APAC Contract Logistics Market Size 2024-2028

The APAC contract logistics market size is forecast to increase by USD 53.9 billion at a CAGR of 8.08% between 2023 and 2028. The market is experiencing significant growth, driven by the wave of digital consumers and the emergence of e-commerce in the region. This trend is leading to increased demand for logistics operators to manage space inventory and manpower resources to meet the needs of occupiers. The use of big data analytics is also becoming more prevalent in the industry, enabling logistics providers to optimize their logistics assets and improve operational efficiency. However, the market faces challenges such as competition, rent growth, and structural undersupply of quality assets. These factors are contributing to a tight market, with occupiers expressing positive sentiments towards investing in logistics real estate to secure their supply chains. Despite these challenges, the market is expected to continue growing, driven by the region's burgeoning e-commerce sector.

The market is experiencing significant growth, driven by the region's strong GDP growth and the establishment of manufacturing hubs in emerging economies. The manufacturing output of motor vehicles, electronics, and consumer retail sectors is fueling the demand for efficient and reliable logistics solutions. The integration of AI, cloud computing, and machine learning technologies is revolutionizing the industry, enabling real-time tracking, predictive maintenance, and optimized distribution channels. Major players in the market include Cainiao Network, Alibaba Holding, Deutsche Post E-commerce, and others. The automotive industry is a key contributor, with Intel and other tech giants leveraging advanced logistics solutions to streamline their supply chains.

Further, the RCEP agreement, CNY road initiative, and the post-e-commerce sector are also catalysts for market growth. Macroeconomic upheavals, inflation levels, and rate hikes pose challenges, but the industry's resilience and adaptability ensure continued expansion. Industry 4.0 technologies and the ASEAN market's increasing importance further underscore the market's potential.

Market Segmentation

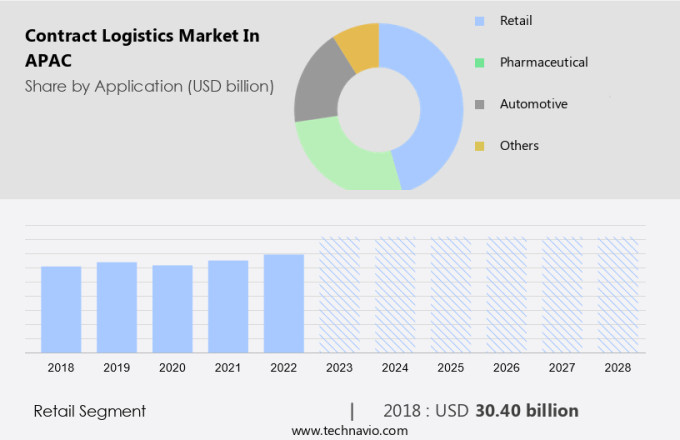

The market research report provides comprehensive data, with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Retail

- Pharmaceutical

- Automotive

- Others

- Type

- Outsourcing

- Insourcing

By Application Insights

The retail segment is estimated to witness significant growth during the forecast period. In the Asia Pacific (APAC) region, the contract logistics market is witnessing significant expansion due to the increasing customer demand for seamless and efficient delivery solutions. The retail sector, which comprises consumer goods, clothing and accessories, pharmacies and drugs, food and beverage stores, electronics and appliances, furniture, and more, is a major contributor to this growth. E-commerce retail, in particular, is experiencing a swell in popularity, necessitating the use of various transportation modes, such as rail, air, water, and roadways, for product distribution. This expansion is attributed to the burgeoning e-commerce industry and escalating government investments in logistics infrastructure.

Furthermore, the rise of digital sales channels in APAC, fueled by the adoption of multiple payment facilities like mobile wallets and net banking, is driving retail sales growth.

Get a glance at the market share of various segments Request Free Sample

The retail segment accounted for USD 30.40 billion in 2018 and showed a gradual increase during the forecast period.

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growth in the e-commerce market in APAC is the key driver of the market. The market is experiencing significant growth due to the increasing e-commerce sales and the resulting demand for efficient and reliable logistics services. E-commerce sales accounted for 13% of total sales during this period. In response to changing consumer behavior and the shift towards e-retailing, contract logistics providers are investing in advanced technologies such as AI, cloud computing, and machine learning to enhance their service offerings. The adoption of these technologies is enabling improved supply chain visibility, faster delivery times, and more accurate inventory management.

Furthermore, the establishment of manufacturing hubs in APAC, particularly in countries like China, India, and Vietnam, is contributing to the growth of the contract logistics market in the region. The manufacturing output in these countries has been increasing due to their strategic locations along the Belt and Road Initiative and their competitive labor costs. Contract logistics providers are providing services for various industries, including motor vehicles, to ensure timely and cost-effective transportation and distribution of goods.

Market Trends

The emergence of big data analytics is the upcoming trend in the market. Contract logistics companies in APAC are utilizing big data analytics to extract valuable insights from extensive data sets, thereby gaining a competitive edge in the industry. By integrating big data analytics solutions, logistics firms can derive insights to fuel strategic initiatives, including tailoring services, expediting market demand, and adopting a flexible business model. However, the implementation of big data analytics in the logistics sector is still in its infancy due to substantial IT disparities. Big data analytics holds immense potential in enhancing operational efficiency and enhancing customer experience within the logistics industry. It enables the optimization of essential activities, such as resource utilization, delivery time, and geographical coverage.

Additionally, the application of advanced technologies like AI, cloud computing, and machine learning in contract logistics is increasingly gaining traction, with motor vehicle manufacturing hubs in APAC, such as China and India, leading the charge. The region's vigorous GDP growth and expanding manufacturing output make it an attractive market for contract logistics companies to invest in and innovate.

Market Challenge

Increased lead time and supply-demand imbalance is a key challenge affecting market growth. The APAC Contract Logistics Market has experienced challenges due to the global impact of the pandemic on supply chain operations. Disruptions in logistics distribution networks have arisen from the supply-demand imbalance, insufficient last-mile fulfillment services, and labor shortages. Domestic transportation services have also been affected by pandemic-induced restrictions, leading to an imbalance between incoming and outgoing freight in restricted areas. Contract logistics providers have encountered complications due to evolving regulations in various APAC states and countries, resulting in extended lead times. Manufacturers have also experienced increased lead times due to raw material shortages, limited workforces, and lockdowns related to the pandemic.

Further, the emerging manufacturing hubs in APAC, including those in the Belt and Road Initiative, continue to drive manufacturing output growth. Advancements in technology, such as AI, cloud computing, and machine learning, are being integrated into logistics operations to optimize processes and increase efficiency. The motor vehicle industry, a significant contributor to the APAC economy, is also leveraging these technologies to streamline logistics and improve supply chain resilience. According to recent GDP growth projections, APAC is expected to recover and maintain a strong economic position in the coming years.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

CEVA Logistics: The company offers contract logistics solutions such as assembly, asset disposal scrap, and consumables management.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BCR Australia Pty Ltd.

- C H Robinson Worldwide Inc.

- CJ Logistics Corp.

- DB Schenker

- Deutsche Post AG

- DSV AS

- GEODIS

- Gulf Agency Co. Ltd.

- Hellmann Worldwide Logistics SE and Co KG

- Hitachi Transport System Ltd.

- Kuehne Nagel Management AG

- Lexzau Scharbau GmbH and Co. KG

- PT. Cipta Mapan Logistik

- Rhenus SE and Co. KG

- SF Express Co. Ltd.

- Silk Contract Logistics Pty Ltd.

- Toll Holdings Ltd.

- United Parcel Service Inc.

- Yamato Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing a ripple in activity due to the region's emerging manufacturing hubs and strong GDP growth. The manufacturing output of sectors such as automotive, electronics, medicine, and consumer retail is driving the demand for efficient and reliable logistics solutions. The integration of AI, cloud computing, and machine learning in the logistics sector is revolutionizing the industry, enabling real-time tracking and optimization of supply chain operations. The logistics sector is also being influenced by macroeconomic upheavals such as inflation levels, rate hikes, energy prices, and climate disasters. Corporate leaders are focusing on business growth and investment in quality assets to stay competitive. The RCEP agreement and the Belt and Road Initiative are expected to further boost trade and logistics activities in the region.

Additionally, the e-commerce market is a significant contributor to the logistics sector's growth, with transaction volumes reaching an all-time high during lockdown periods and the rise of digital consumers. Logistics operators are responding by expanding their logistics assets, renting more space inventory, and hiring manpower resources to meet the increasing demand. The structural undersupply of quality assets and the continuous evolution of spatial requirements are also factors influencing rent growth and sentiments in the market. Revenue growth in the logistics sector is also influenced by the spending decisions of consumers and businesses, fuel costs, convenience, and the ongoing evolution of Industry 4.0.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.08% |

|

Market growth 2024-2028 |

USD 53.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.31 |

|

Key companies profiled |

BCR Australia Pty Ltd., C H Robinson Worldwide Inc., CEVA Logistics, CJ Logistics Corp., DB Schenker, Deutsche Post AG, DSV AS, GEODIS, Gulf Agency Co. Ltd., Hellmann Worldwide Logistics SE and Co KG, Hitachi Transport System Ltd., Kuehne Nagel Management AG, Lexzau Scharbau GmbH and Co. KG, PT. Cipta Mapan Logistik, Rhenus SE and Co. KG, SF Express Co. Ltd., Silk Contract Logistics Pty Ltd., Toll Holdings Ltd., United Parcel Service Inc., and Yamato Holdings Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles,market forecast , fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch