Blockchain Technology In Energy Market Size 2025-2029

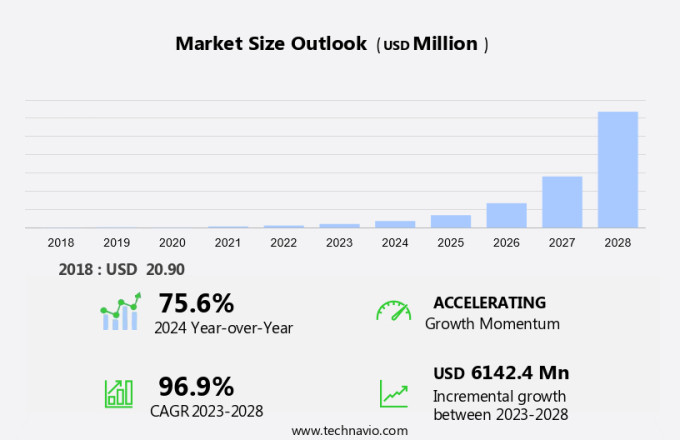

The blockchain technology in energy market size is forecast to increase by USD 7.8 billion, at a CAGR of 85.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing need for secure and reliable energy transactions and the adoption of backend-as-a-service (BaaS) solutions. Blockchain's ability to prevent failure in power grids and ensure secure peer-to-peer energy trading is a major factor fueling market expansion. Despite this obstacle, companies can capitalize on the market's potential by focusing on cost-effective solutions and collaborating with energy industry leaders to drive innovation and adoption.

- The integration of blockchain technology in energy transactions offers numerous benefits, including increased security, transparency, and efficiency. As the market continues to evolve, it is crucial for stakeholders to navigate the challenges and capitalize on the opportunities presented by this emerging technology. However, the high cost of implementing and maintaining blockchain technology poses a significant challenge for market participants.

What will be the Size of the Blockchain Technology In Energy Market during the forecast period?

- In the dynamic energy market, environmental sustainability and social impact are increasingly important factors shaping the industry's future. Blockchain infrastructure plays a pivotal role in enhancing grid resilience and facilitating the integration of renewable energy sources, such as solar and wind, into the electrical grid. Energy derivatives, carbon capture, hydrogen energy, and biomass energy are among the innovative solutions gaining traction in the sector. Smart building technologies and distributed ledger security ensure energy asset management is efficient and secure. Decentralized governance and energy R&D foster innovation, enabling energy hedging and distributed generation. Energy data exchange and smart city initiatives promote market liquidity, while climate change mitigation efforts address the pressing issue of cybersecurity threats to the electric grid.

- Blockchain scalability and smart city initiatives are essential for addressing energy poverty and ensuring a sustainable future. Hydrogen energy and biomass energy are promising alternatives to traditional energy sources, contributing to the overall transition towards a more sustainable energy landscape. The integration of renewable energy sources, energy innovation, and smart city initiatives are key trends shaping the energy market. Blockchain technology, with its inherent security and decentralized governance, is a crucial enabler of these trends, ensuring a more resilient, sustainable, and equitable energy future.

How is this Blockchain Technology In Energy Industry segmented?

The blockchain technology in energy industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Power

