Automotive Transmission Systems Market Size 2024-2028

The automotive transmission systems market size is forecast to increase by USD 53.2 billion at a CAGR of 6.08% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of automatic transmissions in vehicles. This trend is driven by the convenience and improved fuel efficiency that automatic transmissions offer. Additionally, the development of auto-shift manual transmission systems with adaptive transmission control is gaining traction, providing a middle ground between manual and automatic transmissions.

- The industrial sector's shift towards carbon neutrality and stringent environmental regulations are also driving the demand for more efficient and less harmful emissions boiler technologies, such as those fueled by natural gas, biomass, and hydrogen. However, challenges persist in the form of erratic gear shifts resulting in whining and grinding noise due to wear and tear. Manufacturers are investing in research and development to address these issues and improve the overall performance and durability of transmission systems. The market is expected to continue its growth trajectory, driven by these trends and the ongoing demand for advanced and efficient transmission systems.

What will be the Size of the Automotive Transmission Systems Market During the Forecast Period?

- The market is experiencing significant dynamics and trends shaped by various factors. Increasing carbon emissions concerns and the push towards renewable energy sources are driving the demand for more efficient transmission systems. Industrial facilities in multiple industries, including food and beverage, petrochemical, power, and oil and gas, are investing in advanced transmission systems to reduce their environmental footprint and comply with stringent laws.

- However, these investments come with heavy expenses, including installation costs, labor costs, and miscellaneous expenses. Moreover, inflation and volatile oil prices can impact the market's growth. Downtime due to damaged boilers and other maintenance issues can also result in significant losses. Despite these challenges, the market is expected to grow as industries continue to seek ways to optimize their operations and reduce harmful emissions.

How is this Automotive Transmission Systems Industry segmented and which is the largest segment?

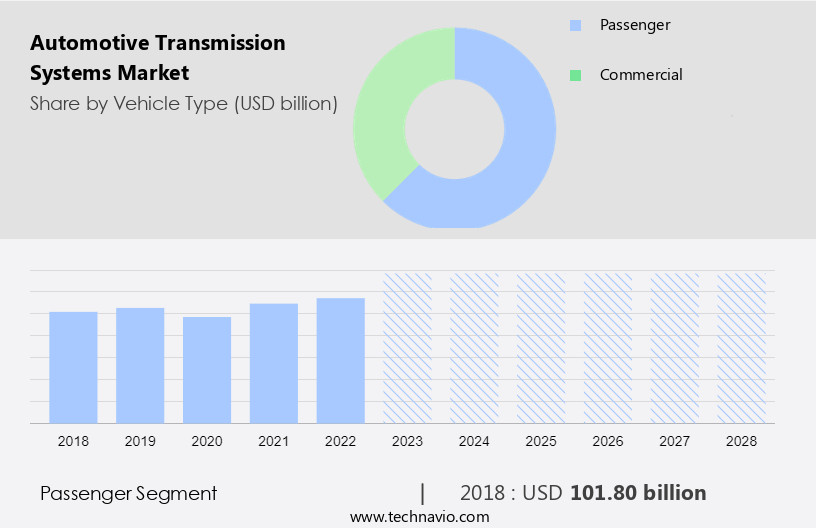

The automotive transmission systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger

- Commercial

- Type

- Manual

- Automatic

- Fuel Type

- Diesel

- Gasoline

- Alternate Fuel

- Transmission Type

- Automatic Transmission

- Automated Manual Transmission

- Dual-Clutch Transmission

- Continuously Variable Transmission

- Manual Transmission

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Vehicle Type Insights

- The passenger segment is estimated to witness significant growth during the forecast period.

