Cardiac Prosthetic Devices Market Size 2024-2028

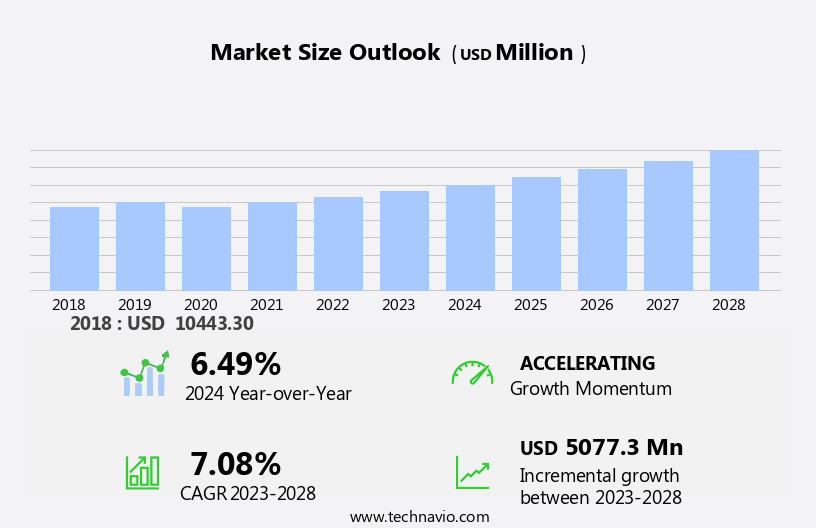

The cardiac prosthetic devices market size is forecast to increase by USD 5.08 billion, at a CAGR of 7.08% between 2023 and 2028.

- The market is driven by the escalating prevalence of cardiac disorders and significant advancements in technology. The increasing incidence of heart diseases, such as heart failure and coronary artery disease, necessitates the use of cardiac prosthetic devices for treatment and management. Furthermore, technological innovations, including the development of minimally invasive procedures and biocompatible materials, enhance the efficacy and safety of these devices. However, the market faces challenges related to the complications associated with implantation procedures. These complications may include infection, thrombosis, and device malfunction, which can lead to rehospitalization and increased healthcare costs.

- Addressing these challenges requires continuous research and development efforts to improve implantation techniques and device durability. Companies in the market must focus on addressing these challenges to ensure patient safety and satisfaction, ultimately capitalizing on the significant growth potential in this sector.

What will be the Size of the Cardiac Prosthetic Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by continuous evolution and dynamism, driven by advancements in infection prevention strategies, patient selection criteria, regulatory approval pathways, and vascular graft materials. Infection prevention remains a top priority, with a focus on minimizing the risk of infection through strict sterilization protocols and the use of biocompatible materials. Patient selection criteria are increasingly sophisticated, with a greater understanding of individual patient needs and risk factors informing device selection. Regulatory approval pathways continue to evolve, with a growing emphasis on rigorous testing and clinical trial methodology to ensure device safety and efficacy. Vascular graft materials are continually being improved, with a focus on durability, biocompatibility, and cost effectiveness.

The total artificial heart is a promising area of development, offering potential solutions for end-stage heart failure patients. Hemodynamic performance remains a key consideration, with ongoing research into stent design optimization, device failure mechanisms, and mitral valve repair. Surgical techniques are continually being refined, with a focus on minimally invasive surgery and remote patient monitoring to improve patient outcomes and reduce healthcare costs. Biomechanical testing standards are becoming more stringent, with a focus on predicting device longevity and assessing thrombogenicity. Cardiac pacemaker technology is advancing rapidly, with a focus on miniaturization and improved battery life. Aortic valve replacement is a growing area of need, with a focus on developing more durable and effective prosthetic devices.

Post-operative complications remain a challenge, with a focus on improving clinical care through cardiac rehabilitation protocols and implantable cardioverter defibrillator technology. Device cost effectiveness is a key consideration, with a focus on developing more affordable and accessible solutions for patients. Ongoing research and development in these areas will continue to shape the market in the years to come.

How is this Cardiac Prosthetic Devices Industry segmented?

The cardiac prosthetic devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Prosthetic heart valves

- Implantable pacemakers

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

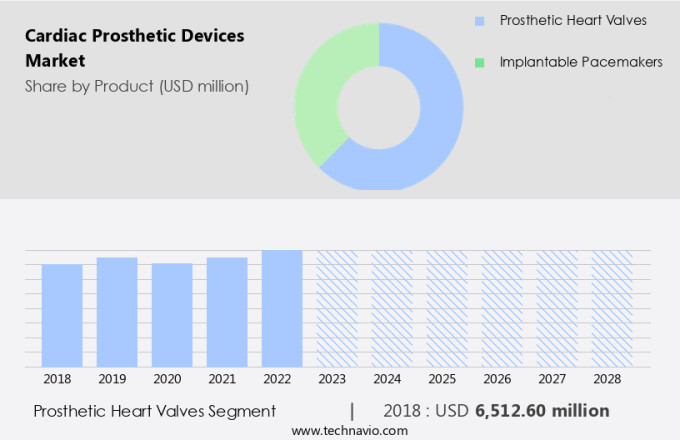

The prosthetic heart valves segment is estimated to witness significant growth during the forecast period.

The market experienced substantial growth in 2023, with the heart valves segment leading the way due to increased procedural volumes, a rising prevalence of valvular heart disease, and an aging population in Europe and other regions. Technological advancements have significantly influenced market expansion, particularly in interventional cardiology. Minimally invasive (MI) procedures, such as transcatheter aortic valve replacement (TAVR), have gained popularity over traditional open surgery. TAVR devices' ease of retrieval and repositionability further enhances their appeal. Infection prevention strategies, patient selection criteria, and regulatory approval pathways remain crucial in ensuring the effectiveness and safety of these devices. Vascular graft materials, device cost effectiveness, hemodynamic performance, stent design optimization, device failure mechanisms, mitral valve repair, surgical techniques comparison, remote patient monitoring, and minimally invasive surgery are all areas of ongoing research and development.

Material biocompatibility, biomechanical testing standards, bioabsorbable polymers, drug-eluting stents, cardiac pacemaker technology, aortic valve replacement, prosthetic device durability, long-term device survival, heart valve bioprosthesis, post-operative complications, thrombogenicity assessment, device longevity prediction, clinical trial methodology, cardiac rehabilitation protocols, and implantable cardioverter defibrillator technologies continue to evolve, driving market innovation.

The Prosthetic heart valves segment was valued at USD 6.51 billion in 2018 and showed a gradual increase during the forecast period.

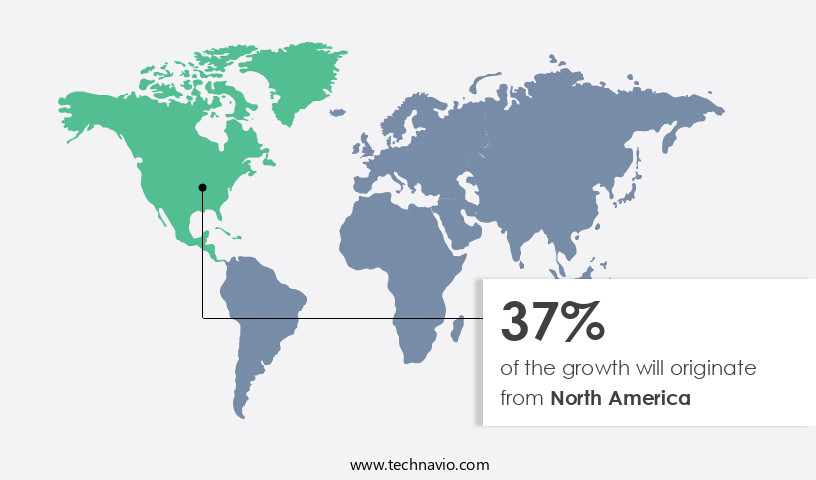

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for cardiac prosthetic devices is experiencing notable growth due to the high incidence of heart conditions, including coronary heart disease (CHD), heart valve diseases, stenosis, and atresia. Approximately one-third (30.9%) of all deaths in the US, or over 800,000 annually, are attributed to cardiovascular diseases (CVD). Factors contributing to this market expansion include the increasing utilization of tissue valves, the rise in minimally invasive (MI) procedures, and the growing elderly population. Tissue valves are gaining popularity due to their advantages, such as allowing free blood flow like a natural heart valve.

Regarding regulatory approval, the US Food and Drug Administration (FDA) sets rigorous standards for cardiac prosthetic devices, ensuring their safety and efficacy. Infection prevention strategies, such as antimicrobial coatings and sterilization techniques, are crucial in this context. Patient selection criteria, including age, medical history, and surgical risk, are carefully considered to optimize outcomes. Vascular graft materials, such as biocompatible polymers and bioabsorbable polymers, are undergoing continuous research and development to improve device cost-effectiveness and durability. Stent design optimization, hemodynamic performance, and material biocompatibility are critical factors in ensuring successful device implementation. Device failure mechanisms, including thrombosis, infection, and structural deterioration, are closely monitored, and efforts are made to minimize their occurrence.

Mitral valve repair and surgical techniques comparison are ongoing areas of research to improve patient outcomes and reduce post-operative complications. Remote patient monitoring and minimally invasive surgery are becoming increasingly popular, enabling better patient care and reducing hospital stays. Clinical trial methodology and cardiac rehabilitation protocols are essential components of ensuring long-term device survival and optimal patient outcomes. Cardiac pacemaker technology, aortic valve replacement, and implantable cardioverter defibrillators are all integral parts of the market, each with unique challenges and advancements. Prosthetic device durability and long-term survival are crucial considerations for both patients and healthcare providers.

Thrombogenicity assessment and device longevity prediction are essential aspects of ensuring the safety and efficacy of cardiac prosthetic devices. The market is continually evolving, with ongoing research and innovation in areas such as biomechanical testing standards, drug-eluting stents, and heart valve bioprosthesis.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of innovative technologies designed to address various heart conditions, including aortic valve replacement surgery outcomes, mitral valve repair techniques, and the use of cardiac pacemakers and implantable cardioverter defibrillators (ICDs). Aortic valve replacement surgery outcomes have shown significant improvements with advancements in surgical techniques and prosthetic materials. Mitral valve repair, on the other hand, is increasingly favored over replacement due to better long-term durability and patient outcomes. In the realm of cardiac rhythm management, understanding cardiac pacemaker battery life prediction and ICD efficacy is crucial. Long-term performance of drug-eluting stents is another critical area of research, with stent design optimization aimed at reducing restenosis. Transcatheter aortic valve implantation (TAVI) has emerged as a minimally invasive alternative to surgical valve replacement, boasting a high success rate. Left ventricular assist devices (LVADs) and total artificial hearts present unique challenges, including complications and device failure mechanisms. Biocompatibility testing of vascular graft materials and understanding bioabsorbable polymer degradation kinetics are essential to ensure optimal patient outcomes. Prosthetic device durability plays a significant role in patient outcomes, with strategies to prevent device failure being a key focus. Patient selection criteria for cardiac devices are crucial, with hemodynamic performance evaluation methods and thrombogenicity assessment in prosthetic valves being essential considerations. Infection prevention strategies in cardiac surgery are also vital to minimize complications and improve long-term device survival rate prediction models. The market continues to evolve, with ongoing research and innovation addressing the unique challenges and opportunities in this field.

What are the key market drivers leading to the rise in the adoption of Cardiac Prosthetic Devices Industry?

- The increasing incidence of cardiac disorders serves as the primary catalyst for market growth. (Within a 100-word context: The cardiac disorders market is experiencing significant expansion due to the escalating prevalence of these conditions. This trend is driven by various factors, including an aging population, sedentary lifestyles, and rising obesity rates. However, the key catalyst for market growth remains the increasing incidence of cardiac disorders.)

- The global market for cardiac prosthetic devices has experienced significant growth due to the increasing prevalence of cardiac disorders, such as bradycardia, sick sinus syndrome, valvular diseases, atrioventricular blocks, ventricular fibrillation, cardiac arrest, and tachycardia. These conditions, which affect adults over the age of 40, are major contributors to morbidity and mortality worldwide. Additionally, other cardiovascular diseases, including stroke, rhythm disorders, congenital heart disease, subclinical atherosclerosis, and peripheral arterial disease, further increase the demand for cardiac prosthetic devices. The market's expansion is also driven by the growing geriatric population, as older adults are more susceptible to cardiac disorders.

- Heart valve bioprostheses, a type of cardiac prosthetic device, have gained popularity due to their durability and reduced post-operative complications. Thrombogenicity assessment and device longevity prediction are crucial factors in the selection and implementation of these devices. Clinical trial methodology and cardiac rehabilitation protocols are essential in ensuring optimal patient outcomes. An implantable cardioverter defibrillator (ICD) is another cardiac prosthetic device that plays a vital role in managing life-threatening arrhythmias and preventing sudden cardiac death. The market's growth is expected to continue as advancements in technology lead to more effective and efficient cardiac prosthetic devices.

What are the market trends shaping the Cardiac Prosthetic Devices Industry?

- The advancement of technology is currently the most significant market trend, with continuous innovation leading to new developments. This progression is mandatory in today's professional environment to remain competitive.

- The market is driven by advancements in interventional cardiology, specifically transcatheter TAVR and minimally invasive valve replacement procedures. These innovations offer improved post-surgery outcomes compared to traditional open surgical procedures. Global market players, including Medtronic plc and Edwards Lifesciences, are competing technologically to meet the growing demand for cardiac prosthetic devices. Both companies have a significant presence in the market due to their extensive range of advanced products. Medtronic, in particular, dominates the heart valve segment with offerings in mechanical, tissue, and transcatheter valves.

- Infection prevention strategies, patient selection criteria, regulatory approval pathways, and cost effectiveness are crucial factors influencing market growth. Vascular graft materials and hemodynamic performance are essential considerations for manufacturers in developing effective and efficient cardiac prosthetic devices.

What challenges does the Cardiac Prosthetic Devices Industry face during its growth?

- The implantation of cardiac prosthetic devices presents significant complications that represent a major challenge to the growth of the industry.

- Cardiac prosthetic devices, which include heart valves and pacemakers, play a crucial role in addressing heart-related issues such as damaged valves and abnormal rhythms. However, the market growth is restrained by the complications associated with these devices. For instance, acute complications with pacemaker insertion, which can occur within a day, have a higher incidence rate compared to late complications. Similarly, transcatheter aortic valve implantation (TAVI), a minimally invasive surgery, carries the risk of life-threatening complications during and post-surgery, despite being less invasive than open aortic valve replacement. Moreover, stent design optimization and material biocompatibility are critical factors in mitigating device failure mechanisms.

- Remote patient monitoring enables early detection and intervention, reducing the risk of complications. Comparing surgical techniques and their outcomes is essential to determine the most effective and safest approach for patients. As the healthcare industry continues to evolve, focusing on these aspects will be vital in ensuring the successful implementation and adoption of cardiac prosthetic devices.

Exclusive Customer Landscape

The cardiac prosthetic devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cardiac prosthetic devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cardiac prosthetic devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in advanced cardiac prosthetic devices, focusing on optimal hemodynamic performance, durability, and implantability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Anteris Technologies Ltd.

- BIOTRONIK SE and Co. KG

- Boston Scientific Corp.

- Braile Biomedica

- Colibri Heart Valve LLC

- Cryolife Inc.

- Edwards Lifesciences Corp.

- Jc Medical Inc.

- JenaValve Technology Inc.

- Lepu Medical Technology Beijing Co. Ltd.

- LivaNova PLC

- Medtronic Plc

- Meril Life Sciences Pvt. Ltd.

- Merit Medical Systems Inc.

- MicroPort Scientific Corp.

- OrbusNeich Medical Co. Ltd.

- Shree Pacetronix Ltd.

- TTK Healthcare Ltd.

- Venus Medtech Hangzhou Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cardiac Prosthetic Devices Market

- In January 2024, Medtronic plc, a global leader in medical technology, solutions, and services, announced the U.S. Food and Drug Administration (FDA) approval of its new HeartMate 3 LVAD (Left Ventricular Assist Device) System with MagLev Technology. This advanced technology offers improved durability and reduced risk of thrombosis (Medtronic Press Release, 2024).

- In March 2024, Abbott Laboratories and Edwards Lifesciences, two major players in the market, entered into a definitive agreement for Edwards to acquire Abbott's structural heart business. This strategic move strengthened Edwards' position in the transcatheter heart valve market (Abbott Press Release, 2024).

- In April 2025, Boston Scientific Corporation received CE Mark approval for its new Watchman FLX Left Atrial Appendage Closure (LAAC) device. This device offers enhanced flexibility and conformability, providing better fit and reduced risk of complications for patients undergoing atrial fibrillation treatment (Boston Scientific Press Release, 2025).

- In May 2025, Siemens Healthineers and the University of California, San Francisco (UCSF) Health announced a collaboration to develop a new AI-powered cardiac ultrasound system. This system aims to improve the accuracy and efficiency of diagnosing cardiac conditions, potentially revolutionizing the market (Siemens Healthineers Press Release, 2025).

Research Analyst Overview

- The market encompasses a range of innovative technologies, including transcatheter valve delivery systems, mechanical and bioprosthetic valves, and implantable cardiac devices such as pacemakers and left ventricular assist devices (LVADs). Rehabilitation effectiveness and surgical outcome measures are crucial factors driving market growth, as patients seek to optimize post-operative recovery and improve patient functional capacity. Device wear analysis, polymer degradation rate, and biomaterial characterization are key areas of focus for manufacturers, as they strive to enhance device lifespan and prevent thrombosis. Clinical trial results and cost benefit analysis are essential for determining the value proposition of new technologies, while patient risk stratification and infection control methods are critical for ensuring safe and effective device implementation.

- Advancements in transcatheter valve delivery and stent deployment mechanisms, as well as telemedicine applications, are revolutionizing the field of cardiac prosthetics. Mechanical testing methods and hemodynamic modeling are essential for evaluating device durability and preventing device failure. LVAD power source selection and defibrillator programming are critical considerations for optimizing patient care. Graft material selection and valve durability testing are ongoing areas of research, with a focus on extending device lifespan and improving patient outcomes. Thrombosis prevention and pacemaker lead management are also key concerns, as manufacturers seek to address the challenges of long-term device use. In the realm of artificial heart design, mechanical testing methods and bioprosthetic valve design are paramount for ensuring optimal performance and patient safety.

- Surgical approach selection and drug elution kinetics are also critical factors in the development of next-generation cardiac prosthetic devices. Device lifetime assessment and cost benefit analysis are essential for healthcare providers and payers, as they seek to make informed decisions about device implementation and resource allocation. Infection control methods and patient risk stratification are also important considerations for optimizing patient care and minimizing the risk of complications. Overall, the market is characterized by ongoing innovation and a focus on improving patient outcomes and quality of life. From transcatheter valve delivery to artificial heart design, manufacturers and researchers are pushing the boundaries of what is possible in the field of cardiac prosthetics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cardiac Prosthetic Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 5077.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cardiac Prosthetic Devices Market Research and Growth Report?

- CAGR of the Cardiac Prosthetic Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cardiac prosthetic devices market growth of industry companies

We can help! Our analysts can customize this cardiac prosthetic devices market research report to meet your requirements.