Cardiovascular Catheters Market Size 2024-2028

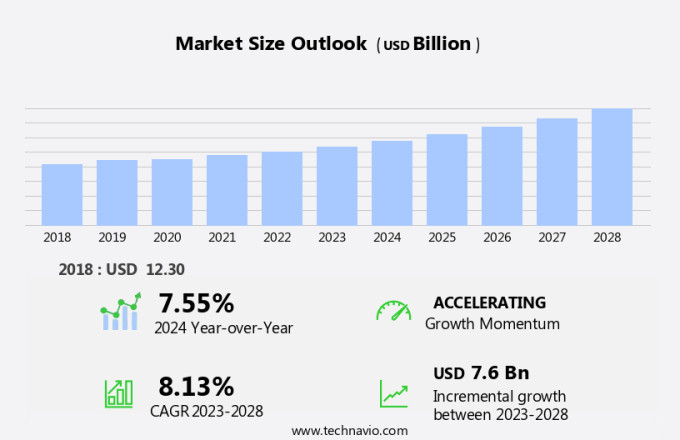

The cardiovascular catheters market size is forecast to increase by USD 7.6 billion at a CAGR of 8.13% between 2023 and 2028.

- The market is experiencing significant growth due to the rising incidence of cardiac diseases and the expansion of insurance coverage for related procedures. This trend is driving innovation and competition In the market, as companies seek to develop more cost-effective and efficient solutions. However, the high cost of cardiovascular procedures remains a challenge for both patients and providers, limiting access to care for some populations. To address this issue, market participants are exploring strategies such as bundled payments and value-based pricing models. Additionally, advancements in technology, including the development of minimally invasive catheters and remote monitoring systems, are expected to further drive market growth.

- Overall, the market is poised for continued expansion, with key players focusing on innovation, cost reduction, and improved patient outcomes to stay competitive.

What will be the Size of the Cardiovascular Catheters Market During the Forecast Period?

- The market In the US is driven by the increasing prevalence of cardiovascular diseases (CVDs), including coronary heart disease and stroke. According to the American Heart Association, CVDs are the leading cause of death In the country. Catheters play a crucial role in diagnosing and treating various cardiovascular disorders, such as coronary angiography and angioplasty. The market is also influenced by the growing number of chronic illnesses, including those affecting the urology, gastrointestinal tract, and nervous system, which require catheterization. Furthermore, initiatives by various governments and organizations to improve public health and reduce the burden of chronic diseases are expected to boost market growth.

- Innovations in technology, such as 3D mapping, remote monitoring, and nanotechnology, are transforming catheter systems, offering improved accuracy, safety, and patient comfort. Physicians and patients alike benefit from these advancements, leading to increased demand for cardiovascular catheters.

How is this Cardiovascular Catheters Industry segmented and which is the largest segment?

The cardiovascular catheters industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Cardiovascular therapeutic catheters

- Cardiovascular diagnostic catheters

- End-user

- Hospitals

- Ambulatory surgical centers

- Clinics

- Geography

- Asia

- China

- India

- North America

- US

- Europe

- Germany

- UK

- Rest of World (ROW)

- Asia

By Product Insights

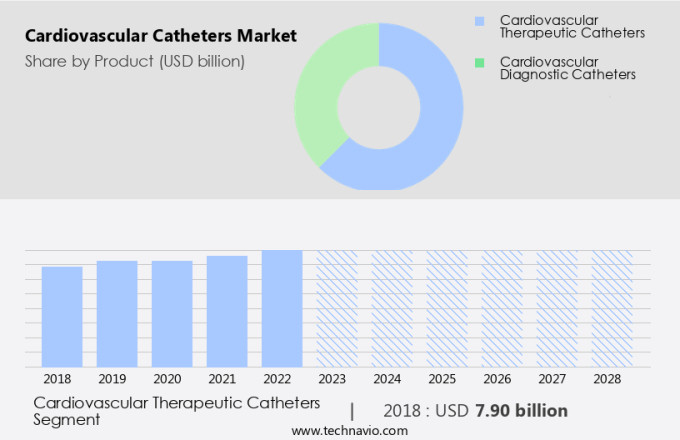

- The cardiovascular therapeutic catheters segment is estimated to witness significant growth during the forecast period.

The market encompasses various types of catheters used for diagnosing and treating cardiovascular conditions. These include conventional catheters, such as traditional balloon catheters used for angiography, and DEB (drug-eluting balloon) catheters, which are increasingly utilized for peripheral artery disease treatment due to their antiproliferative drug-coated surfaces. Additionally, cutting balloon catheters are prescribed for dilation of stenosis in coronary arteries, scoring balloon catheters are employed for treating complex lesions, and cardiac ablation catheters are utilized for ablation procedures aimed at correcting abnormal heart rhythms. Myocardial infarction patients and those with nervous system disorders, ophthalmic ailments, or permanent urinary retention may benefit from these catheters.

Physicians rely on these tools to improve patient outcomes and maintain quality care. Patients undergoing these procedures require thorough education to ensure proper post-procedure care and understanding of potential complications. The integration of nanotechnology in catheter manufacturing offers potential advancements in drug delivery and diagnostic capabilities.

Get a glance at the Cardiovascular Catheters Industry report of share of various segments Request Free Sample

The Cardiovascular therapeutic catheters segment was valued at USD 7.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

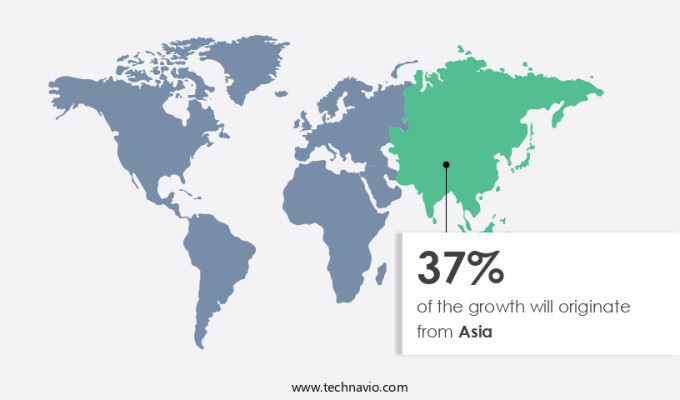

- Asia is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia is expanding due to the rising incidence of cardiovascular diseases (CVDs) In the region. With population growth and urbanization, lifestyle changes such as unhealthy food habits and physical inactivity have become prevalent, leading to obesity, diabetes, and other CVD risk factors. In response, companies are innovating with advanced technologies to develop effective solutions for treating CVDs, including Angioplasty and Arrhythmia catheters. Improved healthcare infrastructure and increasing public awareness of these technologies are driving their adoption. Key features of these catheters include 3D mapping and additional functionalities to ensure precise and efficient treatment. companies, such as Biomerics, are making these technologies more affordable to increase accessibility.

Bodily fluids are carefully managed during procedures to maintain sterility and patient safety. Overall, the market in Asia is poised for significant growth, providing opportunities for market leaders like Increasery, Increasons, and others to expand their offerings.

Market Dynamics

Our cardiovascular catheters market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cardiovascular Catheters Industry?

Rising incidence of cardiac diseases and growth of insurance providers is the key driver of the market.

- The market is experiencing significant growth due to the rising prevalence of cardiovascular diseases (CVDs) and chronic disorders such as arrhythmia, congenital heart disease, and valvular disease. According to the American Heart Association, CVDs are the leading cause of death and hospitalizations In the US. Additionally, sedentary lifestyles and unhealthy diets contribute to the increasing incidence of these conditions. Cardiovascular catheters are essential medical devices used in various diagnostic and therapeutic procedures, including cardiac catheterization, coronary angiography, and angioplasty. These procedures help healthcare professionals assess and treat blocked arteries, myocardial infarction, and other cardiovascular disorders. The market for cardiovascular catheters is driven by advances in technologies such as 3D mapping, nanotechnology, and remote monitoring.

- These technologies enable more accurate diagnoses, better treatment outcomes, and improved patient education. Furthermore, the increasing affordability of these devices, insurance coverage, and reimbursement policies are also contributing factors to the market's growth. Cardiovascular catheters come in various types, including single-lumen, double-lumen, and triple-lumen catheters. These catheters have additional features such as specialized skills required for their use, skilled surgeons, and specialized training for physicians. The market also includes specialized catheters for specific applications, such as urological catheters for urinary tract-related diseases and gastrointestinal catheters for the Gastrointestinal tract. The Cardiovascular devices industry is expected to continue growing due to the increasing healthcare spending on medical procedures and medications to treat cardiovascular diseases.

- The mortality rate from CVDs is high, making the need for effective treatment options crucial. As a result, the market for cardiovascular catheters is expected to continue expanding during the forecast period.

What are the market trends shaping the Cardiovascular Catheters Industry?

Business strategies to emerge In the market is the upcoming market trend.

- The market encompasses a range of diagnostic and therapeutic devices used In the evaluation and treatment of cardiovascular diseases (CVDs) and related disorders. These include Angioplasty and Coronary Heart Disease catheters for the treatment of blocked arteries, as well as catheters for Arrhythmia, Valvular disease, and Chronic diseases. Advanced technologies, such as 3D mapping and nanotechnology, are increasingly being integrated into catheter systems to enhance their capabilities. Stryker's Sustainability Solutions department offers reprocessed single-use cardiovascular catheters, including those for Coronary angiography and Urology, to reduce healthcare spending and hospitalizations. Skilled surgeons and healthcare professionals utilize these devices for various medical procedures, such as cardiac catheterization and intravenous catheterization, to improve patient outcomes and reduce mortality rates from conditions like myocardial infarction.

- Affordability and insurance coverage are significant factors influencing the market's growth, with reimbursement policies and scenarios playing a crucial role in determining the adoption of these catheters. Patient education and remote monitoring are also essential components of the market, as they contribute to better patient care and improved therapeutic outcomes. The Cardiovascular devices industry continues to evolve, with Medical Manufacturing Technologies and specialized skills driving innovation and advancements in catheter design and functionality.

What challenges does the Cardiovascular Catheters Industry face during its growth?

High cost of cardiovascular procedures is a key challenge affecting the industry growth.

- The market encompasses a range of specialized medical devices used In the diagnosis and treatment of cardiovascular diseases (CVDs) and related disorders. These catheters, including single-lumen, double-lumen, and triple-lumen varieties, are integral to procedures such as Cardiac catheterization, Angioplasty, and Coronary angiography. Angioplasty, a common intervention for blocked arteries, involves the use of angioplasty balloon catheters, stents, and embolic protection devices. The high cost of these procedures and products, with PCI procedures ranging from USD12,000 to USD38,000, can be a barrier to access for many patients due to limited insurance coverage and affordability concerns. Cardiovascular diseases, including Coronary Heart Disease, Valvular disease, and Congenital heart disease, necessitate the use of advanced catheter systems.

- Biomerics and Medical Manufacturing Technologies have contributed significantly to the development of these technologies through the integration of 3D mapping, nanotechnology, and additional features. Skilled surgeons and healthcare professionals employ these catheters for therapeutic purposes, such as treating Arrhythmia and Urological conditions like Urinary tract-related diseases and Chronic illnesses like Chronic disorders and Nervous system disorders. The Cardiovascular devices industry is continually evolving, with remote monitoring, patient education, and specialized skills becoming increasingly important. Quality, reimbursement policies, and training are essential factors influencing the market. The use of catheters extends beyond Cardiovascular diseases, with applications In the Gastrointestinal tract and Ophthalmic ailments.

- The market for catheters is vast, with applications in various medical procedures, medications, and surgical procedures. Despite the benefits, challenges such as the high cost and lack of proper reimbursement scenarios persist, impacting patient access and healthcare spending.

Exclusive Customer Landscape

The cardiovascular catheters market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cardiovascular catheters market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cardiovascular catheters market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abbott Laboratories - The company provides a range of cardiovascular catheters for various applications. These include coronary dilatation catheters, peripheral dilatation catheters, and diagnostic catheters. Coronary dilatation catheters are used to widen narrowed or blocked coronary arteries during angioplasty procedures. Peripheral dilatation catheters are utilized to treat peripheral arterial diseases by dilating narrowed or obstructed blood vessels. Diagnostic catheters are essential tools for evaluating cardiovascular conditions, enabling physicians to diagnose and monitor heart and vascular diseases effectively.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- B.Braun SE

- Becton Dickinson and Co.

- BIOTRONIK SE and Co. KG

- Boston Scientific Corp.

- Cardinal Health Inc.

- CardioFocus Inc.

- Cardionovum GmbH

- CathRx Pty Ltd.

- Cook Group Inc.

- Edwards Lifesciences Corp.

- Getinge AB

- Innovative Cardiovascular Solutions LLC

- Johnson and Johnson Services Inc.

- LivaNova PLC

- Medtronic Plc

- Merit Medical Systems Inc.

- MicroPort Scientific Corp.

- Terumo Corp.

- ZOLL Medical Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The cardiovascular devices industry encompasses a broad range of medical equipment used to diagnose and treat various cardiovascular disorders and diseases. Cardiovascular catheters are a significant component of this industry, playing a crucial role In the diagnosis and treatment of cardiac and vascular conditions. These thin, flexible tubes are inserted into the body to access the heart and blood vessels for diagnostic and therapeutic purposes. Cardiovascular catheters are essential tools for healthcare providers in managing cardiovascular diseases (CVDs), which are a leading cause of morbidity and mortality worldwide. CVDs include a range of chronic disorders such as coronary heart disease, arrhythmias, congenital heart disease, and valvular disease, among others.

These conditions can lead to hospitalizations, increased healthcare spending, and a significant burden on patients and healthcare systems. The demand for cardiovascular catheters is driven by several factors, including the growing prevalence of chronic diseases, increasing awareness and education about cardiovascular health, and advancements in medical manufacturing technologies. The development of new catheter systems, such as double-lumen, triple-lumen, and specialized catheters, has expanded the range of diagnostic and therapeutic applications for these devices. One of the primary uses of cardiovascular catheters is in cardiac catheterization procedures, which provide valuable information about the heart's structure and function. These procedures, which include coronary angiography and angioplasty, enable healthcare professionals to diagnose and treat blocked arteries and other cardiac conditions.

The use of advanced imaging technologies, such as 3D mapping, has improved the accuracy and effectiveness of these procedures, leading to better patient outcomes. Another application of cardiovascular catheters is In the treatment of urinary tract-related diseases, such as permanent urinary retention. Urology catheters are used to manage these conditions, providing relief and improving patients' quality of life. The affordability and accessibility of cardiovascular catheters are essential considerations for healthcare providers and patients alike. Insurance coverage and reimbursement policies play a significant role in determining the use of these devices. Remote monitoring technologies have also emerged as a promising solution for managing chronic diseases and reducing hospitalizations, which can help offset the costs associated with cardiovascular catheters.

The use of nanotechnology in cardiovascular catheters has opened up new possibilities for minimally invasive procedures and targeted drug delivery. These advancements have the potential to improve patient outcomes, reduce complications, and enhance the overall effectiveness of cardiovascular catheters. The success of cardiovascular catheters relies on the specialized skills and expertise of healthcare professionals, including skilled surgeons and physicians. Proper training and education are essential for ensuring the safe and effective use of these devices. Patient education is also crucial for ensuring that patients understand the benefits and risks associated with cardiovascular catheters and can make informed decisions about their care.

In conclusion, the market is a dynamic and evolving industry that plays a vital role In the diagnosis and treatment of cardiovascular diseases. The continued advancements in medical manufacturing technologies, the growing prevalence of chronic diseases, and the increasing awareness of cardiovascular health are driving the demand for these devices. The affordability, accessibility, and effectiveness of cardiovascular catheters are essential considerations for healthcare providers and patients alike, and ongoing research and development efforts are focused on improving these aspects of these devices.

|

Cardiovascular Catheters Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.13% |

|

Market growth 2024-2028 |

USD 7.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.55 |

|

Key countries |

India, China, Germany, UK, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cardiovascular Catheters Market Research and Growth Report?

- CAGR of the Cardiovascular Catheters industry during the forecast period

- Detailed information on factors that will drive the Cardiovascular Catheters growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Asia, North America, Europe, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cardiovascular catheters market growth of industry companies

We can help! Our analysts can customize this cardiovascular catheters market research report to meet your requirements.