Automotive HVAC Compressor Market Size 2025-2029

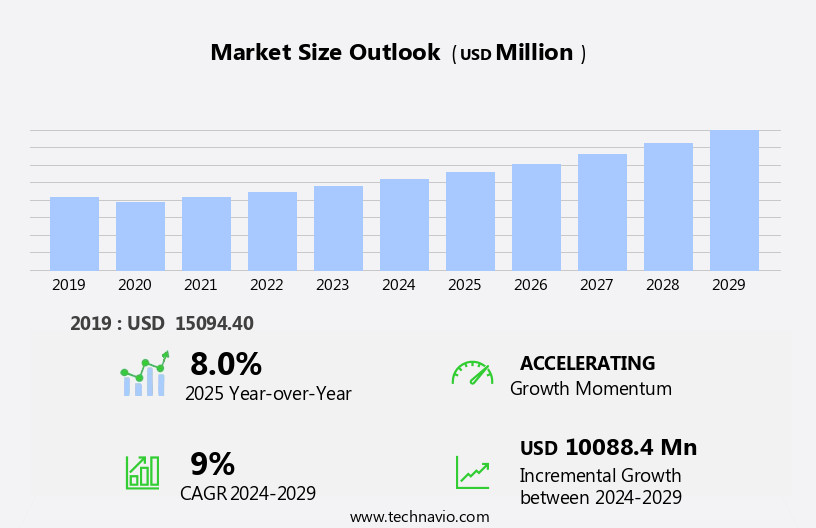

The automotive HVAC compressor market size is forecast to increase by USD 10.09 billion, at a CAGR of 9% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. One of the primary factors driving market expansion is the increasing adoption of electric HVAC compressors in vehicles. As the demand for eco-friendly and fuel-efficient solutions rises, electric compressors are becoming a popular choice. Additionally, the growing popularity of electric vehicles (EVs) is also contributing to market growth, as EVs require specialized HVAC compressors to maintain cabin temperature. The market encompasses the production and supply of compressors utilized in heating, ventilation, and air conditioning systems for both passenger cars and commercial vehicles. However, the high initial cost associated with automotive HVAC compressors remains a challenge for market growth. Despite this, the long-term benefits, such as improved fuel efficiency and reduced emissions, make the investment worthwhile for automakers and consumers alike. Overall, the market for automotive HVAC compressors is poised for continued growth, driven by these trends and the increasing demand for advanced climate control systems in vehicles.

What will be the Size of the Automotive HVAC Compressor Market During the Forecast Period?

- This market exhibits significant growth due to increasing demand for comfort and convenience features in vehicles, particularly in regions with extreme climates. The passenger car segment dominates the market, driven by the large volume of sales.

- In contrast, the commercial vehicle segment, including trucks, light-duty trucks, and pickup trucks, is expected to witness steady growth due to the expanding fleet size and the need for efficient climate control solutions. Technological advancements, such as the adoption of variable displacement compressors and electric vehicle (EV) applications using BLDC motors, are shaping the market landscape. Overall, the market is poised for continued expansion as vehicle manufacturers prioritize enhancing the driving experience for consumers.

How is this Automotive HVAC Compressor Industry segmented and which is the largest segment?

The automotive HVAC compressor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger cars

- LCVs

- MCVs and HCVs

- Type

- Swash plate compressors

- Scroll compressors

- Rotary compressors

- Reciprocating compressors

- Channel

- OEM

- Aftermarket

- Material

- Belt-driven compressors

- Electric-driven compressors

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- South America

- Brazil

- Middle East and Africa

- APAC

By Application Insights

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the near-universal adoption of HVAC systems in passenger cars. With almost all automakers equipping their passenger vehicles with these systems, the market's growth is largely contingent on the production volume of these vehicles. The decline in sales of internal combustion engine (ICE)-based passenger cars has led to a cautious production approach from manufacturers. However, the rising demand for electric powertrain-based passenger cars presents a significant growth opportunity for the market. The commercial vehicles segment, including trucks, light-duty trucks, and pickup trucks, also utilizes HVAC compressors, contributing to the market's expansion. Technological advancements, such as variable displacement compressors, electric compressors, and smart climate control systems, are further enhancing the market's growth potential.

Get a glance at the Automotive HVAC Compressor Industry report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 11.26 billion in 2019 and showed a gradual increase during the forecast period.

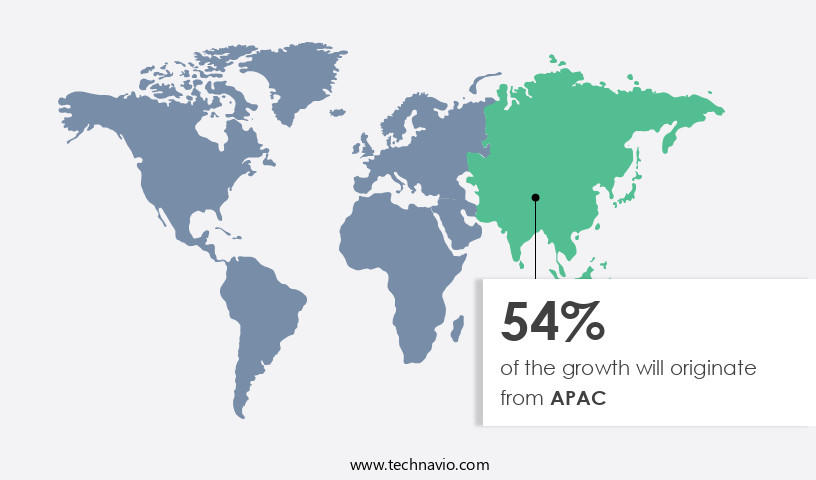

Regional Analysis

- APAC is estimated to contribute 54% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is primarily driven by the high penetration of HVAC systems in passenger cars, which accounts for nearly 100% of market penetration. The commercial vehicle segment is also witnessing an increasing adoption rate of HVAC systems, further fueling market growth. The region is anticipated to experience significant growth In the adoption of HEVs, PHEVs, and BEVs, particularly in China, Japan, and South Korea. This shift towards electric vehicles is expected to result in increased demand for electric compressors, contributing to the expansion of the market in APAC. Key components of HVAC systems include BLDC motors, Variable Displacement Compressors (VDC), and Fixed Displacement Compressors (FDC), available in Electric Compressors, Reciprocating Compressors, Rotary Compressors, and Scroll Compressors. Energy efficiency and smart climate control are crucial factors influencing the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive HVAC Compressor Industry?

Growing adoption of electric HVAC compressors is the key driver of the market.

- The market encompasses components used for heating, ventilation, and air conditioning systems in passenger cars and commercial vehicles. Traditional HVAC compressors are driven by a belt connected to the engine crankshaft, leading to increased engine load, fuel consumption, and exhaust emissions. In response, manufacturers have introduced electric compressors, which operate independently using a built-in motor. These compressors, suitable for hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs), enhance energy efficiency and reduce exhaust emissions.

- The electric compressor market consists of various types, including BLDC motors, electric reciprocating compressors, electric scroll compressors, and electric rotary compressors. The market is segmented by vehicle type into passenger cars and commercial vehicles, with the former including sedans, SUVs, and compact cars. The latter segment comprises trucks, light-duty trucks, and pickup trucks. The distribution channel includes the aftermarket and OEM segments. Technologies such as smart climate control and energy efficiency are driving the growth of the market.

What are the market trends shaping the Automotive HVAC Compressor Industry?

Rise in adoption of EVs is the upcoming market trend.

- The market is experiencing notable growth due to the increasing adoption of electric vehicles (EVs) and hybrid vehicles. This trend is observed in various regions, including India, Canada, the United Kingdom, and South Africa. For instance, India has witnessed a significant increase in EV sales, with approximately 2 million units sold in 2024, encompassing two-wheelers, three-wheelers, and passenger cars. This growth is expected to continue, driving demand for advanced HVAC compressors that are energy-efficient and compatible with electric drivetrains. In the passenger car segment, HVAC systems are essential for providing comfort and ventilation. The market for HVAC compressors in passenger cars is expected to grow due to the increasing demand for smart climate control systems.

- The commercial vehicles segment, including trucks, light-duty trucks, and pickup trucks, also requires HVAC systems for driver comfort and vehicle temperature regulation. The HVAC compressor market offers various types of compressors, including BLDC motor-based compressors, Variable Displacement compressors, Fixed Displacement compressors, Electric Compressors, Reciprocating Compressors, Rotary Compressors, and Scroll Compressors. These compressors use refrigerants such as R134a, R1234yf, and CO2 (R744). Major players In the market include Marelli Corporation, Hanon System, Valeo, and Highly Marelli Holdings. These companies are investing in research and development to produce compressors that are energy-efficient and compatible with various vehicle types and refrigerants.

What challenges does the Automotive HVAC Compressor Industry face during its growth?

High initial cost associated with automotive HVAC compressors is a key challenge affecting the industry growth.

- The market is experiencing a notable challenge due to the elevated costs of various compressor types. This financial hurdle affects both manufacturers and consumers, shaping market trends and acceptance rates. Traditional compressors, including reciprocating, scroll, and fixed displacement compressors, had a manufacturing cost range of USD 50 to USD 100 per unit in 2023. However, a slight increase in costs is projected for 2024, with prices estimated between USD 55 and USD 105 per unit. This marginal rise, though minimal, adds to the financial strain for manufacturers. Meanwhile, electric compressors, such as BLDC motors, are gaining popularity due to their energy efficiency and integration with Electric and Hybrid Vehicles (EVs) from brands like Polestar and Cadillac.

- Despite their advantages, electric compressors currently carry a higher price tag compared to traditional compressors, further complicating the market landscape. In the commercial vehicle sector, including trucks and light-duty trucks, demand for HVAC systems remains strong. Variable displacement compressors cater to this segment, offering improved climate control and fuel efficiency. However, their manufacturing costs are significantly higher than traditional compressors, averaging around USD 200 per unit. As the market evolves, technology advancements, such as smart climate control and CO2 (R744) refrigerants, are expected to drive growth. The aftermarket distribution channel also plays a crucial role in the market's expansion, providing cost-effective solutions for consumers.

Exclusive Customer Landscape

The automotive HVAC compressor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive HVAC compressor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive HVAC compressor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Aotejia New Energy Technology Co. Ltd - The company offers automotive HVAC compressor such as OM612 truck air conditioner compressor, A4 audi AC compressor, BMW E87 AC compressor and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- DENSO Corp.

- ERAE AMS

- ESTRA Automotive Systems Co. Ltd.

- Hanon Systems

- HELLA GmbH and Co. KGaA

- Japan Climate Systems Corp.

- MAHLE GmbH

- Marelli Holdings Co. Ltd.

- Mitsubishi Heavy Industries Ltd.

- Ningbo Anchor Auto Parts Co. Ltd.

- OMEGA Environmental Technologies

- Sanden Corp.

- Smiths Manufacturing (Pty) Ltd.

- Subros Ltd.

- Toyota Industries Corp.

- Valeo SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive heating, ventilation, and air conditioning (HVAC) compressor market encompasses a vital component in modern vehicles, ensuring passenger comfort and energy efficiency. This market caters to both passenger cars and commercial vehicles, with distinct demands and trends shaping its growth. The HVAC compressor market witnesses continuous evolution, driven by advancements in technology and shifting consumer preferences. The component plays a pivotal role in regulating temperature and air quality withIn the vehicle cabin. In recent years, the market has seen an increasing focus on energy efficiency and smart climate control. Two primary vehicle types, passenger cars and commercial vehicles, contribute significantly to the HVAC compressor market.

Further, passenger cars have traditionally been the dominant segment due to their larger market share and higher production volumes. However, the commercial vehicle segment, including trucks, light-duty trucks, and pickup trucks, is gaining traction as fleet operators prioritize driver comfort and productivity. The HVAC compressor market offers a diverse range of compressor types, including variable displacement and fixed displacement compressors. Variable displacement compressors offer improved energy efficiency and better temperature control, making them increasingly popular in modern vehicles. In contrast, fixed displacement compressors have a consistent displacement and are commonly found in older vehicles or budget models. The HVAC compressor market also includes electric compressors, such as BLDC motors, and traditional compressor types like reciprocating, rotary, and scroll compressors.

In addition, electric compressors have gained popularity due to their energy efficiency and quiet operation, while reciprocating, rotary, and scroll compressors continue to dominate the market due to their affordability and reliability. The market's distribution channel landscape includes OEMs and the aftermarket. OEMs represent the primary distribution channel, as they integrate HVAC compressors into new vehicles during manufacturing. The aftermarket caters to the replacement and repair needs of existing vehicles, offering a significant growth opportunity for market participants. Energy efficiency and smart climate control are key market drivers, as consumers increasingly demand comfortable and eco-friendly vehicle environments. The transition to electric and hybrid vehicles (EVs) also influences the HVAC compressor market, as these vehicles require specialized HVAC systems to manage battery temperatures and cabin conditions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market Growth 2025-2029 |

USD 10.09 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

Japan, US, China, India, Germany, UK, Canada, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive HVAC Compressor Market Research and Growth Report?

- CAGR of the Automotive HVAC Compressor industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive HVAC compressor market growth of industry companies

We can help! Our analysts can customize this automotive HVAC compressor market research report to meet your requirements.