Business Process Outsourcing Market Size 2025-2029

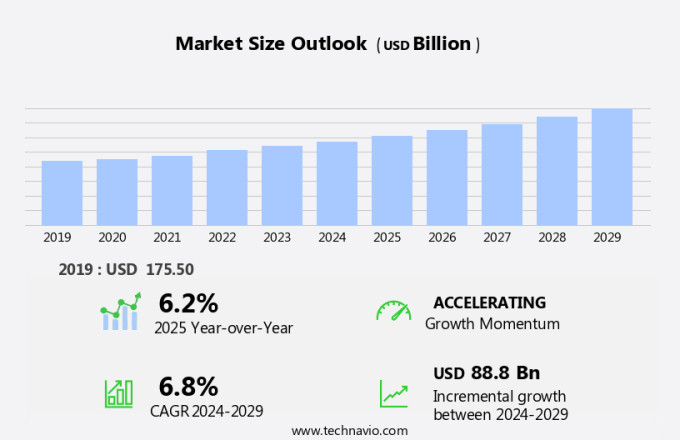

The business process outsourcing market size is forecast to increase by USD 88.8 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth due to various key trends and drivers. One of the primary drivers is the focus on reducing operational costs, as companies seek to minimize expenses and improve efficiency. Another trend is the rising emphasis on process automation, which is becoming increasingly important in the digital age. However, data breaches continue to pose a challenge to the industry, as companies must ensure the security of sensitive information when outsourcing processes. BPO services offer numerous advantages, such as access to technological advancements like cloud computing, Artificial Intelligence, and the Internet of Things (IoT), which can improve efficiency and productivity. These factors, among others, are shaping the future of the BPO market. The market analysis report provides an in-depth examination of these trends and their impact on market growth. Companies are leveraging technology and innovative strategies to address these challenges and stay competitive in the market. The BPO industry is expected to continue its growth trajectory, driven by these key factors and the increasing demand for outsourcing services.

What will be the Size of the Market During the Forecast Period?

- Business Process Outsourcing (BPO), an external service that allows companies to transfer non-core business functions to specialized third-party providers, continues to gain traction in today's business landscape. This trend is driven by the desire for flexibility, reduced costs, and enhanced service delivery in various industries, including healthcare and IT. BPO offers businesses the opportunity to focus on their core competencies while outsourcing operational tasks to external experts. This not only leads to cost savings but also results in improved efficiency and agility. Operating costs associated with hiring and training staff, maintaining infrastructure, and managing technology are significantly reduced. Moreover, advancements in technological improvements such as cloud computing, IoT, AI technologies, and investment in these areas provide a competitive advantage for BPO service providers.

- Moreover, these technological advancements enable seamless integration of business processes and real-time data access, leading to better decision-making and improved customer experiences. The BPO market is diverse, with various outsourcing types such as offshore, nearshore, and onshore. Each type caters to specific business needs, offering varying levels of cost savings and service delivery. Offshore outsourcing, for instance, offers significant cost savings due to lower labor costs in certain regions. Nearshore outsourcing provides a balance between cost savings and proximity to the client, while onshore outsourcing ensures cultural and language compatibility. The adoption of BPO is on the rise due to increased awareness of its benefits and the need for businesses to remain competitive in today's dynamic marketplace. By outsourcing non-core business functions, companies can focus on their core competencies and strategic initiatives, ultimately leading to growth and success.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- IT and telecommunication

- BFSI

- Retail

- Healthcare

- Others

- Business Segment

- Large enterprises

- SMEs

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Brazil

- North America

By End-user Insights

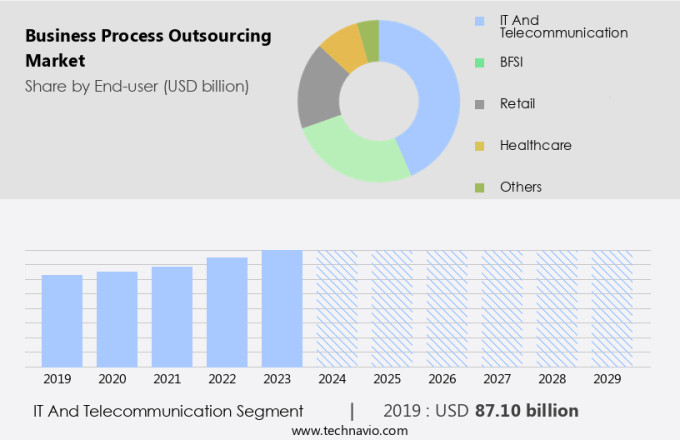

- The IT and telecommunication segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly in segments such as telecom services and digital content creation. Technological advancements and increasing consumer demand for digital communication are driving this expansion. The telecom industry is experiencing steady growth with the emergence of 5G technology. Companies like Bharti Airtel and Tech Mahindra are collaborating to develop and market enterprise-grade digital solutions in this space. The automobile, aviation, ports, utilities, chemicals, oil and gas industries, among others, are expected to benefit from these offerings. Key services within the BPO market include voice processing, telemarketing, image editing, virtual staffing, 3D visualization, and customer care. These services enable businesses to outsource talent sourcing and various business processes, enhancing operational efficiency and reducing costs. The BPO market encompasses nearshore and onshore services, with the former offering cost savings and the latter providing cultural and linguistic compatibility. Overall, the BPO market is poised for continued growth, fueled by technological innovation and evolving business needs.

Get a glance at the market report of share of various segments Request Free Sample

The IT and telecommunication segment was valued at USD 87.10 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

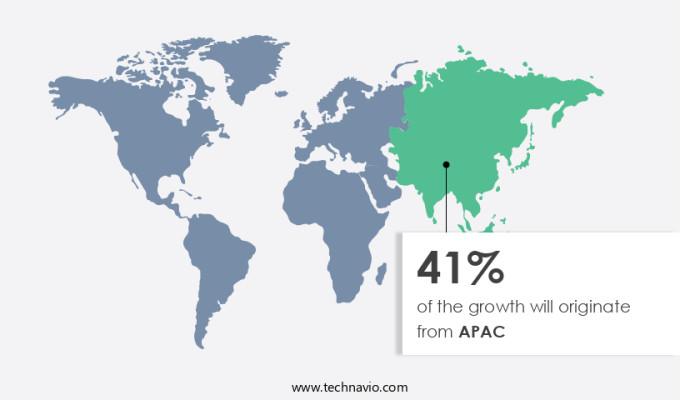

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America, particularly in the IT sector, experiences significant growth due to the region's early adoption of advanced technologies and the presence of leading companies. Outsourcing operations to countries with lower income taxes, such as India, offers cost benefits for businesses in North America. For instance, the US is a major consumer of India's ITES-BPO services, accounting for approximately 66% of the market share. The BPO market in North America is projected to expand at a moderate pace during the forecast period, given its maturity compared to other regional markets. This external service model provides businesses with flexibility, reduced costs, and enhanced service capabilities, making it an attractive option for improving operational efficiency and agility. BPO services span various industries, including healthcare and IT, offering significant cost savings and operational improvements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Business Process Outsourcing Market?

Focus on reducing operational costs is the key driver of the market.

- Business Process Outsourcing (BPO) refers to the practice of contracting external services to manage and execute business processes, enabling organizations to focus on their core competencies and reduce operational costs. BPO encompasses various services, including procurement, logistics, IT, healthcare, finance and accounting, human resource services, telecommunication, and customer care. By outsourcing business processes, organizations can achieve enhanced service levels, flexibility, agility, and economic restructuring. The adoption of these technologies has been accelerated by the increasing awareness of the benefits they offer.

- Moreover, BPO can be categorized into three types: Offshore, Nearshore, and Onshore, depending on the geographical location of the service provider. The choice of outsourcing approach depends on various factors, including cost savings, regulatory requirements, and service quality. Organizations can opt for different deployment modes, such as On-Premise or Cloud, based on their specific needs. BPO services can be availed by organizations of all sizes, from Large Enterprises to Small and Medium-sized Enterprises (SMEs). BPO has gained significant importance in various industries, including manufacturing, finance and accounting, healthcare, IT, and telecommunication, among others. The market for BPO services is expected to continue growing due to the increasing need for cost savings, improved efficiency, and enhanced service levels.

What are the market trends shaping the Business Process Outsourcing Market?

Rising emphasis on process automation is the upcoming trend in the market.

- The market is experiencing significant growth due to the adoption of advanced technologies such as cloud computing, artificial intelligence (AI), and process automation. BPOs leverage these technologies to enhance service delivery, improve efficiency, and reduce operating costs for their clients. In the healthcare and IT sectors, BPOs use AI software for process functions, increasing productivity and accuracy. Cloud technology enables data storage and access to the latest technological advancements, reducing infrastructure equipment costs and enhancing security. BPOs offer a variety of services, including customer care, talent sourcing, product engineering, and facilities and administration. The flexibility and agility offered by BPOs are essential for businesses undergoing economic restructuring, mergers, and acquisitions.

- Moreover, regulatory bodies such as the California Consumer Privacy Act and Anti-Money Laundering require stringent data security measures, making BPOs with strong security protocols a competitive advantage. BPOs deploy various outsourcing approaches, including onshore, nearshore, and offshore, catering to the diverse needs of organizations of all sizes, from large enterprises to Small and Medium-sized Enterprises (SMEs). BPOs also offer deployment modes like on-premise and cloud, providing clients with flexibility and investment opportunities in emerging technologies like AI, Internet of Things (IoT), and Investment in Power transmission and adoption of best-shore strategies, bundled services, and contract-based agreements. BPOs play a crucial role in various industries, including transportation and logistics, travel and hospitality, energy and utilities, and consulting services.

What challenges does Business Process Outsourcing Market face during the growth?

Data breaches is a key challenge affecting the market growth.

- The market refers to the practice of an organization transferring internal business functions to an external service provider. This approach offers businesses flexibility, reduced costs, and enhanced service capabilities. BPO services span various industries, including healthcare, IT, finance and accounting, human resource services, telecommunication, and manufacturing. Technological advancements, such as cloud computing, Artificial Intelligence (AI), and the adoption of the Internet of Things (IoT), are driving the growth of the BPO market. Efficiency and agility are major benefits of BPO, allowing businesses to focus on their core competencies while outsourcing non-core functions. Operating costs are significantly reduced as BPO providers offer standardized platforms and cloud technology, which eliminates the need for infrastructure equipment and data security concerns.

- However, data security remains a critical issue for BPO companies, with data breaches posing a significant challenge. As businesses increasingly rely on digital platforms, protecting confidential, financial, and personal data is essential. Merger and acquisition activity, regulatory bodies, and economic restructuring further add complexity to the BPO landscape. BPO services come in various forms, including voice processing, telemarketing, image editing, virtual staffing, 3D visualization, customer care, talent sourcing, facilities and administration, product engineering, training, and deployment modes such as on-premise and cloud. BPO providers offer different outsourcing types, including offshore, nearshore, and onshore, catering to various industries like transportation and logistics, travel and hospitality, energy and utilities, and consulting services.

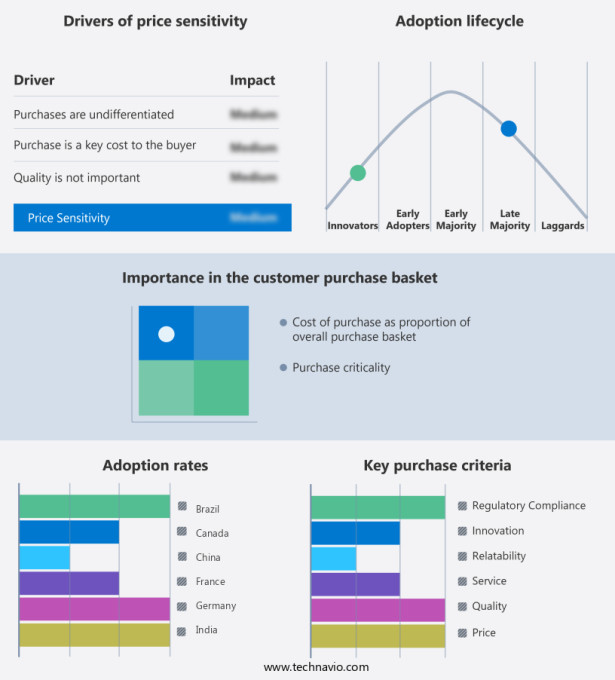

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Accenture PLC - The company offers solutions for business process outsourcing, including finance, supply chain, procurement, human resources, marketing, sales and customer operations, and industry-specific services, such as health, insurance, and banking.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alight Inc.

- Amdocs Ltd.

- Anderson Business Solutions Pvt. Ltd.

- Automatic Data Processing Inc.

- Capgemini Services SAS

- Cognizant Technology Solutions Corp.

- Concentrix Corp.

- Deloitte Touche Tohmatsu Ltd.

- HCL Technologies Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- NEC Corp.

- NTT DATA Corp.

- Oracle Corp.

- Sykes Enterprises Inc.

- Tata Consultancy Services Ltd.

- Tech Mahindra Ltd.

- Wipro Ltd.

- WNS Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Business Process Outsourcing (BPO) has emerged as a strategic solution for organizations seeking to enhance their operational efficiency, reduce costs, and focus on their core competencies. By partnering with external service providers, businesses can access a wide range of services, from IT and healthcare to finance and accounting, human resource services, and telecommunications. One of the primary drivers of BPO adoption is the flexibility it offers. Companies can offload non-core functions to external providers, allowing them to focus on their core business activities. This agility enables organizations to respond quickly to market changes and customer demands.

Moreover, BPO provides businesses with the ability to scale their operations up or down as needed, making it an attractive option for companies undergoing economic restructuring. BPO also offers significant cost savings. By outsourcing non-core functions, businesses can reduce their operating costs. This is particularly true for labor-intensive processes, where the cost savings can be substantial. Additionally, BPO providers often operate on a standardized platform, allowing for economies of scale and technological improvements, such as cloud computing and artificial intelligence. Security is another critical consideration in the BPO market. With the increasing adoption of cloud technology and the growing importance of data, ensuring data security and protecting intellectual property have become essential.

Furthermore, BPO providers invest heavily in security measures, offering advanced security protocols and compliance with regulatory bodies, such as the California Consumer Privacy Act and anti-money laundering regulations. The BPO market is diverse, encompassing various industries and outsourcing types. Offshore outsourcing, which involves partnering with service providers in countries with lower labor costs, has been a popular choice for many years. However, nearshore and onshore outsourcing are also gaining traction, offering advantages such as cultural and language similarities and shorter response times. BPO adoption is not limited to large enterprises. Small and medium-sized enterprises (SMEs) are increasingly turning to external service providers to gain a competitive advantage.

Moreover, the deployment mode is also evolving, with businesses opting for on-premise and cloud-based solutions based on their specific needs. BPO providers offer a range of services, from voice processing and telemarketing to image editing, virtual staffing, and 3D visualization. They also provide customer care services, talent sourcing, facilities and administration, product engineering, training, and deployment mode consulting. BPO market dynamics are influenced by various factors, including merger and acquisition activity, regulatory bodies, and technological advancements. For instance, the increasing adoption of the Internet of Things (IoT) and AI technologies is driving innovation in the BPO industry. Additionally, investment in power transmission and infrastructure equipment is essential for ensuring business continuity and maintaining a distributed workforce. In conclusion, Business Process Outsourcing offers numerous benefits, including flexibility, cost savings, and enhanced service capabilities. As the market continues to evolve, businesses will increasingly turn to external service providers to gain a competitive edge and focus on their core competencies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 88.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.2 |

|

Key countries |

US, Canada, UK, Germany, China, India, Brazil, France, UAE, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch