natural vitamins. Overall, the market is expected to continue its expansion in the coming years, driven by increasing consumer awareness, growing demand for functional foods and beverages, and the rising geriatric population.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising demand from personal care industry is the key driver of the market. Antioxidants, primarily derived from natural sources, play a crucial role in neutralizing free radicals that can cause oxidative stress. Free radicals, formed due to various factors such as sunlight, pollution, environmental toxins, tobacco use, and stress, can damage the skin's structure and genetic material, leading to inflammation, hyperpigmentation, acne, and cell damage, ultimately resulting in wrinkles. To combat this, antioxidants work by scavenging free radicals, preventing them from causing further cell damage. These antioxidants, including vitamin C, help correct signs of aging, repair skin, and brighten skin tone.

Additionally, they can stimulate collagen production, which is essential for maintaining youthful-looking skin. In various industries, antioxidants are used as additives in the defense and aerospace sectors as fuel and plastic additives, and in cosmetic products to enhance their effectiveness.

Market Trends

The rising adoption of new extraction techniques of antioxidants is the upcoming trend in the market. Antioxidants, derived from natural resources, have gained significant attention in various industries due to their beneficial properties. Extraction of these antioxidants, particularly Vitamin A, from natural sources is increasingly preferred over synthetic methods. New techniques, referred to as non-conventional extraction methods, are being adopted to improve the efficiency and sustainability of the extraction process.

These techniques include ultrasound-assisted extraction, pulsed electric field extraction, enzyme-assisted extraction, microwave-assisted extraction, pressurized liquid extraction, supercritical fluid extraction, pressurized low-polarity water extraction, and molecular distillation. These methods offer advantages such as reduced processing time and energy consumption, elimination of harmful solvents, and increased yield. Organic cosmetics and health food industries are major consumers of antioxidants, making the market for these natural extracts a promising one.

Market Challenge

The high cost of antioxidants is a key challenge affecting the market growth. Antioxidants are essential compounds used in various industries, including food and cosmetics, to extend the shelf life and enhance the quality of products. However, the global population's increasing demand for processed foods and antioxidant-enriched cosmetics and anti-aging products puts pressure on the supply chain, leading to potential disruptions and trade barriers. For instance, tocopherol, a popular antioxidant derived from vegetable oil, faces production challenges due to the high demand for vegetable oil in multiple industries.

The limited supply of vegetable oil, used as the raw material for tocopherol production, drives up its cost and, consequently, the cost of antioxidants. Strategic alliances between manufacturing facilities and suppliers can help mitigate these challenges and ensure a stable supply of antioxidants.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Adisseo Co. - The company offers antioxidants such as Selisseo.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3V Sigma USA Inc.

- ADEKA Corp

- Archer Daniels Midland Co.

- Barentz International BV

- BASF SE

- Beijing Tiangang Auxiliary Co. Ltd.

- BIOTECNOLOGIAS APLICADAS SL

- Cargill Inc.

- Chitec Technology Co. Ltd.

- Clariant AG

- Double Bond Chemical Ind. Co. Ltd.

- Dover Chemical Corp.

- DuPont de Nemours Inc.

- Eastman Chemical Co.

- Everspring Chemical Co. Ltd.

- Evonik Industries AG

- IMCD NV

- Kalsec Inc.

- Kemin Industries Inc.

- Koninklijke DSM NV

- Oxiris Chemicals SA

- SI Group Inc.

- Solvay SA

- Taiwan Dyestuffs and Pigments Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The antioxidants market encompasses the production and consumption of various antioxidants used in different industries. Antioxidants are substances that prevent or slow down the oxidation process in organisms' cells. Oxidation is a natural process that results in the formation of free radicals, which can damage cells and lead to various health issues. Fruits and vegetables are rich sources of natural antioxidants such as vitamin C, vitamin E, carotenoids, and polyphenols. Raspberries, spinach, and eggplant are some of the foods known for their high antioxidant content. However, antioxidants are also artificially produced and used as additions in processed food, preservatives in fuels, plastics, and latex, and as ingredients in the pharmaceutical and cosmetic industries. Natural antioxidants like vitamin C and vitamin E are popular in the food antioxidants market, while synthetic antioxidants like butylated hydroxyanisole (BHA), butylated hydroxytoluene (BHT), and propyl gallate are widely used in various industries.

Further, antioxidants offer numerous health benefits, including extending shelf life, reducing food waste, and enhancing the nutritional value of food and beverages, animal feeds, and vitamin-based products. The global population's increasing demand for clean label products and the growing awareness of the health benefits of antioxidants are driving the market's growth. The market also caters to the defense and aerospace sectors, where antioxidants are used as fuel and plastic additives, and in the production of antioxidant-enriched cosmetics and anti-aging products. The market's growth is, however, challenged by supply chain disruptions, trade barriers, and strategic alliances among market players.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2024-2028 |

USD 1.50 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.6 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 56% |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3V Sigma USA Inc., ADEKA Corp, Adisseo Co., Archer Daniels Midland Co., Barentz International BV, BASF SE, Beijing Tiangang Auxiliary Co. Ltd., BIOTECNOLOGIAS APLICADAS SL, Cargill Inc., Chitec Technology Co. Ltd., Clariant AG, Double Bond Chemical Ind. Co. Ltd., Dover Chemical Corp., DuPont de Nemours Inc., Eastman Chemical Co., Everspring Chemical Co. Ltd., Evonik Industries AG, IMCD NV, Kalsec Inc., Kemin Industries Inc., Koninklijke DSM NV, Oxiris Chemicals SA, SI Group Inc., Solvay SA, and Taiwan Dyestuffs and Pigments Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch