The autonomous military vehicle market share is expected to increase by USD 457.09 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 11.10%.

This autonomous military vehicle market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers autonomous military vehicle market segmentation by product (semi-autonomous vehicle and fully autonomous vehicle) and geography (North America, APAC, Europe, MEA, and South America). The autonomous military vehicle market report also offers information on several market vendors, including BAE Systems Plc, Elbit Systems Ltd., General Dynamics Corp., Kratos Defense and Security Solutions Inc., Lockheed Martin Corp., Northrop Grumman Corp., Oshkosh Corp., Polaris Inc., Rheinmetall AG, and RUAG International Holding Ltd. among others.

What will the Autonomous Military Vehicle Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Autonomous Military Vehicle Market Size for the Forecast Period and Other Important Statistics

Autonomous Military Vehicle Market: Key Drivers, Trends, and Challenges

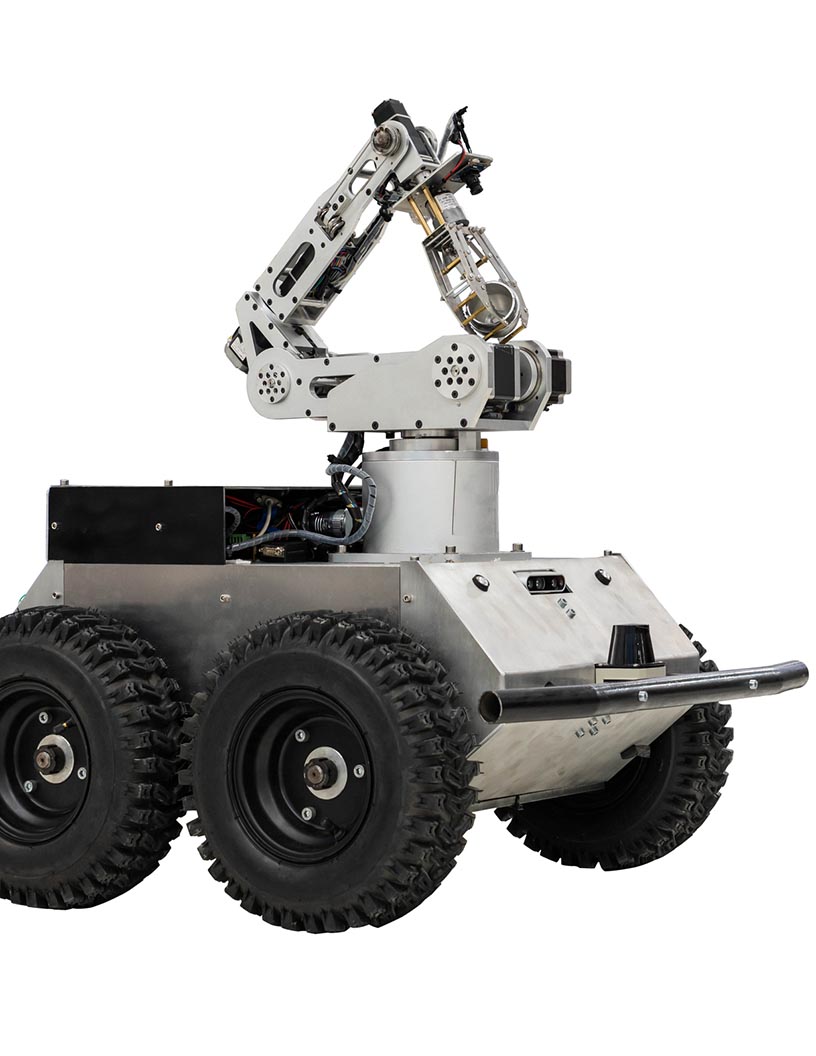

The increasing concerns over improvised explosive device (IED) blasts incentivizing government-funded development is notably driving the autonomous military vehicle market growth, although factors such as system reliability and uncertainty in user acceptance of autonomous features may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the autonomous military vehicle industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Autonomous Military Vehicle Market Driver

The increasing concerns over the improvised explosive device (IED) blast incentivizing government-funded development are some of the drivers supporting the autonomous military vehicle market growth. The use of IEDs is highly regulated and necessitates full adherence to international humanitarian law. Although the indiscriminate use of IEDs against civilians or civilian objects is strictly prohibited, their unlawful use, particularly by non-state armed groups and rogue individuals, is rapidly rising. Meanwhile, complementing technologies installed in autonomous vehicles will help ensure that in case an IED is missed by one scan, it is picked up by another. However, the researchers are trying to create an algorithm to make the identification of IEDs and other targets more effective with the help of the data collected by cameras and sensors. At the same time, the DARPA has invested considerably in developing similar technologies. Therefore, organizations coming forward to invest in such developing technologies will drive the market growth during the forecast period.

Key Autonomous Military Vehicle Market Trend

The emerging truck platooning is another factor supporting the autonomous military vehicle market share growth. In vehicle platooning, multiple cars, buses, and trucks travel at an aerodynamically efficient distance and maintain the distance at high speeds. For platooning, the autonomous system installed in vehicles uses ADAS, along with high-end specific platooning algorithms, involving the use of radar, LiDAR, and cameras. Vehicles in the fleet communicate via wireless connectivity and automatically synchronize speed and braking actions, thereby resulting in better fuel efficiency and improved traffic congestion control for all vehicles in the platoon. Truck platooning is a concept devised from connected truck technologies enabled in trucks that are engineered with level 2 automation. Developments in the Cooperative Adaptive Cruise Control (CACC) technology (these stem from level 1 and level 2 automation accomplishments in trucks) have resulted in the emergence of truck platooning.

Key Autonomous Military Vehicle Market Challenge

The factors such as system reliability and uncertainty in user acceptance of autonomous features are hampering the autonomous military vehicle market growth. As the military vehicle market is likely to register a high number of repeated users of autonomous technologies, customers must be assured of the reliability factors associated with such new technology-enabled systems and sub-systems. Though semi-autonomous vehicles use advanced driver assistance systems (ADAS) to prevent accidents and assist the driver, the safety aspect is still unclear. At the same time, the purpose of the autonomous vehicle technology system is defeated if the technology is tuned to generate only high-risk alerts. Therefore, the rapidly growing autonomous military vehicle market may pose challenges for players operating in ADAS and new technologies like semi-automated vehicles.

This autonomous military vehicle market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global autonomous military vehicle market as a part of the global aerospace and defense market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the autonomous military vehicle market during the forecast period.

Who are the Major Autonomous Military Vehicle Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- BAE Systems Plc

- Elbit Systems Ltd.

- General Dynamics Corp.

- Kratos Defense and Security Solutions Inc.

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- Oshkosh Corp.

- Polaris Inc.

- Rheinmetall AG

- RUAG International Holding Ltd.

This statistical study of the autonomous military vehicle market encompasses successful business strategies deployed by the key vendors. The autonomous military vehicle market is fragmented and the vendors are deploying growth strategies such as contract acquisitions, product and aftermarket service quality, reliability, and cost to compete in the market.

Product Insights and News

-

BAE Systems Plc - The company offers autonomous military vehicles which provide crucial insights into the capabilities of integrated autonomous technologies on future battlefields.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The autonomous military vehicle market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Autonomous Military Vehicle Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the autonomous military vehicle market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chains is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the aerospace and defense market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Autonomous Military Vehicle Market?

For more insights on the market share of various regions Request for a FREE sample now!

53% of the market’s growth will originate from North America during the forecast period. The US is the key market for the autonomous military vehicle market in North America. Market growth in this region will be faster than the growth of the market in other regions.

The reviving economy after the 2008-2009 financial crisis and the robust demand for automobiles in the country will facilitate the autonomous military vehicle market growth in North America over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In 2020, the COVID-19 pandemic led to the imposition of lockdowns in various countries in the region to prevent the spread. The defense industry in North America showed resilience in Q1 2021. It recovered from the economic downturn experienced in Q2 and Q3 2020. Moreover, with the easing of lockdown restrictions and increasing vaccination drives in the first half of 2021, the auto parts and equipment market is expected to drive the sales of autonomous military vehicles in North America, which will fuel the growth of the regional market during the forecast period.

What are the Revenue-generating Product Segments in the Autonomous Military Vehicle Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The autonomous military vehicle market share growth by the semi-autonomous vehicle segment will be significant during the forecast period. A semi-autonomous vehicle is controlled by a human operator from a remote location via an established communication network. All cognitive movements are processed based on the inputs provided by the operator. The vehicle operator analyses the sensory feedback captured from the line-of-sight visual observation or from remote sensory inputs. Thus, such applications may contribute to segment growth during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the autonomous military vehicle market size and actionable market insights on post COVID-19 impact on each segment.

|

Autonomous Military Vehicle Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.10% |

|

Market growth 2021-2025 |

$ 457.09 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

10.84 |

|

Regional analysis |

North America, APAC, Europe, MEA, and South America |

|

Performing market contribution |

North America at 53% |

|

Key consumer countries |

US, China, India, Russian Federation, and France |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

BAE Systems Plc, Elbit Systems Ltd., General Dynamics Corp., Kratos Defense and Security Solutions Inc., Lockheed Martin Corp., Northrop Grumman Corp., Oshkosh Corp., Polaris Inc., Rheinmetall AG, and RUAG International Holding Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Autonomous Military Vehicle Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive autonomous military vehicle market growth during the next five years

- Precise estimation of the autonomous military vehicle market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the autonomous military vehicle industry across North America, APAC, Europe, MEA, and South America

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of autonomous military vehicle market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch