US Blinds And Shades Market Size 2024-2028

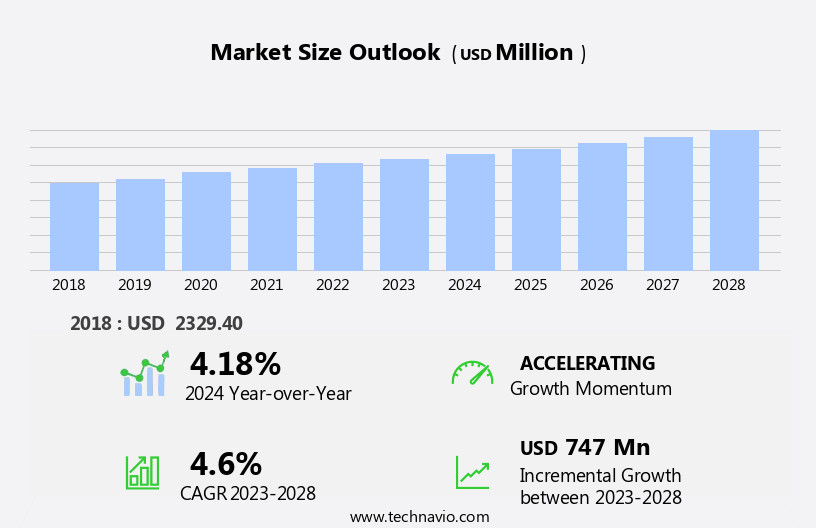

The US blinds and shades market size is forecast to increase by USD 747 million, at a CAGR of 4.6% between 2023 and 2028.

- The Blinds and Shades Market in the US is experiencing significant growth, driven primarily by the expanding construction industry. This sector's resurgence is fueling increased demand for interior solutions, including blinds and shades. Moreover, the influence of organized retailing is intensifying, as large retailers expand their product offerings and enhance their distribution networks, making these products more accessible and convenient for consumers. However, the market faces challenges, with volatility in raw material prices posing a significant obstacle. Suppliers must navigate these price fluctuations to maintain profitability and competitiveness.

- As such, companies in the Blinds and Shades Market must stay agile, implementing strategic sourcing and pricing strategies to mitigate risks and capitalize on opportunities. Additionally, investing in research and development to innovate and differentiate offerings will be crucial for market success.

What will be the size of the US Blinds And Shades Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- The Blinds and Shades market in the US continues to evolve, with key trends shaping consumer preferences. Customization options, such as pattern matching and color matching, remain popular, allowing homeowners to tailor their window treatments to interior design trends. Smart home integration, including voice control and app control, is gaining traction, enabling users to operate their blinds and shades with ease. Replacement parts, moisture resistance, and flame retardancy are essential considerations for long-term use and safety. Maintenance tips and cleaning instructions ensure the longevity of these window treatment accessories. Insulation ratings and heat control are crucial for energy efficiency, while motorized lift systems offer convenience and ease of use.

- Window covering trends include light diffusion, glare reduction, and cordless operation. Warranty coverage and installation guides provide peace of mind for consumers, with professional installation available for those seeking expert assistance. Fabric weight, insulation ratings, and design consultation are essential for selecting the optimal blinds and shades for various home decor trends.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Blinds

- Shades

- Distribution Channel

- Offline

- Online

- Application

- Residential

- Commercial

- Operation

- Manual

- Motorized

- Material Type

- Wood

- Fabric

- Aluminum

- Vinyl

- Geography

- North America

- US

- North America

By Product Insights

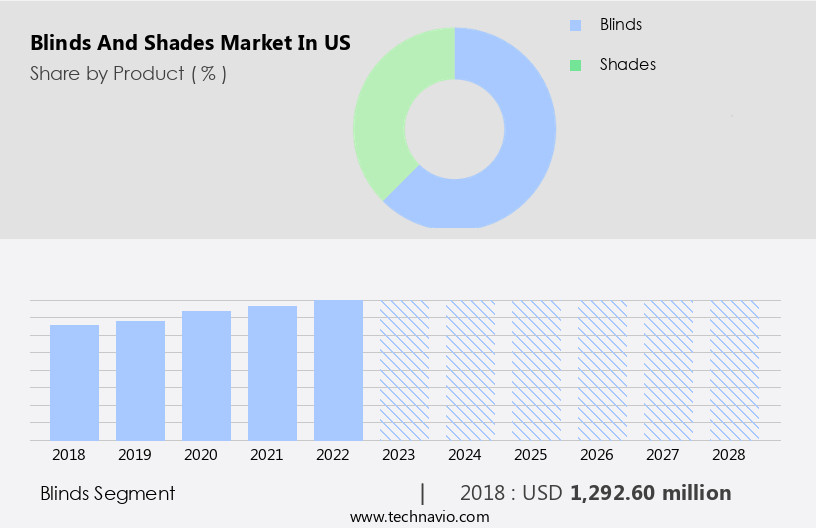

The blinds segment is estimated to witness significant growth during the forecast period.

The US blinds market encompasses various types of window coverings, such as remote control blinds, woven wood shades, honeycomb shades, bamboo shades, blackout shades, and more. This market caters to both residential and commercial sectors, offering installation services and custom solutions. Energy efficiency is a significant trend, with energy-saving options like cellular shades, pleated shades, roller shades, and solar shades gaining popularity. Smart home technology integration, including motorized and smart blinds, adds convenience and functionality. Design trends lean towards eco-friendly materials, such as recycled materials, and sustainable manufacturing processes. Window sizing and light control are essential considerations, with various options available for skylight shades, venetian blinds, and vertical blinds.

Quality control, product warranties, and UV protection are crucial factors for manufacturers. Window coverings serve various purposes, including privacy control, light filtering, and energy efficiency. New product development continues, with innovations in materials, motorization, and home automation. Window film and window dressings are alternative solutions that complement the blinds market. Window covering manufacturers cater to diverse styles, including mini blinds, roman shades, and style trends. Color trends and cost savings are essential factors for consumers. Commercial blinds, outdoor blinds, and window film are growing segments within the market. Customer service and online sales are essential aspects of the blinds market, ensuring a seamless purchasing experience.

Light control and energy efficiency are significant selling points, making blinds a popular choice for home decor and interior design projects.

The Blinds segment was valued at USD 1292.60 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the US Blinds And Shades Market drivers leading to the rise in adoption of the Industry?

- The construction industry's continuous expansion in the United States serves as the primary catalyst for market growth.

- The US blinds and shades market is poised for growth due to the expansion of the construction industry. The increasing demand for high-end home furnishings, particularly in residential properties, is a significant factor driving market growth. The privately owned housing sector in the US has experienced a notable increase in construction rates, leading to a subsequent surge in demand for window coverings, including blinds and shades. Moreover, the trend towards green building and energy efficiency is influencing the market, with consumers expressing a preference for eco-friendly window fashions such as honeycomb shades and woven wood shades.

- These energy-efficient window coverings help regulate indoor temperatures and reduce energy consumption, making them an attractive option for homeowners. Additionally, the convenience offered by advanced technologies like remote control blinds is gaining popularity among consumers, further boosting market growth. Installation services and window film are other complementary products that contribute to the market's expansion. Customer service remains a crucial factor in the market, with companies focusing on providing customized solutions and ensuring customer satisfaction. The blinds and shades market in the US is expected to witness steady growth during the forecast period, driven by these factors.

What are the US Blinds And Shades Market trends shaping the Industry?

- Organized retailing is gaining significant momentum as a market trend, with the potential to make a substantial impact on the industry. The increasing popularity of large-format stores and e-commerce platforms is transforming the way consumers shop and businesses operate.

- The blinds and shades market in the US is experiencing significant growth due to various factors. One of the key trends is the increasing adoption of home automation and smart home technology. Consumers are seeking energy-efficient solutions for their homes, leading to the popularity of products like pleated shades, roman shades, cellular shades, solar shades, and smart home-enabled window coverings. These products not only provide energy savings but also contribute to home decor and design trends. Manufacturers are responding to these trends by expanding their product offerings and distribution channels. They are introducing new types of shades, such as vertical blinds and skylight shades, to cater to diverse customer needs.

- Additionally, they are increasing their online presence to reach a wider audience. The retail industry's evolution, particularly in developed markets, is providing more opportunities for companies to showcase their products. Overall, the blinds and shades market is poised for continued growth as consumers seek innovative and energy-efficient window covering solutions.

How does US Blinds And Shades Market faces challenges face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory, requiring heightened agility and risk management strategies to mitigate potential financial impacts.

- The Blinds and Shades market in the US is characterized by varying raw material prices and a focus on quality control. companies face rising costs due to the use of high-quality raw materials, such as cotton and silk, in the production of Venetian blinds, mini blinds, roller shades, and custom blinds. These increased costs result in higher selling prices for consumers. However, the high prices may limit sales, particularly for residential blinds, as some end-users may opt for lower-priced alternatives. To mitigate the impact of raw material price volatility, companies are increasingly using low-priced and low-quality alternatives.

- Unusual weather conditions, such as heavy snow, rain, storms, hurricanes, floods, tornados, or extended periods of unseasonable temperatures, can also cause fluctuations in raw material prices. In response to consumer preferences for energy efficiency and UV protection, companies are investing in manufacturing processes that produce smart blinds and motorized blinds. These products cater to the growing demand for interior design solutions that save energy and protect against harmful UV rays. Product warranties are essential for building customer trust and ensuring customer satisfaction. Companies are offering extended warranties and guarantees to differentiate themselves from competitors and provide peace of mind to consumers.

- In conclusion, the Blinds and Shades market in the US is influenced by raw material price volatility, consumer preferences for energy efficiency and UV protection, and the growing demand for smart and motorized blinds. Companies must balance the use of high-quality raw materials with competitive pricing to meet consumer demands while maintaining profitability.

Exclusive US Blinds And Shades Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Hunter Douglas Inc.

- Springs Window Fashions LLC

- Levolor Inc.

- Graber (Newell Brands)

- Bali (Springs Window Fashions)

- Lutron Electronics Co. Inc.

- Somfy Systems Inc.

- Budget Blinds LLC

- 3 Day Blinds Corporation

- The Home Depot Inc.

- Lowe's Companies Inc.

- Wayfair Inc.

- IKEA North America Services LLC

- JCPenney Company Inc.

- Walmart Inc.

- Amazon.com Inc.

- Select Blinds LLC

- Blinds.com

- Norman Window Fashions

- Chicology Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Blinds And Shades Market In US

- In March 2023, Hunter Douglas, a leading player in the Blinds and Shades Market in the US, introduced its new motorized Duette Architella Shades, which feature unique pleats that provide superior energy efficiency and light control (Hunter Douglas Press Release). This innovation aligns with the growing consumer preference for energy-efficient and smart home solutions.

- In July 2024, Lutron Electronics, another significant player, announced a strategic partnership with Amazon to integrate Lutron's Serena wireless shading system with Amazon's Alexa voice control (Lutron Electronics Press Release). This collaboration expands Lutron's market reach and enhances the convenience of its offerings for consumers.

- In October 2024, Graber, a major player, was acquired by Leggett & Platt, a US-based manufacturing company, for approximately USD1.1 billion (Business Wire). This acquisition strengthens Leggett & Platt's position in the Blinds and Shades Market by adding Graber's extensive product portfolio and strong brand reputation.

- In February 2025, the US Department of Energy introduced new energy efficiency standards for residential shading products, including blinds and shades (US Department of Energy). These regulations aim to reduce energy consumption and greenhouse gas emissions, encouraging manufacturers to develop more energy-efficient solutions.

Research Analyst Overview

The blinds and shades market in the US continues to evolve, driven by advancements in technology and shifting consumer preferences. Home automation is a key trend, with remote control blinds and motorized options gaining popularity for their convenience and energy savings. Energy efficiency is a significant factor, with solar shades and cellular shades offering excellent insulation properties. Smart home technology integrates seamlessly with window coverings, enabling users to control lighting and temperature with a tap or voice command. Design trends favor minimalist and eco-friendly materials, such as pleated shades, roman shades, and woven wood shades. Manufacturers are responding with new product development, utilizing recycled materials and smart technology.

Window sizing and customization are essential considerations, with many companies offering installation services and custom blinds. Light control, privacy, and UV protection are crucial features, with various options available, including roller shades, vertical blinds, and skylight shades. Quality control and customer service are essential for manufacturers, ensuring product warranties and meeting the demands of a diverse customer base. Energy efficiency and cost savings remain key selling points, as the market continues to prioritize sustainability and green building practices. In the commercial sector, energy efficiency and privacy control are critical concerns, with commercial blinds and window films offering solutions.

Design trends favor modern aesthetics and functionality, with mini blinds and style trends reflecting this demand. Manufacturing processes are continually improving, with a focus on innovation and sustainability. The market for window coverings is dynamic, with ongoing developments in technology, materials, and design trends shaping the landscape. The industry's ability to adapt and innovate will be crucial in meeting the evolving needs of residential and commercial consumers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Blinds And Shades Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2024-2028 |

USD 747 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.18 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch