Ball Clay Market Size 2024-2028

The ball clay market size is forecast to increase by USD 166.9 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the expanding construction industry. The sector's increasing demand for ball clay as a key raw material in the production of ceramics and refractories is fueling market expansion. However, market dynamics are not without challenges. The adoption of alternative construction materials, such as engineered cementitious composites and aerated concrete, poses a threat to the market's growth trajectory. Additionally, the volatile prices of raw materials, particularly kaolin and quartz, create uncertainty and risk for market participants.

- Producers must navigate these challenges by focusing on cost optimization, product innovation, and strategic sourcing to remain competitive. Companies that can effectively manage these factors while capitalizing on the construction industry's growth will be well-positioned to succeed in the market.

What will be the Size of the Ball Clay Market during the forecast period?

The market exhibits a continuous and evolving nature, driven by the dynamic interplay of various factors. This market is characterized by its application in diverse sectors, including ceramic manufacturing, where it serves as a crucial ceramic raw material. Ball clay's performance characteristics, such as color stability and firing behavior, are essential for producing high-quality ceramic products. Demand forecasting in the market is influenced by water management and water absorption properties, which impact clay refining and the overall supply chain. Plastic fillers and paint extenders are essential additives that enhance the properties of ball clay in various applications.

Energy efficiency and environmental impact are increasingly important considerations in the market, with a focus on reducing waste and improving thermal properties. Regulatory compliance and clay mining practices are also critical aspects of this market, ensuring safety standards and consumer protection. The evolving landscape of the market includes new technologies and product development, as well as raw material sourcing and quality assurance. Application areas span from ceramic decoration and glaze quality to refractory clay, whiteware body, construction materials, and even paper coatings and ceramic colors. Clay minerals, such as china clay and kaolin, are integral to the production of ball clay, while clay additives and clay processing techniques further refine its properties.

The ongoing unfolding of market activities reveals a complex and intricate web of interactions, with each factor influencing the others in a constantly evolving pattern.

How is this Ball Clay Industry segmented?

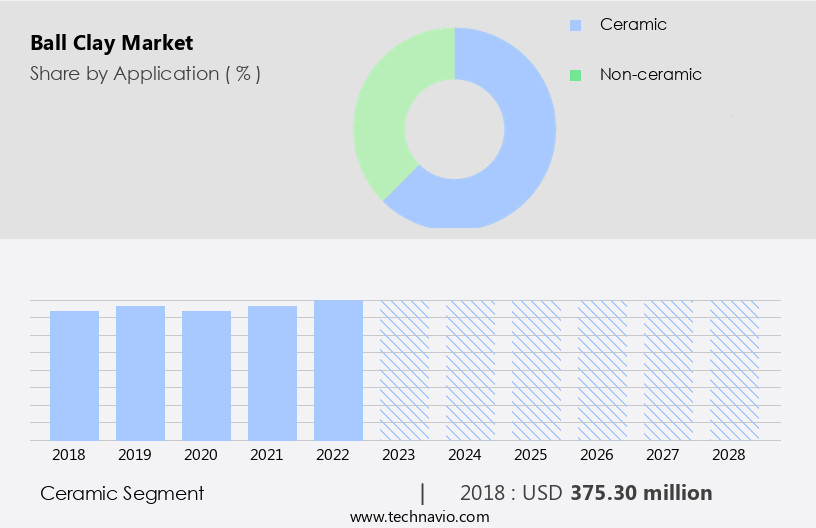

The ball clay industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Ceramic

- Non-ceramic

- Grade

- High Plasticity

- Medium Plasticity

- Low Plasticity

- Extraction Type

- Surface Mining

- Underground Mining

- End-User

- Construction

- Ceramics Industry

- Chemical Industry

- Paper Industry

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The ceramic segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to its extensive applications in various industries. Ball clay, a fine-grained ceramic raw material, is essential for ceramic manufacturing as it enhances plasticity and improves the performance characteristics of ceramic products. Its fine particle size and water absorption properties make it suitable for use in glazes, engobes, casting slips, and refractory materials. The demand for ball clay is particularly high in the construction sector, where it is used in the production of ceramic tiles for flooring, walls, and ceilings. Additionally, ball clay's water management properties make it an ideal choice for sanitary ware and other residential applications.

The market's growth is further driven by the increasing focus on energy efficiency and environmental sustainability in manufacturing processes. Ball clay's ability to reduce the amount of water required in the manufacturing process and its potential as a raw material for the production of paint extenders and plastic fillers makes it a preferred choice for many manufacturers. The market's supply chain is characterized by a focus on quality control, regulatory compliance, and raw material sourcing. New technologies and innovations in clay processing and safety standards continue to shape the market dynamics. Despite the challenges posed by waste management and firing temperature issues, the market is expected to continue its growth trajectory in the forecast period.

The Ceramic segment was valued at USD 375.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Asia-Pacific construction industry is experiencing significant growth due to population growth, rising disposable income, and urbanization. China's rapid development, driven by increased infrastructure investments, is a major contributor to this trend. India and ASEAN countries are also focusing on infrastructure development, leading to increased demand for sanitary ware, wall and floor tiles, and other ceramics. Ball clay, a key raw material in the production of these ceramics, is in high demand. Ball clay's performance characteristics, including color stability and firing behavior, make it an essential component in ceramic manufacturing. Its water management and water absorption properties are crucial in the production process.

Clay refining and ceramic raw material sourcing are important considerations in ensuring product quality and consistency. Environmental impact and regulatory compliance are becoming increasingly important in the industry. Energy efficiency and waste management are key areas of focus, with new technologies and quality assurance measures being implemented to reduce environmental impact and improve production processes. Ball clay is also used in various application areas outside of ceramics, including paper coatings, paint extenders, and refractory clay. Its particle size distribution and chemical resistance make it a versatile material in various industries. End-use industries, such as consumer products and construction materials, rely on the consistent supply of high-quality ball clay.

The supply chain must ensure timely delivery and quality control to meet the demands of these industries. Clay mining and processing are critical aspects of the market. Clay additives and china clay are important sub-markets, with glaze quality and ceramic decoration being key considerations for manufacturers. The ceramic standards and technical specifications set by regulatory bodies play a crucial role in ensuring product safety and quality. Raw material sourcing and product development are ongoing processes in the market, with a focus on innovation and sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ball Clay Industry?

- The construction industry's growth serves as the primary catalyst for market expansion.

- The market is experiencing significant growth due to the increasing demand for ceramic manufacturing, particularly in the construction sector. Traditional ceramic products, such as floor tiles and tableware, are driving market expansion. The Asia-Pacific region presents numerous opportunities for market participants, while the Middle East, Africa, and Latin America are projected to emerge as major markets. The rise in disposable income worldwide is also contributing to the market's growth, as consumers invest in high-quality ceramic products. Ball clay's performance characteristics, including color stability and water management, are crucial in ceramic manufacturing. Waste management is another essential consideration for market players.

- Clay refining is a critical process in producing high-quality ball clay, ensuring the desired application areas, such as sanitary ware, technical ceramics, and refractories, are met. Ball clay's firing behavior and water absorption properties make it an ideal ceramic raw material. Understanding these properties is essential for manufacturers to produce consistent, high-quality ceramic products. As the demand for ceramics continues to grow, The market is expected to maintain its momentum during the forecast period.

What are the market trends shaping the Ball Clay Industry?

- The use of novel construction materials is gaining popularity in the current market. This trend reflects the industry's ongoing pursuit of innovation and efficiency.

- Ball clay, a key material in the ceramics industry, is experiencing significant market dynamics due to advancements in technology and shifting industry trends. The need for higher firing temperatures to produce superior quality ceramic products necessitates stringent quality control measures. End-use industries, such as paint, plastic, and construction, rely on ball clay as plastic fillers and paint extenders. Technological innovations in the supply chain have led to increased energy efficiency and reduced environmental impact. Companies prioritize thermal properties, regulatory compliance, and clay mining practices to meet customer demands and industry standards. The integration of technology in the manufacturing process has streamlined production, enabling the production of a wider range of products with consistent quality.

- Moreover, the construction industry's shift towards automated, manufacturing-based design methods necessitates a more comprehensive and efficient supply chain management system. This transition not only increases productivity but also poses product liability risks for construction companies. Therefore, it is crucial for industry players to adapt to these changes and maintain a robust and harmonious supply chain to remain competitive in the market.

What challenges does the Ball Clay Industry face during its growth?

- The volatile pricing of raw materials poses a significant challenge to the industry's growth trajectory.

