Avocado Oil Market Size 2025-2029

The avocado oil market size is forecast to increase by USD 710.8 million at a CAGR of 13.8% between 2024 and 2029.

- The market exhibits growth, driven by the increasing health consciousness among consumers and the recognition of avocado oil's numerous health benefits. Avocado oil, rich in monounsaturated fatty acids and vitamins, is gaining popularity as a healthy alternative to other cooking oils. Natural oil blends and flavored avocado oil variants are further expanding the market's reach, catering to diverse consumer preferences. However, the market faces stringent regulations, particularly in regions with strict food safety and labeling, and packaging requirements. These regulations necessitate significant investments in research and development, production, and certification processes.

- Companies seeking to capitalize on market opportunities must navigate these regulatory complexities effectively while ensuring product quality and consumer safety. By staying informed of evolving regulations and consumer trends, businesses can effectively position themselves in this dynamic and growing market.

What will be the Size of the Avocado Oil Market during the forecast period?

- The market exhibits growth, driven by its versatility and health benefits. This market encompasses various applications, including culinary, cosmetic, and industrial uses. Avocado oil's high monounsaturated fat content and mild flavor make it a popular choice for consumers seeking healthier alternatives to traditional cooking oils. Key market trends include increasing demand for high-quality, organic, and cold-pressed avocado oils. Consumers prioritize health and wellness, leading to a preference for unrefined oils with minimal processing. Additionally, research and development efforts focus on enhancing the oil's stability, clarity, and smoke point to cater to diverse industrial applications. Avocado oil's desirable properties, such as high heat tolerance, smooth texture, and neutral flavor, contribute to its widespread adoption.

- However, challenges related to oxidation and rancidity necessitate careful storage and handling to maintain its quality and extend its shelf life. Innovations in the market include the exploration of avocado oil's potential in bioplastics, biodiesel, and other industrial applications, further expanding its market reach. Overall, the market is poised for continued growth, driven by consumer preferences for healthier alternatives and the versatility of this natural oil.

How is this Avocado Oil Industry segmented?

The avocado oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Refined avocado oil

- Crude avocado oil

- Distribution Channel

- Offline

- Online

- Application

- Food and beverages

- Pharmaceuticals and medicinal formulations

- Personal care and cosmetics

- Others

- Type

- Extra virgin oil

- Virgin oil

- Pure or refined oil

- Blend

- Geography

- North America

- US

- Canada

- Mexico

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- South America

- Brazil

- Middle East and Africa

- North America

By Product Insights

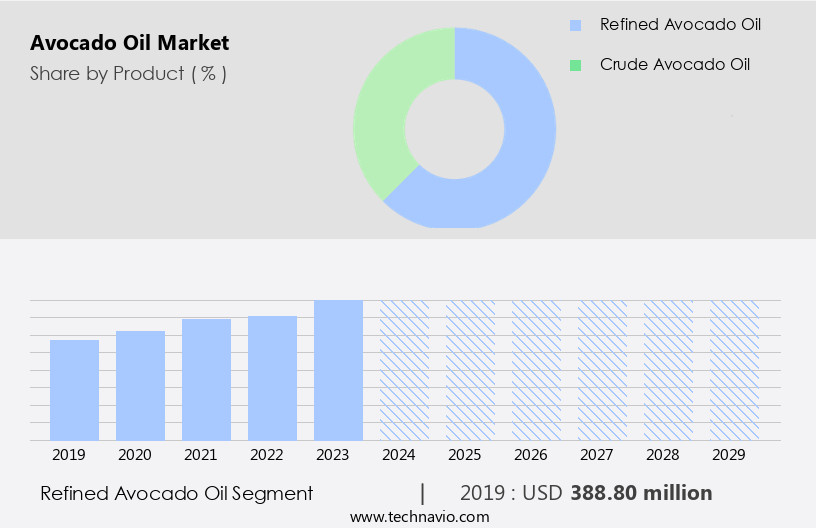

The refined avocado oil segment is estimated to witness significant growth during the forecast period. Avocado oil, derived from the pulp of ripe avocados, is gaining popularity in the US market due to its numerous health benefits and versatile uses. The oil is available in various forms, including refined avocado oil, which is processed using methods like refining and deodorization. Extra virgin avocado oil, produced through cold-pressed extraction, is prized for its high smoke point, nutritional value, and distinct flavor. This premium oil can be used for various culinary applications, such as frying, sautéing, and baking, as well as for skincare and haircare. Avocado oil supplements are another segment of the market, catering to consumers seeking health benefits beyond culinary uses.

Regulations governing the production and labeling of avocado oil are stringent to ensure product quality and consumer safety. Avocado oil contains essential antioxidants, potassium, and other nutrients, making it a valuable addition to a healthy diet. Sustainability is a key consideration in avocado oil production and processing, with many companies adhering to organic practices and obtaining certifications to meet consumer demand. Innovation in avocado oil packaging and distribution channels has expanded its accessibility and convenience for consumers. Despite its premium pricing, the demand for avocado oil continues to grow, driven by its health benefits and diverse applications.

Get a glance at the market report of share of various segments Request Free Sample

The Refined avocado oil segment was valued at USD 388.80 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Avocado oil, derived from the fruit of the avocado tree, is gaining popularity in the US market due to its numerous health benefits and versatile uses. Culinary avocado oil is commonly used in cooking for its high smoke point and rich, nutty flavor. Avocado oil supplements offer additional health advantages, such as antioxidants and potassium. Avocado oil regulations ensure its purity and quality, with refined and cold-pressed options available. Sustainability is a key consideration in avocado oil production and processing, with certifications available for organic and ethically sourced oils. The health-conscious consumer trend is driving the demand for avocado oil in the US.

With increasing awareness of the potential health risks associated with high-fat oils and butter, avocado oil's health benefits, including heart health and anti-inflammatory properties, make it an attractive alternative. Avocado oil consumption extends beyond the kitchen, with blends and skincare and haircare products also gaining popularity. Innovation in avocado oil packaging and distribution methods ensures easy accessibility and convenience for consumers. Despite its rising popularity, avocado oil pricing remains competitive, making it an affordable option for those seeking to incorporate healthy fats into their diet.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Avocado Oil Industry?

- Health benefits of avocado oil is the key driver of the market. Avocado oil, derived from the fruit of the avocado tree, is renowned for its rich nutritional profile. The oil is a valuable source of various essential nutrients, including proteins, iron, magnesium, vitamins, and minerals. Notably, it contains a significant amount of monounsaturated oleic acid, which is also present in olive oil. Oleic acid is known for its health benefits, such as reducing the risk of cancer, promoting cell regeneration, aiding in wound recovery, eliminating microbial infections, and decreasing inflammation. Avocado oil is also rich in dietary fibers, folic acid, potassium, and vitamins A, B1, B2, B3, B5, B6, E, K, and C.

- These nutrients contribute to maintaining heart health, enhancing eyesight, improving digestion, and detoxifying the body. With its numerous health advantages, avocado oil has gained popularity as a healthy alternative to other cooking oils.

What are the market trends shaping the Avocado Oil Industry?

- Natural oil blends and flavored avocado oil is the upcoming market trend. Avocado oil, a popular edible oil, is often blended with other oils to create hybrid oils that offer enhanced benefits. The selection of oils for blending is meticulous, ensuring each oil's characteristics complement one another and increase the value of the final product. Commonly blended oils include coconut oil, safflower oil, olive oil, almond oil, shea butter, and grapeseed seed oil. The volume ratio of these oils is carefully considered to preserve the value and smoke point of the hybrid oil.

- During the blending process, various properties of the oil, such as color, viscosity, smoke point, fatty acid composition, aroma, and other parameters, are analyzed to determine the optimal blend proportion. This approach allows for the creation of high-quality, complementary oil blends that cater to consumers' preferences and health needs.

What challenges does the Avocado Oil Industry face during its growth?

- Stringent regulations is a key challenge affecting the industry growth. The market faces regulatory challenges due to stringent government requirements in various countries. Companies operating in this market must adhere to the regulations and guidelines issued by different government bodies. For instance, in the United States, the United States Department of Agriculture sets the standards for avocado products, including avocado oil. All imported avocados, including those used for oil production, must meet the USDA's grade, color, and maturity requirements.

- Compliance with these regulations adds to the production costs and may limit market growth. However, the health benefits associated with avocado oil continue to drive demand, making it a valuable addition to the food industry.

