BOPET Films Market Size 2024-2028

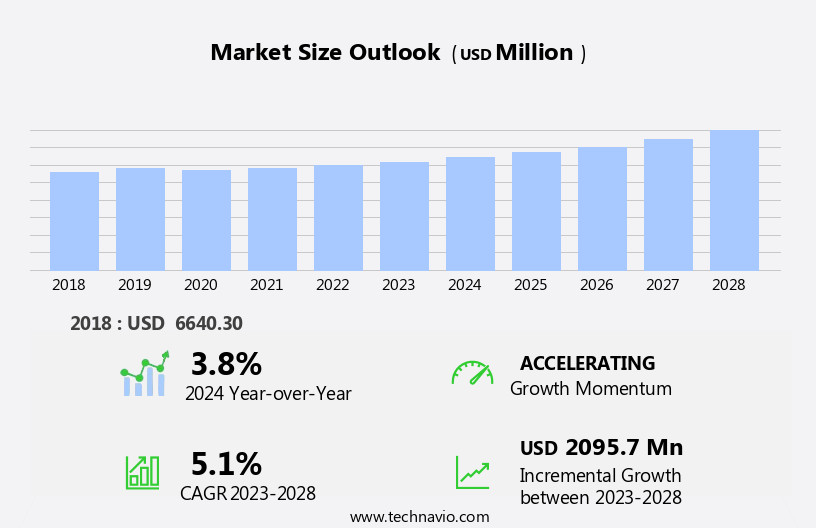

The bopet films market size is forecast to increase by USD 2.1 billion at a CAGR of 5.1% between 2023 and 2028.

What will be the Size of the BOPET Films Market During the Forecast Period?

How is this BOPET Films Industry segmented and which is the largest segment?

The bopet films industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Labels

- Tapes

- Wraps

- Bags and pouches

- Laminates

- End-user

- Food and beverages

- Cosmetics and personal care

- Electrical and electronics

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Middle East and Africa

- South America

- APAC

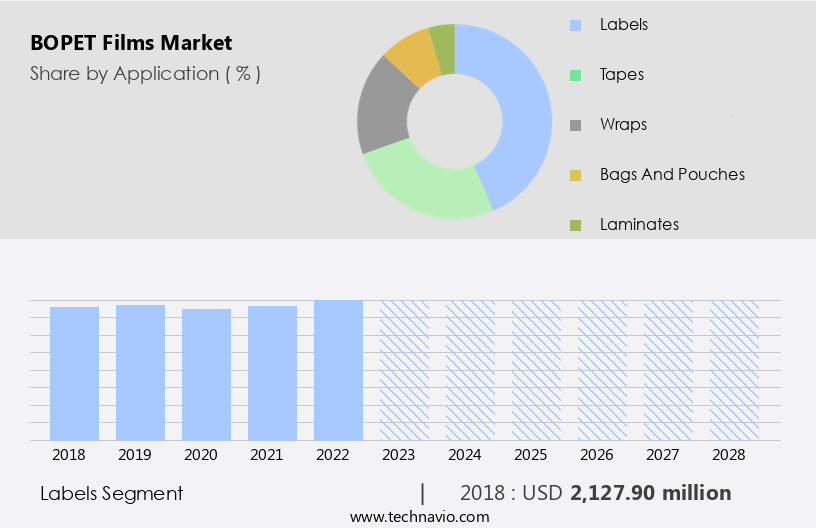

By Application Insights

The labels segment is estimated to witness significant growth during the forecast period. The market encompasses various applications, with labels as a prominent segment due to BOPET films' superior clarity and printability. BOPET films offer exceptional optical properties, enabling vivid and precise printing, and exhibit robust resistance to moisture, chemicals, and abrasion. These features make BOPET films an optimal choice for labels on bottles and other packaging, ensuring legibility and visual appeal under challenging conditions. Furthermore, their durability enhances their suitability for applications requiring high resistance to environmental factors. BOPET films are widely utilized In the labeling of food, beverage, pharmaceutical, and cosmetic products, among others, due to their high-quality packaging capabilities. Additionally, BOPET films are employed in non-food applications, such as consumer electronics, medical devices, and ready-to-eat snacks, demonstrating their versatility.

The market for BOPET films is expected to grow due to the increasing demand for high-barrier, multi-layered, and sustainable packaging solutions, as well as the changing lifestyle trends and the need for extended shelf life and food safety.

