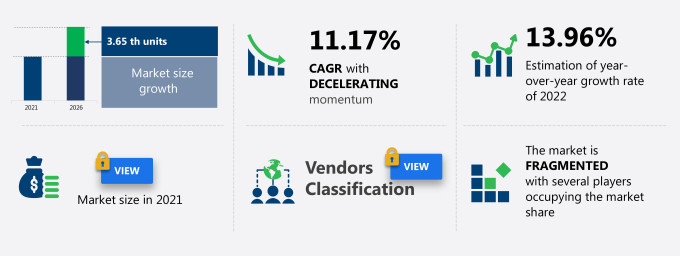

The automotive carbon fiber composites market share in China is expected to increase by 3.65 thousand units from 2021 to 2026, at a CAGR of 11.17%.

This automotive carbon fiber composites market in China research report extensively covers the automotive carbon fiber composites market segmentation in China by vehicle type (passenger vehicles and commercial vehicles) and application (structural assembly, powertrain components, and others). The China automotive carbon fiber composites market report also offers information on several market vendors, including Jiangsu Hengshen Co. Ltd., Jiangsu Tianniao High-technology Co. Ltd., Mitsubishi Chemical Corp., Owens Corning, Polar Manufacturing Ltd., Rock West Composites Inc., SGL Carbon SE, Solvay SA, Toray Industries Inc., and Weihai Guangwei Group Co. Ltd. among others.

What will the Automotive Carbon Fiber Composites Market Size in China be During the Forecast Period?

Download the Free Report Sample to Unlock the Automotive Carbon Fiber Composites Market Size in China for the Forecast Period and Other Important Statistics

Automotive Carbon Fiber Composites Market in China: Key Drivers, Trends, and Challenges

The excellent properties exhibited by carbon fiber composites are notably driving the automotive carbon fiber composites market growth in China, although factors such as costs associated with carbon fiber composites may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the automotive carbon fiber composites industry in China. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Automotive Carbon Fiber Composites Market Driver in China

One of the key factors driving the automotive carbon fiber composites market growth in China is the excellent properties exhibited by carbon fiber composites due to which it is widely used in diversified applications. Certain vital properties include high strength to weight ratio, resistance to corrosion and fire, electrical conductivity, lubricating, inert, and less poisonous. Although the substitutes of carbon fiber composites such as steel exhibit a high strength-to-weight ratio, it is considered comparatively better in carbon fiber composites due to the honeycomb structure of the carbon fiber. Similarly, carbon fiber is chemically stable and corrosion-resistant. Moreover, they are thermally stable and resistant to fire. Such properties enable their extensive use in the automobile, aerospace, and defense industries, which will positively impact the growth of the market in focus during the forecast period.

Key Automotive Carbon Fiber Composites Market Trend in China

Another key factor driving the automotive carbon fiber composites market growth in China is the increasing demand for fuel-efficient vehicles due to the increasing urban population and industrialization. The most crucial factor for the change in consumers' preference from conventional passenger cars to fuel-efficient cars is the high and volatile cost of fuel. Fuel-efficient cars are eco-friendly, provide high mileage, and can be powered by alternative fuels and advanced fuel technologies. The stringent government norms to reduce the emission of greenhouse gas (GHGs), carbon dioxide (CO2), and other harmful pollutants, are leading to an increase in the demand for fuel-efficient and green vehicles, which directly increases the demand for carbon fiber in the automotive carbon fiber composites market in China.

Key Automotive Carbon Fiber Composites Market Challenge in China

One of the key challenges to the China automotive carbon fiber composites market growth is the costs associated with carbon fiber composites. The cost of manufacturing and R&D associated with carbon fiber can reduce the demand for carbon fiber in automotive composites and increase the demand for substitute products. The cost of production and R&D of carbon fiber composites is eight times that of steel. Polyacrylonitrile (PAN) is one of the raw materials that is used in the production of carbon fiber composites; PAN is more expensive compared to its substitutes. The high manufacturing costs associated with carbon fiber composites are mainly due to the high cost of raw materials.

This automotive carbon fiber composites market in China analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the automotive carbon fiber composites market in China as a part of the global diversified metals and mining market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the automotive carbon fiber composites market in China during the forecast period.

Who are the Major Automotive Carbon Fiber Composites Market Vendors in China?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Jiangsu Hengshen Co. Ltd.

- Jiangsu Tianniao High-technology Co. Ltd.

- Mitsubishi Chemical Corp.

- Owens Corning

- Polar Manufacturing Ltd.

- Rock West Composites Inc.

- SGL Carbon SE

- Solvay SA

- Toray Industries Inc.

- Weihai Guangwei Group Co. Ltd.

This statistical study of the China automotive carbon fiber composites market encompasses successful business strategies deployed by the key vendors. The automotive carbon fiber composites market in China is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Solvay SA - The company offers automotive carbon fiber composites products such as IPh Sodium Carbonate, thornel-p30, and thornel-p25.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The automotive carbon fiber composites market in China forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Automotive Carbon Fiber Composites Market in China Value Chain Analysis

Our report provides extensive information on the value chain analysis for the automotive carbon fiber composites market in China, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global diversified metals and mining market includes the following core components:

- Inputs

- Operations

- Mine development and extraction

- Outbound logistics

- Marketing and sales

- End-user industries

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

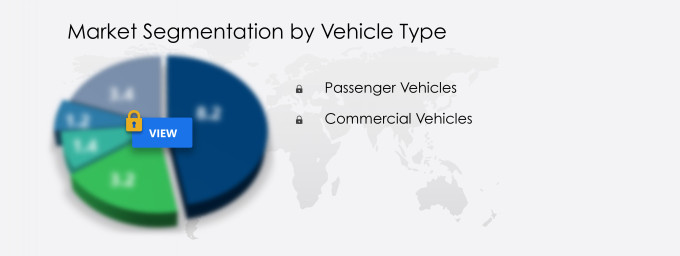

What are the Revenue-generating Vehicle Type Segments in the Automotive Carbon Fiber Composites Market in China?

To gain further insights on the market contribution of various segments Request for a FREE sample

The automotive carbon fiber composites market share growth in China by the passenger vehicles segment will be significant during the forecast period. The growth is attributed to the significant increase in disposable income of consumers that encouraged consumers to invest in passenger vehicles in developing countries such as China. Furthermore, over the past decade, passenger vehicles have transformed from mechanically driven mobility to high-end electronic/electrical vehicles with advanced features in the area of safety, security, propulsion, connectivity, and environment, which will further support the market growth through this segment.

This report provides an accurate prediction of the contribution of all the segments to the growth of the automotive carbon fiber composites market size in China and actionable market insights on post COVID-19 impact on each segment.

|

Automotive Carbon Fiber Composites Market Scope in China |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 11.17% |

|

Market growth 2022-2026 |

3.65 th units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

13.96 |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Jiangsu Hengshen Co. Ltd., Jiangsu Tianniao High-technology Co. Ltd., Mitsubishi Chemical Corp., Owens Corning, Polar Manufacturing Ltd., Rock West Composites Inc., SGL Carbon SE, Solvay SA, Toray Industries Inc., and Weihai Guangwei Group Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Carbon Fiber Composites Market in China Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive automotive carbon fiber composites market growth in China during the next five years

- Precise estimation of the automotive carbon fiber composites market size in China and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive carbon fiber composites industry in China

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive carbon fiber composites market vendors in China

We can help! Our analysts can customize this report to meet your requirements. Get in touch