Business Management Software Market Size 2025-2029

The business management software market size is forecast to increase by USD 421 billion, at a CAGR of 12.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of cloud-based deployment solutions. Companies are recognizing the benefits of flexible, scalable, and cost-effective software solutions that enable remote work and real-time data access. Furthermore, the integration of advanced technologies, such as artificial intelligence, machine learning, and the Internet of Things, is revolutionizing business processes, leading to improved efficiency and productivity. However, the market's growth trajectory is not without challenges. The lack of skilled professionals with expertise in implementing and managing these complex systems poses a significant obstacle for businesses. As the demand for business management software continues to rise, there is a growing need for a workforce that can effectively leverage these technologies to gain a competitive edge.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively must invest in upskilling their workforce or partnering with experts to ensure successful implementation and adoption of business management software solutions.

What will be the Size of the Business Management Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Entities offering data warehousing solutions integrate advanced reporting tools to facilitate comprehensive business intelligence. Technical support and financial management systems are seamlessly integrated, ensuring optimal performance and accuracy. Human capital management solutions provide training programs to enhance workforce skills, while user experience is prioritized to boost employee engagement. Project management tools enable efficient collaboration and workflow automation, fostering business process re-engineering. Cloud computing facilitates mobility and adaptive insights, allowing real-time data analytics. Document management and system integration are crucial components, ensuring seamless data flow and streamlined operations.

Consultancy and implementation services are in high demand, as organizations seek expert guidance in adopting new technologies. Change management strategies are essential to ensure successful implementation and minimize disruption. API integration enables seamless data exchange between applications, enhancing overall system functionality. Inventory management and supply chain optimization are critical aspects of business operations, with software solutions offering advanced features to optimize stock levels and streamline logistics. Ongoing market activities demonstrate the continuous need for innovation and adaptation to meet evolving business requirements.

How is this Business Management Software Industry segmented?

The business management software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Large enterprises

- SMEs

- Deployment

- On-premises

- Cloud

- Type

- Software

- Services

- End-user

- BFSI

- IT and telecom

- Healthcare

- Government

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

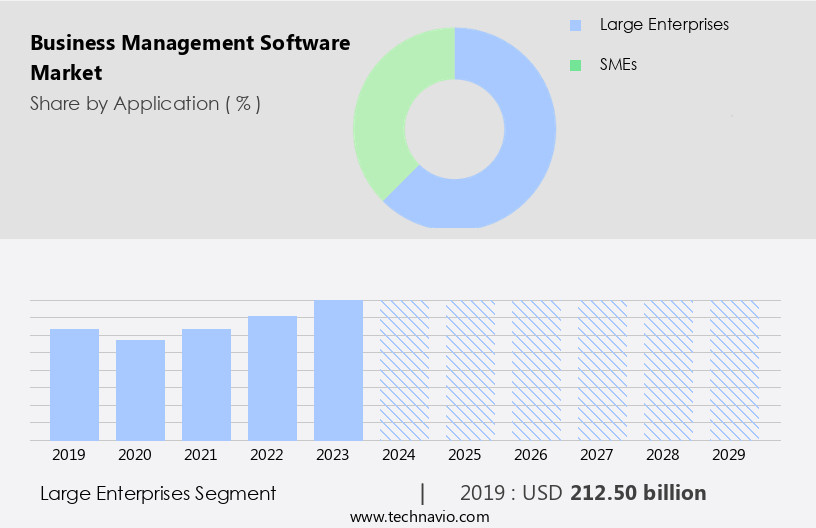

The large enterprises segment is estimated to witness significant growth during the forecast period.

Business development software has become an essential tool for large enterprises seeking to streamline and manage their complex and diverse operations more efficiently. This software enables better coordination and control across various departments and business units, facilitating data-driven decision-making and process optimization. With the increasing focus on automation and workflow efficiency, workflow automation and business process re-engineering have gained significant attention. Data security is another critical concern for large enterprises, and business development software provides robust solutions to safeguard sensitive information. Cloud computing and mobile accessibility have made software more accessible and scalable, allowing businesses to adapt to changing needs.