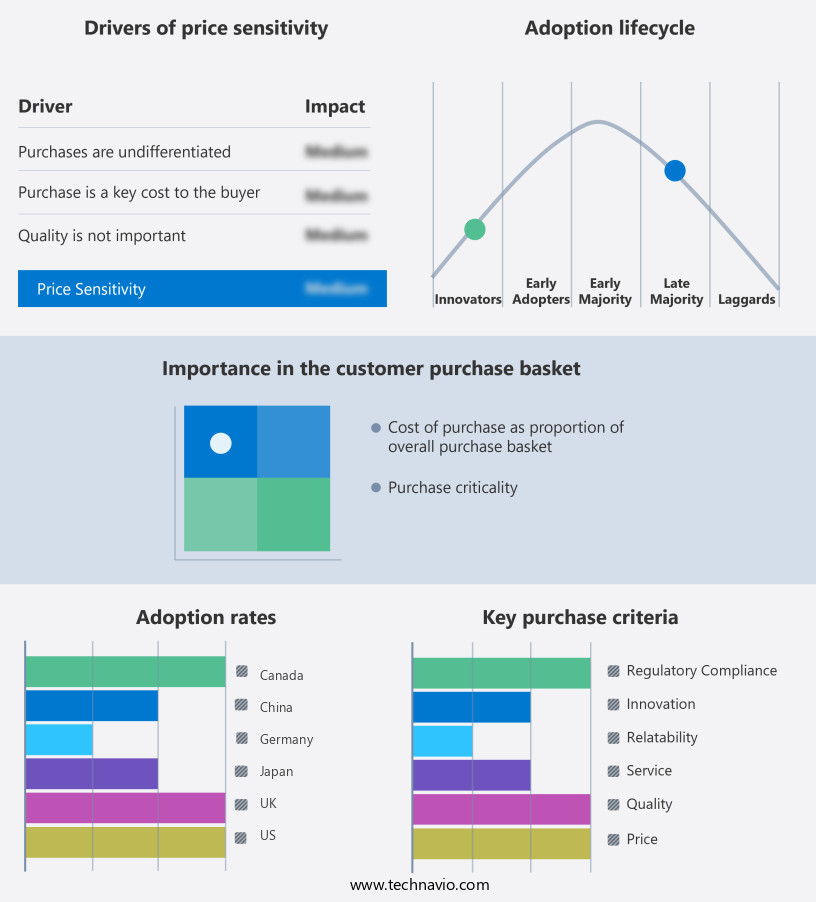

Exclusive Customer Landscape

The avocado oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the avocado oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, avocado oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A.G. Industries - The company offers avocado oil, such as cold-pressed avocado oil.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.G. Industries

- AMD Oil Sales LLC

- AOS Products Pvt. Ltd.

- Avi Naturals

- Avocado Global Pte Ltd.

- Avocado Oil New Zealand Ltd.

- Bella Vado

- BIO PLANETE

- Bo International

- Chosen Foods LLC

- Crofts Ltd.

- Kevala International LLC

- La Tourangelle Inc.

- Olivado Ltd.

- Plenty Foods

- Storinos Quality Products

- SVA Naturals

- The Hain Celestial Group Inc.

- The Village Press

- Westfalia Fruit Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Avocado oil, derived from the pulp of ripe avocados, has gained significant attention in the global market due to its numerous health benefits and versatile applications. This natural oil is rich in monounsaturated fatty acids, vitamins, and antioxidants, making it a popular choice for both culinary and non-culinary uses. The market is driven by increasing consumer awareness and preference for healthy food options. The oil's high smoke point and neutral taste make it an ideal substitute for other cooking oils, particularly in the preparation of salads, dressings, and sautéing. Moreover, avocado oil's nutrient-rich profile has led to its incorporation in dietary supplements, further expanding its market reach.

Regulations play a crucial role in the market. Strict quality standards ensure the production of high-quality avocado oil, which is free from harmful additives and contaminants. The refining process, which includes extraction, filtration, and deodorization, is a critical factor in determining the oil's quality and price. The antioxidant properties of avocado oil contribute to its popularity in the skincare and cosmetics industries. Cold-pressed avocado oil, which retains the oil's natural nutrients, is particularly sought after for its moisturizing and anti-aging benefits. Sustainability is a growing concern in the market. Producers are focusing on sustainable farming practices, such as using organic farming methods and implementing fair trade practices, to meet the increasing demand for ethically produced oils.

Innovation continues to drive growth in the market. New product developments, such as avocado oil blends and infusions, cater to diverse consumer preferences and expand the oil's applications. Certifications, such as organic and non-GMO certifications, provide consumers with assurance of the oil's authenticity and quality. These certifications also enable producers to target specific consumer segments and premium price points. The pricing dynamics of the market are influenced by various factors, including production costs, supply and demand, and market trends. Avocado oil's high value-added properties and increasing demand make it a profitable commodity for producers and investors. The demand for avocado oil is expected to continue growing, driven by its health benefits and versatile applications.

The market's expansion is further fueled by increasing consumer awareness and preference for natural and organic food and personal care products. Distribution channels, including e-commerce platforms and traditional retailers, play a crucial role in meeting the growing demand for avocado oil. Producers and distributors are adopting innovative strategies, such as direct-to-consumer sales and subscription models, to reach and engage consumers. The market is a dynamic and growing industry, driven by increasing consumer awareness and preference for healthy and natural food and personal care products. Regulations, sustainability, innovation, and pricing are key factors influencing the market's growth and development.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.8% |

|

Market growth 2025-2029 |

USD 710.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.1 |

|

Key countries |

South Korea, Canada, UK, US, Mexico, China, India, Japan, Germany, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Avocado Oil Market Research and Growth Report?

- CAGR of the Avocado Oil industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the avocado oil market growth and forecasting

We can help! Our analysts can customize this avocado oil market research report to meet your requirements.