The passenger segment of the market is projected to expand at a consistent rate due to the increasing consumer preference for automobiles equipped with advanced transmission systems. Automated gearboxes, including CVTs and DCTs, offer advantages such as enhanced fuel efficiency and seamless gear shifts, making them increasingly popular. The passenger cars segment has historically accounted for a significant share of global automobile sales in terms of volume. This trend is driven by the rapid pace of urbanization and the increasing disposable income of consumers. Superior fuel efficiency and smoother gear shifts provided by automated transmission systems are particularly appealing in bumper-to-bumper traffic conditions, leading to their widespread adoption in the passenger car market. The transition towards cleaner and more efficient energy sources, such as renewables and biofuels, is also expected to influence the market, with a growing focus on reducing carbon emissions and promoting industrial sustainability. Industrial facilities, including those in the petrochemical, power, and primary metal industries, are also major consumers of steam generating boilers, which are integral to the operation of these industries.

Moreover, the efficiency and running costs of steam generating boilers, including water-tube, hot water, and oil fired boilers, are critical factors influencing their adoption. The installation, labor, and miscellaneous expenses, along with downtime due to damaged boilers and heavy expenses related to electricity bills, closure of industries, and commercial spaces, are important considerations for industries when investing in new boiler systems. The production of boilers, including fuel type, boiler horsepower, and application segment, varies across industries such as refineries, chemical, food processing, pulp & paper, and metal manufacturing plants. The global boiler market is influenced by factors such as inflation, oil prices, and government incentives and subsidies, which can impact the overall market dynamics. The market for boilers is expected to continue evolving in response to rapid industrialization, the growing demand for clean fuels, and the increasing importance of energy efficiency and environmental considerations.

Get a glance at the Automotive Transmission Systems Industry report of share of various segments Request Free Sample

The passenger segment was valued at USD 101.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

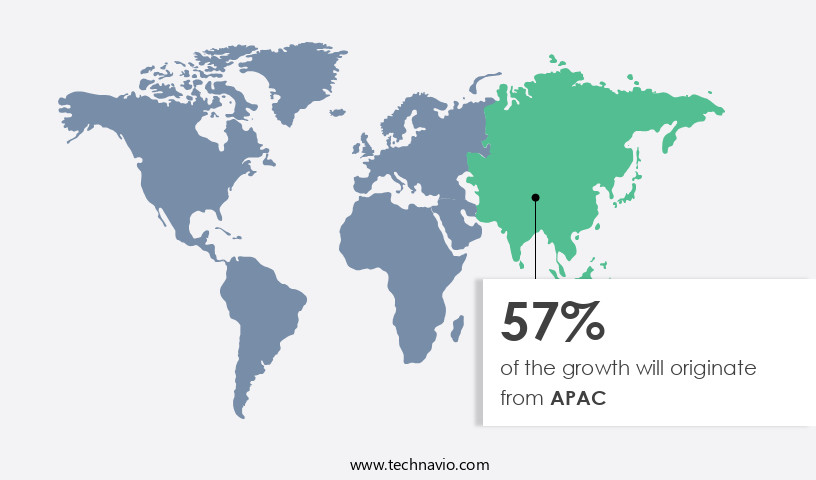

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the Asia Pacific (APAC) region, economic growth, driven primarily by China and India, has led to an increase in per capita income since 2016. This trend has boosted consumer purchasing power, resulting in higher automobile sales not only in China and India but also in countries like Indonesia and Thailand. Stringent emission norms, derived from Euro standards, have been implemented in most APAC countries. For instance, India introduced BS-VI norms in April 2020, based on Euro 6 emission standards. The market in APAC is expected to grow due to the increasing demand for fuel-efficient and eco-friendly vehicles. The market is influenced by factors such as inflation, oil prices, and government initiatives like the European Union's Green Deal and industrial incentives and subsidies.

Moreover, industrial facilities, including those in the petrochemical industry, are transitioning to cleaner fuels like natural gas and renewables, such as hydrogen firing and biomass boilers. The application segments include refineries, chemical, food processing, pulp & paper, primary metal, and others. The market growth is also impacted by factors like installation costs, labor costs, miscellaneous expenses, downtime due to damaged boilers, heavy expenses such as electricity bills, and the closure of industries. The market for steam generating boilers is expected to grow due to their energy efficiency and ability to generate steam for various applications. The market for fossil fuel segment and non-fossil fuels, including biomass, is expected to expand as industries strive for carbon neutrality.