- The ceramics industry, specifically the clay market, faces significant challenges due to the energy-intensive nature of tile manufacturing and the volatility of raw material prices. Electricity and fuel costs are major expenses for ceramic manufacturers, and fluctuations in their availability and pricing can significantly impact the industry's growth. Furthermore, the prices of essential raw materials, such as quartz sand, kaolin, feldspar, and bentonite, can be unpredictable, leading to increased capital requirements for the entire manufacturing process. These price fluctuations, coupled with the volatile markets, pose a significant challenge to the growth of the clay market during the forecast period. Clay additives, including china clay and clay minerals, play a crucial role in the production of ceramic decoration, glaze quality, refractory clay, whiteware body, and construction materials.

- Ensuring a consistent supply of these raw materials at reasonable prices is essential for the continued success of consumer product manufacturers and industrial ceramics producers.

Exclusive Customer Landscape

The ball clay market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ball clay market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ball clay market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashapura Group - The company specializes in providing a range of ball clay products, including Ashawhite, Paintolin, and Wonderglaze. These clays are renowned for their superior quality and versatility in various industries. The Ashawhite clay is known for its high whiteness and low iron content, making it an ideal choice for porcelain and earthenware production. Paintolin clay, on the other hand, is recognized for its excellent plasticity and strength, making it suitable for the manufacturing of sanitary ware and technical ceramics. Lastly, Wonderglaze clay offers excellent coverage and durability, making it a preferred choice for the production of brick and tile. Our offerings cater to diverse industries, ensuring we meet the unique needs of each client.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashapura Group

- Ashok Alco-Chem Limited

- Ceramic Raw Materials

- G&W Mineral Resources

- Gleason Clay Company

- Gujarat Mineral Development Corporation

- Imerys S.A.

- Jabalpur Mineral Industries

- Kaolin AD

- Keramost a.s.

- Lhoist Group

- Micronized Group

- Old Hickory Clay Company

- Quarzwerke GmbH

- Sibelco

- Stephan Schmidt KG

- Thiele Kaolin Company

- United Clay Mines

- WBB Minerals

- Yunnan Minmetals

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ball Clay Market

- In February 2023, Imerys, a leading global mineral processing and mining company, announced the expansion of its ball clay production capacity in the United States. The USD30 million investment will increase the company's output by 25%, making it a significant strategic move to cater to the growing demand for ball clay in the North American market (Imerys, 2023).

- In November 2022, Orchid Ceramics, an Indian ceramics manufacturer, entered into a collaboration with the Indian Institute of Technology (IIT) Kharagpur to develop advanced ball clays using industrial waste. This initiative aims to reduce the environmental impact of ball clay mining and promote sustainable manufacturing practices (Orchid Ceramics, 2022).

- In August 2021, Riedel Chimie, a French specialty chemicals company, acquired a 50% stake in the Brazilian ball clay mining company, Mineração e Transformação de Argilas (MTA). This strategic partnership will enable Riedel Chimie to secure a stable and sustainable supply of high-quality ball clay for its global operations (Riedel Chimie, 2021).

- In March 2020, the European Commission approved the merger of Imerys and Sibelco, two major players in the market. The combined entity will create a leading global minerals processing company, with an enhanced product portfolio and expanded geographic reach (European Commission, 2020).

Research Analyst Overview

- The market encompasses a diverse range of applications, from ceramic design and functional ceramics to advanced ceramics and electronic ceramics. Automated production processes have become increasingly prevalent, optimizing energy usage and enhancing clay rheology for improved manufacturing efficiency. Emerging applications, such as renewable resources in clay compositions and bio-based materials in glaze chemistry, reflect the industry's commitment to sustainability. Clay mineral content plays a significant role in determining particle shape, firing shrinkage, and glaze chemistry. Sustainable manufacturing practices, including water conservation and the circular economy, are gaining traction. Energy optimization and life cycle assessment are essential considerations for reducing environmental impact.

- Artificial intelligence and data analytics are revolutionizing the industry, enabling more precise chemical analysis and optimizing clay deposits for specific applications. Functional ceramics, such as those used in 3D printing and ceramic decoration techniques, are expanding the market's reach. Electronic ceramics, with their unique properties, are driving innovation in areas like digital printing and advanced ceramics. Particle shape and clay composition are critical factors in ensuring optimal performance in these applications. Color pigments and ceramic design continue to evolve, with a focus on energy-efficient production methods and eco-friendly materials. The integration of sustainable manufacturing practices, renewable resources, and technological advancements is shaping the future of the market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ball Clay Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 166.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ball Clay Market Research and Growth Report?

- CAGR of the Ball Clay industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ball clay market growth of industry companies

We can help! Our analysts can customize this ball clay market research report to meet your requirements.