Car Rental Market Size 2025-2029

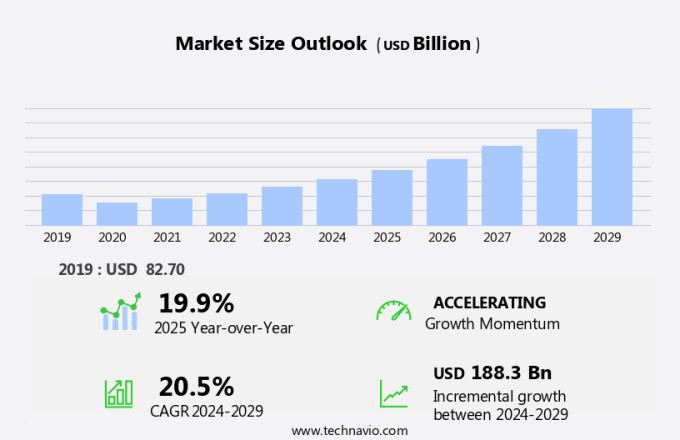

The car rental market size is forecast to increase by USD 188.3 billion, at a CAGR of 20.5% between 2024 and 2029.

- The market is experiencing significant shifts, driven by rising vehicle ownership costs and the advent of intermediaries. The escalating expense of owning and maintaining a personal vehicle has led an increasing number of consumers to opt for car rental services, providing a lucrative opportunity for market players. Furthermore, the emergence of intermediaries, such as ride-hailing and car-sharing services, has disrupted traditional car rental business models, compelling companies to adapt and innovate. These intermediaries offer flexible, on-demand services, catering to the evolving consumer preference for convenience and affordability. However, this dynamic market landscape also presents challenges.

- The intensifying competition from car-sharing services and other intermediaries puts pressure on car rental companies to differentiate themselves and offer competitive pricing and value-added services. Additionally, regulatory hurdles and changing consumer preferences pose significant challenges, requiring companies to stay agile and responsive to market trends. To capitalize on the opportunities and navigate these challenges effectively, car rental companies must focus on enhancing their customer experience, expanding their service offerings, and leveraging technology to streamline operations and improve efficiency.

What will be the Size of the Car Rental Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping various sectors. Fleet management plays a crucial role, as operating costs are closely monitored through effective utilization of resources. Infotainment systems, from Bluetooth connectivity to Android Auto and Apple CarPlay, enhance the customer experience. Fleet leasing and mileage limits are essential components of business rentals, while vehicle inspection ensures safety and maintenance. One-way rentals and pickup trucks cater to diverse customer needs, with seasonal rates offering flexibility. Customer retention is a priority, achieved through loyalty programs, excellent customer service, and marketing campaigns. Compact cars and fuel efficiency are in demand, with pricing strategies reflecting market trends.

Liability insurance and third-party liability are non-negotiable, while fleet leasing and mileage limits help manage costs. Mobile apps and online booking streamline the process, with revenue management and data analytics optimizing performance. Technology integration, from GPS tracking to rental agreements, is essential for smooth operations. Electric vehicles (EVs) and hybrid vehicles are gaining popularity, requiring new strategies for fleet management and customer segmentation. Fuel costs, engine size, and geographic targeting influence pricing. Vehicle maintenance and reputation management are key to brand awareness and customer satisfaction. In the business-to-business sector, corporate accounts and franchise opportunities offer growth potential.

Peak season pricing and rental duration impact revenue, while discount programs and airport transfers cater to specific customer segments. Damage assessment and vehicle inspection ensure fleet readiness, and navigation systems help optimize routes. In conclusion, the market is a continually evolving landscape, with fleet management, operating costs, infotainment systems, fleet leasing, mileage limits, vehicle inspection, one-way rentals, pickup trucks, customer retention, marketing campaigns, compact cars, liability insurance, third-party liability, mobile app, vehicle maintenance, hybrids, EVs, fuel costs, engine size, geographic targeting, technology integration, reputation management, brand awareness, fuel costs, and navigation systems shaping its future.

How is this Car Rental Industry segmented?

The car rental industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Mode Of Booking

- Offline

- Online

- Rental Category

- Airport transport

- Local transport

- Outstation transport

- Other transport

- Type

- Economy cars

- Executive cars

- Luxury cars

- SUVs

- MUVs

- Application

- Leisure/Tourism

- Business Travel

- Local Usage

- Airport Transport

- Outstation/Long Distance

- End-use

- Self-Drive

- Chauffeur-Driven

- Rental Length

- Short-Term Rental

- Long-Term Rental/Leasing

- Fare Price

- Economy/Budget Cars

- Luxury/Premium Cars

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

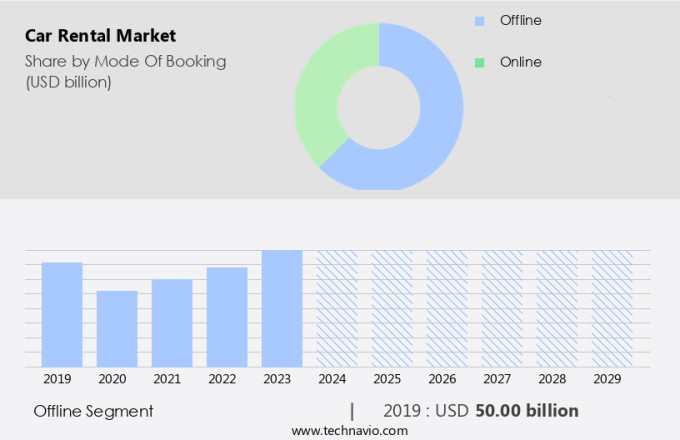

By Mode Of Booking Insights

The offline segment is estimated to witness significant growth during the forecast period.

The Offline segment was valued at USD 50.00 billion in 2019 and showed a gradual increase during the forecast period.

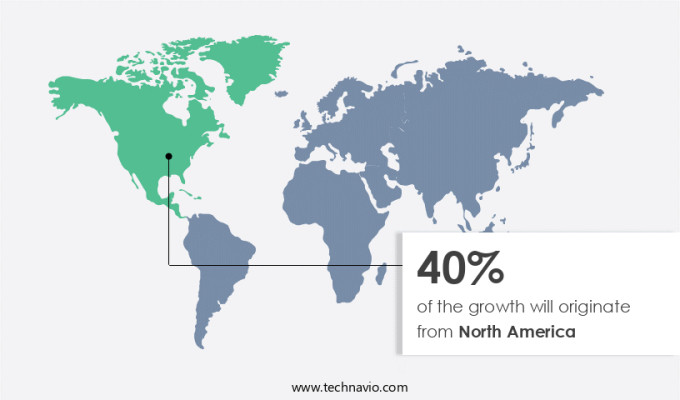

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market exhibits a moderate level of competition, with major players such as Enterprise Holdings Inc., Avis Budget Group Inc. (Avis), and Hertz Global Holdings Inc. (Hertz) leading the market. Smaller companies also exist, but they generate significantly lower revenue than their larger counterparts. Fuel efficiency and affordability, driven by decreasing fuel prices, are significant market growth factors. For example, in Canada, with fuel costs declining and a weakening currency, families are opting for domestic vacations, leading to increased rental spending. Customer satisfaction is a priority in the market, with companies investing in automated check-in/check-out, reservation systems, and mobile apps for seamless customer experiences.

Fleet utilization and revenue management strategies are also essential, with off-season rates, seasonal discounts, and loyalty programs used to optimize revenue. Safety features, including Bluetooth connectivity, GPS tracking, and vehicle inspection, are increasingly important to customers. Demographic targeting and geographic targeting are essential strategies for car rental companies, with fleet leasing, fleet management, and mileage limits catering to specific customer segments. Technology integration, including Android Auto and Apple CarPlay, enhances the customer experience. Fleet leasing, insurance coverage, and liability insurance are crucial aspects of the market, with damage assessment and vehicle maintenance ensuring fleet readiness. Electric vehicles (EVs) and hybrid vehicles are gaining popularity, with one-way rentals and compact cars catering to various customer needs.

Corporate accounts and franchise opportunities offer growth opportunities, while peak season pricing and rental duration strategies cater to demand fluctuations. Data analytics and marketing campaigns help companies understand customer preferences and optimize their offerings. In conclusion, the North American the market is dynamic, with fuel efficiency, customer satisfaction, and technology integration driving growth. Companies focus on fleet utilization, revenue management, and customer segmentation to optimize their offerings and meet evolving customer needs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the dynamic and competitive the market, consumers seek flexibility and convenience when it comes to travel and transportation solutions. Car rental companies offer a diverse range of vehicles, from economy cars to luxury models, catering to various budgets and preferences. Fuel-efficient and eco-friendly options are increasingly popular, reflecting growing environmental consciousness. Short-term and long-term rentals, one-way trips, and airport car rentals are common services that cater to diverse customer needs. Additionally, the market features various add-ons, such as GPS navigation systems, child seats, and extended insurance coverage, ensuring a customized and comprehensive rental experience. The market continues to evolve, with advancements in technology and innovative business models, offering customers more convenience and value.

What are the key market drivers leading to the rise in the adoption of Car Rental Industry?

- The increasing cost of vehicle ownership serves as the primary catalyst for market growth.

- The market offers a cost-effective alternative to vehicle ownership, allowing customers to enjoy the benefits of a car without the added expenses of fuel, registration, taxes, finance, and maintenance. However, the cost of renting a car also includes rental agreements, cleaning services, and customer service. With the increasing popularity of electric vehicles (EVs), seasonal rates may vary based on demand. Customer satisfaction is a key priority for car rental companies, leading to the implementation of loyalty programs, online booking, and damage assessment processes.

- Corporate accounts and fleet management solutions cater to businesses requiring multiple rentals. Apple CarPlay and other advanced technologies enhance the rental experience. Franchise opportunities enable entrepreneurs to enter the market with established branding and support. Peak season pricing and rental duration vary based on market dynamics and demand.

What are the market trends shaping the Car Rental Industry?

- The emergence of intermediaries is a notable trend in The market. These intermediaries, such as ride-hailing apps and car-sharing platforms, are increasingly disrupting traditional rental models. (Alternatively): The market is witnessing a significant shift, with intermediaries like ride-hailing apps and car-sharing platforms gaining prominence. These innovative platforms are transforming the industry by offering more convenient and flexible rental solutions.

- The market in the US has witnessed significant changes with the emergence of online car rental brokers. Prior to the Internet, customers had to make direct phone calls to service providers for booking cars and negotiating prices. However, the advent of car rental brokers, such as carrentals.Com, expedia.Com, cartrawler.Com, and priceline.Com, has transformed the industry. These intermediaries act as demand aggregators, offering customers competitive prices and convenience. From the operator's perspective, sales through intermediaries come with additional commissions, making direct sales more favorable. Fleet management plays a crucial role in the car rental industry, with operating costs being a significant concern.

- Infotainment systems, mileage limits, vehicle inspection, fleet leasing, and one-way rentals are essential aspects of fleet management. Operators offer a range of vehicles, including pickup trucks and compact cars, to cater to diverse customer needs. Liability insurance, including third-party liability, is a mandatory requirement for car rental companies. Marketing campaigns and mobile apps are essential tools for customer retention and attracting new clients. Effective fleet management, competitive pricing, and excellent customer service are key differentiators for car rental companies in a highly competitive market.

What challenges does the Car Rental Industry face during its growth?

- The surge in car-sharing services poses a significant challenge to the automotive industry's growth, as this trend increasingly disrupts traditional ownership and usage patterns.

- Car sharing is a key component of the evolving shared mobility landscape. Urban mobility is undergoing a transformation, with car sharing gaining traction as a means to reduce carbon emissions and alleviate city congestion. Unlike traditional car rental services, which involve renting a vehicle at a designated location for a set period, car sharing enables the use of freely parked vehicles in urban and business areas. This model is increasingly popular in both developed and emerging economies. For instance, car-sharing platforms facilitate city-to-city journeys by connecting car owners and co-travelers through one of the world's largest carpooling services.

- Vehicle maintenance is a crucial aspect of car sharing, ensuring customer satisfaction and trust. Hybrid vehicles are a popular choice due to their fuel efficiency and lower emissions. Engine size and technology integration, including navigation systems and discount programs, are essential features that cater to various customer segments. Geographic targeting and reputation management are critical for brands to expand their reach and awareness. Fuel costs remain a significant consideration for car-sharing services, necessitating data analytics to optimize fleet management and pricing strategies. Luxury sedans and customer segmentation are also essential components of the car-sharing market. Airport transfers are a common application, offering convenience and cost savings for travelers.

- Overall, the car-sharing market is driven by the need for sustainable and flexible mobility solutions.

Exclusive Customer Landscape

The car rental market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the car rental market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, car rental market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aspark Holidays Pvt. Ltd. - Professionally, I present the company's car rental solution: self-driven cars require advance reservation. Choose from a diverse fleet, ensuring a seamless travel experience. Pre-booking guarantees availability and convenience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aspark Holidays Pvt. Ltd.

- Autorent Car Rental LLC

- Avis Budget Group Inc.

- Carzonrent India Pvt. Ltd.

- Centauro Rent a Car S.L.U.

- DriiveMe Ltd.

- Enterprise Holdings Inc.

- Europcar Group UK Ltd.

- Expedia Group Inc.

- Getaround Inc.

- GO Rentals Auckland Ltd.

- Hertz Global Holdings Inc.

- Localiza Rent a Car SA

- Movida Participacoes SA

- Renault SAS

- SIXT SE

- Turismo Gargo SAÂ de CV

- Turo Inc.

- Uber Technologies Inc.

- Zoomcar India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Car Rental Market

- In January 2024, Europcar Mobility Group, a leading car rental company, announced the launch of its new electric vehicle (EV) rental service in Paris, France, in collaboration with Renault-Nissan-Mitsubishi Alliance (Reuters). This initiative marked a significant step towards sustainable mobility solutions in the car rental industry.

- In March 2024, Enterprise Holdings, the world's largest car rental company, completed the acquisition of National Car Rental's parent company, Enterprise Rent-A-Car's holding company, Enterprise Financial Services Corp., for approximately USD4.4 billion (SEC Filing). This merger strengthened Enterprise Holdings' market dominance and expanded its reach in the North American the market.

- In May 2024, Hertz Global Holdings, Inc. And Tesla, Inc. Announced a strategic partnership to offer Tesla vehicles for rental at select Hertz locations in the United States (Bloomberg). This collaboration brought Tesla's electric vehicles to a wider audience and provided Hertz with a competitive edge in the growing EV car rental segment.

- In April 2025, Turo, the peer-to-peer car sharing platform, secured a USD1 billion investment from a consortium led by Daimler AG and funds and accounts advised by BlackRock (Wall Street Journal). This funding round supported Turo's expansion plans and further disrupted the traditional the market by promoting the sharing economy model.

Research Analyst Overview

- In the dynamic the market, Budget Car Rental and Luxury Car Rental segments cater to diverse customer needs. Alternative fuels, such as hydrogen fuel cells, are gaining traction, aligning with sustainability initiatives and reducing environmental impact. Autonomous vehicles and driverless cars are poised to disrupt the industry, necessitating technology adoption for operational efficiency and revenue maximization. Rental Car Insurance remains a critical concern for customers, necessitating robust data security measures and regulatory compliance. Customer acquisition and sales conversion rely heavily on marketing strategies, including online chat support, email support, and social media engagement. Brands prioritize customer support channels, employee training, and brand identity to differentiate themselves.

- Car sharing and real-time location tracking offer cost optimization and process optimization. Sustainability initiatives, such as carbon footprint reduction and privacy compliance, are essential for corporate social responsibility. Dynamic pricing, fraud prevention, and competitive pricing strategies ensure revenue maximization. Staff management, vehicle tracking systems, and competitive pricing models are crucial for operations efficiency. As the market evolves, rental companies must balance technology adoption with cost optimization and regulatory compliance. Customer feedback management and roadside assistance are essential for maintaining brand loyalty. Ultimately, the car rental industry's success hinges on its ability to adapt to market trends while prioritizing customer needs and ensuring operational excellence.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Car Rental Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.5% |

|

Market growth 2025-2029 |

USD 188.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

19.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Car Rental Market Research and Growth Report?

- CAGR of the Car Rental industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the car rental market growth of industry companies

We can help! Our analysts can customize this car rental market research report to meet your requirements.