Audio Driver IC Market Size 2024-2028

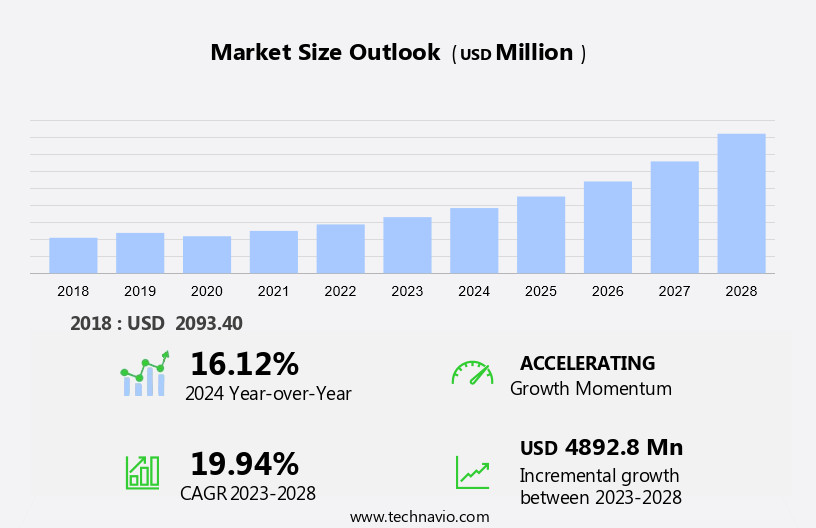

The audio driver IC market size is forecast to increase by USD 4.89 billion, at a CAGR of 19.94% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing penetration of smart devices, such as smartphones and smart home systems, is driving demand for high-quality audio output. Additionally, the popularity of wireless streaming of audio content, such as music and podcasts, is leading to increased adoption of audio driver ICs. Furthermore, the market is witnessing intense competition among companies, resulting in advancements in technology and innovation to meet the evolving needs of consumers. These trends are expected to continue shaping the growth of the market In the coming years.

What will be the size of the Audio Driver IC Market During the Forecast Period?

- The market encompasses integrated circuits (ICs) specifically designed for audio processing in various applications, including smartphones, tablets, music players, car entertainment setups, smart home gadgets, and portable multimedia devices. With the increasing demand for high-definition audio and energy-efficient solutions, the market is experiencing significant growth. The integration of advanced sound processing abilities in smartphones and tablets, as well as the proliferation of smart speakers and virtual/augmented reality devices, is driving market expansion.

- The professional audio industry also benefits from Audio ICs, which enable high-quality audio solutions in various applications. Device miniaturization and the integration of amplification functions into Audio ICs further enhance their appeal. The market's future direction is towards energy-efficient, high-performance, and high-definition audio solutions for various applications, including automotive, smart appliances, and entertainment systems.

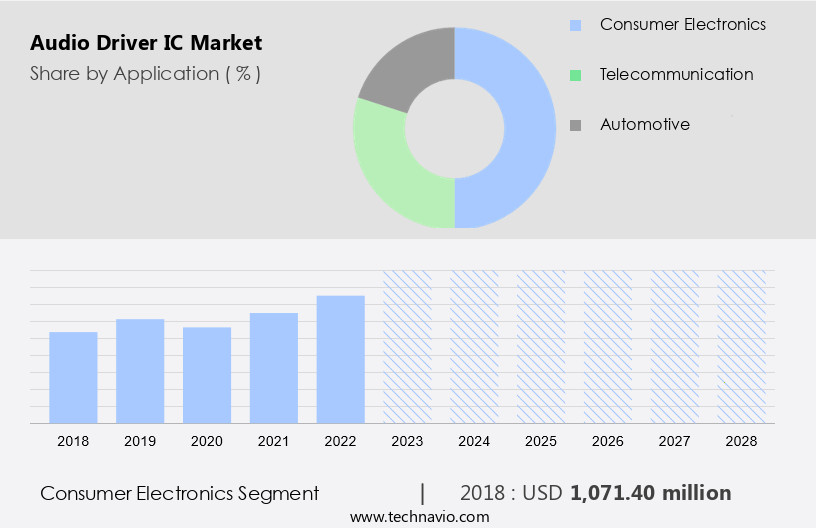

How is this Audio Driver IC Industry segmented and which is the largest segment?

The audio driver IC industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Consumer electronics

- Telecommunication

- Automotive

- Type

- Mono channel

- 2-channel

- 4-channel

- 6-channel

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

- The consumer electronics segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for advanced audio features in consumer electronics. Audio ICs, which include amplifiers, converters, processors, and digital signal processors, are integral components in various devices such as smartphones, tablets, TVs, music systems, cars, entertainment setups, smart home gadgets, and wearables. With a focus on device miniaturization and energy efficiency, semiconductor manufacturers are developing high-performance, low-power audio ICs. The demand for high-definition audio, virtual reality, and augmented reality technologies is also driving the market. Manufacturers are addressing design challenges in complex sound systems by employing strong rules for analog and digital forms.

Further, the automotive industry and smart home appliances are significant end-users, with applications ranging from automotive audio to smart speakers. The consumer electronics sector, including telecommunications and computing, is expected to continue dominating the market due to the increasing popularity of voice-assisted devices and the growing interest in high-quality audio solutions.

Get a glance at the Audio Driver IC Industry report of share of various segments Request Free Sample

The consumer electronics segment was valued at USD 1.07 billion in 2018 and showed a gradual increase during the forecast period.

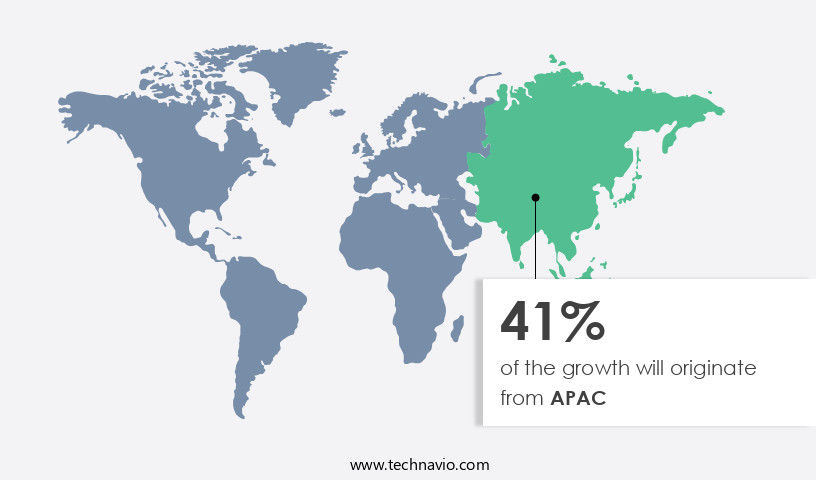

Regional Analysis

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Audio IC market in APAC is driven by the demand for high-quality audio solutions in various devices, including smartphones, tablets, TVs, music systems, cars, entertainment setups, smart home gadgets, and wearables. The market is characterized by the use of digital signal processors (DSPs), audio processors, audio amplifiers, and converters for sound processing abilities and improved sound quality. The market is also influenced by the trend towards device miniaturization and energy-efficient audio devices. In the professional audio industry, complex sound systems require strong rules for analog and digital forms of audio tech. Key markets include automotive audio, smart homes, and virtual reality technology. Countries like China, India, South Korea, and Japan are significant contributors to the market due to their high production and sales of consumer electronics, telecommunication, and automotive industries. Improving economic conditions In these countries have led to increased demand for high-definition audio systems, smart speakers, and other high-quality audio solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Audio Driver IC Industry?

Increasing penetration of smart devices is the key driver of the market.

- The market is experiencing significant growth due to the increasing popularity of smart devices such as smartphones, tablets, TVs, and entertainment setups. These devices require advanced audio features, including sound processing abilities, amplification, filtering, and input/output circuitry, which are provided by Audio ICs. The market is also driven by the demand for energy-efficient audio devices and high-definition audio systems in various applications, including automotive audio, smart homes, and wearables. The consumer electronics industry, including telecommunication and automotive industries, is a major contributor to the market's growth. In developing regions, such as APAC, the Middle East, Africa, and South America, the penetration of smart devices is increasing rapidly, driven by economic growth, increasing literacy rates, and rising purchasing power.

- China and India are the largest markets for smartphones in APAC and are experiencing significant growth. Audio ICs are used in various forms, including digital signal processors (DSPs), converters, processors, and amplifiers, to provide high-quality audio solutions for various applications. The market is characterized by strong rules and regulations, with a focus on sound quality, power consumption, and manufacturing costs. ROHM Semiconductor and other key players are investing in research and development to meet the growing demand for advanced audio technology in various applications.

What are the market trends shaping the Audio Driver IC Industry?

The popularity of wireless streaming of audio content is the upcoming market trend.

- The market experiences significant growth due to the increasing demand for wireless audio devices and the elimination of headphone jacks in smartphones. Wireless technology, which enables short-range radio wave transmission, is utilized in audio driver ICs to transfer sound signals from devices to wireless headphones. This trend is driven by smartphone manufacturers, such as Apple Inc., who have discontinued the use of headphone jacks, leading to a higher demand for audio driver ICs. The convenience of cordless audio devices enhances user experience, particularly in portable multimedia devices like smartphones and tablets, as well as in entertainment setups, smart home gadgets, and automotive applications.

- Additionally, the market is influenced by the advancements in sound processing abilities, energy efficiency, and miniaturization of audio devices. Audio ICs integrate digital signal processors (DSPs), converters, amplifiers, and filtering input/output circuitry to deliver high-definition audio, powering various audio applications, from smart speakers to virtual reality technology.

What challenges does the Audio Driver IC Industry face during its growth?

Increasing competition among vendors is a key challenge affecting the industry growth.

- The market encompasses semiconductor devices that integrate amplification, filtering, input/output circuitry, and sound processing abilities for various devices. Smartphones, tablets, TVs, music players, cars, entertainment setups, smart home gadgets, and wearables are major applications. Market competition is escalating due to the entry of numerous global and regional companies, including Analog Devices and Infineon Technologies. The absence of stringent technological entry barriers has attracted an influx of new participants. This intensifies competition, leading to potential price wars. Audio ICs are utilized in digital signal processors (DSPs), audio processors, audio amplifiers, converters, and automotive audio systems.

- The market caters to smart homes, smart appliances, virtual reality (VR) technology, mobile phones, computer and tablets, headphones, home entertainment systems, portable multimedia devices, high-definition audio systems, and smart speakers. Energy-efficient audio devices and high-quality audio solutions are key trends. Companies focus on channel requirements for stereo systems, surround sound setups, and mono channel ICs to cater to consumer electronics, telecommunication, and automotive industries.

Exclusive Customer Landscape

The audio driver IC market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the audio driver ic market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, audio driver IC market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ams OSRAM AG

- Analog Devices Inc.

- Asahi Kasei Microdevices Corp.

- Bang and Olufsen Group

- Cirrus Logic Inc.

- ESS Technology Inc.

- Infineon Technologies AG

- Monolithic Power Systems Inc.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Princeton Technology Corp.

- Qualcomm Inc.

- Realtek Semiconductor Corp.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- Silicon Laboratories Inc.

- STMicroelectronics International N.V.

- Synaptics Inc.

- Texas Instruments Inc.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of semiconductor devices that play a crucial role in various consumer and professional applications. These ICs are integral to numerous devices, including smartphones, tablets, TVs, music players, cars, entertainment setups, smart home gadgets, and more. The demand for audio ICs is driven by the increasing popularity of devices that offer advanced sound processing abilities. With the proliferation of digital signal processors (DSPs), audio processors, audio amplifiers, and converters, the market for audio ICs is expected to grow significantly. The audio IC market caters to diverse applications, from simple sound amplification and filtering to complex sound systems that require strong rules for channel requirements, stereo systems, and surround sound setups.

Further, analog and digital forms of audio ICs are used to meet the varying needs of these applications. The professional audio industry also relies heavily on audio ICs for high-definition audio systems, virtual reality (VR) technology, and augmented reality (AR) applications. In the consumer electronics sector, audio ICs are used in mobile phones, computer and tablets, headphones, home entertainment systems, wearables, portable multimedia devices, and high-definition audio systems. Automotive applications and smart home appliances are other significant markets for audio ICs. In the automotive industry, audio ICs are used to enhance the user experience in cars, while in smart homes, they are integrated into various gadgets to improve sound quality and energy efficiency.

In addition, manufacturing costs, power consumption, and sound quality are critical factors that influence the design of audio ICs. As device miniaturization continues to be a trend, energy-efficient audio devices are becoming increasingly important. The audio IC market is expected to grow as technology advances and new applications emerge. Audio ICs are used in various applications, including amplification, filtering, and input/output circuitry. They are available in mono channel ICs and multi-channel ICs, catering to different channel requirements. The market for audio ICs is diverse and dynamic, with constant innovation and advancements in technology driving growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.94% |

|

Market Growth 2024-2028 |

USD 4.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.12 |

|

Key countries |

US, China, Japan, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Audio Driver IC Market Research and Growth Report?

- CAGR of the Audio Driver IC industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the audio driver ic market growth of industry companies

We can help! Our analysts can customize this audio driver ic market research report to meet your requirements.