Chemical Licensing Market Size 2025-2029

The chemical licensing market size is forecast to increase by USD 4.6 billion, at a CAGR of 6.2% between 2024 and 2029.

- The market is driven by technological innovation and research and development advancements, which continue to shape the industry landscape. Companies invest significantly in R&D to develop new chemical processes and products, thereby fueling market growth. Strategic partnerships and collaborations are another key trend in the market, as companies seek to expand their reach and enhance their competitive position. Intellectual property and patent protection, however, pose significant challenges for market players. With the increasing importance of intellectual property in the chemical industry, companies must invest in robust IP strategies to protect their innovations and maintain a competitive edge.

- Additionally, the complex regulatory environment and stringent safety standards add to the challenges faced by market participants. To capitalize on market opportunities and navigate these challenges effectively, companies must stay abreast of the latest technological developments, forge strategic alliances, and implement robust IP strategies.

What will be the Size of the Chemical Licensing Market during the forecast period?

The market continues to evolve, driven by the constant advancement of technology and the need for environmental compliance in various sectors. Machine learning and data analytics play a significant role in technology evaluation and licensing, enabling companies to make informed decisions during the technology audit process. Materials science and specialty chemicals are at the forefront of innovation, with a focus on sustainable development and the circular economy. Contract negotiation and intellectual property management are crucial aspects of licensing agreements, ensuring a competitive advantage for licensees. Milestone payments and royalty payments provide financial incentives for technology adoption and process optimization. Technology licensing and process engineering are essential for companies seeking to expand their offerings and enter new markets.

The legal framework surrounding technology transfer, including exclusive and non-exclusive licensing agreements, is continually evolving to accommodate digital transformation and the adoption of advanced materials. Joint ventures and open innovation are increasingly popular strategies for accessing new technologies and renewable resources. Green chemistry and innovation ecosystems are shaping the future of the chemical industry, with a focus on process automation, regulatory approvals, and supply chain optimization. Due diligence and technology transfer are critical components of successful partnerships, ensuring a seamless integration of trade secrets and intellectual property. The ongoing digital transformation and the increasing importance of environmental compliance are shaping the market.Companies must stay abreast of the latest trends and technologies to remain competitive and maintain a sustainable business model.

How is this Chemical Licensing Industry segmented?

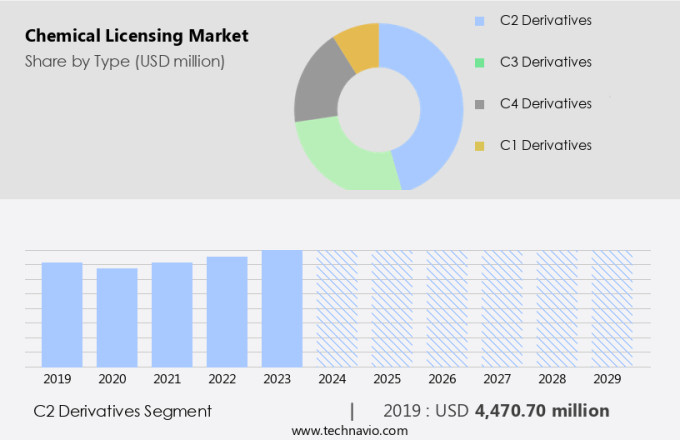

The chemical licensing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- C2 derivatives

- C3 derivatives

- C4 derivatives

- C1 derivatives

- End-user

- Chemical industry

- Oil and gas industry

- Pharmaceutical industry

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The c2 derivatives segment is estimated to witness significant growth during the forecast period.

The market encompasses a wide range of activities, from research and development in materials science to the adoption of advanced technologies such as machine learning and artificial intelligence. One significant segment within this market involves the licensing of C2 derivatives, which are chemicals derived from molecules containing two carbon atoms. These derivatives, including ethylene, Ethyl Alcohol (ethanol), acetic acid, and ethylene oxide, play essential roles in various industrial applications. Ethylene, a primary C2 derivative, is extensively used in the production of polyethylene, a fundamental material for plastics. As a vital feedstock in the chemical industry, it enables the manufacture of numerous products.

Ethyl alcohol, or ethanol, is another crucial C2 derivative, widely used as a biofuel and in the production of beverages, pharmaceuticals, and chemicals. Non-exclusive licensing agreements are common in the chemical industry, allowing multiple parties to access and utilize licensed technology under specific terms. Licensing fees, milestone payments, and royalty payments are key components of these agreements, providing revenue streams for intellectual property owners. Technology evaluation, technology audits, and due diligence are critical aspects of the licensing process, ensuring that both parties fully understand the potential risks and benefits of the agreement. Regulatory approvals and environmental compliance are also essential considerations, with increasing focus on sustainable development and the circular economy.

Contract negotiation, process engineering, and process optimization are ongoing activities in the chemical industry, with the aim of improving efficiency, reducing costs, and enhancing competitiveness. Contract manufacturing, supply chain optimization, and technology transfer are other key areas of focus, with the integration of data analytics and digital transformation playing increasingly important roles. Specialty chemicals, advanced materials, and green chemistry are emerging trends in the chemical industry, with renewable resources and bio-based chemicals gaining popularity due to their environmental benefits and market access opportunities. Joint ventures and open innovation are also strategies being employed to foster innovation ecosystems and accelerate technology adoption.

Intellectual property management and legal frameworks are crucial components of the market, ensuring that intellectual property rights are protected and that agreements are legally binding. Exclusive licensing and licensing agreements are common strategies for protecting and monetizing intellectual property, while trade secrets and confidentiality agreements help to maintain the competitive advantage of innovations. In conclusion, the market is a dynamic and evolving landscape, with a focus on innovation, sustainability, and efficiency. The integration of machine learning, artificial intelligence, and data analytics is driving digital transformation, while regulatory compliance and environmental considerations are increasingly important factors in the industry. The licensing of C2 derivatives, including ethylene and ethyl alcohol, continues to play a significant role in the market, with ongoing efforts to optimize processes, reduce costs, and enhance competitiveness.

The C2 derivatives segment was valued at USD 4.47 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

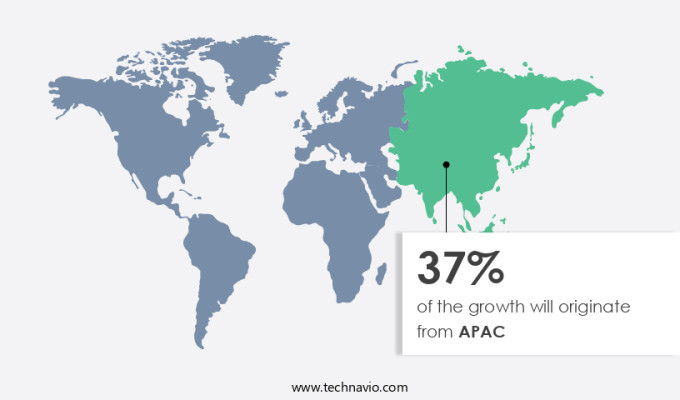

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant activity in the Asia-Pacific region, with China leading the way. In 2023, China accounted for over 40% of the global chemical industry, primarily due to its extensive production of basic chemicals. This substantial market share highlights China's pivotal role in the industry, driven by numerous licensing agreements that enhance production capabilities and technological advancements. One notable development is the technology licensing agreement between BASF and Ningbo Refining and Chemical Co. Ltd (NZRCC), signed in October 2023. Under this agreement, BASF's proprietary oxo-technology will be used to produce isononyl alcohol (INA) at NZRCC. This collaboration represents the integration of machine learning and materials science in chemical production, contributing to process optimization and intellectual property management.

Non-exclusive licensing agreements facilitate the adoption of advanced materials and green chemistry, enabling companies to remain competitive in the market. Regulatory approvals and environmental compliance are crucial aspects of technology transfer, ensuring sustainable development and supply chain optimization. Royalty payments and milestone payments are integral components of licensing agreements, providing financial incentives for technology adoption and innovation ecosystems. The legal framework governing technology licensing agreements is essential, as it outlines the terms and conditions of the partnership. Artificial intelligence and data analytics play a vital role in technology evaluation and contract negotiation, ensuring a harmonious and efficient process.

The circular economy and process automation are driving the adoption of renewable resources and bio-based chemicals, creating new opportunities for market access and technology transfer. Joint ventures and open innovation are essential strategies for companies seeking to expand their reach and enhance their competitive advantage. Exclusive licensing agreements offer a more protective approach to intellectual property, while licensing fees and contract manufacturing ensure a steady revenue stream. Overall, the market is undergoing a digital transformation, with technology licensing playing a pivotal role in driving innovation and growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Chemical Licensing Market grows with chemical process licensing and petrochemical licensing agreements. Chemical licensing trends 2025 highlight sustainable chemical technologies and bio-based chemical licensing. Licensing for specialty chemicals and chemical patents for industry fuel demand, per chemical licensing market forecast. Green chemistry licensing leverages licensing for carbon neutrality, while chemical technology transfers ensure scalability. Licensing for pharmaceutical chemicals and licensing for agrochemicals enhance innovation. Licensing for environmental compliance, advanced chemical processes, and chemical licensing supply chain drive efficiency. Licensing for global markets, licensing for regulatory standards, licensing for industrial chemicals, licensing for R&D collaboration, and chemical licensing for B2B sectors propel growth through 2029.

What are the key market drivers leading to the rise in the adoption of Chemical Licensing Industry?

- Technological innovation and advances in research and development are the primary catalysts fueling market growth.

- The market is propelled by technological innovations and continuous research and development in the chemical industry. Companies invest significantly in R&D to create new and improved processes, which are crucial for staying competitive and addressing evolving market demands. Licensing enables firms to swiftly adopt these advancements, thereby reducing time-to-market for new products and enhancing their competitive edge. An illustrative instance of this trend is the establishment of Sumitomo Chemical's Innovation Center MEGURU on June 26, 2024. This cutting-edge facility brings together various research groups dedicated to developing technologies that minimize environmental impact. Sustainable development is a major focus in the chemical industry, with companies striving to optimize their supply chains and minimize their carbon footprint.

- Digital transformation, including process automation and artificial intelligence, is also a significant trend, as it streamlines operations and improves efficiency. Intellectual property management and legal frameworks play a vital role in the market, ensuring that innovations are protected and that licensing agreements are fair and equitable for all parties involved. The circular economy is another key consideration, as companies seek to minimize waste and maximize resource utilization. Due diligence is essential in the chemical licensing process, as it ensures that both parties fully understand the terms and conditions of the agreement. With the increasing complexity of chemical processes and the growing importance of sustainability, it's crucial that all parties have a clear and comprehensive understanding of the technology being licensed and the associated risks and benefits.

- In conclusion, the market is driven by technological innovation, a focus on sustainability, and the need for supply chain optimization. Digital transformation, intellectual property management, and legal frameworks are also critical components of the market, ensuring that licensing agreements are fair, efficient, and effective.

What are the market trends shaping the Chemical Licensing Industry?

- Expanding strategic partnerships and collaborations is currently a significant market trend. To stay competitive, it is essential for businesses to form alliances and work together on projects to leverage each other's strengths and resources.

- The market is experiencing a notable trend towards strategic collaborations and technology adoption to address intricate market demands and gain a competitive edge. One instance of this trend is the exclusive licensing alliance between Axens and Exxon Mobil Catalysts and Licensing LLC, announced on June 7, 2023. Under the terms of this agreement, Axens acquires worldwide rights to market, license, and provide engineering services for Exxon Mobil's MTBE Decomposition Technology, which is utilized in producing high-purity isobutylene.

- This technology licensing deal underscores the industry's shift towards process optimization and environmental compliance, particularly in advanced materials and green chemistry. Intellectual property and process engineering are crucial elements in these collaborations, fostering innovation ecosystems and driving growth in the chemical industry.

What challenges does the Chemical Licensing Industry face during its growth?

- Intellectual property protection, particularly patents, poses a significant challenge and can hinder the growth of industries by limiting innovation and competition.

- The market is characterized by the exchange of intellectual property (IP) rights between entities for the commercialization of chemical technologies. This market is driven by various factors, including open innovation, access to new markets, and technology transfer. However, the protection of IP is a significant challenge. The intricate nature of chemical processes and formulations complicates effective patent protection, leaving licensors vulnerable to infringement or unauthorized use. This risk can undermine the value of licensed technologies and hinder innovation. Joint ventures and exclusive licensing agreements are common strategies employed to mitigate IP risks. Technology transfer through licensing agreements enables access to advanced technologies and renewable resources, fostering innovation and sustainability.

- Trade secrets and confidentiality agreements are also crucial in safeguarding IP. Despite these challenges, the market continues to grow, with a focus on bio-based chemicals and renewable resources. The global chemical industry recognizes the importance of robust IP protection to maintain competitive advantage and secure revenue streams from licensed technologies. The complexity of chemical processes necessitates ongoing research and development to refine IP protection strategies and stay ahead of competitors.

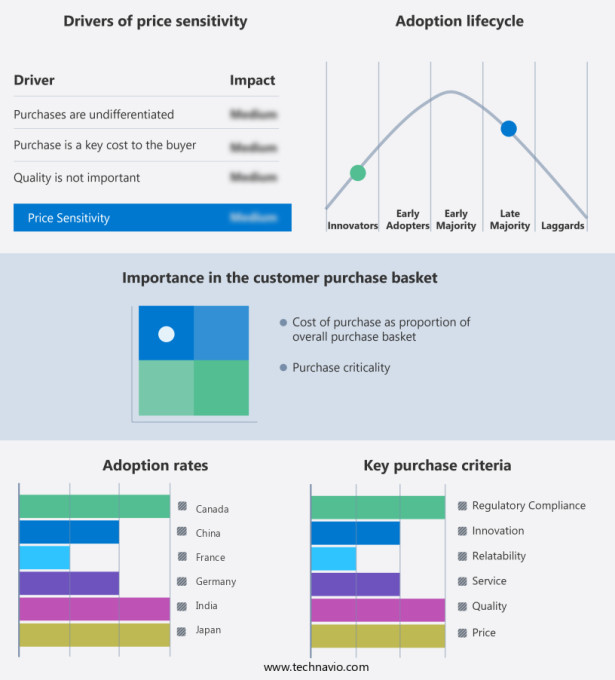

Exclusive Customer Landscape

The chemical licensing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chemical licensing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, chemical licensing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air Liquide SA - This company specializes in licensing cutting-edge chemical technologies, including Acrylic Acid technology. Applicable industries include paint manufacturing, coatings production, adhesives development, and plasticizer synthesis. By implementing these advanced technologies, businesses can enhance their product offerings and improve overall performance. Acrylic Acid technology, in particular, is a versatile solution that contributes significantly to various industries' growth. It is essential for companies seeking to stay competitive in today's market to adopt innovative technologies, and this company's offerings cater to that need.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Liquide SA

- BASF SE

- Bayer AG

- DuPont de Nemours Inc.

- Eastman Chemical Co.

- Exxon Mobil Corp.

- Honeywell International Inc.

- INEOS Group Holdings S.A.

- LG Chem Ltd.

- LyondellBasell Industries NV

- Mitsubishi Chemical Corp.

- Reliance Industries Ltd.

- Saudi Basic Industries Corp.

- Shell plc

- Solvay SA

- Sumitomo Chemical Co. Ltd.

- The Dow Chemical Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Chemical Licensing Market

- In February 2023, DuPont announced the launch of its new digital licensing platform, DuPont Water Solutions Online, which streamlines the chemical licensing process for water treatment applications (DuPont Press Release, 2023). This innovative solution allows customers to access DuPont's water treatment technologies and obtain licenses online, reducing the time and effort required for traditional licensing processes.

- In July 2024, BASF SE and INEOS entered into a strategic collaboration to create a new joint venture, INEOS Styrolution Solutions, focusing on the production and licensing of styrenic monomers and polymers (BASF Press Release, 2024). This partnership combines BASF's extensive chemical expertise with INEOS's market leadership in styrenics, aiming to expand their market presence and enhance their product offerings.

- In October 2024, Dow Inc. Completed the acquisition of Avantor Performance Materials, a leading global supplier of high-performance materials and services, for approximately USD6.2 billion (Dow Inc. SEC Filing, 2024). This acquisition significantly expanded Dow's portfolio in the specialty chemicals sector, enabling them to offer a broader range of products and services and strengthening their position in the market.

- In March 2025, the European Chemicals Agency (ECHA) introduced new regulations for the licensing and use of biocidal active substances, ensuring a more stringent and harmonized approval process across Europe (ECHA Press Release, 2025). These regulations aim to improve public health and the environment by enhancing the safety assessment and authorization of biocidal products, creating opportunities for chemical companies to innovate and comply with the new standards.

Research Analyst Overview

- The chemical industry is experiencing significant convergence, as intellectual property (IP) valuation becomes a crucial aspect of business strategy. Bio-based materials and emerging technologies are driving innovation, requiring advanced technology infrastructure for Product Stewardship and technology commercialization. Life cycle analysis and technology scouting are essential for identifying opportunities and ensuring compliance with regulatory landscape. Technology foresight and benchmarking enable companies to stay competitive, while process simulation and technology roadmapping facilitate process scale-up and sustainable manufacturing. Intellectual property litigation and licensing disputes pose challenges, necessitating effective licensing strategies and technology risk management. Disruptive technologies, such as digital twin technology and predictive analytics, are transforming the industry, driving manufacturing capacity expansion and international trade.

- Circular economy principles and sustainable manufacturing practices are shaping the regulatory landscape, with a focus on product safety and environmental impact assessment. Quality control and green technology are essential components of technology portfolio management, while technology trends like technology infrastructure, process simulation, and technology trends continue to shape the industry. Supply chain resilience and licensing models are key considerations for companies seeking to remain competitive in this dynamic market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Chemical Licensing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2025-2029 |

USD 4595.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, China, Germany, Japan, South Korea, France, UK, India, Canada, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chemical Licensing Market Research and Growth Report?

- CAGR of the Chemical Licensing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chemical licensing market growth of industry companies

We can help! Our analysts can customize this chemical licensing market research report to meet your requirements.