Cell Site Tower Market Size 2025-2029

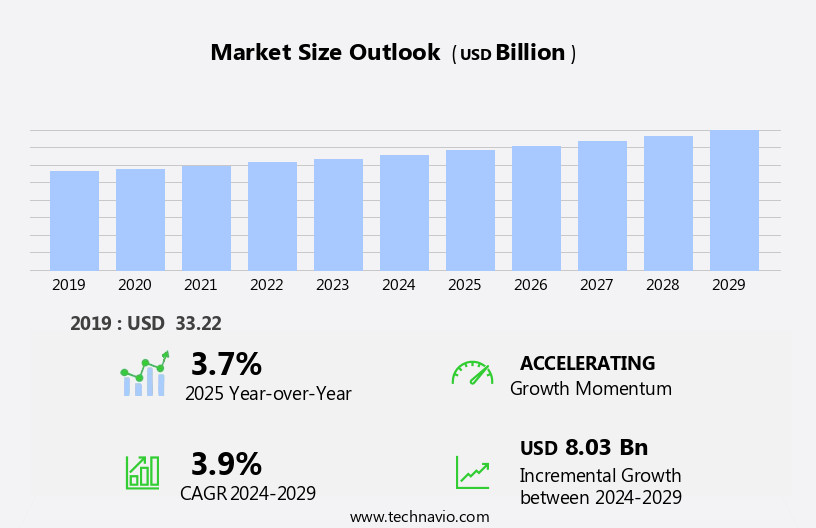

The cell site tower market size is forecast to increase by USD 8.03 billion at a CAGR of 3.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing mobile data usage and the rollout of 5G technology. According to industry estimates, mobile data traffic is projected to increase at an unprecedented rate, fueled by the proliferation of smartphones, the Internet of Things (IoT), and the adoption of bandwidth-intensive applications. This in data consumption necessitates the deployment of more cell sites and towers to ensure adequate network coverage and capacity. Moreover, the global shift towards 5G networks is set to further boost the market's expansion. 5G's high-speed, low-latency connectivity promises to revolutionize various industries, from healthcare and education to manufacturing and transportation.

- However, the market's growth trajectory is not without challenges. Health concerns surrounding the radiation emitted by cell towers remain a significant hurdle. As public awareness of these risks grows, regulatory bodies are increasingly imposing stringent safety norms. Consequently, tower companies must invest in advanced technologies to minimize radiation emissions and mitigate potential health hazards. Companies seeking to capitalize on this market's opportunities must stay abreast of these trends and challenges to effectively navigate the competitive landscape and ensure long-term success.

What will be the Size of the Cell Site Tower Market during the forecast period?

- The market encompasses ground-based telecommunication towers used to support wireless networks, including those owned by operators and private entities. These structures facilitate various applications, such as radio broadcast, television antennas, cellular services, military forces' communication systems, radar systems, and smart agriculture solutions. The market's growth is driven by the increasing demand for wireless communication services and the expansion of 5G networks.

- The market's size is substantial, with a significant number of towers deployed worldwide to ensure comprehensive mobile coverage for voice calls, data transmission, and mobile device connectivity. The market's direction is towards the integration of advanced technologies, such as antennas and precision farming technologies, to enhance network efficiency and capacity.

How is this Cell Site Tower Industry segmented?

The cell site tower industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Ground-based

- Roof top

- Type

- Lattice tower

- Monopole tower

- Guyed tower

- Stealth tower

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- UAE

- North America

By Deployment Insights

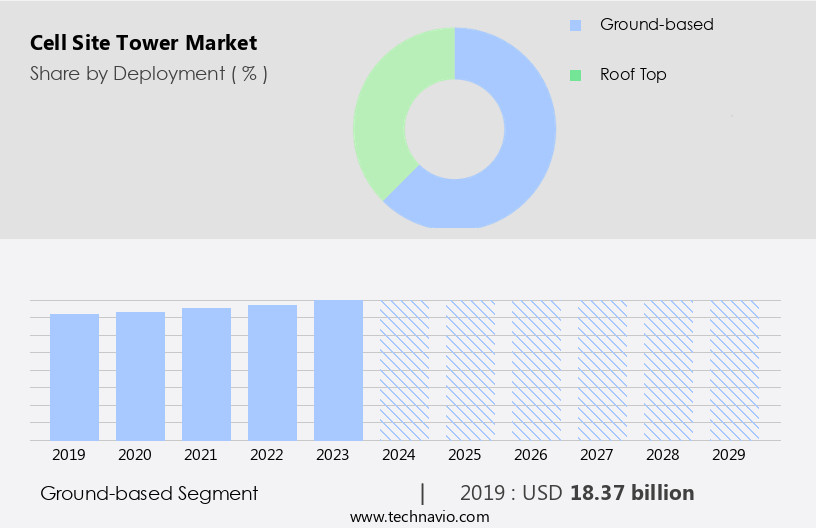

The ground-based segment is estimated to witness significant growth during the forecast period.

Ground-based cell sites, including towers and rooftop installations, are essential infrastructure for wireless communication, enabling mobile networks to deliver cellular coverage and support the growing demand for high-speed internet and connectivity. Traditional cell towers and self-support structures provide the foundation for telecommunications networks, while rooftop installations offer a quicker deployment option for meeting immediate coverage and capacity needs. Telecom operators are increasingly collaborating through infrastructure-sharing arrangements to optimize costs and accelerate deployment. These partnerships involve sharing cell towers and other network infrastructure to enhance efficiency.

With the advent of 5G technology and the Internet of Things, the demand for wireless networks and telecommunications services continues to expand. Ground-based cell towers remain a critical component of this infrastructure, providing the foundation for 5G penetration, tower industry growth, and the wireless revolution.

Get a glance at the market report of share of various segments Request Free Sample

The Ground-based segment was valued at USD 18.37 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing demand for mobile data and high-speed Internet connectivity. This trend is particularly prominent in urban areas and along major transportation routes, where reliable wireless communication is essential. The adoption of Long Term Evolution (LTE) Advanced technology and the Internet of Things (IoT) is driving the need for more cellular towers to handle the increasing data traffic. Self-support towers, which do not require guy wires or other external support structures, are gaining popularity due to their ease of installation and lower maintenance costs. The telecommunications sector is undergoing a wireless revolution, with infrastructure companies investing heavily in 5G infrastructure.

The growing adoption of 5G-enabled technologies, such as smart agriculture solutions and precision farming technologies, is expected to increase the demand for cellular towers in both urban and rural areas. The tower industry is also witnessing the deployment of 5G subscriptions and mobile subscriptions, leading to tower densification and increased network connection speeds. The need for reliable wireless communication for emergency services, such as FirstNet In the US, is driving the installation of cell towers for enhanced coverage and capacity in critical areas. The growth of mobile operators, video signals, mobile services, and mobile users is also fueling the demand for cellular towers.

The tower industry is expected to continue its expansion, with a focus on energy-efficient solutions, such as renewable fuels and solar panels, to reduce the environmental impact of tower installations. The market is expected to grow significantly during the forecast period, driven by technological advancements, consumer demands, and regulatory changes. The market is highly competitive, with various companies, including infrastructure companies, wireless communication providers, and telecommunications networks, vying for market share. The market is also witnessing the emergence of new technologies, such as monopole towers and stealth towers, which offer improved coverage and reduced visual impact. Overall, the market is an essential component of the wireless communication ecosystem, enabling high-speed Internet connectivity and reliable wireless communication for businesses and consumers alike.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cell Site Tower Industry?

Increasing mobile data usage is the key driver of the market.

- The escalating mobile data usage, fueled by applications such as video streaming, social media, online gaming, and video conferencing, is driving the necessity for additional cell site towers to manage the increased data traffic. With an increasing number of users relying on data-intensive applications, the demand for a reliable and high-capacity network is paramount. The popularity of video streaming services, including YouTube, Netflix, and other OTT platforms, significantly contributes to the data consumption .

- To deliver superior video quality, networks must be capable of handling the increased data demand, which is achievable through the deployment of more cell site towers.

What are the market trends shaping the Cell Site Tower Industry?

Increase in 5G deployment is the upcoming market trend.

- The deployment of 5G technology necessitates a denser network of cell site infrastructure due to its higher frequencies and shorter transmission distances. This new generation of wireless technology relies on small cells, macrocells, and other infrastructure to deliver the promised speeds and low latency. The utilization of higher frequency bands, such as millimeter waves (mmWave), necessitates a more extensive network to provide coverage and capacity in densely populated areas.

- 5G networks offer ultra-low latency, making them ideal for applications like autonomous vehicles and real-time industrial control systems. Consequently, the rollout of 5G technology necessitates a significant expansion of cell site towers to accommodate the increased demand for network infrastructure.

What challenges does the Cell Site Tower Industry face during its growth?

Health risks associated with radiation of cell towers is a key challenge affecting the industry growth.

- The market faces challenges due to health concerns surrounding non-ionizing RF radiation emissions. These emissions, while not causing DNA damage like ionizing radiation, have raised apprehensions among the public regarding potential health risks. As a result, stricter regulations and stringent permitting requirements for cell tower construction have emerged, increasing both time and cost. This regulatory environment can hinder market growth.

- Moreover, negative public perception and social stigma towards cell towers due to health concerns can impact their aesthetics and social acceptance, making it challenging for carriers and tower companies to secure community support for new tower constructions. These factors will likely influence the expansion of the market during the forecast period.

Exclusive Customer Landscape

The cell site tower market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cell site tower market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cell site tower market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

American Tower Corp. - The company specializes in providing cell site towers, essential for wireless communications infrastructure and advanced wireless technologies, enabling the deployment and support of wireless networks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Tower Corp.

- AT and T Inc.

- Axiata Group Berhad

- Bharti Airtel Ltd.

- China Tower Corporation Limited

- Crown Castle Inc.

- CTI Towers Inc.

- GTL Infrastructure Ltd

- Harmoni Towers

- Helios Towers plc

- IHS Holding Ltd

- Phoenix Tower International

- Saudi Telecom Co.

- SBA Communications Corp.

- T Mobile US Inc.

- Tarpon Towers.

- United States Cellular Corp.

- Vertical Bridge REIT LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the infrastructure required to support the deployment and operation of various radio communications technologies, including Long Term Evolution (LTE) and its advanced versions, as well as the emerging 5G infrastructure. This market plays a crucial role In the telecommunications sector, enabling wireless networks to deliver high-speed internet, voice calls, text messaging, and multimedia services to an ever-growing number of mobile users in urban and rural areas. Radio communications form the backbone of modern wireless networks, transmitting radio signals through towers and other structures to ensure seamless network connection. These towers can range from self-support structures to guyed towers, monopoles, and stealth towers, each with its unique advantages and applications.

The tower industry has seen significant growth due to the wireless revolution, driven by the increasing demand for mobile subscriptions and the proliferation of 5G-enabled technologies. The Internet of Things (IoT) and various smart initiatives, such as precision farming solutions, smart transportation systems, and intelligent lighting, have further expanded the scope of the market. These applications require reliable, high-speed network coverage to facilitate real-time data transmission and analysis, making the tower industry a critical component of the digital transformation. The tower density and network connection have become essential factors In the telecommunications sector, with tower densification playing a significant role in enhancing coverage and capacity.

The adoption of 5G technology has accelerated this trend, as the new standard requires denser networks to support its high-bandwidth, low-latency capabilities. The tower industry also caters to various sectors, including military forces, radar systems, and television broadcasting. In the context of 5G infrastructure, the market is witnessing the integration of renewable fuels, such as hydroelectric, geothermal, solar, and wind, to make energy production more sustainable and eco-friendly. The telecommunications sector's growth is driven by the increasing demand for high-speed internet and mobile services, as well as the shift towards remote working and virtual communication. This trend is particularly pronounced in urban areas, where the need for reliable network coverage is most pressing.

However, rural areas are also seeing significant investment in cellular networks to bridge the digital divide and provide access to essential services. The tower industry's future lies in its ability to adapt to evolving market dynamics and support the deployment of innovative technologies. This includes the integration of big data analytics, cloud computing, and other advanced solutions to optimize network performance and enhance user experience. The sector's continued growth is expected to be fueled by the increasing adoption of 5G technology, the proliferation of mobile devices, and the expansion of online services, including e-commerce platforms, OTT platforms, and live streaming events.

In , the market plays a vital role in enabling the deployment and operation of various radio communications technologies, from LTE to 5G. Its continued growth is driven by the increasing demand for mobile services, the proliferation of smart initiatives, and the shift towards renewable energy sources. The tower industry's ability to adapt to evolving market dynamics and support the deployment of innovative technologies will be crucial in ensuring seamless network coverage and capacity for an increasingly connected world.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market growth 2025-2029 |

USD 8.03 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

US, China, Canada, Japan, Germany, UK, France, India, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cell Site Tower Market Research and Growth Report?

- CAGR of the Cell Site Tower industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cell site tower market growth of industry companies

We can help! Our analysts can customize this cell site tower market research report to meet your requirements.