Market Dynamics

Our automotive transmission systems market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Transmission Systems Industry?

The growing adoption of automatic transmissions in vehicles is the key driver of the market.

- The market is experiencing significant growth, particularly in the passenger car segment, as automatic transmission systems become more accessible to budget-conscious consumers. In developed countries and emerging economies like China and India, increasing purchasing power is driving the demand for automatic vehicles. These systems eliminate the need for clutch and gearshifts, reducing driving fatigue and traffic congestion-related stress. Carbon emissions are a major concern for the automotive industry, and the shift towards renewable energy sources and clean fuels is gaining momentum. Industrial facilities, including those in the petrochemical industry, are exploring the use of steam generating boilers fueled by biomass, coal, natural gas, and oil. The European Green Deal and similar initiatives aim to incentivize the adoption of renewable energy and reduce the reliance on coal-fired and industrial boilers. The efficiency and operating cost of steam generating boilers, including water-tube boilers, hot water boilers, and oil fired boilers, are critical factors influencing their adoption.

- Moreover, fuel type, boiler horsepower, and running costs are also essential considerations. The power sector, refineries, chemical, food processing, pulp & paper, primary metal, and various industries are major applications for steam generating boilers. The transition towards carbon neutrality and the increasingly stringent laws on harmful emissions have led industries to explore alternative fuels like hydrogen and biofuels. The cost of installation, labor, miscellaneous expenses, downtime due to damaged boilers, electricity bills, and the closure of industries due to non-compliance with emission norms are significant challenges. The production of boilers and their application segments, including distilleries, craft distilling, petrochemical plants, and petroleum refineries, require careful consideration. The materials used in boiler manufacturing, such as steel, are subject to issues like deformation, stress corrosion, and welding problems. Hydrogen embrittlement is a significant concern for hydrogen firing applications. The textile, FMCG, and industrial plants, including mega power projects, are significant consumers of steam generating boilers. Boiler rules and environmental emissions regulations are stringent, and compliance with these regulations can be costly.

- Thus, the cost of fuel, whether fossil or non-fossil, is a significant factor in the running costs of these boilers. In summary, the market is growing due to the increasing demand for automatic transmission vehicles. The industrial sector's shift towards renewable energy and carbon neutrality is driving the adoption of steam generating boilers. The efficiency, cost, and environmental considerations are crucial factors in the selection of fuel types and boiler applications. The challenges of installation, maintenance, and compliance with regulations require careful planning and implementation.

What are the market trends shaping the Automotive Transmission Systems Industry?

The development of auto-shift manual transmission systems with adaptive transmission control is the upcoming market trend.

- The market is experiencing significant growth due to the adoption of advanced technologies such as continuous variable transmissions (CVT) and dual-clutch transmissions (DCT). These systems offer smoother gear shifts and improved fuel efficiency, making them increasingly popular in the automotive industry. Additionally, innovative developments like auto-shift manual transmission systems, which combine the advantages of automatic and manual systems, are gaining traction. These systems operate using an electronic control system, eliminating the need for manual gear shifting. The global automotive industry is undergoing transformation, driven by stringent emission control laws and the shift towards renewable energy and clean fuels. Developed countries are leading the way in this transition, with many implementing policies like the European Union's Green Deal to incentivize the use of renewable energy and reduce carbon emissions.

- Moreover, developing nations are following suit, with rapid industrialization leading to the installation of industrial boilers in various sectors, including power, petrochemical, food and beverage, and primary metal. The cost of oil and inflation have influenced the choice of fuel type and boiler horsepower in industrial facilities. Industrial boiler efficiency and operating cost are critical factors in the decision-making process. Steam generating boilers, including water-tube boilers, hot water boilers, and oil fired boilers, are widely used in various industries, including refineries, chemicals, food processing, pulp & paper, and metal manufacturing plants. The transition towards carbon neutrality has led to the exploration of non-fossil fuels like biomass, hydrogen, and natural gas.

- Biomass boilers, using feedstock like wood, bagasse, sorghum stalks, and sugarcane, are increasingly being adopted for their environmental benefits. Industrial facilities are also turning to hydrogen firing and coal-based counterparts with carbon capture and storage technology to reduce CO2 emissions. The application segments for steam generating boilers include distilleries, craft distilling, petrochemical plants, petroleum refineries, and steel mills. The fossil fuel segment dominates the market, but the non-fossil fuels segment is expected to grow rapidly due to the increasing focus on reducing harmful emissions and achieving sustainability. The installation costs, labor costs, miscellaneous expenses, downtime, and damaged boiler expenses are significant factors affecting the market dynamics.

- Thus, electricity bills and the closure of industries due to environmental regulations also impact the market. In summary, the market is evolving rapidly, driven by advancements in technology and the shift towards renewable energy and clean fuels. The global automotive industry is undergoing a transformation, with various sectors adopting steam generating boilers to meet their energy needs. The market dynamics are influenced by factors like fuel type, boiler horsepower, industrial facilities, and environmental regulations. The transition towards carbon neutrality and the adoption of non-fossil fuels are expected to significantly impact the market in the coming years.

What challenges does the Automotive Transmission Systems Industry face during its growth?

Erratic gear shifts resulting in whining and grinding noise due to wear and tear is a key challenge affecting the industry's growth.

- The market encompasses various types of systems, including Automatic Transmission (AT) and Manual Transmission (MT). Automotive Transmission Systems, particularly Automatic Transmission Systems (ATS), such as Dual Clutch Transmissions (DCTs), are more complex in design and functionality compared to MT. This complexity makes diagnosis of ATS issues a challenge. One common problem is contaminated transmission fluid, which can lead to transmission slipping. DCT systems utilize a set of planetary gears for gear shifting, which are coupled with input and output shafts. The gear shift occurs through a dual-clutch system and bands, which are activated with DCT fluid. Worn-out clutches or bands result in harder gear shifts, causing the engine to rev longer. The transition towards cleaner fuels and renewable energy sources, such as carbon neutrality initiatives, influences the market. Industrial facilities, including the petrochemical industry, face rising inflation and oil prices, compelling them to focus on energy efficiency and cost savings. Industrial boilers, including water-tube boilers, hot water boilers, and oil fired boilers, are subject to various fuel types, boiler horsepower, and application segments, such as refinery, chemical, food processing, pulp & paper, primary metal, and others. Industrial boiler efficiency and operating cost are crucial factors in the decision-making process.

- Moreover, incentives, subsidies, and stringent laws aiming to reduce harmful emissions from coal-fired boilers, industrial boilers, and coal plants have led to the adoption of clean fuels, such as natural gas, biomass, and hydrogen firing. Developing nations are rapidly industrializing, leading to the production of industrial plants, mega power projects, and commercial spaces, further increasing the demand for steam generating boilers. The market dynamics are influenced by factors such as installation costs, labor costs, miscellaneous expenses, downtime due to damaged boilers, heavy expenses like electricity bills, closure of industries, and the production of boilers. The non-fossil fuel segment, including biomass, is gaining popularity due to its environmental benefits and cost savings. Materials used in boiler manufacturing, such as metals, are subject to deformation, stress corrosion, welding issues, and hydrogen embrittlement. Application segments, such as distilleries, craft distilling, petrochemical plants, petroleum refineries, and steel mills, have unique requirements for transmission systems.

- Thus, the fossil fuel segment, including coal-based counterparts, faces increasing competition from non-fossil fuels, such as biomass, bagasse, sugarcane, sorghum stalks, and others. In summary, the market is influenced by various factors, including the transition towards cleaner fuels, industrial requirements, and the need for energy efficiency and cost savings. The market dynamics are complex, with factors such as fuel types, application segments, and material challenges impacting the market. The focus on carbon neutrality and environmental emissions reduction is driving the adoption of non-fossil fuels and advanced transmission systems.