Microsoft Dynamics 365, Oracle NetSuite, and Intuit Quickbooks are popular solutions that offer a range of features, including customer relationship management, financial management, human capital management, and supply chain management. Consultancy and implementation services ensure smooth software integration and adoption. Business intelligence and data analytics provide valuable insights into business performance, helping organizations make informed decisions. Collaboration tools facilitate teamwork and communication, while document management systems streamline document workflows. API integration and system integration enable seamless data exchange between different applications. Change management and user experience are essential considerations for successful software implementation. Maintenance contracts and technical support offer ongoing assistance and ensure software functionality.

Inventory management and process optimization help businesses manage resources efficiently and reduce costs. Data migration and data warehousing are crucial for businesses looking to consolidate data from various sources. Reporting tools provide valuable insights into business performance, while financial management and project management solutions help organizations manage their finances and projects effectively. Overall, business development software plays a vital role in enabling large enterprises to streamline their operations, improve efficiency, and drive growth.

The Large enterprises segment was valued at USD 212.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

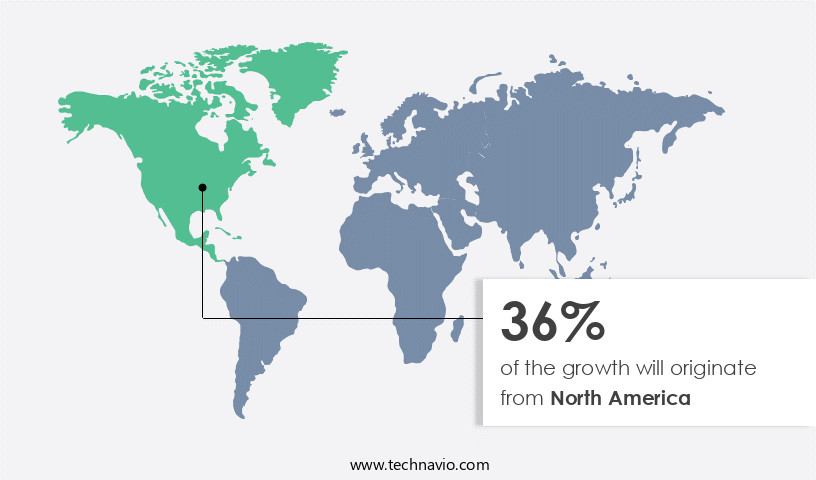

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The markets in North America are experiencing significant growth, with the US being the primary market. Enterprises in this region are early adopters of cloud services, and the technologically mature industrial sector drives high adoption rates. Advanced technologies, including AI, ML, virtualization, and cloud computing, are increasingly utilized, expanding the scope of business management software applications. Cloud computing enables workflow automation, data migration, and real-time collaboration through tools like Microsoft Dynamics 365 and Oracle NetSuite. Data security is paramount, ensuring encryption and access controls for sensitive business information. Customer relationship management (CRM) systems, such as Salesforce and Intuit Quickbooks, facilitate customer interaction and data analytics.

Business intelligence (BI) tools, like Tableau and Power BI, provide insights for data-driven decision making. Inventory management, process optimization, and document management systems streamline operations. Change management, adaptive insights, and user experience enhance user adoption and satisfaction. Blue Prism and UiPath offer RPA solutions for automating repetitive tasks. Consultancy and implementation services ensure successful deployments. Maintenance contracts, technical support, and system integration services provide ongoing support. Supply chain management and financial management systems improve operational efficiency. Training programs and user experience design ensure user-friendly interfaces. API integration and data warehousing enable data sharing and reporting tools.

Financial management, human capital management, and project management systems optimize resources and budgets. The market's evolution emphasizes adaptability, ease of use, and seamless integration.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive business landscape, the demand for robust and efficient business management software solutions continues to surge. These solutions cater to diverse industries, streamlining operations through features like inventory management, customer relationship management, accounting, and project management. Key players in this market offer cloud-based alternatives, ensuring accessibility and flexibility. Integration capabilities with other business tools, customizable workflows, and real-time analytics are essential components. Additionally, advanced security features, scalability, and user-friendly interfaces are crucial. The market is characterized by continuous innovation, with trends like artificial intelligence, machine learning, and automation shaping the future. Companies seeking competitive advantages and operational excellence increasingly rely on these solutions.

What are the key market drivers leading to the rise in the adoption of Business Management Software Industry?

- The introduction of cloud-based deployment solutions is the primary catalyst fueling market growth. These innovative technologies enable businesses to streamline operations, enhance efficiency, and reduce IT infrastructure costs, making them an indispensable component of modern business strategies.

- Cloud-based business management software has gained significant traction in the corporate world due to its ability to deliver process optimization, document management, and supply chain management capabilities remotely. These solutions, which are hosted on a company's server and accessed via the internet, offer several advantages, including scalability, flexibility, and cost savings. Cloud-based services encompass public, private, and hybrid cloud options, allowing businesses to choose the best fit for their specific needs. Oracle Corp., for instance, offers Oracle NetSuite, a leading cloud-based enterprise resource planning (ERP) solution. Intuit Quickbooks also provides cloud-based accounting software, enabling users to manage their financial operations from anywhere.

- Consultancy and implementation services are often provided alongside these cloud-based software solutions to ensure a seamless transition. API integration is another crucial feature, enabling seamless data exchange between different applications and systems. By streamlining business processes and improving overall efficiency, cloud-based business management software is an essential tool for modern organizations.

What are the market trends shaping the Business Management Software Industry?

- Advanced technologies are increasingly being adopted in various industries, marking a significant market trend. This trend reflects the growing recognition of the benefits these technologies bring to efficiency, productivity, and innovation.

- The market has witnessed significant growth due to the adoption of advanced technologies such as hybrid cloud and AI. Hybrid cloud solutions enable seamless application movement between public and private cloud environments, offering organizations the benefits of both models. These solutions provide application efficiency, security, backup, privacy, and control while reducing costs. Data warehousing and reporting tools are essential components of business management software, allowing organizations to collect, store, and analyze data to make informed decisions. Technical support, financial management, human capital management, training programs, project management, system integration, and user experience are other crucial features. The market's growth is driven by the increasing demand for efficient business operations, data-driven decision-making, and the need for seamless integration of various business functions.

- Organizations are investing in business management software to streamline their processes, enhance productivity, and improve overall performance. Moreover, the user-friendly interface and immersive user experience of these solutions have made them increasingly popular. The market is expected to continue its growth trajectory, driven by technological advancements and the evolving business landscape.

What challenges does the Business Management Software Industry face during its growth?

- The scarcity of proficient experts poses a significant barrier to the expansion and growth of the industry.

- The market faces growth challenges due to the inadequate technological skills among end-users. While several companies offer user-friendly products and training, users find it difficult to adapt to customized solutions and analytics. For instance, Asure Software provides workspace management solutions with advanced analytics. However, the misinterpretation of data due to insufficient knowledge of analytical tools can lead to incorrect utilization of business management software. To address this issue, companies are focusing on providing user-friendly interfaces and comprehensive training programs.

- Additionally, workflow automation, data security, customer relationship management, business intelligence, collaboration tools, and software licensing are key features driving the market. Microsoft Dynamics 365 is a notable solution offering these features. Despite these challenges, the market is expected to grow due to the increasing demand for streamlined business processes and data-driven decision-making.

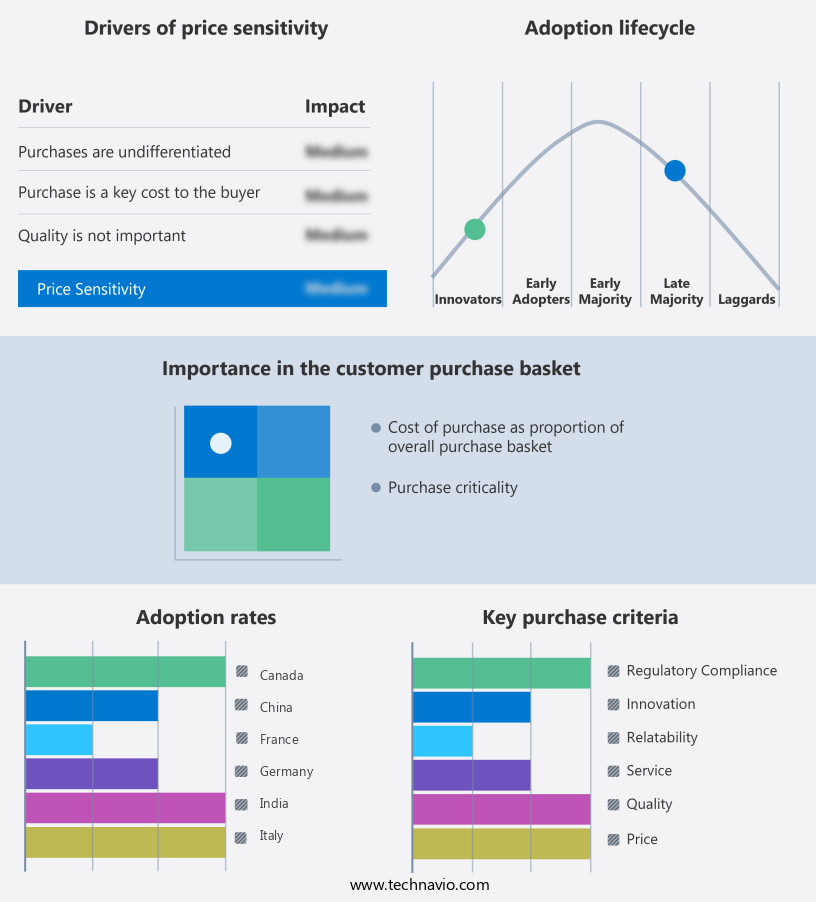

Exclusive Customer Landscape

The business management software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the business management software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, business management software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - This company delivers an advanced human capital management solution, automating HR processes and enabling employee self-service capabilities, enhancing operational efficiency and productivity. Integrated features streamline tasks, ensuring compliance and data accuracy.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- AgilQuest Corp.

- Asure Software Inc.

- Comarch SA

- Condeco Group Ltd.

- FM Systems Group LLC

- Fortive Corp.

- Infor Inc.

- International Business Machines Corp.

- iOFFICE LP

- Microsoft Corp.

- ONESOFT GLOBAL PTE. Ltd.

- Oracle Corp.

- OverIT Spa

- Planon Group

- Salesforce Inc.

- SAP SE

- ServiceMax Inc.

- Trimble Inc.

- Yardi Systems Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Business Management Software Market

- In January 2024, Microsoft announced the global availability of Microsoft Dynamics 365 Business Central, an all-in-one business solution designed for small and mid-sized enterprises (SMEs) (Microsoft Press Release, 2024). This cloud-based software integrates finance, supply chain, sales, project management, and inventory functions, among others.

- In March 2024, Oracle and NetSuite entered into a strategic partnership to expand their business management software offerings, allowing Oracle's Netsuite to leverage Oracle's marketing, sales, and service applications, while Oracle gained access to NetSuite's ERP and e-commerce capabilities (Oracle Press Release, 2024).

- In April 2025, Intuit QuickBooks, a leading business management software provider, raised USD500 million in a funding round led by T. Rowe Price and BlackRock, to fuel its product development, international expansion, and strategic acquisitions (Bloomberg, 2025).

- In May 2025, Salesforce acquired Tableau, a leading data visualization and business intelligence platform, for approximately USD15.7 billion, expanding its Business Intelligence and Analytics capabilities, and enhancing its CRM offerings (Salesforce Press Release, 2025).

Research Analyst Overview

- In the dynamic the market, hybrid cloud solutions are gaining traction, allowing organizations to reap the benefits of both on-premise and cloud-based systems. Risk management software, integrated with blockchain technology, ensures data security and transparency. Mobile application development and web application development continue to dominate, driven by the need for remote work and digital transformation. Microservices architecture and serverless computing streamline software development lifecycle (SDLC), enabling faster time-to-market. Big data and predictive modeling are revolutionizing decision-making, while data privacy and regulatory compliance remain top priorities. Natural language processing and artificial intelligence are transforming customer interactions, enhancing user experience.

- Internet of Things (IoT) integration and real-time analytics provide valuable insights for business optimization. Proprietary software and open source software each have their merits, with the former offering customization and the latter flexibility. Software testing and quality assurance ensure software reliability and performance. Database management and data governance are crucial for effective data utilization and security. Disaster recovery and business continuity plans ensure business resilience during crises. Overall, the market is evolving rapidly, driven by emerging technologies and changing business needs.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Business Management Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.8% |

|

Market growth 2025-2029 |

USD 421 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.5 |

|

Key countries |

US, China, Canada, Germany, UK, Japan, India, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Business Management Software Market Research and Growth Report?

- CAGR of the Business Management Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the business management software market growth of industry companies

We can help! Our analysts can customize this business management software market research report to meet your requirements.