Bioplastics Market Size 2024-2028

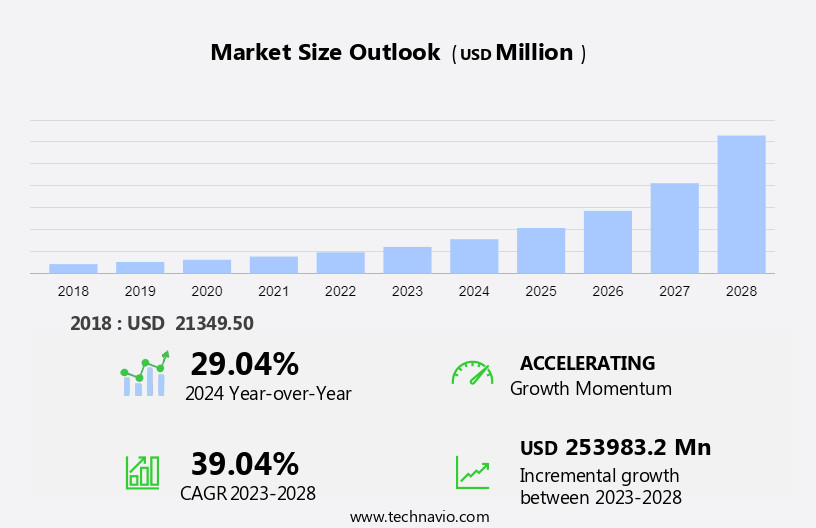

The bioplastics market size is forecast to increase by USD 253.98 billion at a CAGR of 39.04% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for eco-friendly and sustainable alternatives to conventional plastics. A key trend in this market is the emergence of bio-based and renewable raw materials, which are derived from renewable sources such as corn, sugarcane, and vegetable oils. Another significant driver is the expanding application base of bioplastics and flexible packaging, particularly in novel sectors such as packaging, automotive, and textiles.

- In the automotive sector, bioplastics are being used in interior components and exterior parts due to their lightweight properties and improved fuel efficiency. One of the primary challenges is the cost-effectiveness of conventional plastics, which are currently cheaper than bioplastics. This price disparity makes it difficult for bioplastics to compete in price-sensitive markets. Additionally, the production process for bioplastics is more complex than that of plastic, which adds to their production costs.

- Companies seeking to capitalize on this market opportunity can focus on reducing production costs through economies of scale and technological advancements. Additionally, they can explore new applications and markets to expand their customer base and increase revenue.

What will be the Bioplastics Market Size During the Forecast Period?

Moreover, biodegradable plastics, including biodegradable packaging materials and compostable bags, offer a viable alternative to traditional plastics like polyethylene and polypropylene. Nature-based materials like cellulose acetate are also gaining traction. The market is expected to grow as consumers demand more sustainable solutions and governments push for stricter regulations on plastic waste. However, the lack of composting infrastructure and the availability of cheaper alternatives remain significant barriers to the market's growth. The bioplastics industry is continuously innovating to address these challenges and meet the evolving needs of consumers and the environment.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Non-biodegradable