Exclusive Customer Landscape

The automotive transmission systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive transmission systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive transmission systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ZF Friedrichshafen AG

- Aisin Seiki Co. Ltd.

- BorgWarner Inc.

- Eaton Corp. plc

- Magna International Inc.

- Allison Transmission Holdings Inc.

- JATCO Ltd.

- Hyundai Transys Inc.

- Hitachi Astemo Ltd.

- Schaeffler AG

- Meritor Inc.

- Transmission Technologies Corp.

- Valeo SA

- Continental AG

- DENSO Corp.

- Mitsubishi Heavy Industries Ltd.

- Sumitomo Heavy Industries Ltd.

- thyssenkrupp AG

- Dana Inc.

- American Axle and Manufacturing Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a critical component of the global industrial sector, playing a significant role in the efficient operation of various industries and commercial spaces. Transmission systems enable the conversion of engine power into motion, allowing vehicles and industrial equipment to function effectively. In the current business landscape, several market dynamics are shaping the market. Industrial facilities in developed countries are increasingly focusing on reducing carbon emissions and adopting renewable energy sources. This shift is driving the demand for transmission systems that are compatible with clean fuels, such as hydrogen and electricity. The European Green Deal, for instance, is a key initiative aimed at making Europe carbon neutral by 2050, which is expected to boost the demand for transmission systems that support the use of clean fuels in industries. Fuel type is a significant factor influencing the market. Industrial boilers, which are essential for various industries, are available in different types, including water-tube boilers, hot water boilers, and oil fired boilers. The choice of fuel type depends on several factors, including operating cost, industrial application, and availability. Industrial boiler efficiency is a crucial consideration for industries, as higher efficiency translates into lower fuel consumption and reduced emissions.

Moreover, the petrochemical industry is a significant consumer of automotive transmission systems. The industry's rapid industrialization and the need for energy efficiency have led to the adoption of advanced transmission systems. The industry's reliance on fossil fuels, however, presents a challenge in terms of carbon emissions. The trend towards carbon neutrality and the adoption of non-fossil fuels, such as biomass and hydrogen, is expected to create new opportunities for transmission systems in the petrochemical industry. The cost of installation, labor, and miscellaneous expenses are essential factors influencing the market. Downtime due to maintenance or damages can result in heavy expenses for industries. Therefore, transmission systems that offer high reliability and durability are preferred. The closure of industries due to stringent environmental emissions laws is another factor that can impact the demand for transmission systems. The application segment for automotive transmission systems includes various industries, such as refineries, chemicals, food processing, pulp & paper, primary metal, and textile. Each industry has unique requirements, and the choice of transmission system depends on the specific application.

For instance, distilleries require transmission systems that can handle high temperatures and pressures, while steel mills require systems that can handle heavy loads. The market is subject to various challenges, including material deformation, stress corrosion, and welding issues. Hydrogen embrittlement is a significant concern for industries using hydrogen as a fuel source. These challenges require continuous research and development efforts to create transmission systems that can withstand the demands of various industries while maintaining high efficiency and reliability. In summary, the market is a dynamic and complex landscape, influenced by various factors, including fuel type, industrial application, and environmental regulations. The shift towards clean fuels and carbon neutrality is expected to create new opportunities for transmission systems that support the use of non-fossil fuels. Industries will continue to seek transmission systems that offer high efficiency, reliability, and durability while minimizing costs and environmental impact.

|

Automotive Transmission Systems Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.08% |

|

Market growth 2024-2028 |

USD 53.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.61 |

|

Key countries |

China, US, Germany, Japan, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Transmission Systems Market Research and Growth Report?

- CAGR of the Automotive Transmission Systems industry during the forecast period

- Detailed information on factors that will drive the Automotive Transmission Systems growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive transmission systems market growth of industry companies

We can help! Our analysts can customize this automotive transmission systems market research report to meet your requirements.