Get a glance at the market report of various segments Request Free Sample

The Labels segment was valued at USD 2.13 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia-Pacific (APAC) is witnessing notable growth due to the expansion of industries such as food processing, e-commerce, and electronics. BOPET films are extensively utilized in flexible packaging and protective film applications withIn these sectors. The food processing industry is a primary contributor to the demand for BOPET films in APAC. For instance, China's food production value grew by 2.8% in 2023 compared to the previous year, as reported by the Ministry of Commerce (MOC). Likewise, the Indian food processing sector has experienced steady growth, with an average annual growth rate of 5.35% over the past eight years, reaching a Gross Value Added (GVA) of USD23 billion.

BOPET films' high barrier properties make them suitable for packaging various food products, including meat, confectionery, dairy products, and fresh produce. Additionally, the increasing demand for high-quality packaging, sustainable materials, and recyclable packaging is driving the market growth. BOPET films are also used in non-food packaging applications, such as tobacco, consumer electronics, medical devices, and ready-to-eat snacks. The trend towards longer shelf life, food safety, and high-end visual packaging further boosts the demand for BOPET films.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of BOPET Films Industry?

- Growing demand for flexible packaging is the key driver of the market.The market experiences significant growth due to the rising demand for high-quality packaging solutions in various industries. BOPET films, derived from Polyethylene Terephthalate (PET), are extensively used in producing packaging films, bags and pouches, tapes, and labels. These films offer superior properties such as high-barrier protection, multi-layered structures, and excellent printability, making them suitable for numerous applications. In the food sector, BOPET films are commonly used for meat, confectionery, dairy products, and ready-to-eat snacks packaging. Their high-barrier properties help maintaIn the freshness and extend the shelf life of these products. Moreover, BOPET films ensure food safety and comply with stringent regulations, making them a preferred choice for food packaging.

In the non-food sector, BOPET films are utilized in tobacco packaging, consumer electronics, medical devices, and personal care products. Their flexibility, combined with excellent printability and high-barrier properties, make them ideal for these applications. Sustainability is a key trend driving the market, with an increasing focus on recyclable and eco-friendly packaging solutions. BOPET films offer recyclability and can be produced using sustainable materials, making them a popular choice for environmentally-conscious consumers and businesses. In conclusion, the market is expected to continue growing due to the increasing demand for high-quality, flexible, and sustainable packaging solutions across various industries.

These films offer numerous advantages, including extended shelf life, improved product protection, and enhanced visual appeal, making them a preferred choice for food, consumer electronics, medical devices, and personal care products.

What are the market trends shaping the BOPET Films market?

- Introduction of new products by vendors is the upcoming market trend.The market is witnessing significant innovation, with companies introducing high-performance and sustainable solutions. UFlex, for instance, launched the F-PSX film in Q1 FY24, a high-barrier, transparent BOPET film featuring a printable protective layer. This film boasts excellent moisture and oxygen barrier properties, essential for preserving the quality and shelf life of various packaged goods. Additionally, it offers enhanced clarity and a higher yield compared to traditional PVDC-coated alternatives. The F-PSX film's advantages make it a desirable choice for numerous packaging applications, including meat, confectionery, dairy products, cosmetics, and consumer electronics. Furthermore, its recyclable nature aligns with the growing demand for sustainable materials and recyclable packaging In the flexible packaging industry.

UFlex's innovation underscores the market's shift towards high-barrier, multi-layered packaging solutions, such as retort pouches, that cater to the changing lifestyle and food safety requirements of consumers.

What challenges does the BOPET Films Industry face during its growth?

- Competition from alternative materials is a key challenge affecting the industry growth.The market experiences growing competition from sustainable packaging solutions, such as biodegradable films and paper-based packaging. Biodegradable films, derived from materials like polylactic acid (PLA) and starch-polymers, are gaining popularity due to their eco-friendliness. These materials decompose easily in natural environments, appealing to consumers and businesses committed to reducing their carbon footprint. For instance, NatureWorks' Ingeo, a PLA-based biopolymer, competes directly with BOPET films in various applications, including food packaging. Paper-based packaging, particularly coated paper or paperboard, is also on the rise, especially In the food and consumer goods sectors. Brands are embracing these materials for their sustainable appeal and the ability to offer high-quality visual packaging.

Despite these challenges, BOPET films continue to offer advantages such as high barrier protection, long shelf life, and versatility in various industries, including food, tobacco, non-food, consumer electronics, medical devices, and personal care.

Exclusive Customer Landscape

The bopet films market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bopet films market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bopet films market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Cosmo First Ltd. - BOPET films, including transparent and metalized variants, represent a significant segment In the global film market. Transparent BOPET films offer excellent clarity and strength, making them suitable for various applications such as packaging, labeling, and industrial uses. Metalized BOPET films, on the other hand, provide enhanced barrier properties and are commonly used In the production of flexible packaging for food and beverage products. The demand for BOPET films is driven by their versatility, durability, and ability to replace traditional materials like aluminum and glass in various industries. Additionally, the increasing trend towards sustainable and lightweight packaging solutions is expected to further boost the market growth. BOPET films' unique properties make them a preferred choice for numerous applications, contributing to their growing adoption across various end-use industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cosmo First Ltd.

- Ester Industries Ltd.

- Flex Films

- GARWARE POLYESTER FILMS

- JBF Bahrain

- JPFL FILMS Pvt. Ltd.

- Mitsubishi Chemical America Inc.

- Mylar Specialty Films Ltd.

- Oben Holding Group

- Polinas

- Polyplex Corp. Ltd

- PT. KOLON INA

- RETAL Films

- SRF Ltd.

- Sumilon Polyester Ltd.

- Toray Plastics America Inc.

- Tredegar Corp.

- UFlex Ltd.

- Yishuya

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global market for high-quality packaging films, including bopet films, continues to experience significant growth due to the increasing demand for sustainable and recyclable packaging solutions. This trend is particularly prominent in various industries such as food, cosmetics, and consumer electronics. Bopet films, a type of biaxially oriented polyethylene terephthalate (PET) film, have gained popularity due to their high-barrier properties, making them suitable for packaging a wide range of products. In the food industry, these films are commonly used for meat, confectionery, dairy products, and ready-to-eat snacks. The demand for high-barrier packaging is driven by the need to extend shelf life and maintaIn the freshness and quality of food products.

Furthermore, the shift towards sustainable and eco-friendly packaging solutions has led to an increased focus on using recyclable materials in packaging films. Bopet films made from sustainable materials are gaining traction In the market, particularly In the cosmetics and personal care industries. These films offer the benefits of flexible packaging while reducing the environmental impact. Another trend In the packaging films market is the use of multi-layered packaging solutions. Retort pouches, for instance, are a popular choice for packaging food products due to their ability to withstand high temperatures during sterilization. These pouches are made using multiple layers of films, including bopet films, to ensure the required level of protection and shelf life.

Printing and laminating technologies have also advanced significantly, enabling the production of high-end visual packaging. This is particularly important In the food industry, where attractive and eye-catching packaging can influence consumer purchasing decisions. The demand for high-quality packaging films is not limited to food products. They are also used extensively In the tobacco, non-food, consumer electronics, medical devices, and pharmaceutical industries. In the tobacco industry, bopet films are used for tobacco packaging due to their high-barrier properties and ability to protect the contents from moisture and oxygen. In the consumer electronics industry, these films are used for packaging sensitive components due to their protective properties.

The changing lifestyle and consumer preferences towards convenience and portability have also contributed to the growth of the packaging films market. Bags and pouches made from bopet films are increasingly popular for packaging various products, including food, cosmetics, and consumer electronics. Food safety is another critical factor driving the demand for high-quality packaging films. With increasing consumer awareness about food safety, there is a growing demand for packaging solutions that ensure the safety and quality of food products. Bopet films offer excellent barrier properties, making them an ideal choice for food packaging applications. In conclusion, the global market for high-quality packaging films, including bopet films, is expected to continue growing due to the increasing demand for sustainable and recyclable packaging solutions, changing consumer preferences, and the need for high-barrier packaging to maintain product quality and extend shelf life.

The advancements in printing and laminating technologies and the growing demand for convenient and portable packaging are also expected to drive market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2024-2028 |

USD 2095.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.8 |

|

Key countries |

China, US, Germany, India, UK, Japan, Canada, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this BOPET Films Market Research and Growth Report?

- CAGR of the BOPET Films industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bopet films market growth of industry companies

We can help! Our analysts can customize this bopet films market research report to meet your requirements.