Automotive Floor Carpet Market Size 2025-2029

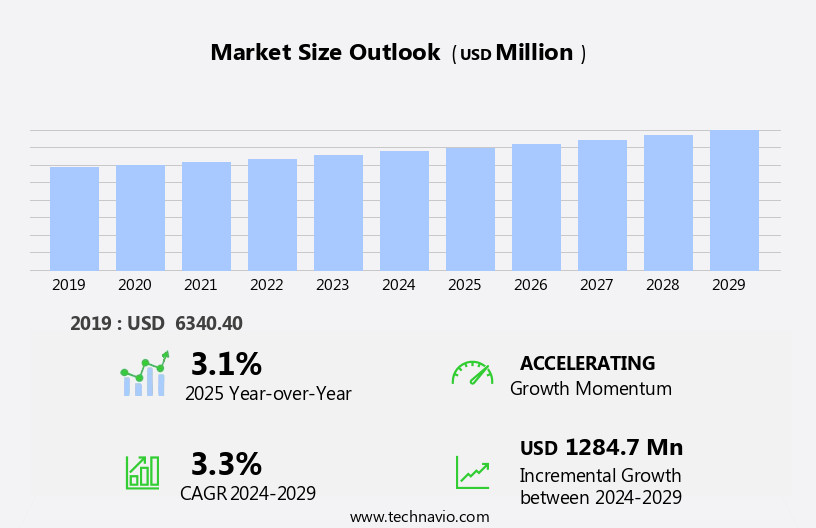

The automotive floor carpet market size is forecast to increase by USD 1.28 billion, at a CAGR of 3.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing trend towards vehicle customization in Western regions. Consumers are seeking unique and personalized interiors, leading to an elevated demand for high-quality, stylish floor carpets. Furthermore, technological advancements are transforming the market landscape, with innovations in materials, manufacturing processes, and design. However, the market faces challenges due to the volatile prices of raw materials, particularly crude oil and synthetic leather fibers, which can significantly impact production costs.

- Companies must navigate these price fluctuations to maintain profitability and competitiveness. To capitalize on market opportunities and effectively manage challenges, market participants should focus on developing sustainable, cost-effective solutions and staying abreast of consumer preferences and technological advancements.

What will be the Size of the Automotive Floor Carpet Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Cargo liners, a popular application, are engineered with increased durability and stain resistance to meet the demands of active lifestyles. Carpet cutting and binding techniques have advanced, enabling customized solutions for various vehicle models and sizes. Carpet pile height and tufting methods have gained significance, offering improved comfort and noise reduction. Stain resistance remains a key focus, with innovative solutions ensuring carpets maintain their appearance. Recycling initiatives have emerged, addressing sustainability concerns and reducing waste. Trunk liners and carpet shaping cater to the growing trend of personalized vehicle interiors.

Carpet tiles, an alternative to traditional rolls, offer flexibility and ease of installation. The integration of carpet weight, printing, fibers, and kits in automotive carpeting further expands the market's scope. Carpet care products and fire retardancy standards ensure longevity and safety. Installation tools and certification processes streamline the process for automotive manufacturers and installers. The automotive interior design sector continues to influence carpet trends, with carpet seams and edges receiving increased attention for seamless integration. Carpet recycling and the development of eco-friendly materials are shaping the future of the market. The ongoing dynamism of this sector underscores its importance in the broader automotive industry landscape.

How is this Automotive Floor Carpet Industry segmented?

The automotive floor carpet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Non-woven

- Tufted

- Application

- Passenger vehicles

- Commercial vehicles

- Material

- Polyurethane

- Polypropylene

- Rubber

- Nylon

- Others

- Distribution Channel

- OEM

- Aftermarket

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

By Type Insights

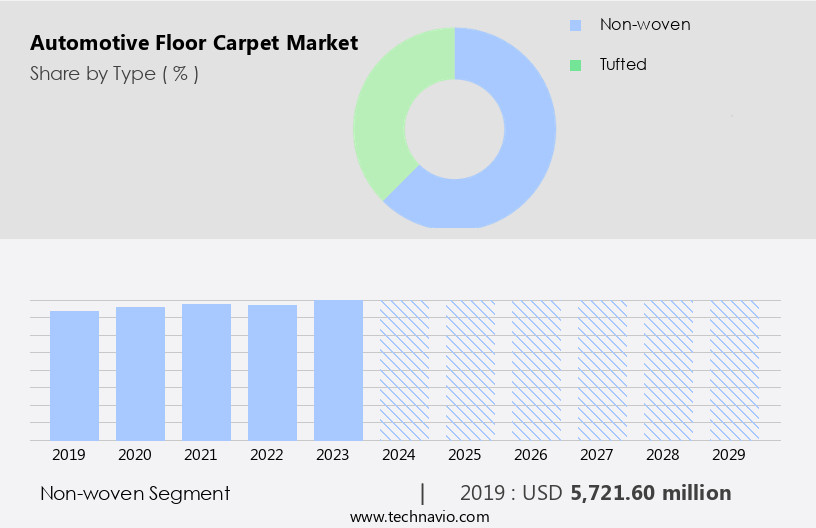

The non-woven segment is estimated to witness significant growth during the forecast period.

In the market, non-woven carpets are a significant segment, accounting for a substantial market share. These carpets are made from fibers bonded together without weaving, resulting in a durable and cost-effective floor covering. Commonly used materials include synthetic polyester and polypropylene, with natural fibers like wool also utilized. Non-woven carpets offer advantages such as stain and moisture resistance, ease of cleaning, and improved durability compared to woven carpets. Automotive applications for non-woven carpets span passenger vehicles, commercial vehicles, and other transportation types. Carpet acoustics, a crucial aspect of automotive interior design, can be enhanced with non-woven carpets due to their sound-absorbing properties.

Carpet padding, edges, underlay, and fitting are essential considerations for carpet installation, and non-woven carpets are compatible with various fastening methods, including carpet tiles, rolls, and custom-cut pieces. Carpet density, pile height, and tufting techniques influence the overall quality and performance of non-woven carpets. Carpet templates, maintenance tools, and care products ensure proper installation and upkeep. Carpet certification, fire retardancy, and recycling initiatives contribute to the industry's standards and sustainability efforts. Carpet dyeing, printing, and binding techniques allow for customization, while adhesives and carpet seams ensure a secure fit. Cargo liners, trunk liners, and carpet shaping tools cater to specific automotive needs.

Carpet weight and carpet fibers determine the carpet's durability and resistance to wear and tear. Floor mats and carpet tiles provide additional protection and convenience. Overall, the non-woven carpet segment continues to evolve, offering innovative solutions for automotive floor coverings.

The Non-woven segment was valued at USD 5.72 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

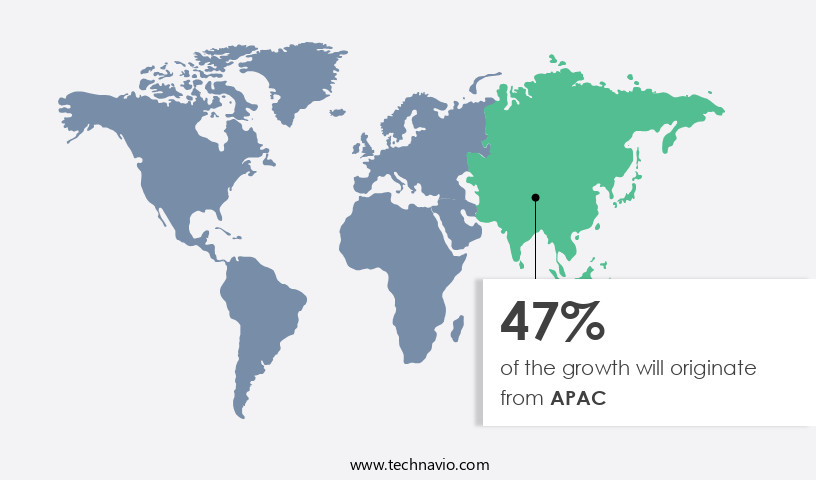

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is a significant segment of the global automotive interior industry. Carpet acoustics, warranties, padding, edges, underlay, remnants, maintenance, trims, fitting, fasteners, density, templates, durability, dyeing, installation tools, certification, weaving, custom carpets, adhesives, vehicle upholstery, interior design, seams, cargo liners, cutting, binding, pile height, tufting, stain resistance, rolls, recycling, trunk liners, shaping, tiles, weight, printing, fibers, kits, backing, care products, fire retardancy, cleaning, floor mats, standards, and installation are integral components of this market. APAC is the leading market for automotive floor carpets, with China, India, and South Korea being major contributors due to the increasing demand for automobiles and rapid industrialization and urbanization.

The market's growth in APAC is driven by OEMs and is directly proportional to the demand for automobiles in the region. Carpet manufacturers focus on innovations in carpet technology, such as improved carpet density, stain resistance, and pile height, to cater to the evolving consumer preferences and automotive industry trends. Carpet recycling and the use of eco-friendly materials are also gaining traction in the market to reduce the environmental impact.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Floor Carpet Industry?

- In the Western markets, the increasing demand for personalized vehicle features drives market growth in the automotive customization industry.

- The market is experiencing significant growth due to the increasing demand for vehicle customization in various regions. Consumers seek personalized interiors, and floor carpets, with their options in color, texture, and design, are an essential element. Moreover, the automotive industry's continuous evolution necessitates differentiation, making customizable floor carpets an attractive value-add for manufacturers. Another driving factor is the shift towards electric vehicles (EVs) and hybrid vehicles, which require high-quality floor carpets to ensure durability and resistance to specific chemicals and wear. Carpet templates, carpet dyeing, carpet installation tools, and carpet certification are essential aspects of the market, ensuring the production of high-quality, long-lasting carpets.

- Carpet weaving techniques and carpet adhesives are also crucial components in creating carpets that meet the specific requirements of the automotive industry. In conclusion, the market is thriving due to the rising demand for customization and the shift towards electric and hybrid vehicles. Manufacturers are responding by offering high-quality, customizable floor carpets to meet the evolving needs of consumers and the industry.

What are the market trends shaping the Automotive Floor Carpet Industry?

- The market is currently experiencing significant technological advancements, which represents an emerging trend in this industry. Innovations in carpet materials, manufacturing processes, and design are driving growth in this sector.

- The market is experiencing growth due to the adoption of advanced materials and technologies. Companies are utilizing composite materials, increasing the value proposition of floor carpets with enhanced durability and longevity. Notably, high-quality, scratch-resistant polyurethane leather is being used for entry-level passenger vehicles. Additionally, the use of cross-linked, environment-friendly, and odorless polyethylene (PE) in floor carpets offers improved sound insulation and absorption. Market growth is further driven by the production of cargo liners, carpet tiles, trunk liners, and carpet rolls, all of which cater to various automotive applications.

- Carpet pile height and carpet tufting techniques contribute to the market's diversity, while carpet binding and carpet cutting processes ensure a customized fit. Furthermore, carpet stain resistance is a significant consideration in the production of automotive floor carpets. Lastly, carpet recycling initiatives have gained traction, contributing to the market's sustainability efforts.

What challenges does the Automotive Floor Carpet Industry face during its growth?

- The volatile pricing of raw materials poses a significant challenge to the industry, hindering its growth.

- The market experiences volatility due to fluctuating raw material prices. Key components of automotive floor carpets include carpet fibers, carpet backing, and adhesives. Synthetic and natural fibers, as well as adhesives, are subject to price fluctuations caused by supply and demand shifts, geopolitical events, and natural disasters. This market challenge necessitates effective cost management and pricing strategies for manufacturers. Simultaneously, the global automotive sector experiences a growing demand for comfort and convenience features, leading to the increased use of high-quality materials in vehicles. As a result, automotive floor carpets must meet stringent standards for carpet weight, carpet printing, carpet fire retardancy, and carpet care products.

- Additionally, floor mats and carpet installation are essential considerations for the industry. Manufacturers must balance the need for cost efficiency with the demand for superior quality and performance in their products. In response, they invest in research and development to create innovative carpet solutions that meet customer expectations while addressing market challenges. This ongoing focus on innovation and quality is expected to drive the growth of the market.

Exclusive Customer Landscape

The automotive floor carpet market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive floor carpet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive floor carpet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adler Pelzer Holding GmbH - The company specializes in providing innovative automotive flooring solutions, encompassing Integrated Floor Carpeting, Floor Insulation, Dilour Carpet, Tufted Carpet, and Floor Trim. These offerings cater to various automotive applications, ensuring superior comfort, insulation, and aesthetics. Integrated Floor Carpeting integrates the carpet into the vehicle's floor structure for a seamless look. Floor Insulation minimizes noise and heat transfer, enhancing the driving experience. Dilour Carpet features a unique texture and appearance, while Tufted Carpet showcases a luxurious, plush finish. Lastly, Floor Trim completes the interior design with a refined edge. By combining these options, the company delivers customizable, high-quality flooring solutions for automotive manufacturers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adler Pelzer Holding GmbH

- Auto Custom Carpets Inc.

- Autoneum Holding Ltd.

- Beaulieu International Group

- Betap B.V.

- Bharat Seats Ltd.

- Corinthian Textiles

- Dorsett

- Feltol Manufacturing Co. Ltd.

- Freudenberg and Co. KG

- Hayashi Telempu Co. Ltd.

- Hitkari Hitech Pvt. Ltd.

- Hyosung Advanced Materials

- IDEAL Automotive GmbH

- KK Motors Inc.

- Knox Auto Carpets Pty Ltd.

- Kotobukiya Fronte Co. Ltd.

- Toyota Motor Corp.

- Vaccess India Pvt. Ltd.

- Wade Automotiv

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Floor Carpet Market

- In March 2023, leading automotive floor carpet manufacturer, Interiors International, introduced its new eco-friendly carpet line, "GreenCarpet," at the New York International Auto Show (NYIAS). This innovative product, made from 100% recycled materials, marks a significant stride towards sustainability in the automotive industry (Interiors International Press Release, 2023).

- In July 2024, Magna International, a global automotive supplier, announced a strategic partnership with Tesla to produce floor carpets for the electric vehicle manufacturer. This collaboration signifies Magna's entry into the electric vehicle floor carpet market, expanding its customer base and strengthening its market position (Magna International Press Release, 2024).

- In October 2024, automotive floor carpet manufacturer, Fibertex Nonwovens, secured a â¬100 million investment from Blackstone, a leading global investment firm. The funds will be used to expand production capacity and accelerate the development of new, innovative floor carpet solutions (Fibertex Nonwovens Press Release, 2024).

- In February 2025, the European Union passed the new "Green Deal" regulation, which includes a mandate for all new cars to be fitted with recyclable or biodegradable floor carpets by 2030. This regulatory initiative is expected to drive significant growth in the market, as manufacturers shift towards more sustainable materials (European Commission Press Release, 2025).

Research Analyst Overview

- The market encompasses a diverse range of offerings, with carpet brand loyalty and value playing significant roles in consumer decision-making. Carpet performance, design, and comfort are key factors influencing customer needs and preferences. The carpet industry standards prioritize safety, innovation, and sustainability, driving research and development in areas such as carpet manufacturing, technology, and certifications. Carpet marketing strategies focus on advertising and distribution channels, aiming to reach diverse consumer segments. The carpet supply chain is subject to regulations and automation, ensuring efficient production and delivery. Carpet trends lean towards aesthetics, with an increasing emphasis on carpet sustainability and social responsibility.

- Carpet innovation continues to shape the market, with new materials, manufacturing processes, and certifications emerging to address evolving consumer demands. Price remains a critical consideration, as competition intensifies among carpet brands and manufacturers. Carpet certifications, such as those related to environmental impact and safety, are increasingly important to consumers and industry stakeholders alike. The carpet industry strives to meet these standards, fostering a culture of transparency and accountability. In summary, the market is dynamic and diverse, with a focus on performance, design, and sustainability. Carpet manufacturers and brands must navigate complex market trends, consumer preferences, and regulatory requirements to remain competitive and meet evolving customer needs.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Floor Carpet Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

233 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 1284.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, UK, Germany, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Floor Carpet Market Research and Growth Report?

- CAGR of the Automotive Floor Carpet industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive floor carpet market growth of industry companies

We can help! Our analysts can customize this automotive floor carpet market research report to meet your requirements.