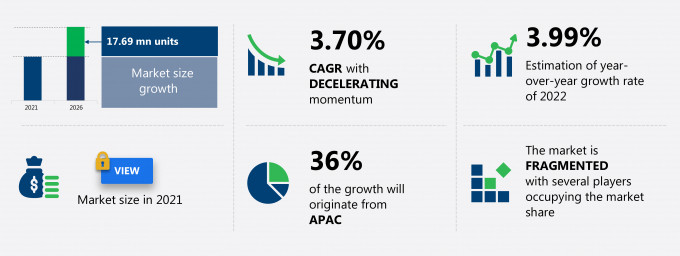

The automotive dashboard market share is expected to increase by 17.69 million units from 2021 to 2026, at a CAGR of 3.70%. This automotive dashboard market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. The automotive dashboard market report also offers information on several market vendors, including Continental AG, Dongfeng Motor Parts and Components Group Co. Ltd., Faurecia SE, Lear Corp., Marelli Holdings Co. Ltd., Minda Corp. Ltd., SAIC Motor Corp. Ltd., Sterling Technologies Inc., Toyoda Gosei Co. Ltd., and Visteon Corp. among others. Furthermore, this report extensively covers automotive dashboard market segmentation by vehicle type (passenger vehicles and commercial vehicles) and geography (APAC, North America, Europe, South America, and MEA).

What will the Automotive Dashboard Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Automotive Dashboard Market Size for the Forecast Period and Other Important Statistics

Automotive Dashboard Market: Key Drivers, Trends, and Challenges

The rising adoption of advanced driver assistance systems is notably driving the automotive dashboard market growth, although factors such as sharp decline in automobile production and sales may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the automotive dashboard industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Automotive Dashboard Market Driver

One of the key factors driving growth in the automotive dashboard market is the rising adoption of advanced driver assistance systems. The adoption of advanced driver assistance systems coupled with the increasing levels of electrification in vehicles are transforming the dashboards of both passenger and commercial vehicles. The role of infotainment systems will become primary for the smooth operation of the vehicles and for ensuring passengers' safety, security, and comfort. With the evolution of technology, automotive dashboards will undergo significant changes in the near future, provisioning an enormous scope for the market to expand during the forecast period. The trends in the automotive industry, such as connected vehicles, autonomous vehicles, and electric vehicles, will shift the focus of automakers to interiors for product differentiation to attract customers. Thus, it would further propel the demand for innovative and up-to-date automotive dashboards during the forecast period.

Key Automotive Dashboard Market Trend

The technological developments creating demand for digital dashboards is another factor supporting the automotive dashboard market share growth. With the advancements in technology, newly introduced dashboards have also been integrating the display of gauges and controls, as well as information, climate control, and entertainment systems. The demand for digital dashboards is largely dependent on sales of premium and luxury vehicles, as these dashboards are of high cost due to the integration of the latest technology. The was a gradual rise in the demand for luxury and premium vehicles in 2021 leading to a rise in demand for digital automotive dashboards. The increase in demand for luxury and premium vehicles will further drive the demand for digital dashboards during the forecast period leading to significant growth in the global automotive dashboard market.

Key Automotive Dashboard Market Challenge

The sharp decline in automobile production and sales will be a major challenge for the automotive dashboard market during the forecast period. All passenger vehicles and commercial vehicles have a dashboard. Therefore, the overall production and sales of automobiles will impact the global automotive dashboard market. Since 2018, the global automotive market has been registering a slump in sales and production, leading to a decline in the demand for several automotive components, such as automotive dashboards. In other major automotive manufacturing countries, such as India, Japan, and the US, automotive production registered growth during 2017-2018. However, a slowdown in the growth rate of the sales of vehicles in 2019 and 2020 is increasing the inventory cost for OEMs and compelling them to reduce or temporarily stop production. Such factors adversely affect automotive sales and production, which further reduce the demand for automotive components and parts in the global automotive market and hamper the growth of the global automotive dashboard market.

This automotive dashboard market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global automotive dashboard market as a part of the global automotive components and accessories market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the automotive dashboard market during the forecast period.

Who are the Major Automotive Dashboard Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Continental AG

- Dongfeng Motor Parts and Components Group Co. Ltd.

- Faurecia SE

- Lear Corp.

- Marelli Holdings Co. Ltd.

- Minda Corp. Ltd.

- SAIC Motor Corp. Ltd.

- Sterling Technologies Inc.

- Toyoda Gosei Co. Ltd.

- Visteon Corp.

This statistical study of the automotive dashboard market encompasses successful business strategies deployed by the key vendors. The automotive dashboard market is fragmented and the vendors are deploying growth strategies such as expanding their business with innovative dashboard systems to compete in the market.

Product Insights and News

-

SAIC Motor Corp. Ltd. - The company offers automotive dashboards that have high-grade leather cutting, sewing and wrapping, to slush molding and injection molding, under the brand name of Yanfeng

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The automotive dashboard market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Automotive Dashboard Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the automotive dashboard market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the automotive components and accessories market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Distribution and logistics

- Marketing and sales

- Service

- Industry innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Automotive Dashboard Market?

For more insights on the market share of various regions Request for a FREE sample now!

36% of the market’s growth will originate from APAC during the forecast period. China, Japan, and India are the key markets for automotive dashboards in APAC. Market growth in this region will be slower than the growth of the market in other regions.

The various government initiatives to go green, increasing stringent carbon emission norms, increase in the number of EV charging stations, and the increase in participation by the foreign as well as local OEMs to make EV technology more efficient and cost-effective will facilitate the automotive dashboard market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The region was the epicenter of COVID-19 in 2020. To control the spread of the disease, the regional governments-imposed lockdowns which disturbed the manufacturing process for automotive dashboards for up to 90 days in Q1 and Q2 of 2020. The supply chain for automobile components was also disturbed by the restrictions on global trade. This negatively affected the manufacturing process for automobile components such as dashboards in 2020. Since 2021, the region has, however, rapidly recovered from the pandemic, and gradually the demand and supply chains in the market in focus have reached the pre-pandemic levels. However, the economic slowdown caused by COVID-19 is expected to adversely affect the demand for automobiles, which could further curb the demand for automotive dashboards during the forecast period.

What are the Revenue-generating Vehicle Type Segments in the Automotive Dashboard Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The automotive dashboard market share growth by the passenger vehicles segment will be significant during the forecast period. The passenger vehicles segment grabbed the largest share in the global automotive dashboard market in 2021. This is due to the rise in the sales of passengers cars. An automotive dashboard is considered one of the most important components in passengers cars. The rise in sales of passenger vehicles will therefore bolster the demand for automotive dashboards during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the automotive dashboard market size and actionable market insights on post COVID-19 impact on each segment.

You may be interested in:

Automotive Dashboard Camera market - The market share has the potential to grow by $3.89 bn during 2021-2025, and the market’s growth momentum will accelerate at a CAGR of 27.48%.

Strain Gauges market - The market size is expected to grow by USD 64.37 mn and record a CAGR of 4% during 2020-2024.

|

Automotive Dashboard Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of 3.70% |

|

Market growth 2022-2026 |

17.69 mn units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

3.99 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 36% |

|

Key consumer countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Continental AG, Dongfeng Motor Parts and Components Group Co. Ltd., Faurecia SE, Lear Corp., Marelli Holdings Co. Ltd., Minda Corp. Ltd., SAIC Motor Corp. Ltd., Sterling Technologies Inc., Toyoda Gosei Co. Ltd., and Visteon Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Dashboard Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive automotive dashboard market growth during the next five years

- Precise estimation of the automotive dashboard market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive dashboard industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive dashboard market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch