Butadiene Market Size 2024-2028

The butadiene market size is forecast to increase by USD 13.9 billion at a CAGR of 6.9% between 2023 and 2028.

- The market is experiencing significant growth due to increasing demand from the automotive industry and the rising preference for bio-based feedstocks. The automotive sector's expansion, driven by infrastructure development and consumer goods manufacturing, is boosting the demand for nitrile butadiene rubber and high-performance plastics. Additionally, regulations enforcing the reduction of toxic emissions are encouraging the adoption of butadiene as a substitute for hexamethylenediamine in water treatment applications.

- Furthermore, the development of polymer technology and synthetic rubbers is expanding the market's scope in various industries, including construction, packaging, and electronics. The shift towards sustainable alternatives is also influencing market trends, with an increasing focus on bio-based alternatives to traditional butadiene production methods. Overall, the market is poised for growth, driven by these factors and the continuous innovation in the field of polymer technology.

What will be the Size of the Market During the Forecast Period?

- Butadiene is a vital chemical compound used in the production of synthetic rubber and polymers. This organic compound, with the molecular formula C4H6, is primarily derived from the refining process of butane and butene. The market is significant due to its extensive applications in various industries, including automotive tires, plastics, resins, and construction. In the automotive sector, butadiene is a crucial component in the manufacturing of synthetic rubbers such as Acrylonitrile Butadiene Styrene (ABS) and Styrene-Butadiene Rubber (SBR). These elastomers are essential in producing tires, enhancing their durability and flexibility. Moreover, butadiene is also used in the production of thermoplastic elastomers and elastomers, which find extensive applications in the manufacturing of lightweight vehicles.

- Furthermore, the increasing focus on fuel efficiency and the production of eco-friendly vehicles is expected to boost the demand for these materials, subsequently increasing the demand for butadiene. In the plastics and resins industry, butadiene is used to produce Polybutadiene Rubber (PBR), which is widely used as a building crack filler and concrete additive. Furthermore, butadiene is also used in the production of Nitrile Rubber, which is extensively used in the manufacturing of industrial hoses, seals, and gaskets. The market is driven by the increasing demand for synthetic rubbers and polymers in various industries. The growing construction sector and the increasing production of lightweight vehicles are expected to boost the demand for butadiene in the coming years.

- Additionally, the increasing focus on the production of bio-butadiene, derived from renewable sources, is expected to provide significant growth opportunities to the market. The market is primarily driven by the steam cracking process, which involves the thermal cracking of hydrocarbons to produce butadiene and other chemicals. This process is energy-intensive and requires significant capital investment, making it a capital-intensive industry. However, the high demand for butadiene and its derivatives justifies the investment. In conclusion, the market is a significant and growing industry, driven by the extensive applications of butadiene in various industries, including automotive, plastics, resins, and construction. The increasing focus on fuel efficiency and eco-friendly materials is expected to boost the demand for butadiene and its derivatives in the coming years. The steam cracking process remains the primary production method for butadiene, making it a capital-intensive industry.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Derivative Type

- Polybutadiene rubber

- Styrene butadiene rubber

- Acrylonitrile butadiene styrene resins

- Styrene butadiene latex

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Derivative Type Insights

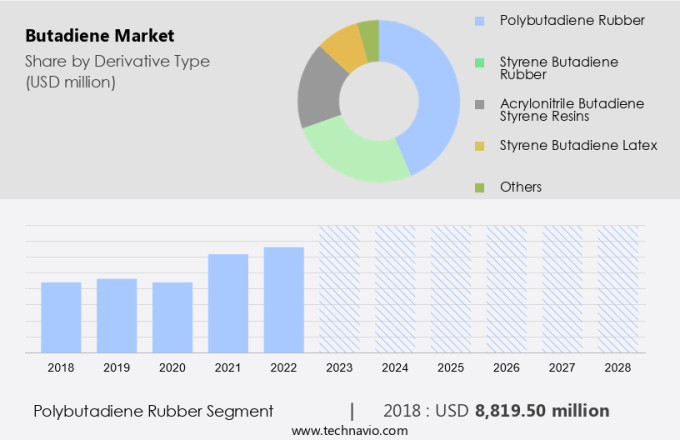

- The polybutadiene rubber segment is estimated to witness significant growth during the forecast period.

Butadiene, specifically polybutadiene rubber (PBR), is a synthetic rubber that serves as a substitute for natural rubber in various industries. This rubber is produced through anionic polymerization or coordination polymerization of 13-butadiene in non-polar solvents. In the market, two primary types of PBR exist: solid and liquid. Solid PBR accounts for the larger market share due to its extensive applications. Solid PBR is further categorized into four types based on the catalyst system: high cis, low cis, high trans, and high vinyl. This synthetic rubber provides desirable properties, such as resistance to low temperatures, superior elasticity, high wear resistance due to its low coefficient of friction, and strength properties with minimal hysteresis loss.

Furthermore, butadiene rubber is extensively used in the production of butadiene rubber latex, which is further processed to create butadiene rubber products. Some of the major applications include butadiene rubber in the manufacturing of butadiene rubber tires, adhesives, coatings, and sealants. In addition, it plays a crucial role in the production of high-performance plastics, synthetic rubbers, and infrastructure development. Moreover, butadiene rubber is a vital component in the production of high-value consumer goods such as footwear, automotive parts, and sports equipment. Furthermore, it is used in water treatment processes due to its excellent chemical resistance and mechanical properties. Hexamethylenediamine, a byproduct of butadiene production, is used in the synthesis of polyurethanes, a type of high-performance plastic.

In conclusion, butadiene rubber, specifically polybutadiene, is a versatile synthetic rubber with a wide range of applications across various industries, including consumer goods, infrastructure development, and high-performance plastics. Its unique properties make it an essential component in the production of various products and processes.

Get a glance at the market report of share of various segments Request Free Sample

The polybutadiene rubber segment was valued at USD 8.82 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

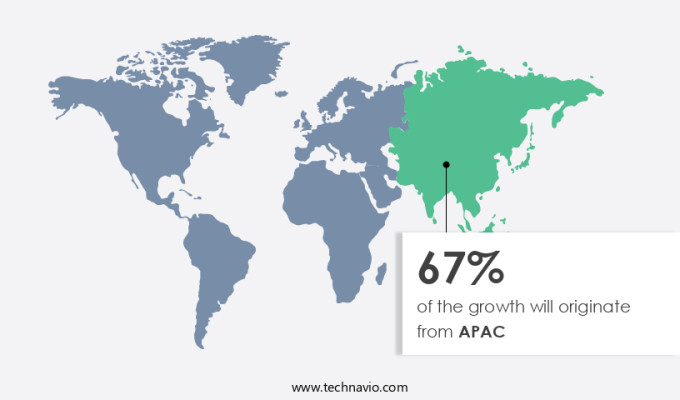

- APAC is estimated to contribute 67% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific region led The market in 2023, driven by the presence of a vast manufacturing industry base producing a significant amount of rubber-based products. China, in particular, is a major chemical manufacturing hub with a diverse range of industries, leading to a substantial increase in the demand for butadiene. According to industry reports, China is projected to produce approximately 704 million tires annually by 2025, including passenger radial tires, truck/bus radial tires, bias truck tires, extra-large industrial tires, agricultural tires, and aircraft tires.

Furthermore, butadiene is a crucial intermediate used in the production of elastomers like Nylon, Styrene-butadiene rubber (SBR), and Polybutadiene. These elastomers are extensively used in the manufacturing of automotive products, including conveyor belts and tires. Therefore, the growth in automobile production and tire shipments in China and other countries in the region will continue to fuel the demand for butadiene.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Butadiene Market?

Increasing demand from the automotive industry is the key driver of the market.

- Butadiene plays a significant role in the automotive industry, accounting for a substantial portion of its consumption. In tire manufacturing, butadiene is a crucial component of styrene-butadiene rubber (SBR), which is an affordable synthetic rubber alternative to natural rubber. The escalating natural rubber prices have driven tire manufacturers to increasingly utilize synthetic rubber to improve product quality and reduce costs. SBR enhances tire durability and rolling resistance, making it ideal for passenger cars and motorcycle tires, providing superior grip performance.

- Furthermore, butadiene's production primarily relies on steam cracking of butane and butene dehydrogenation. The C4 markets, including butadiene, are influenced by oil prices, as they are derived from petrochemical feedstocks. Ethylene crackers, which produce ethylene and other C4 chemicals, also contribute to the butadiene supply chain. The automotive industry's demand for butadiene is expected to remain strong due to its essential role in tire production.

What are the market trends shaping the Butadiene Market?

Rising demand for bio-based feedstock is the upcoming trend in the market.

- The production of synthetic rubber through the utilization of bio-based feedstocks is gaining significant traction in the industry. This trend is driven by the increasing focus on sustainability and the rising costs and finite availability of traditional petroleum-derived raw materials and natural rubber. Major players in the Synthetic Butadiene Rubber (SBR) market are actively investing in the development of renewable chemicals to manufacture rubber.

- Additionally, these companies are forging alliances with industrial biotech firms to advance the commercial production of bio-based rubber raw materials. Plant-based feedstocks, such as sugar and glycerin, are emerging as economically viable alternatives to conventional feedstocks like butadiene and isoprene. This shift towards renewable feedstocks not only promotes sustainability but also offers potential cost savings and improved fuel efficiency for applications in the automotive tire sector, plastics, resins, and construction industries.

What challenges does Butadiene Market face during the growth?

Regulations imposed on the emission of toxic fumes are key challenges affecting the market growth.

- Butadiene is a crucial petrochemical used in various industries, primarily derived from the conversion of base petrochemicals such as ethane and butane. However, the production of butadiene involves the emission of volatile organic compounds (VOCs), including ethylene and butadiene, which can contribute to the formation of toxic oxides. As a carcinogenic chemical, butadiene's presence in the air due to emissions is a concern. A typical butadiene manufacturing plant emits between 6-22 pounds of VOCs for every ton of product produced. VOC emissions are typically fugitive and can vary depending on the manufacturing processes, handling of materials, effluent treatment, equipment maintenance, and climatic conditions.

- However, the price of butadiene is influenced by energy prices and feedstock variances. New ethylene crackers have led to an increase in butadiene production, making it a valuable feedstock for the production of various end-use industries, including automotive applications, paints and coatings, healthcare, and building and construction. Despite its importance, regulations over the emission of toxic fumes continue to impact the market. In conclusion, the market plays a significant role in various industries, but its production process involves the emission of VOCs, including butadiene and ethylene. Regulations over emissions and the influence of energy prices and feedstock variances continue to impact the market's growth. The end-use industries for butadiene include automotive applications, paints and coatings, healthcare, and building and construction.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Braskem SA

- China National Petroleum Corp.

- Dow Inc.

- Evonik Industries AG

- Exxon Mobil Corp.

- Formosa Petrochemical Corp.

- INEOS Group Holdings S.A.

- JSR Corp.

- Kumho Petrochemical Co. Ltd.

- Lanxess AG

- LG Chem Ltd.

- Lotte Chemical Titan Holding Bhd

- LyondellBasell Industries Holdings BV

- Reliance Industries Ltd.

- Repsol SA

- Saudi Basic Industries Corp.

- Shell plc

- TPC Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Butadiene is a vital intermediate chemical used in the production of synthetic rubber, plastics, and resins. It is primarily used in the manufacturing of acrylonitrile butadiene styrene (ABS) and styrene-butadiene rubber (SBR). The automotive industry is a significant consumer of butadiene, with its primary application being in the production of automotive tires. In the plastics and resins sector, butadiene is used to produce high-performance plastics, thermoplastic elastomers, and elastomers. These materials find extensive use in various industries such as construction, consumer goods, and infrastructure development. Butadiene is also used in the production of nitrile rubber, which is widely used in the manufacturing of conveyor belts, automotive products, and other industrial applications.

Furthermore, the demand for butadiene is driven by the increasing production of lightweight vehicles, which require fuel-efficient tires and components. The production of butadiene involves steam cracking of butane and butene. The prices of butadiene are influenced by energy prices and feedstock variances, with ethylene and crude C4 being the primary feedstocks. The market for butadiene is expected to grow due to the increasing demand for synthetic rubbers in various applications, including automotive tires, construction, and consumer goods. Bio-based alternatives to traditional butadiene production are also gaining popularity due to their environmental benefits. These alternatives include the use of bio-butadiene derived from renewable sources such as corn sugar or sugarcane.

IN summary, the development of new ethylene crackers and the increasing use of natural gas as a feedstock are also expected to impact the market. Butadiene is used in various industries, including automotive tires, plastics, resins, construction, consumer goods, healthcare, and infrastructure development. Its applications include tire manufacturing, tire shipments, automobile production, intermediates, paints and coatings, and building and construction. The demand for butadiene is expected to grow due to the increasing production of lightweight vehicles, infrastructure development, and the growing demand for high-performance plastics and elastomers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2024-2028 |

USD 13.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

China, US, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch