Automatic And Smart Pet Feeder Market Size 2025-2029

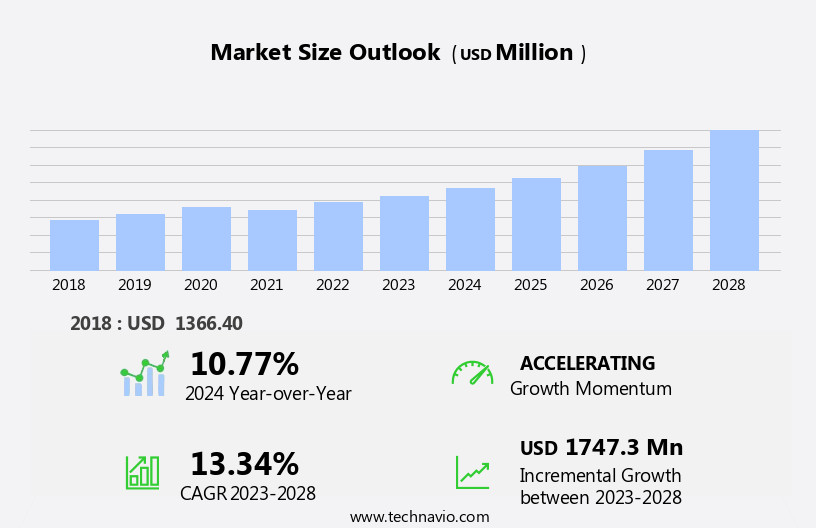

The automatic and smart pet feeder market size is forecast to increase by USD 2.2 billion, at a CAGR of 14.8% between 2024 and 2029.

- The market is experiencing significant growth due to changing lifestyle patterns and the increasing adoption of Smart Home technology. The urban populace's busy work lives have led to a surge in demand for convenient pet feeding solutions. Smart homes, integrating advanced technology into daily life, are augmenting this trend, with automatic and smart pet feeders becoming an essential component. However, the market faces challenges, primarily related to low battery life and battery runtime. This issue may hinder the market's growth as frequent battery replacements or charging can deter potential customers.

- Companies in the market must address this challenge by focusing on improving battery life and developing innovative solutions to ensure uninterrupted feeding for pets. To capitalize on the market's potential, businesses should prioritize product development, focusing on user-friendly designs and integrating advanced features to cater to the evolving needs of pet owners.

What will be the Size of the Automatic And Smart Pet Feeder Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and growing consumer demand for convenient and customized pet care solutions. This market caters to various sectors, including pet hydration, food freshness, Data Security, smart home integration, and pet wellness. Pet hydration solutions offer automatic water dispensing systems, ensuring pets have constant access to clean water. Wet food dispensers cater to pets with specific dietary needs, while pricing strategies vary to accommodate different consumer budgets. Multiple pet support features enable feeding multiple pets with customized schedules and portion sizes. Online sales channels and e-commerce platforms have significantly impacted market growth, allowing for easy access to a wide range of smart pet feeders.

Pet activity monitoring and health management applications are integrated into these devices, providing valuable insights into pet well-being. Food freshness is ensured through innovative food storage solutions and time scheduling features, while retail sales channels offer additional distribution opportunities. Smart pet feeders integrate with cloud services, voice control, and app integration for added convenience. Industry standards and safety certifications prioritize pet and food safety, ensuring the quality and reliability of these devices. Pet feeder maintenance is simplified through user-friendly designs and remote monitoring capabilities. The pet supplies market is continuously expanding, with smart pet feeders offering differentiation through advanced features and design aesthetics.

Emerging technologies, such as water filtration and camera integration, further enhance the functionality of these devices. Pet obesity and food allergies are addressed through portion control and custom feeding schedules. Ethical considerations and animal welfare are prioritized through the use of energy-efficient designs and eco-friendly materials. The future outlook for the market is promising, with continued innovation and integration into the broader pet technology landscape. Pet weight management, water quality, and feeding history tracking are among the emerging trends shaping this dynamic market.

How is this Automatic And Smart Pet Feeder Industry segmented?

The automatic and smart pet feeder industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Automatic

- Smart

- End-user

- Dogs

- Cats

- Price

- Mid-range feeder

- Low-cost feeder

- Premium feeder

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

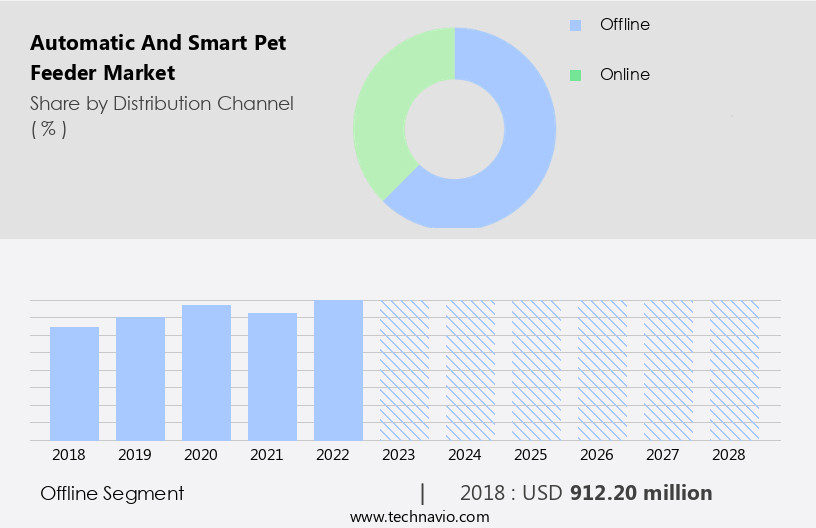

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments, including wet and dry food dispensing, water dispensers, and smart features such as multiple pet support, online sales, pet wellness, pet activity monitoring, and camera integration. Pricing strategies vary to cater to diverse pet dietary needs and pet ownership preferences. Department stores dominate the market, generating significant revenue due to competitive pricing, effective customer service, and the ability to facilitate close product evaluations. Wet food dispensers, camera integration, and app integration are emerging trends, enhancing pet health management and nutrition. Environmental considerations, ethical considerations, and food safety are crucial factors shaping the market.

Remote monitoring, voice control, and cloud services are future outlooks, reflecting the integration of pet technology into daily life. Product differentiation, animal welfare, and feeding patterns are key innovation drivers. E-commerce platforms and IoT devices facilitate pet hydration and food dispensing, while ensuring data security and food freshness. Industry standards, pet feeder maintenance, and custom feeding schedules ensure consistent water quality and feeding history. The pet supplies market distribution channels continue to expand, with retail sales and energy efficiency playing significant roles.

The Offline segment was valued at USD 1.29 billion in 2019 and showed a gradual increase during the forecast period.

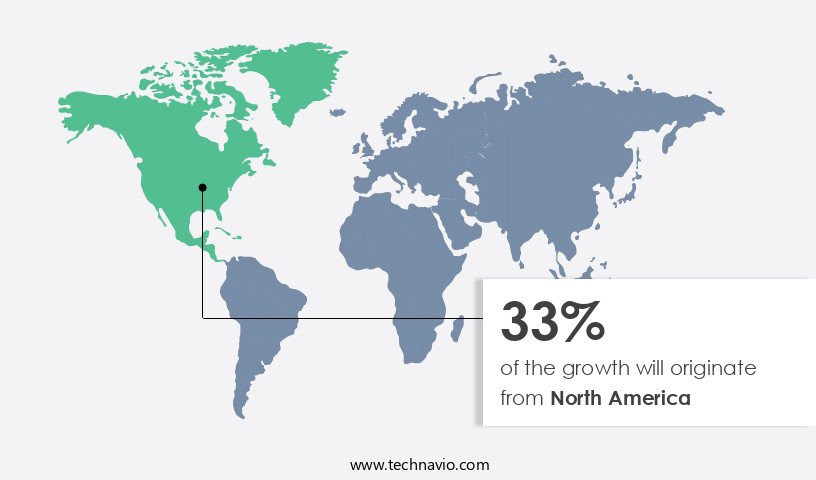

Regional Analysis

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, with the region leading the global market. Factors contributing to this growth include increasing pet ownership, technological advancements, and rising consumer awareness. Online sales have surged, making it more convenient for customers to purchase these devices. Pet wellness and nutrition are top priorities for pet owners, leading to the adoption of smart feeders that offer features like pet activity monitoring, feeding history, and custom feeding schedules. Automatic and smart pet feeders cater to various pet dietary needs, including wet and dry food dispensing, and some models even support multiple pets. These feeders come with safety certifications, ensuring food safety and portion control.

Ethical considerations, such as animal welfare and environmental impact, are also addressed through energy-efficient designs and eco-friendly materials. Emerging technologies, such as app integration, voice control, and camera integration, have further enhanced the functionality of these feeders. Pet health management and nutrition are crucial aspects of pet care, and smart pet feeders offer features like food storage, water filtration, and water quality monitoring to ensure optimal pet health. As the demand for these devices continues to rise, retail sales have become a significant distribution channel. The market is expected to witness further growth due to the integration of smart home technology, cloud services, and pet technology.

Product differentiation, such as design aesthetics and brand recognition, also plays a role in consumer decision-making. The market faces challenges like data security and food freshness, but industry standards and pet feeder maintenance ensure consumer trust. The future outlook for the market is promising, with potential applications in pet weight management, pet obesity prevention, and addressing Pet Food allergies. Overall, the market in North America is a dynamic and innovative space that continues to evolve to meet the needs of pet owners.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automatic And Smart Pet Feeder Industry?

- The urban populace's shifting lifestyle patterns and demanding work schedules serve as the primary catalyst for market growth.

- The market is witnessing significant growth due to the increasing number of pet owners with busy work schedules. With the rise in female labor force participation rates, particularly in urban areas, there is a growing need for technologies that ensure proper pet feeding and health management. Smart pet feeders offer features such as time scheduling, portion control, and app integration, addressing the concerns of pet owners who cannot be present to feed their pets at regular intervals. Emerging technologies like water dispensing, safety certifications, camera integration, and pet health management are enhancing the functionality of these feeders.

- Material composition and dry food dispensing are also important considerations for pet owners dealing with pet obesity and food allergies. The market for automatic pet feeders is expected to continue its growth trajectory as more pet owners seek convenient and technologically advanced solutions for their pets' feeding needs.

What are the market trends shaping the Automatic And Smart Pet Feeder Industry?

- The trend toward smart homes is driving increased demand for advanced pet feeding technologies, such as smart pet feeders. These innovative devices offer automated feeding, connectivity, and remote control, enhancing convenience and peace of mind for pet owners.

- The market for automatic and smart pet feeders has experienced significant growth due to the increasing prioritization of pet nutrition and animal welfare. These advanced feeders offer product differentiation through features such as remote monitoring, feeding pattern customization, and integration with digital voice assistants like Amazon's Alexa. Pet owners appreciate the convenience of managing their pet's feeding from a distance, ensuring food safety and water filtration systems. The demand for pet care innovation continues to surge, with e-commerce platforms and IoT devices facilitating easy access to these smart pet feeder solutions. Design aesthetics also play a role in consumer preference, as many pet owners seek sleek and modern devices for their homes.

- Companies are responding to this trend by investing in research and development to create more sophisticated and harmonious pet feeder designs. Overall, the market for automatic and smart pet feeders is poised for continued growth, driven by the intersection of pet ownership, technology, and the desire for enhanced pet care.

What challenges does the Automatic And Smart Pet Feeder Industry face during its growth?

- The limited battery life, resulting in reduced runtime, poses a significant challenge to industry growth. This issue, which is mandatory for businesses to address, can hinder advancements and innovation within the sector.

- Automatic and smart pet feeders have gained significant traction in the pet supplies market due to their advanced features and benefits. These feeders offer convenience and peace of mind for pet owners by ensuring timely and accurate feeding, even when they are away. They come equipped with various features such as custom feeding schedules, food dispensing, water quality maintenance, and pet hydration. Moreover, smart home integration, voice control, and cloud services have added to the appeal of these feeders. Smart home integration allows pet owners to connect their feeders to other smart devices, enabling remote monitoring and control.

- Voice control feature enables hands-free operation, adding to the convenience. Cloud services provide access to feeding history, allowing pet owners to keep track of their pet's eating habits. Data security is another essential aspect of automatic and smart pet feeders. These devices often collect and store sensitive information, such as feeding schedules and pet health data. It is crucial that this information is protected with robust security measures to prevent unauthorized access. Food freshness is another critical factor that pet owners consider when purchasing a pet feeder. Automatic and smart pet feeders ensure that the food remains fresh by dispensing the right amount at the right time.

