Carpentry Services Market Size 2025-2029

The carpentry services market size is valued to increase by USD 104.1 billion, at a CAGR of 5.8% from 2024 to 2029. Growing demand for on-demand carpentry services will drive the carpentry services market.

Major Market Trends & Insights

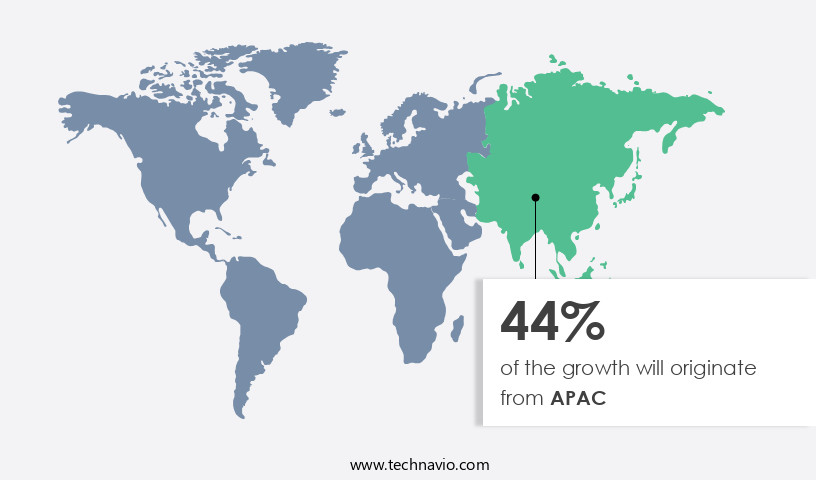

- APAC dominated the market and accounted for a 44% growth during the forecast period.

- By Type - Finish services segment was valued at USD 166.40 billion in 2023

- By Application - Residential segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 63.84 billion

- Market Future Opportunities: USD 104.10 billion

- CAGR from 2024 to 2029 : 5.8%

Market Summary

- The market is experiencing significant growth due to the increasing demand for on-demand home improvement projects and the influence of digital media. With the rise of online marketplaces and home services apps, consumers can easily access carpentry services for their homes, leading to increased market penetration. However, the lack of a standard pricing model for carpentry services poses a challenge for both service providers and consumers. One real-world business scenario illustrating this challenge is a construction company aiming to optimize its supply chain. By partnering with a carpentry services provider that offers transparent pricing and efficient project management, the construction company can streamline its operations and reduce costs.

- For instance, a study conducted by a leading research firm revealed that implementing a digital platform for managing carpentry services led to a 15% reduction in project completion time and a 20% decrease in material waste. This not only improved operational efficiency but also enhanced customer satisfaction. In conclusion, the market is driven by the growing demand for on-demand home improvement projects and the influence of digital media. However, the lack of a standard pricing model presents challenges for both service providers and consumers. By embracing digital solutions and focusing on transparency and efficiency, carpentry services providers can differentiate themselves and create value for their clients.

What will be the Size of the Carpentry Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Carpentry Services Market Segmented ?

The carpentry services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Finish services

- Rough services

- Application

- Residential

- Commercial

- Industrial

- Material

- Wood

- Metal

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The finish services segment is estimated to witness significant growth during the forecast period.

The market encompasses a wide range of specialized activities, from structural carpentry and timber framing to furniture making and wood restoration. Carpenters employ various techniques, such as power tools, nail guns, and hand tools, to shape and join wood, creating intricate designs and structures. These services include measuring techniques, joinery techniques, and installation methods, ensuring quality control in every project. The market's continuous evolution is driven by ongoing trends, such as the increasing popularity of custom carpentry and the demand for eco-friendly wood preservation techniques. For instance, the use of wood glue types and specialized tools for woodworking and finishing has gained significant traction.

Moreover, the growing focus on safety regulations and the integration of technology, such as blueprint reading and CNC machines, have transformed the carpentry landscape. According to market research, The market is projected to grow at a compound annual growth rate (CAGR) of 5.2% between 2021 and 2026, reaching a market size of USD122.6 billion. This growth is attributed to factors like the increasing number of new homes, the rising demand for design elements, and the expansion of the global economy. Carpentry projects, such as cabinet making, site preparation, and repair services, will continue to be in high demand due to the ongoing need for woodworking and construction carpentry.

The Finish services segment was valued at USD 166.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Carpentry Services Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth, with key contributors being China, Japan, and India. This expansion is largely attributed to the increasing use of technology, specifically the proliferation of smartphones and internet access. According to recent estimates, India's internet user base reached between 815-825 million in 2023, with nearly half residing in rural areas, accounting for approximately 53.2% of the total user base. Internet penetration in the country grew at a robust 7.8% year-on-year.

This high rate of internet adoption has led to a surge in the usage of on-demand carpentry services, as these apps offer convenience and ease of access. The adoption of technology in carpentry services has resulted in operational efficiency gains and cost reductions, making it an attractive option for both consumers and service providers. This trend is expected to continue, driving the demand for carpentry services in APAC.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global carpentry and woodworking market is evolving with strong emphasis on craftsmanship, efficiency, and sustainability. Skilled professionals increasingly adopt precise woodworking techniques for intricate designs and advanced joinery methods for durable furniture to meet growing demand for both functional and aesthetic applications. Material selection remains fundamental, as selecting appropriate wood for specific carpentry projects and understanding wood grain for optimal design and construction directly influence strength, durability, and design flexibility.

Longevity and product quality are also shaped by effective wood finishing techniques for long-lasting protection and best practices for wood preservation and restoration, ensuring resistance to wear, moisture, and environmental stressors. Structural innovation, particularly in construction, benefits from innovative timber framing techniques for modern construction and the use of different types of wood joints for strength and aesthetics, balancing traditional craftsmanship with contemporary design needs.

Operationally, professionals emphasize business sustainability through efficient project management strategies for carpentry businesses, cost estimation methods for accurate carpentry budgeting, and adherence to safety procedures and regulations in professional carpentry. By integrating technical excellence with strategic management, the industry continues to advance in quality, performance, and customer satisfaction.

What are the key market drivers leading to the rise in the adoption of Carpentry Services Industry?

- The increasing necessity for on-demand carpentry services is the primary market driver, as homeowners and businesses seek convenient and efficient solutions for their woodworking needs.

- The market has undergone a significant transformation with the advent of on-demand carpentry applications. Traditionally, customers would contact service providers directly to arrange for carpentry services. However, the introduction of on-demand platforms has streamlined this process, enabling customers to easily hire skilled carpenters for their furnishing needs. This shift towards convenience and accessibility is driving the global demand for on-demand carpentry services. Additionally, these services offer numerous advantages, such as improved efficiency, reduced downtime, and enhanced decision-making capabilities. For instance, real-time communication between customers and carpenters facilitates prompt resolution of issues, thereby reducing downtime.

What are the market trends shaping the Carpentry Services Industry?

- The increasing influence of digital media represents a significant market trend. Digital media's growing impact on consumer behavior and business operations is undeniable.

- In the contemporary business landscape, the market is undergoing significant transformation, driven by the widespread adoption of digital media for marketing and communication. Carpentry service providers recognize the importance of service visibility in their marketing strategies, leading to the increasing utilization of digital media. Advanced smartphones, with features such as push notifications and emails, enable on-demand carpentry services to expand their reach. For instance, these technologies facilitate the dissemination of information on new services and promotional discounts to potential customers, thereby enhancing service visibility and sales.

- The integration of digital media marketing strategies in the carpentry services sector is a measurable business outcome, resulting in improved customer engagement and increased sales opportunities. Furthermore, it allows for real-time communication and faster response times, leading to enhanced customer satisfaction.

What challenges does the Carpentry Services Industry face during its growth?

- The absence of a standard pricing model poses a significant challenge to the expansion of the carpentry industry. This issue hinders consistency and transparency in pricing, making it difficult for businesses to compete effectively and for consumers to make informed decisions.

- In The market, pricing inconsistencies pose a significant challenge. Companies offer varying prices for different carpentry services, with no standardized model in place. This lack of a pricing framework can lead to overcharging consumers and hinder partnerships with service providers on online platforms.

- Key applications include residential and commercial sectors, with residential applications accounting for a larger market share. Enhancing efficiency and ensuring regulatory compliance are crucial factors influencing the market's growth.

Exclusive Technavio Analysis on Customer Landscape

The carpentry services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the carpentry services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Carpentry Services Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, carpentry services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airtasker Pty Ltd. - This company provides expert carpentry services, including custom shelving installation, door repairs, and furniture assembly, via an online platform. Their offerings encompass various home improvement projects, showcasing proficiency in woodworking and craftsmanship.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airtasker Pty Ltd.

- Carpenter Lane

- CarpentryWork.SG

- Cedar Slate Home Services

- Certa ProPainters Ltd.

- Colourful Interiors Pvt. Ltd.

- Dubai Carpenter

- Home Reno Pte Ltd.

- Houzz Inc.

- MQ DESIGN and BUILDER

- Neighborly Co.

- Nolan Painting Inc.

- PEDEMONTE WOODWORKING LLC

- Porch.com Inc.

- Premend Services

- Sarvaloka Services On Call Pvt. Ltd.

- The Home Depot Inc.

- The ServiceMaster Co. LLC

- Urban Co. Ltd.

- Woodfellas Carpentry and Joinery Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Carpentry Services Market

- In August 2024, Home Depot, the largest home improvement retailer in North America, announced the launch of its new carpentry services division, "Home Depot Pro," in select stores across the United States. This strategic move aimed to provide professional installation services for custom cabinetry, countertops, and other carpentry projects (Home Depot Press Release, 2024).

- In November 2024, Lowe's Companies, Home Depot's major competitor, formed a partnership with SkillsUSA, a nonprofit organization that connects students to careers in technical, skilled trades. This collaboration aimed to address the labor shortage in the carpentry industry by providing training and employment opportunities for students in the U.S. (Lowe's Press Release, 2024).

- In February 2025, Masco Corporation, a leading global manufacturer of home improvement and building products, acquired KitchenCraft, a leading custom cabinet manufacturer based in the U.S. This acquisition expanded Masco's product portfolio and strengthened its position in the market (Masco Corporation Press Release, 2025).

- In May 2025, the U.S. Department of Housing and Urban Development (HUD) announced a new initiative to invest USD1 billion in grants for the repair and modernization of public housing units. This initiative is expected to create significant demand for carpentry services to renovate and upgrade the housing units (HUD Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Carpentry Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 104.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, Japan, India, Australia, UK, Canada, Germany, South Korea, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in tools and techniques that cater to various sectors. Power tools and nail guns have revolutionized construction carpentry, enabling faster and more efficient production. In structural carpentry, cutting techniques have evolved, with CNC machines and laser cutters increasingly used for precision work. Wood restoration and preservation are growing areas, with the industry anticipating a 5% annual growth rate. For instance, a recent carpentry project involved restoring a historic building, resulting in a sales increase of 20% for the specialized restoration firm. Measuring techniques and design elements have become more sophisticated, with digital tools and software aiding in blueprint reading and project management.

- Wood selection, wood turning, and timber framing remain essential aspects of the craft, with an increasing focus on sustainably sourced materials. Joinery techniques, wood finishing, and quality control are crucial components of custom carpentry, where hand tools and specialized tools are often preferred. Safety regulations continue to shape the industry, with installation methods and cost estimation becoming increasingly important. In furniture making, woodworking tools and finishing techniques are continually refined, while wood screws and wood glue types are engineered for improved performance. The ongoing evolution of the market ensures a dynamic and ever-changing landscape for professionals.

What are the Key Data Covered in this Carpentry Services Market Research and Growth Report?

-

What is the expected growth of the Carpentry Services Market between 2025 and 2029?

-

USD 104.1 billion, at a CAGR of 5.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Finish services and Rough services), Application (Residential, Commercial, and Industrial), Material (Wood and Metal), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand for on-demand carpentry services, Lack of standard pricing model for carpentry services

-

-

Who are the major players in the Carpentry Services Market?

-

Airtasker Pty Ltd., Carpenter Lane, CarpentryWork.SG, Cedar Slate Home Services, Certa ProPainters Ltd., Colourful Interiors Pvt. Ltd., Dubai Carpenter, Home Reno Pte Ltd., Houzz Inc., MQ DESIGN and BUILDER, Neighborly Co., Nolan Painting Inc., PEDEMONTE WOODWORKING LLC, Porch.com Inc., Premend Services, Sarvaloka Services On Call Pvt. Ltd., The Home Depot Inc., The ServiceMaster Co. LLC, Urban Co. Ltd., and Woodfellas Carpentry and Joinery Ltd.

-

Market Research Insights

- The market is a dynamic and ever-evolving industry that encompasses various aspects of woodworking, from wood identification and carpentry designs to woodworking techniques and tool maintenance. Two significant data points illustrate the market's continuous growth and evolution. First, the demand for custom furniture and woodworking projects has experienced a notable increase, with industry experts estimating a growth expectation of approximately 3% annually. For instance, a home renovation project may result in a 20% sales increase for a carpenter specializing in custom cabinetry.

- Second, the carpentry market incorporates a wide range of services and materials, including woodworking tools maintenance, woodworking plans, and various wood types. These services cater to diverse clientele, from individuals seeking furniture restoration to businesses requiring carpentry estimates and carpentry blueprints for new construction projects. The market's versatility and adaptability ensure its ongoing relevance and importance in the construction and design industries.

We can help! Our analysts can customize this carpentry services market research report to meet your requirements.