- Oil and gas

- Type

- Public blockchain

- Private blockchain

- Hybrid blockchain

- Deployment

- Cloud-based

- On-premises

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Russia

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

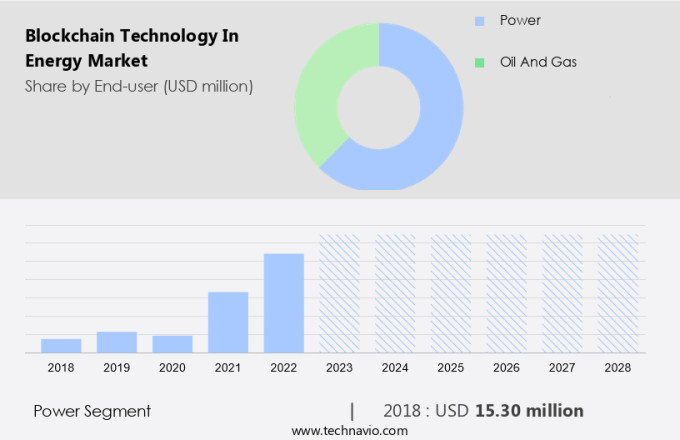

By End-user Insights

The power segment is estimated to witness significant growth during the forecast period. The global energy market is undergoing significant transformation, moving away from traditional centralized, fossil fuel-based power systems towards decentralized, renewable energy solutions. Blockchain technology plays a pivotal role in this transition, ensuring data security and transparency in energy transactions. Renewable energy sources, such as solar and wind, are becoming increasingly popular, with governments investing billions in green infrastructure. For instance, Germany committed USD62.7 billion USD in 2024 to renewable energy initiatives. Decentralized energy systems, powered by solar panels, batteries, and smart appliances, enable consumers to produce and manage their electricity consumption. Hashing algorithms and digital signatures secure energy transactions, while peer-to-peer energy trading and smart contracts facilitate energy marketplaces.

Key management systems ensure the secure handling of digital assets, including renewable energy certificates and energy credits. Energy efficiency, demand response, and electric vehicle charging are further areas of focus, with IoT devices and energy analytics driving innovation. Regulatory compliance, energy audits, and emissions trading are essential aspects of the energy policy landscape. Energy utilities, power generators, and retail energy providers are adapting to these changes, employing public, private, and consortium blockchains to streamline supply chain management and reduce carbon emissions. Energy cooperatives and grid modernization initiatives are also gaining traction, empowering consumers and promoting sustainable energy solutions.

The Power segment was valued at USD 23.00 billion in 2019 and showed a gradual increase during the forecast period.

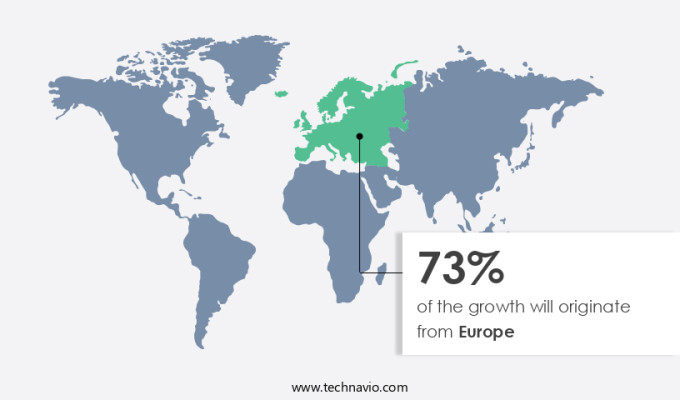

Regional Analysis

Europe is estimated to contribute 73% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the European energy market, the adoption of decentralized renewable energy systems is on the rise. By 2050, over half of EU citizens are projected to generate electricity from renewable sources, with Denmark aiming to reach 100% renewable electricity consumption by 2028. Major energy providers are shifting from traditional sources to energy citizens, who generate electricity through smaller renewable power projects. The European Commission is promoting household energy generation through incentives for small-scale installations like rooftop solar panels. Blockchain technology plays a crucial role in this transition, ensuring data security and transparency in the energy supply chain.

Hashing algorithms and digital signatures facilitate peer-to-peer energy trading, enabling energy efficiency and demand response. Renewable energy certificates and smart contracts streamline regulatory compliance and energy management. Distributed ledger technology and smart meters enhance data privacy and consumer empowerment. Energy cooperatives and grid modernization are key to the energy transition, while carbon emission reduction and energy credits align with sustainable energy policies. The integration of IoT devices, battery storage, and electric vehicles further strengthens the renewable energy ecosystem. Government agencies, non-profit organizations, and retail energy providers collaborate to ensure a seamless energy trading system. Consensus mechanisms and supply chain management ensure the reliability and efficiency of the energy market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Blockchain Technology In Energy market drivers leading to the rise in the adoption of Industry?

- The implementation of blockchain technology is a primary catalyst for preventing failures in power grids and driving market growth in this sector. Blockchain technology is revolutionizing the energy market by introducing decentralized energy systems. This technology enhances data security through hashing algorithms, ensuring the integrity and transparency of energy transactions. The adoption of blockchain platforms in the energy sector facilitates the integration of renewable energy sources, battery storage, and electric vehicle charging into the energy supply chain. Moreover, energy transparency enables demand response programs, energy efficiency initiatives, and real-time pricing.

- Blockchain technology's decentralized nature enables enterprises to manage their energy keys independently, increasing control and reducing reliance on traditional energy suppliers. The implementation of blockchain technology in energy systems can improve grid performance, enable faster problem detection, and streamline the repair process, ultimately reducing losses and increasing efficiency.

What are the Blockchain Technology In Energy market trends shaping the Industry?

- Backend-as-a-Service (BaaS) is gaining significant traction in the current market. This trend signifies the increasing demand for cloud-based solutions that enable developers to build and deploy applications more efficiently, without having to manage the backend infrastructure themselves. Blockchain technology is revolutionizing the energy market by providing a secure and decentralized platform for digital asset transactions. Government agencies, energy utilities, non-profit organizations, and power generators are exploring the benefits of this technology in various applications. One significant development is the integration of blockchain with Internet of Things (IoT) devices, electric vehicles, and energy analytics, enabling peer-to-peer energy trading and energy management. Block-as-a-Service (BaaS) providers help companies set up and manage blockchain-connected nodes, reducing the need for enterprises to build in-house technology. Major tech companies like IBM, Oracle, Amazon, and SAP are investing in BaaS solutions, offering enterprises the flexibility to test blockchain technology without the risks and costs of in-house deployment.

- BaaS is increasingly being adopted in various industries, including energy, insurance, cybersecurity, and supply chain management. Its advantages include increased transparency, secure record keeping, and reduced fraud. The technology's potential in the energy sector is vast, with applications in carbon markets, commercial and industrial energy management, and power generation. Digital signatures and smart contracts facilitate seamless transactions and enhance overall efficiency. The adoption of blockchain technology in the energy market is a promising trend that offers numerous benefits, and BaaS is a key enabler for enterprises looking to leverage this technology.

How does Blockchain Technology In Energy market faces challenges face during its growth?

- The high cost of implementing and maintaining blockchain technology is a significant challenge that can hinder the industry's growth. This financial burden, which includes the expense of hardware, software, and human resources, can deter potential adopters and limit the technology's widespread use. Blockchain technology is revolutionizing the energy market by enhancing transparency, security, and efficiency. Renewable Energy Certificates (RECs) can be traded using smart contracts, ensuring regulatory compliance and eliminating intermediaries. Energy audits and energy storage solutions can be managed through distributed ledger technology, enabling consumer empowerment and sustainable energy initiatives. Smart contracts also facilitate the automation of grid modernization processes, such as energy trading and peer-to-peer transactions. Moreover, data privacy is ensured through public blockchains, as every participant has access to the same information, reducing the need for intermediaries and increasing trust. Energy cooperatives can benefit from this technology by streamlining their operations and ensuring secure and transparent transactions.

- However, the initial implementation of blockchain technology in the energy sector can be capital-intensive. Developing the software required to run blockchain technology and procuring or developing servers and nodes to store the exponentially increasing amount of data can be expensive. A blockchain database is designed to store data indefinitely, and every transaction is added to the ledger, causing the amount of data to increase rapidly. Despite these challenges, the long-term benefits of blockchain technology in the energy sector, such as increased productivity, security, and efficiency, make it a worthwhile investment.

Exclusive Customer Landscape

The blockchain technology in energy market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the blockchain technology in energy market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, blockchain technology in energy market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company specializes in implementing blockchain technology for the oil and gas industry, enhancing documentation security and ensuring the verification of personnel, including employees, contractors, and experts.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Amazon.com Inc.

- BigchainDB GmbH

- Capgemini Service SAS

- Chaddenwych Services Ltd.

- Deloitte Touche Tohmatsu Ltd.

- Enosi Australia Pty Ltd.

- Greeneum Ltd.

- HCL Technologies Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- LO3 Energy Inc.

- Oracle Corp.

- Power Ledger Pty Ltd.

- SAP SE

- Tata Consultancy Services Ltd.

- Tencent Holdings Ltd.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Blockchain Technology In Energy Market

- In February 2023, Power Ledger, a leading Australian blockchain-based peer-to-peer energy trading platform, announced the successful integration of its blockchain solution with the grid of the South Australian Power Networks (SAPN), marking a significant milestone in the adoption of blockchain technology for energy trading (Power Ledger Press Release, 2023). This collaboration enables the secure and efficient trading of renewable energy between households and businesses, reducing the need for centralized power distribution and promoting energy independence.

- In May 2024, IBM and ENGIE, a global energy and services company, announced a strategic partnership to develop blockchain-based solutions for the energy sector. The collaboration aims to enhance grid resilience, optimize energy trading, and improve energy management through decentralized systems (IBM Press Release, 2024). This partnership represents a significant step towards the mainstream adoption of blockchain technology in the energy industry.

- In October 2024, ConsenSys, a leading Ethereum software company, raised USD65 million in a Series D funding round to expand its blockchain solutions in various industries, including energy. The investment will be used to accelerate the development of ConsenSys' energy platform, Grid+, which aims to optimize energy trading, enhance grid stability, and promote renewable energy adoption (ConsenSys Press Release, 2024).

- In March 2025, the European Union (EU) passed the Markets in Crypto-Assets (MiCA) regulation, which includes provisions for the use of blockchain technology in the energy sector. The regulation sets guidelines for the licensing, supervision, and operational requirements of crypto-asset service providers, including those offering blockchain-based energy trading solutions (European Parliament Press Release, 2025). This regulatory approval is expected to boost the adoption of blockchain technology in the EU energy market.

Research Analyst Overview

Blockchain technology, a decentralized and distributed digital ledger, is revolutionizing the energy market by enhancing data security, transparency, and efficiency. This continuous evolution encompasses various sectors, including renewable energy, battery storage, and energy analytics. Government agencies, digital assets, energy utilities, electric vehicles, IoT devices, non-profit organizations, carbon markets, commercial & industrial entities, and power generators are integrating this technology into their operations. Decentralized energy systems employ hashing algorithms to ensure energy transparency and regulatory compliance. Renewable energy certificates and emissions trading are facilitated through smart contracts, enabling carbon emission reduction and energy credit transactions. Peer-to-peer energy trading and energy management systems empower consumers, enabling demand response and energy efficiency.

Key management and digital signatures secure data privacy and ensure regulatory compliance. Energy supply chain management is optimized through blockchain, providing transparency and reducing the risk of counterfeit products. Energy transition and grid modernization are accelerated through this technology, with sustainable energy and distributed ledger technology at the forefront. The energy sector's ongoing dynamism is reflected in the adoption of this technology by various entities. Consensus mechanisms and supply chain management are crucial components of this transformation, driving the evolution of energy policy and retail energy provision. Energy cooperatives and consumer empowerment are also benefiting from this technological advancement. In the realm of energy, blockchain technology is a continuously unfolding pattern of innovation, with applications ranging from energy efficiency and demand response to energy trading and grid modernization.

The integration of this technology by various entities, including government agencies, digital assets, energy utilities, electric vehicles, IoT devices, non-profit organizations, carbon markets, commercial & industrial entities, energy analytics, power generators, and retail energy providers, is driving the energy sector towards a more sustainable and efficient future. The Blockchain Technology in Energy Market is revolutionizing operations by enhancing efficiency and transparency. Renewable energy integration is a key focus, enabling decentralized energy trading and optimizing resource distribution. Improved energy market liquidity allows peer-to-peer transactions, facilitating seamless exchanges between producers and consumers. Ensuring electric grid security is critical, and blockchain technology strengthens infrastructure by preventing cyber threats and unauthorized access. Solar energy adoption benefits from blockchain-based smart contracts, which streamline transactions and incentivize clean energy production.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Blockchain Technology In Energy Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 85.1% |

|

Market growth 2025-2029 |

USD 7.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

78.5 |

|

Key countries |

US, Germany, UK, France, Russia, Italy, Canada, China, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Blockchain Technology In Energy Market Research and Growth Report?

- CAGR of the Blockchain Technology In Energy industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the blockchain technology in energy market growth of industry companies

We can help! Our analysts can customize this blockchain technology in energy market research report to meet your requirements.