- Proper maintenance of the feeder is also essential to ensure its longevity and optimal performance. Industry standards and regulations play a crucial role in ensuring the safety and quality of these feeders. In conclusion, the market is driven by the growing demand for advanced pet care solutions that offer convenience, accuracy, and peace of mind for pet owners. The integration of smart home technology, voice control, and cloud services has added to the appeal of these feeders, making them an essential part of the pet supplies market. Data security, food freshness, and proper maintenance are essential considerations for pet owners when purchasing a pet feeder.

Exclusive Customer Landscape

The automatic and smart pet feeder market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automatic and smart pet feeder market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automatic and smart pet feeder market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

C and A Marketing Inc. - This company specializes in innovative pet care solutions. Our flagship product is an automatic pet feeder, designed to dispense food at consistent intervals. By automating the feeding process, pet owners can ensure their pets receive regular meals, promoting optimal health and wellbeing. The feeder's advanced technology ensures precise portion control and timely feeding, providing peace of mind for busy pet parents.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- C and A Marketing Inc.

- CEVA SANTE ANIMALE S.A

- Dogness International Co. Ltd.

- Doskocil Manufacturing Co. Inc.

- Encaya Corp.

- Faroro

- OWON Technology Inc.

- Paiwang Pet APP

- Petcube Inc.

- PetKeen

- PETKIT Ltd.

- Pets at Home Group Plc

- Qpets Inc.

- Radio Systems Corp.

- Shenzhen Skymee Technology Co. Ltd.

- SureFlap Ltd.

- Tuya Inc

- Vet Innovations Inc.

- Wopet

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automatic And Smart Pet Feeder Market

- In February 2023, iHome Pet Tech, a leading pet technology company, introduced the iFit Smart Pet Feeder Pro, integrating facial recognition technology to ensure accurate feeding for individual pets (iHome Pet Tech press release). In May 2023, Arden Grange, a UK-based pet food manufacturer, announced a strategic partnership with Petnet, a smart pet feeding solutions provider, to expand their offerings and cater to the growing demand for automated pet feeders (Arden Grange press release).

- In September 2024, PetSafe, a well-established pet product company, completed the acquisition of PetMate, a significant competitor in the market, bolstering PetSafe's product portfolio and market share (PetSafe press release). In January 2025, the Food and Drug Administration (FDA) approved the use of Bluetooth-enabled automatic pet feeders, paving the way for more advanced and connected pet feeding solutions (FDA press release).

- These developments underscore the growing importance of technology in the pet care industry, with companies focusing on innovation, strategic partnerships, and acquisitions to cater to the evolving needs of pet owners. The integration of advanced technologies like facial recognition and Bluetooth connectivity is transforming the market, offering convenience, accuracy, and improved pet care experiences.

Research Analyst Overview

- The market is experiencing significant growth, driven by the integration of advanced technologies such as cloud storage, AI integration, and voice recognition into pet care solutions. These innovations enable pet owners to monitor and manage their pet's feeding schedules and lifestyle preferences remotely. Smart home ecosystems are increasingly embracing pet feeders with programmable logic controllers, microprocessor control, and machine learning capabilities. Food sensors and water quality monitoring systems ensure optimal nutrition and hygiene, while customization options cater to unique pet needs. Pet identification systems, pet wearables and facial recognition technology offer personalized feeding experiences, ensuring that only the intended pet gains access to the feeder.

- Self-cleaning features and replacement parts ensure long-term durability, aligning with industry trends toward sustainable and efficient pet care solutions. Subscription models and data analytics enable pet owners to track their pet's health and wellbeing, offering valuable insights into their pet's diet and behavior patterns. Water dispensing technology with UV sterilization and water filtration systems further enhance the overall value proposition. Data privacy remains a priority, with secure wireless communication protocols and anti-bacterial coatings ensuring the protection of sensitive information and maintaining a clean and hygienic feeding environment. Pet feeder accessories, such as app features, water pumps, and weight sensors, add convenience and functionality to these advanced systems.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automatic And Smart Pet Feeder Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.8% |

|

Market growth 2025-2029 |

USD 2203.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.8 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, France, Italy, Spain, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automatic And Smart Pet Feeder Market Research and Growth Report?

- CAGR of the Automatic And Smart Pet Feeder industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automatic and smart pet feeder market growth of industry companies

We can help! Our analysts can customize this automatic and smart pet feeder market research report to meet your requirements.