- Biodegradable

- Application

- Packaging and food service

- Agriculture and horticulture

- CG and HA

- Automotive

- Others

- Geography

- Europe

- France

- Germany

- UK

- North America

- US

- Canada

- Mexico

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Europe

By Type Insights

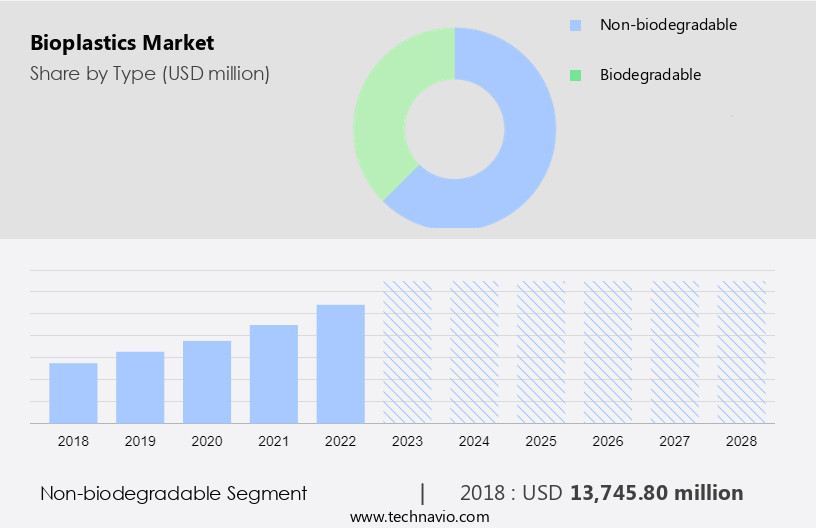

The non-biodegradable segment is estimated to witness significant growth during the forecast period. The global market for non-biodegradable bioplastics, which include bio-PET and bio-PE, is poised for substantial expansion during the forecast period. These plastics, derived from both fossil fuels and renewable sources, offer a reduced carbon footprint compared to conventional plastics, making them an attractive alternative. Additionally, they can be mechanically recycled in existing streams. The increasing demand for eco-friendly solutions in various sectors, such as agriculture, consumer goods, textiles, construction, electronics, medical devices, and others, is driving the growth of the non-biodegradable market. However, the market expansion for non-biodegradable bioplastics is expected to be slower than that of biodegradable bioplastics due to their non-degradable nature.

Moreover, despite this, their adoption is gaining traction in the residential and commercial sectors. Agriculture, in particular, is witnessing a shift towards the use of non-biodegradable bioplastics for packaging and other applications due to their durability and resistance to environmental conditions. The production of non-biodegradable bioplastics involves the use of natural fibers and nanoparticles, which adds to their appeal as sustainable alternatives to conventional plastics. However, the construction industry's reliance on conventional plastics and production halts due to environmental issues may pose challenges to the market's growth.

Get a glance at the share of various segments. Request Free Sample

The non-biodegradable segment was valued at USD 13.75 billion in 2018 and showed a gradual increase during the forecast period.

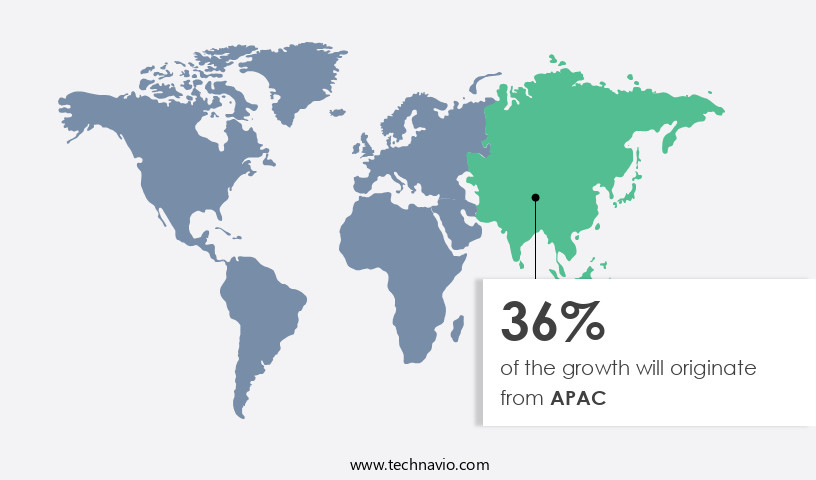

Regional Insights

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Bioplastics have been a significant part of the European market for over two decades, with the region leading in its adoption. The primary products in this sector include biodegradable waste bags and loose-fill packaging. European governments' legislative framework and incentive strategies have been instrumental in driving market growth. Europe accounted for the largest share of the global bioplastics consumption in 2023, primarily due to the high demand for eco-friendly packaging solutions in consumer goods industries. Bioplastics have expanded their reach beyond agriculture to textiles, construction, electronics, medical devices, and other sectors. Natural fibers, such as cellulose and starch, are commonly used in their production.

Moreover, the nanoparticles have also been integrated into bioplastics to enhance their properties. Despite the advantages, the bioplastics industry faces challenges, including longer lead times and production halts due to polymer plant construction. However, the environmental concerns associated with conventional plastics continue to fuel the demand for bioplastics. The market is expected to grow steadily, driven by increasing consumer awareness and government initiatives.

Market Dynamics

The market is witnessing a paradigm shift as the world moves towards renewable feedstocks for sustainable plastics. Bioplastics, also known as biodegradable plastics, offer eco-friendly properties and reduce carbon dioxide emissions. These biodegradable products are gaining popularity in various sectors, including flexible packaging, food items, and the electronics industry. The circular economy is driving innovation in hybrid material combinations. Additionally, the growing demand for biopolymer packaging is further accelerating the adoption of sustainable packaging solutions, reducing reliance on traditional plastic materials.

The bioplastics market is experiencing significant growth as consumers and businesses alike increasingly seek eco-friendly alternatives to traditional plastics. Eco-friendly polymers and plant-based plastics are at the forefront of this shift, offering sustainable options for packaging, consumer goods, and industrial applications. Compostable packaging films, bio-degradable wraps, and sustainable resin blends are being used widely across industries to reduce plastic waste and environmental impact. Renewable material bags, green plastic trays, and natural fiber composites are gaining popularity for their ability to be recycled or composted, making them an excellent choice for packaging solutions. Bioplastic cutlery sets, organic polymer sheets, and eco-conscious bottles are meeting the rising demand for products that align with sustainable practices. Biomass-derived plastics, recyclable bio-films, and eco-polymer trays provide versatility while supporting circular economies.

In addition to packaging, the market is seeing an increase in demand for biodegradable shrink wraps, plant-sourced cups, and bio-based lids. Companies are also investing in bio-plastic coatings and natural resin tubs to create more sustainable consumer products. With growing awareness and consumer preference for green solutions, the bioplastics market is set to expand as it continues to offer innovative, environmentally friendly alternatives to conventional plastic materials.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The emergence of bio-based and renewable raw materials is the key driver of the market. The market is experiencing significant growth due to the increasing utilization of renewable feedstocks, such as starch, vegetable crops, and biomass, in the production of eco-friendly plastics. Biodegradable products derived from these sources are gaining popularity, particularly in applications like flexible packaging and food service, as they offer carbon dioxide emission reductions and contribute to the circular economy. Biomass, which encompasses grass, trees, plants, and other organic materials that decompose through microbial activities, is increasingly being used as a raw material in place of petroleum-based plastics. The availability of abundant renewable resources worldwide sets bioplastics apart from traditional plastics, making it an attractive alternative for manufacturers.

Market Trends

Consumption of bioplastics in novel applications is the upcoming trend in the market. The market is experiencing notable expansion, driven by the growing emphasis on sustainability and supportive government regulations for eco-friendly procurement policies. The packaging sector, in particular, is poised for substantial growth. Biodegradable waste bags, for instance, can be utilized for organic waste disposal, enhancing the composting process and improving compost quality, thereby preventing inappropriate landfilling. In agriculture, biodegradable mulch films are widely adopted, offering cost savings through labor reduction and direct disposal in the field post-use. The food industry, a significant segment, uses bioplastics extensively for catering needs, including trays, cutlery, cups, and dishes.

Moreover, various international entities are also implementing policies to promote the use of bioplastics, further fueling market growth. Hybrid material innovations are also gaining traction, combining the benefits of both biodegradable and traditional plastics. This circular economy approach is expected to significantly reduce carbon dioxide emissions and contribute to a more sustainable future.

Market Challenge

The cost-effectiveness of conventional plastic over bioplastics is a key challenge affecting the market growth. Bioplastics, derived from renewable feedstocks, are gaining popularity due to their eco-friendly properties. These biodegradable products offer significant benefits, including reduced carbon dioxide emissions and alignment with the circular economy. However, the production cost of bioplastics is higher than conventional plastics, ranging from 25% to 75%, primarily due to the high polymerization cost. Furthermore, most bioplastic production processes are still in the development stage and have not yet reached economies of scale. The lack of a well-established supply chain network at new production sites also poses a challenge. The production technology for bioplastics is still evolving, with various raw materials under investigation for optimal production.

However, various international borders are implementing regulations to encourage the adoption of biodegradable plastics in flexible packaging. According to Business Standard, the market is expected to grow, driven by increasing consumer awareness and government initiatives.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Biome Bioplastics Ltd.- The company offers bioplastics including BiomeHT90 and BiomeHTX (450).

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema Group

- BASF SE

- Braskem SA

- Cargill Inc.

- Corbion nv

- DuPont de Nemours Inc.

- Evonik Industries AG

- Finasucre SA

- Fkur Kunststoff GmbH

- Futerro SA

- Koninklijke DSM NV

- KURARAY Co. Ltd.

- Novamont S.p.A.

- Resonac Holdings Corp.

- Saudi Basic Industries Corp.

- Solvay SA

- Sulzer Ltd.

- Teijin Ltd.

- Toray Industries Inc.

- Toyota Motor Corp.

- Trinseo PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Bioplastics, derived from renewable feedstocks, have gained significant attention due to their eco-friendly properties. These biodegradable products offer a sustainable alternative to conventional plastics, contributing to the circular economy. The market for bioplastics is expanding, driven by the increasing demand for sustainable solutions in various industries. Companies like Danone and Nestlé are leading the way in this paradigm shift, incorporating bioplastics into their consumer goods, including food items, beverage bottles, and packaging films. The agriculture sector is a major contributor to bioplastics production, with feedstocks such as corn, sugarcane, and castor oil being used to produce biopolymers like polylactic acid (PLA), bio polyethylene terephthalate (PET), biopolyethylene (PE), and bio polypropylene (PP).

Moreover, innovations in hybrid materials, such as nanoparticles and starch blends, are further enhancing the properties of bioplastics. The flexible packaging, textiles, construction, electronics, medical devices, and automotive industries are among the key sectors adopting bioplastics. Bioplastics are used in various applications, including packaging films, jars, containers, bottles, and fresh food packaging. The production of bioplastics is also being used for agricultural mulch films and shopping bags. Despite the benefits, the market faces challenges, including production halts due to environmental issues and longer lead times compared to conventional plastics. The market is expected to continue growing, driven by the increasing demand for sustainable solutions and the need to reduce carbon dioxide emissions.

Further, the future of bioplastics lies in the development of cheaper alternatives and the expansion of composting infrastructure. In conclusion, bioplastics offer a sustainable solution to conventional plastics, with applications ranging from packaging and textiles to construction and electronics. The market for bioplastics is expected to continue growing, driven by the increasing demand for eco-friendly alternatives and the need to reduce carbon emissions. Companies and industries are adopting bioplastics to meet consumer demand for sustainable solutions and reduce their environmental footprint.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

188 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 39.04% |

|

Market Growth 2024-2028 |

USD 25.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

29.04 |

|

Regional analysis |

Europe, North America, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 36% |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arkema Group, BASF SE, Biome Bioplastics Ltd., Braskem SA, Cargill Inc., Corbion nv, DuPont de Nemours Inc., Evonik Industries AG, Finasucre SA, Fkur Kunststoff GmbH, Futerro SA, Koninklijke DSM NV, KURARAY Co. Ltd., Novamont S.p.A., Resonac Holdings Corp., Saudi Basic Industries Corp., Solvay SA, Sulzer Ltd., Teijin Ltd., Toray Industries Inc., Toyota Motor Corp., and Trinseo PLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch